Friday 6/23 update for AMD & TSLA

Traders set the tone for AMD and TSLA early this week and options flow hasn't changed a lot since then.

We made it to Friday! In this post, I'll give some quick updates on AMD and TSLA going into next week. There haven't been any big changes from the posts earlier this week.

A wise trader once told me: Don't try to be a hero on Friday. Avoid trying to do things you shouldn't to make up for a bad week or grab extra profits on a good week. Set your rules and follow them! 😉

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

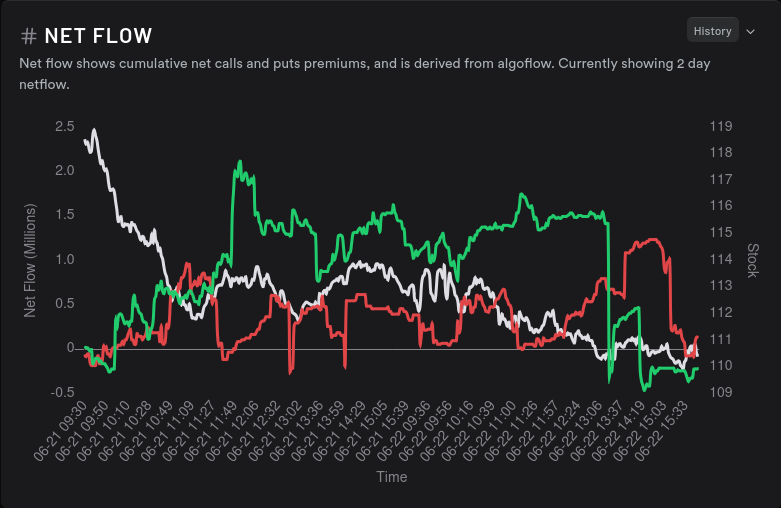

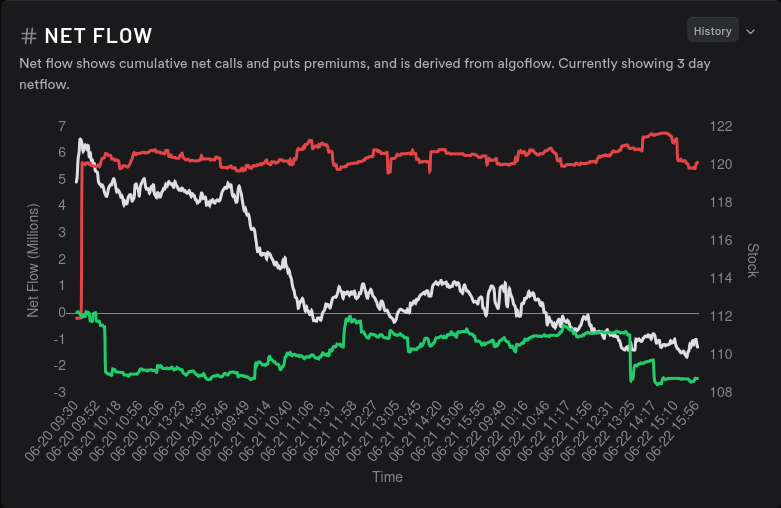

AMD

Although there were some changes for AMD over the week, most were fairly small. Here's what I noticed:

- Vanna became more positive (now ~ 6x more positive than negative), which is bullish in a decreasing IV environment.

- Gamma has turned very bearish with almost the entire vanna curve below the zero line. There's not much selling pressure underneath $100, however, so this could be our floor.

- Dealers are still long AMD on a 15 day momentum chart, but it's slowly making its way back to balanced as the price comes down.

- Options are still priced for a downward move, but a little less than earlier in the week.

- Traders blasted out the door with a massive run on bearish contracts on Monday, but the rest of the week has been quiet.

- AMD's IV rank climbed to 54% and adds some selling pressure from positive vanna.

