AMD and TSLA analysis for August 21

Let's wrangle all the options data for AMD and TSLA that we can find and make some sense out of it. 🤔

Welcome back to another wild week in the markets. The pre-market looks quite green today, but will it last? 🎢

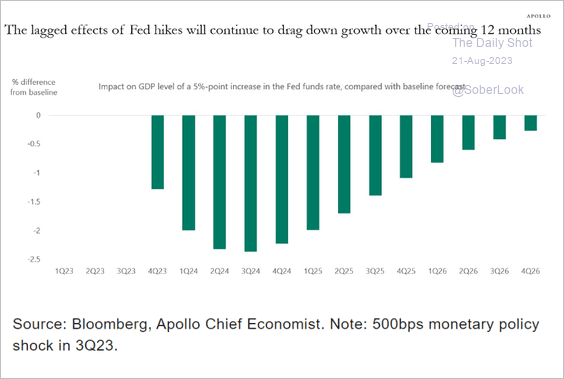

On the macro side, I'm still concerned about the levels of debt held by people in the US, mainly in automobiles, housing, and student loans. Each of these will have an impact on our economy over the next 1-2 years. Economists expect the knock-on effects from interest rate changes to cause us problems for a while:

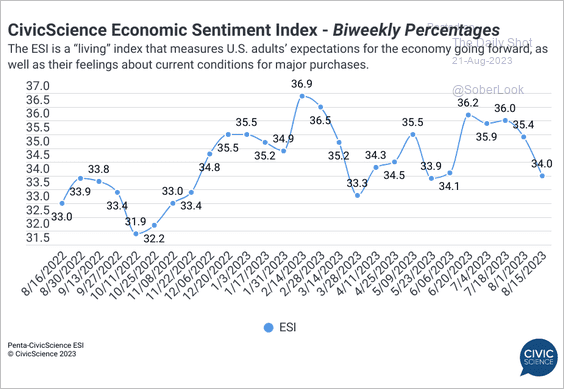

Customer sentiment has come down again:

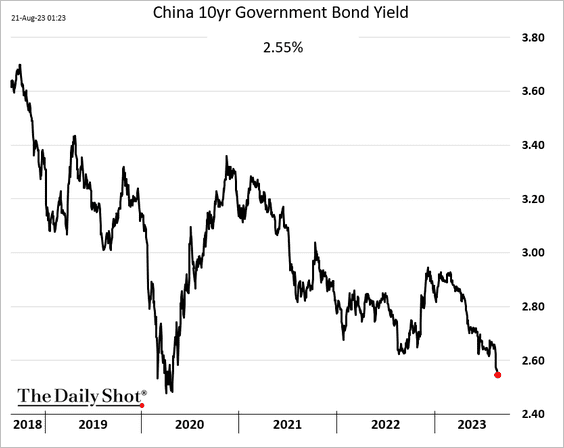

But many eyes are on China, where they are reducing interest rates to jump start the economy. Bond yields are falling:

Let's get an updated look at AMD and TSLA.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Happy Monday! 🌄

