CPI-eve analysis for August 9

CPI data drops tomorrow morning and it's difficult to determine where stocks might be headed. Let's pick through the data we have. 🔎

We're due for an update on inflation numbers tomorrow around 8:30AM Eastern Time and these will be critical. Many have bet against more interest rate hikes and these numbers could surprise the market if they are outside the expected range.

On the macro front, small businesses seem to be in a recovery. Although hiring remains challenging, fewer small businesses reported that prices were the biggest concern. There are also more plans for capital expenditures:

The inflation numbers for shelter is easing gradually:

Auto manufacturers are coming back with big manufacturer incentives on new vehicles. I've seen reports for almost $20,000 off some Jeep electric SUVs. 🤯

Let's get into the numbers for TSLA and AMD. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Happy Wednesday! 👋

AMD

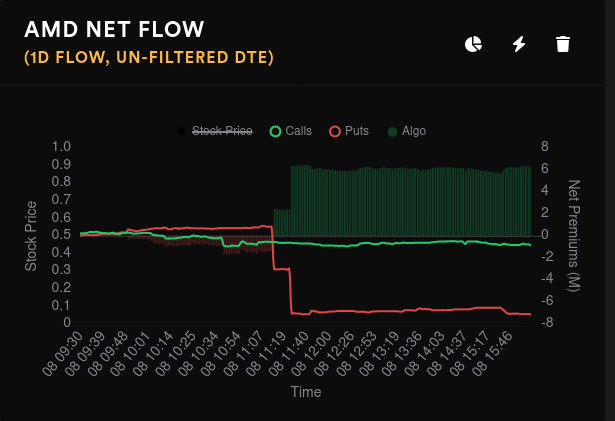

Something interesting happened in AMD's options flow yesterday. Can you find it? 😜

The premium for puts fell off abruptly yesterday, but calls didn't move much. This leads me to think that these were long puts that were bought back. These trades happened just as AMD touched the dark pool level around $111.61:

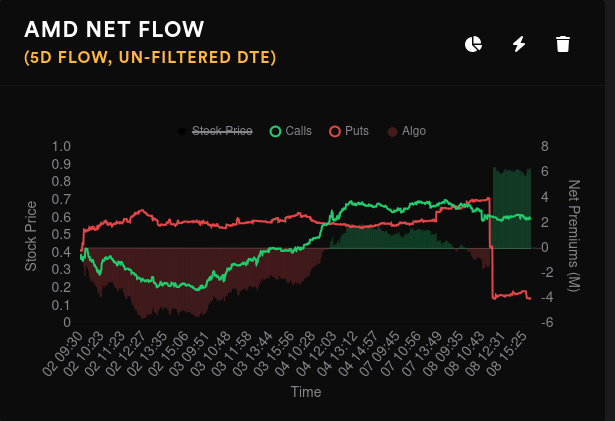

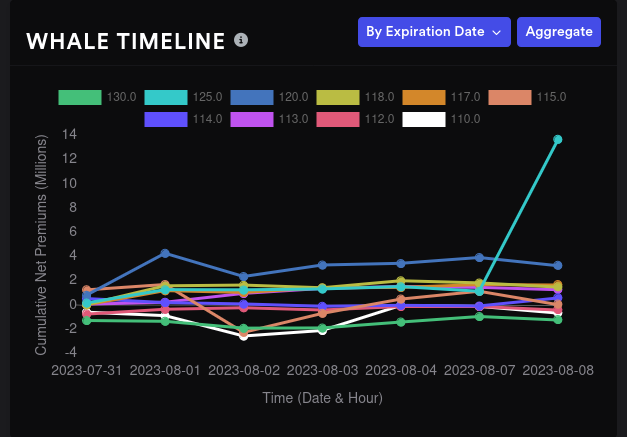

So what's changed since earlier in the week? First off, a big money options trader made a big bet on $125 for November:

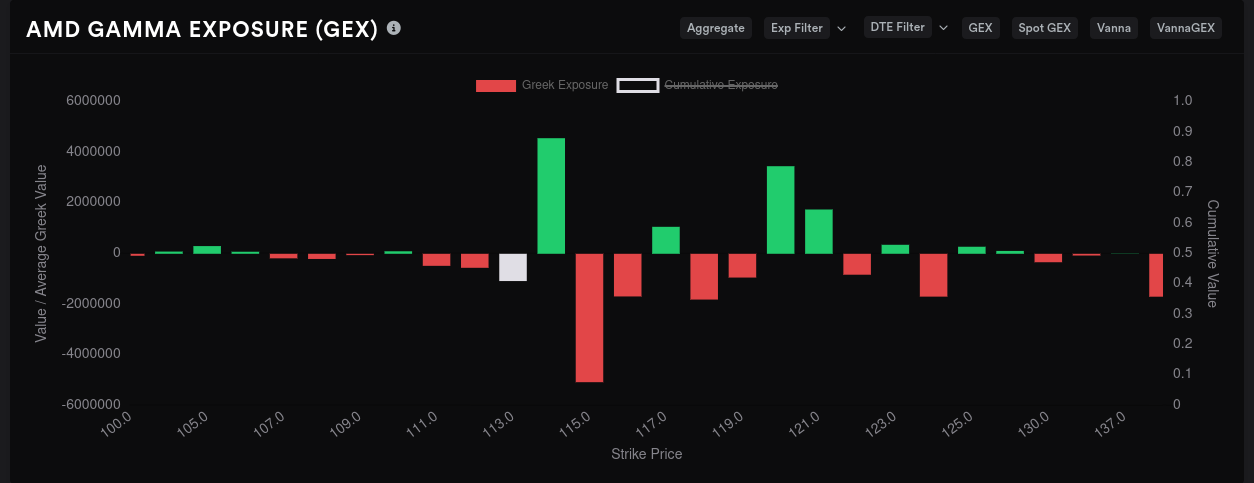

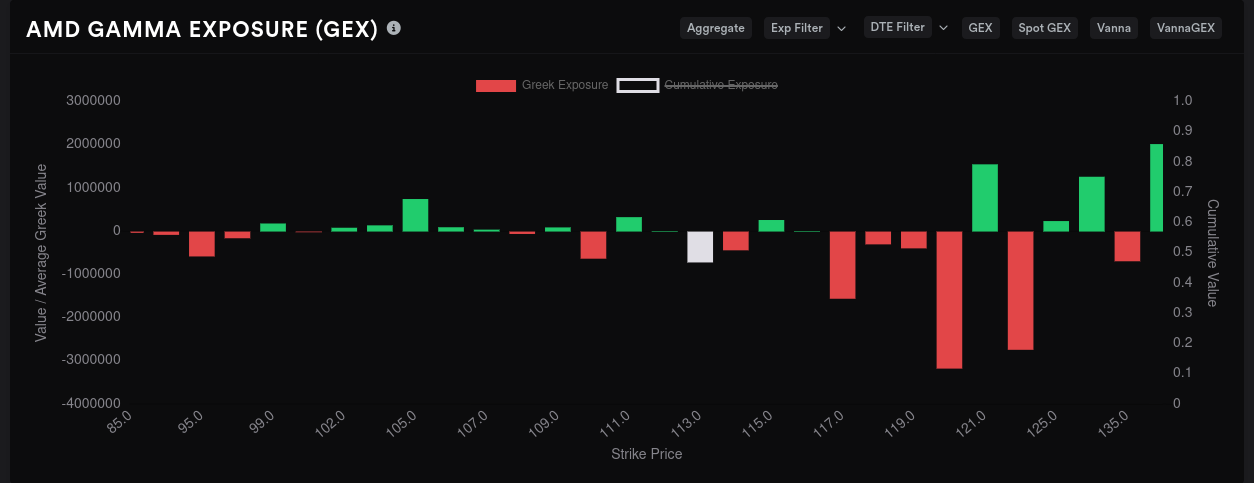

We're also on the wrong side of the positive GEX resistance line at $114 from the aggregate GEX. It may block an upward move to $115.