AMD's bearish tilt was set Tuesday and the rest of the week hasn't had much of an effect:

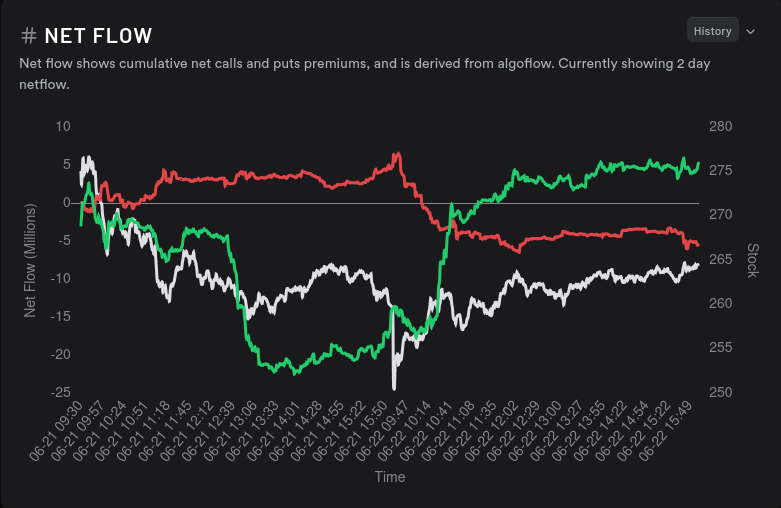

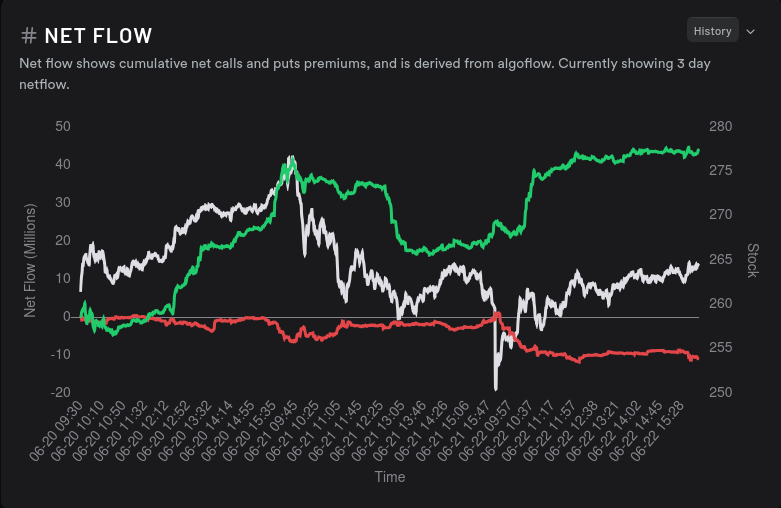

TSLA

There were some wild swings this week on TSLA but options positioning hasn't changed much:

- Like AMD, vanna for TSLA has become more positive (~ 2-2.5x more positive than negative). $300 remains the tallest bar by far and the $250 negative vanna line is down about 25%.

- Gamma is quiete bearish, but it looks like most of the bearishness is concentrated at $265. That might be a temporary top for TSLA unless something changes.

- Dealers are still short TSLA (bullish indicator), but there's not a lot of momentum there. This could mean that most traders have put their bets in place already and aren't moving them much.

- TSLA's IV rank climbed to 36% and that adds selling pressure from vanna (perhaps that's why we have selling pressure from gamma at $265).

- Options are still priced for a significant upward move (1.6-3.3%) and the 6/30 expiration looks firmly bullish.

Just like AMD, most of TSLA's flow was set early in the week:

Thesis

AMD appears to still be in a correction phase which could last until the 8/18 expiration (based on dealer OI until then). TSLA looks bullish at least through 6/30 and indecisive after that.

Both of these stocks could be impacted quite a bit by changes in volatility, so keep an eye on the VIX.

Good luck! 🍀

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Discussion