AMD

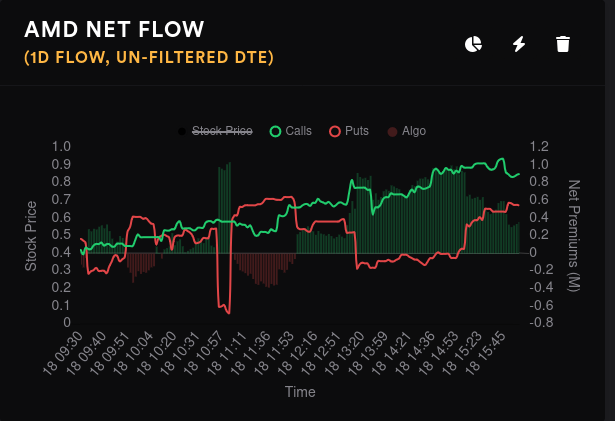

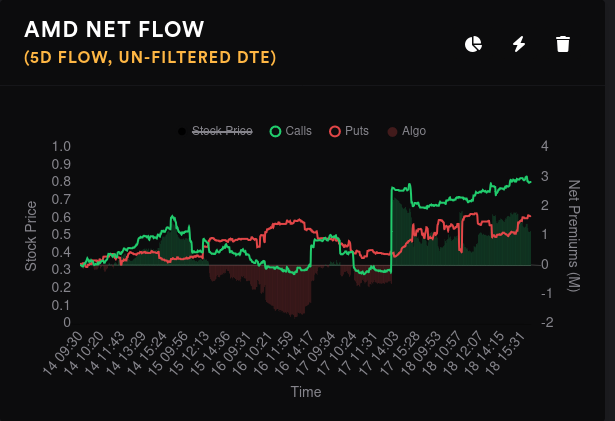

AMD had a decent dip last week, but sentiment improved later in the week:

Last week saw a trend towards short puts on AMD with fewer long calls. However, 15 day momentum on dealer greeks finally went green, which is usually a bearish sign for AMD. I'd like to see if this gets confirmed for a second day.

What else am I seeing here?

- 8/25 leans bullish, 9/15 is flat, and 10/20 has a bearish lean. Note that these are leaning and there's plenty of indecision here.

- Vanna looks fairly weak until we reach 10/20, where it's quite positive. AMD's aggregate vanna is positive, which is bullish when IV is contracting.

- 9/15 big money traders have bearish bets on $90 and bullish bets on $115, almost at the same levels. This will be interesting to watch.

Aggregate GEX shows a price magnet around $125 with a secondary magnet around $122. There's some light resistance in the $108-$111 range.

The data for 9/15 hasn't changed in a week or two. Price should gravitate towards $115 with strong resistance at $120.

10/20 looks to be a bearish expiry for AMD based on open interest and vanna, but we have price magnets at $105 and $125. $110-$120 looks like a "do not pass" zone. Big money options traders have gone very bearish on $80 for 10/20.

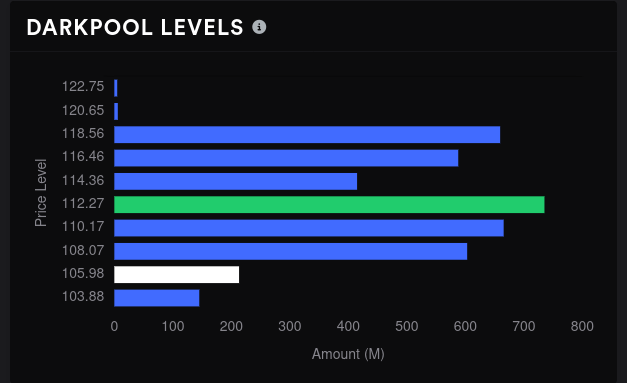

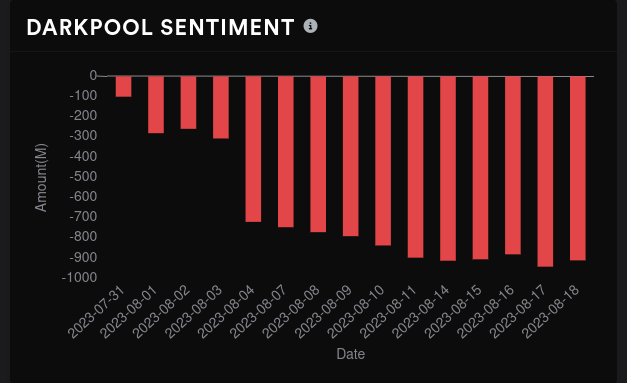

Dark pool sentiment remains negative but it has leveled off.