8/11 still looks like $115 is the likely target. This would require AMD to get some volume to push past the $114 resistance:

The door is still open for AMD to run to $120 for 8/18:

But 9/15 is gaining negative GEX magnets at $110 and $115 which suggests we may slide backwards a bit:

Vanna won't help AMD much through 8/18 as the effects dwindle as we approach $115:

But things get brighter for now through 9/15 as we pick up positive vanna at $120:

AMD's vanna is mostly positive, so an environment of reduced implied volatility would give us the most bullish outcome.

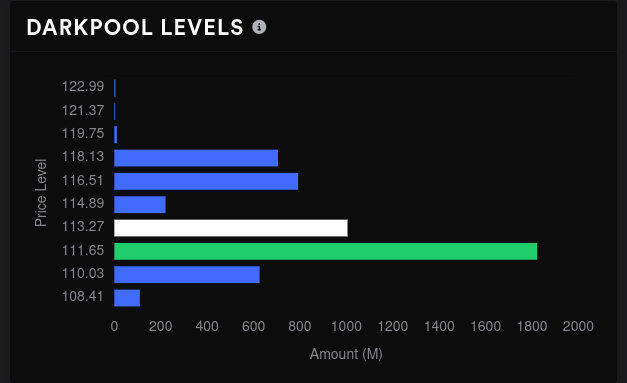

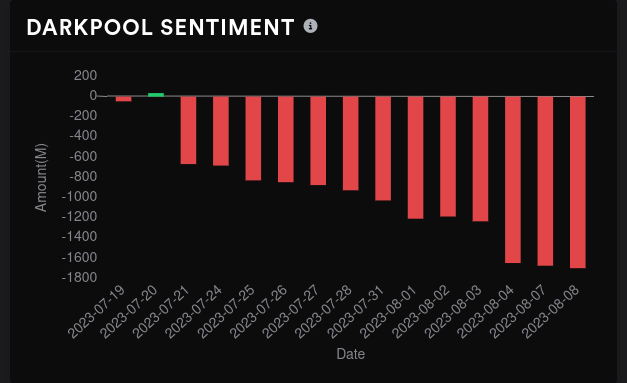

Dark pool sentiment remains bearish and our largest level is still around $111.65. The $113 level began building out well yesterday and it's still one I'm watching:

TSLA

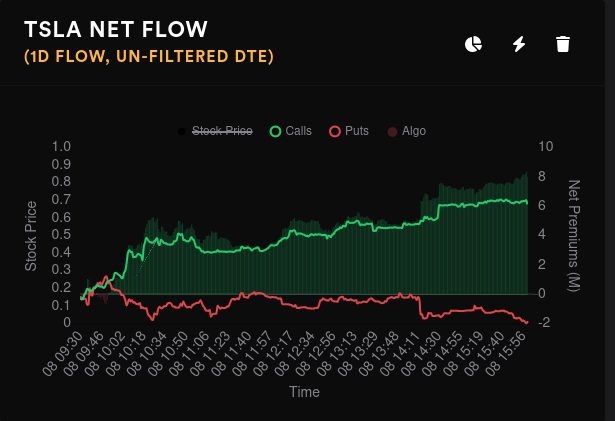

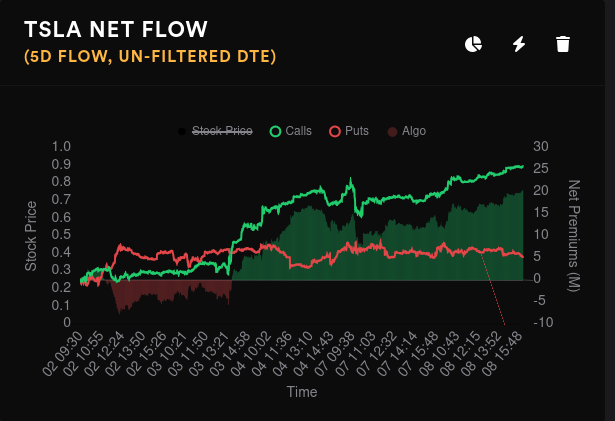

Price action on TSLA has been difficult to predict as usual, but the overall flow remains bullish:

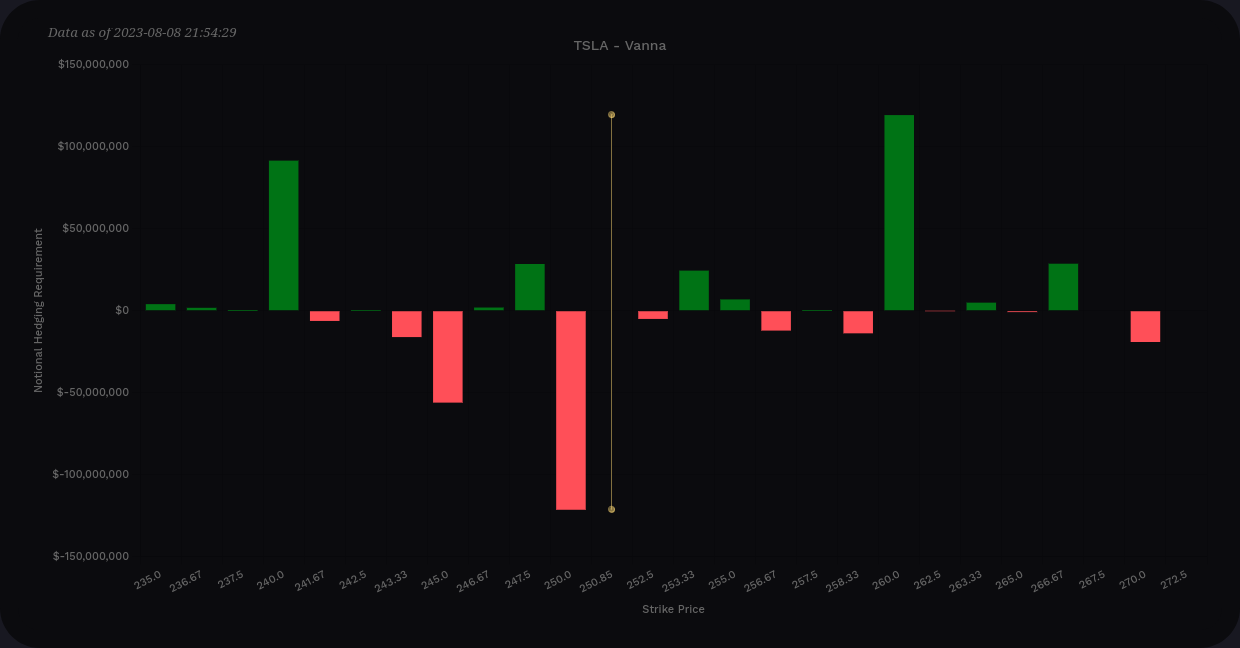

TSLA's vanna remains positive overall with the highest aggregate bar around $260:

Bear in mind that the majority of that positive vanna comes from the furthest out contract in 2025. A look at TSLA's vanna for now through 9/15 looks much different:

GEX for 8/18 suggests that $270 remains the biggest price magnet, but there are plenty of positive GEX resistance points in between. $242.50 is our downward resistance point:

$270 seems to be the target again for 9/15 and some of the resistance lines come down a bit as we approach it:

But dealers are still long TSLA and that suggests customers are net short. Historically, TSLA has much more bullish price action when the dealers are short, so this is a bearish sign:

Thesis

AMD and TSLA both look like the doors are opening a bit soon for some upward movement. AMD could run up to $120 but the $118-$120 zone has been a liquidity problem for weeks. TSLA looks like it could run to $280, but $270 is more likely. There are speed bumps in the way for both stocks.

A lot hinges on tomorrow's CPI numbers and the subsequent interest rate decision. Making bets across the CPI release is similar to betting on earnings. Even if you had an advanced copy of the report, that's no guarantee that you can pick the right trade.

Use caution in the market for the rest of the week and take another look once we have CPI data in hand and we see how the market reacts.

Good luck out there. 🍀

Discussion