TSLA

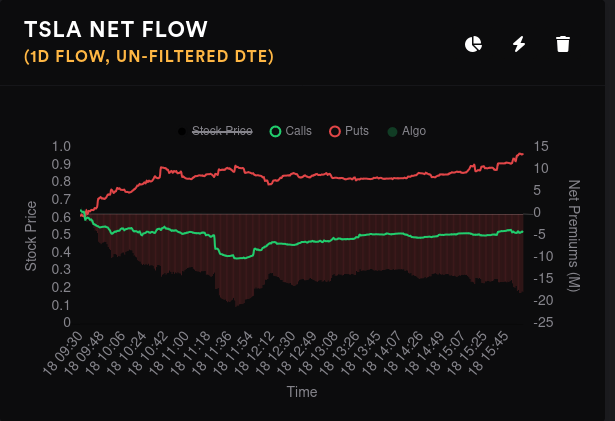

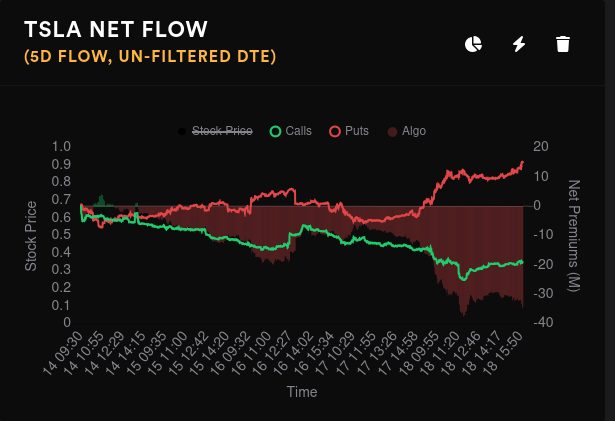

There's some interesting price action happening with TSLA right now. The price dropped aggressively last week and the flow was horribly bearish towards the end of the week:

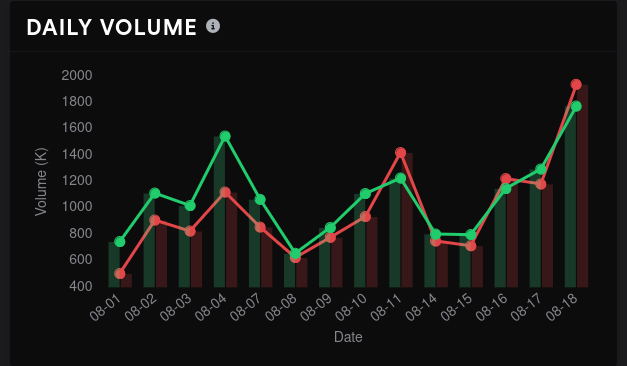

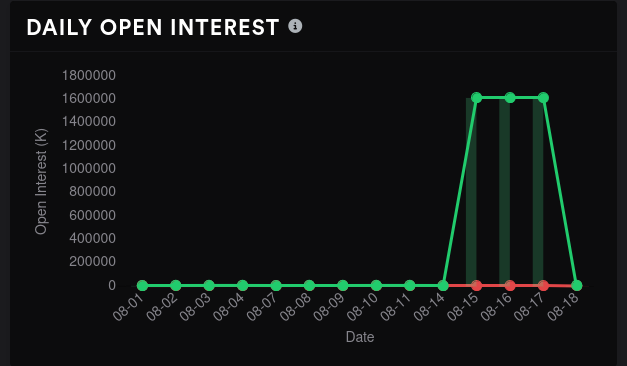

However, something interesting happened. Customer calls hugged the middle line for most of the week and puts ran there, too. TSLA had a significant amount of options contracts expiring last week:

Dealers overall are still long TSLA, which implies customers are short. Vanna is quite weak until 2025, where it's incredibly positive. 9/15 tilts slightly bearish and 10/20 has a bullish lean.

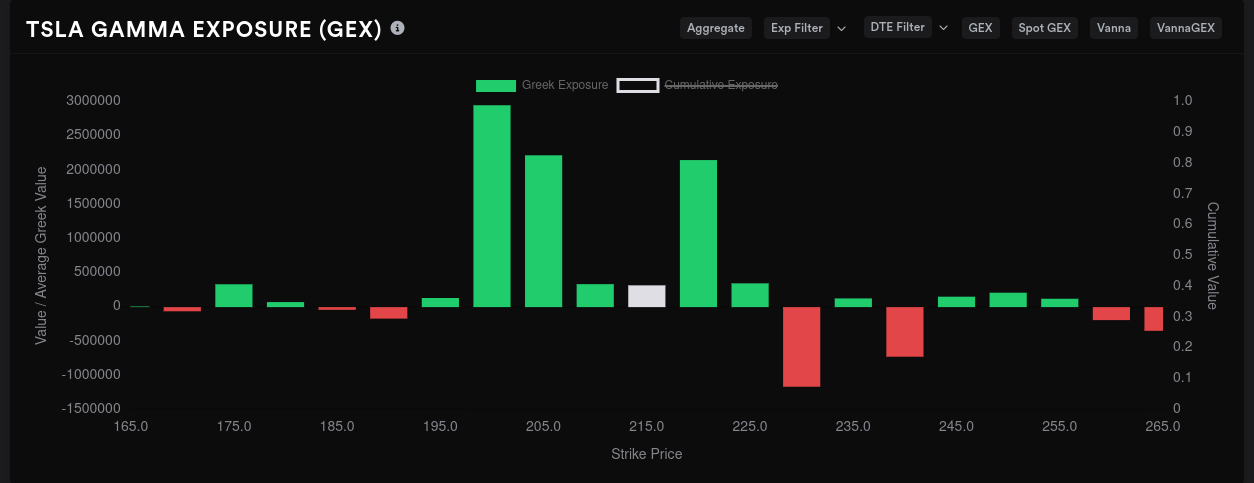

TSLA's aggregate GEX suggests a run to $225 with some resistance above around $230.

The 9/15 GEX shows a massive resistance line around $210. If price falls down to that level, it could likely get a good bounce back upwards with some momentum behind it. If it somehow falls below: watch out. It could fall for a while.

TSLA's 10/20 GEX shows strong resistance below around $200-$205 with a target price of $230. However, TSLA needs to crack $220's resistance to make it there.

Big money options traders suddenly went incredibly bullish on $270 last week. It looks like that happened in the 9/15 expiry:

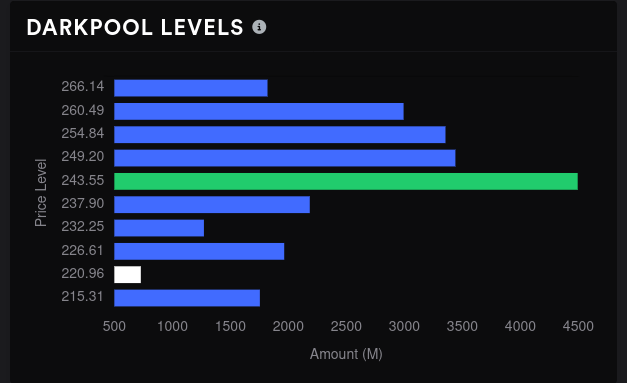

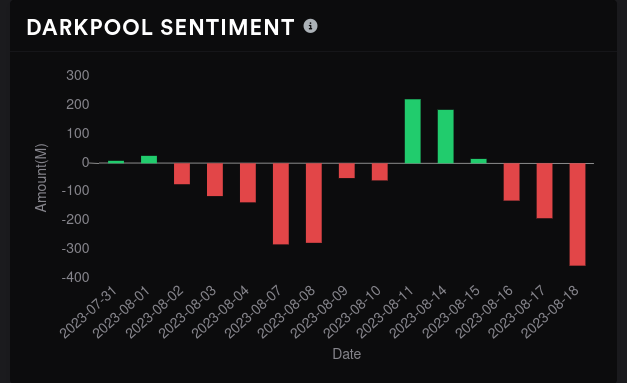

Dark pool sentiment turned ugly last week and we finished in a volume gap. This leads me to think that TSLA won't spend too long at this price.

Thesis

There's plenty of data showing that TSLA's base is likely between $200-$210, at least through October. However, the top-end looks fuzzy. It seems like we could reclaim the area right around $230, but getting over that level could be challenging. Dark pool resistance exists around $243 and GEX will fight that move above $230.

However, there are plenty of traders in the market doing different things, and it's entirely possible with some big market mechanics changes, such as a drop in treasury yields or a weakening dollar, that could give TSLA the fuel to climb over $230. I have some short puts from $200-$210 for 9/15 that took a beating last week.

My goal with TSLA this week is to go short on puts under $210 if the $220 level holds and avoid selling any covered calls unless we're getting close to $230.

As for AMD, I'm closely watching NVDA's earnings to see where we might go. I shorted some puts from $95-$105 for 9/15 and I'm sitting on quite a few uncovered shares. AMD has fought a resistance level around $117-$120 for weeks and I haven't seen enough that would suggest we can break that level yet. I'll likely start getting into covered calls again if AMD can creep up to $115.

Good luck out there to everyone! 🍀

Discussion