Friday analysis for August 11th

Trading ranges seem to be opening up for some stocks which looks promising at first, but there's plenty of indecision going into the 9/15 OPEX. 🤔

We're one week away from the August OPEX and we received some promising CPI numbers yesterday. These improvements are good for inflation, but the feeling of reduced inflation really hasn't reached people yet.

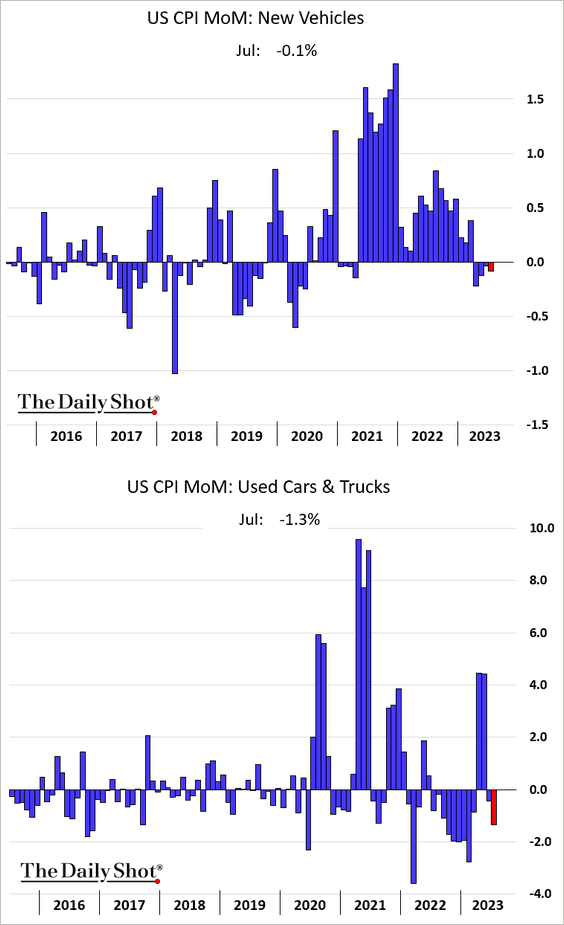

Home and auto prices are usually the biggest expenses for most and when these come down, people will feel inflation come down. Used car prices are the first to drop, followed by new car prices:

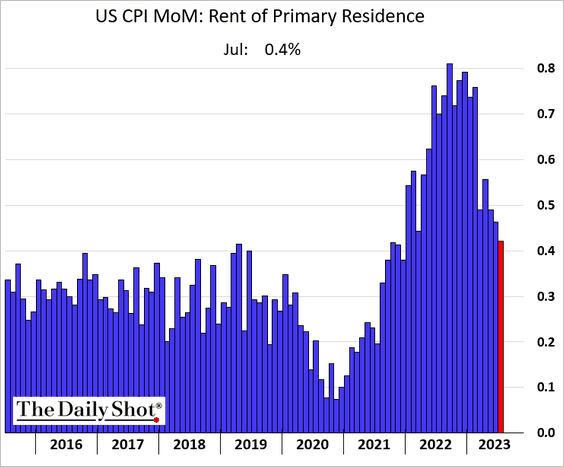

Rent inflation is still incredibly high and although it isn't deflating yet, its rate of increase is coming down:

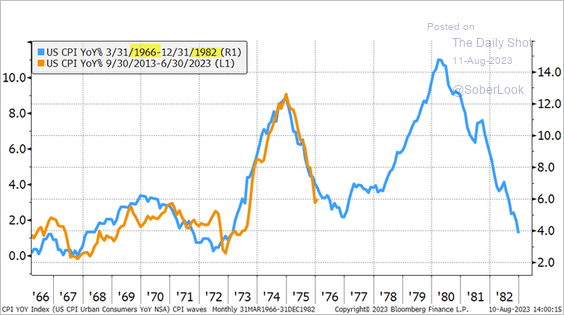

One of the worries here is that we will spike right back up after getting inflation to cool:

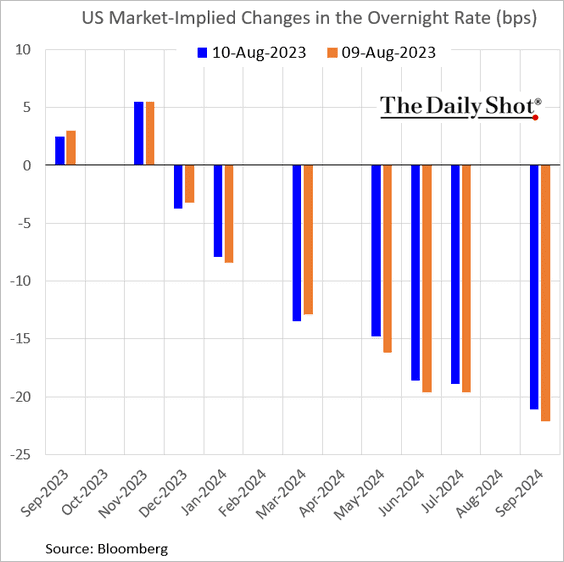

But the market is betting on the Federal Reserve to hold interest rates steady in September:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get into today's data!

AMD

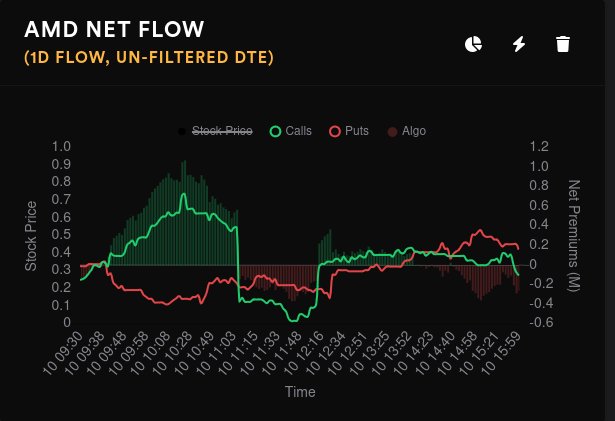

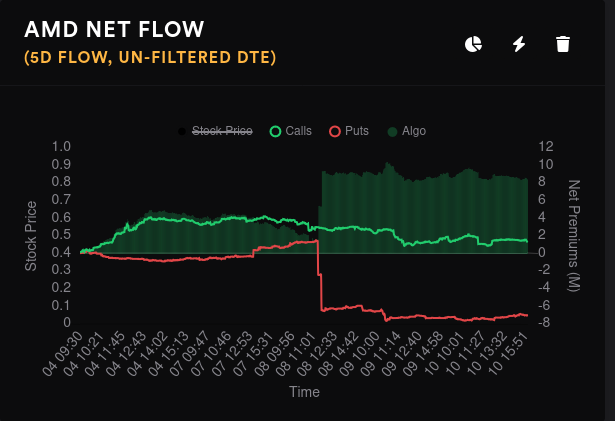

AMD finished right on its main dark pool volume level around $111 and the flow shows bears heading for the exits. However, there hasn't been a significant amount of traffic in calls to match it:

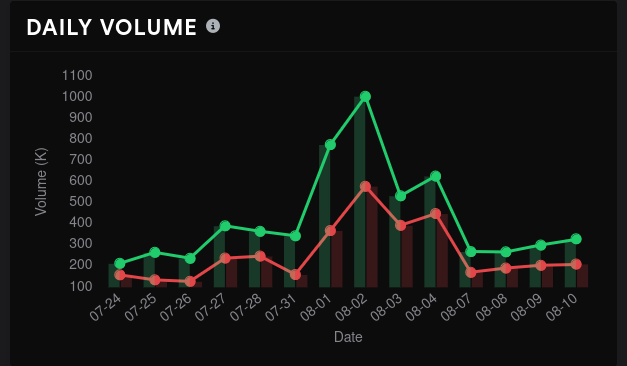

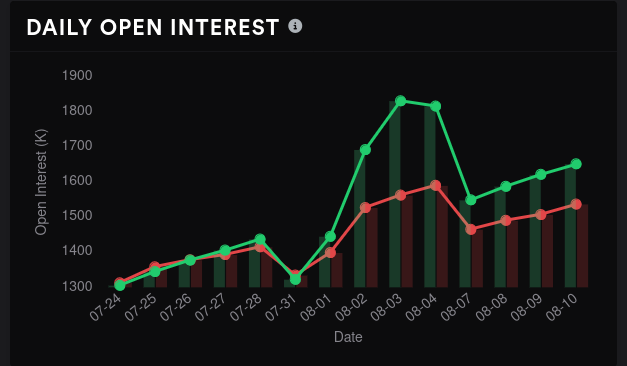

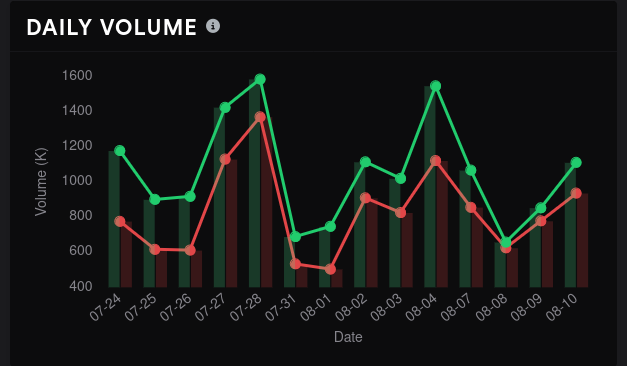

Volume on AMD options has dropped sharply but open interest (the amount of contracts that remain currently open) is steadily increasing. NVDA reports on the 23rd, so this could be some proxy betting on AMD for those earnings.

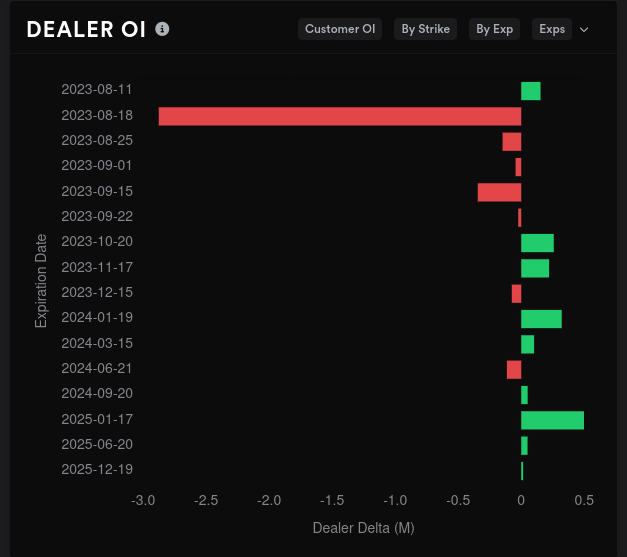

Dealers remain short and customers are long which has proven to be a bullish sign for AMD in the past:

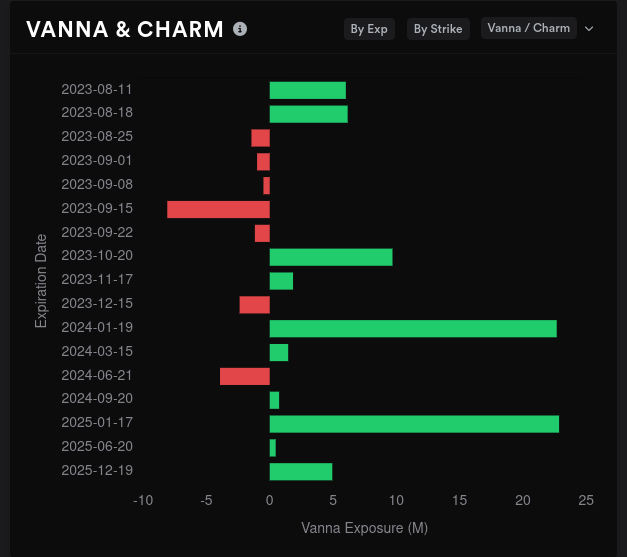

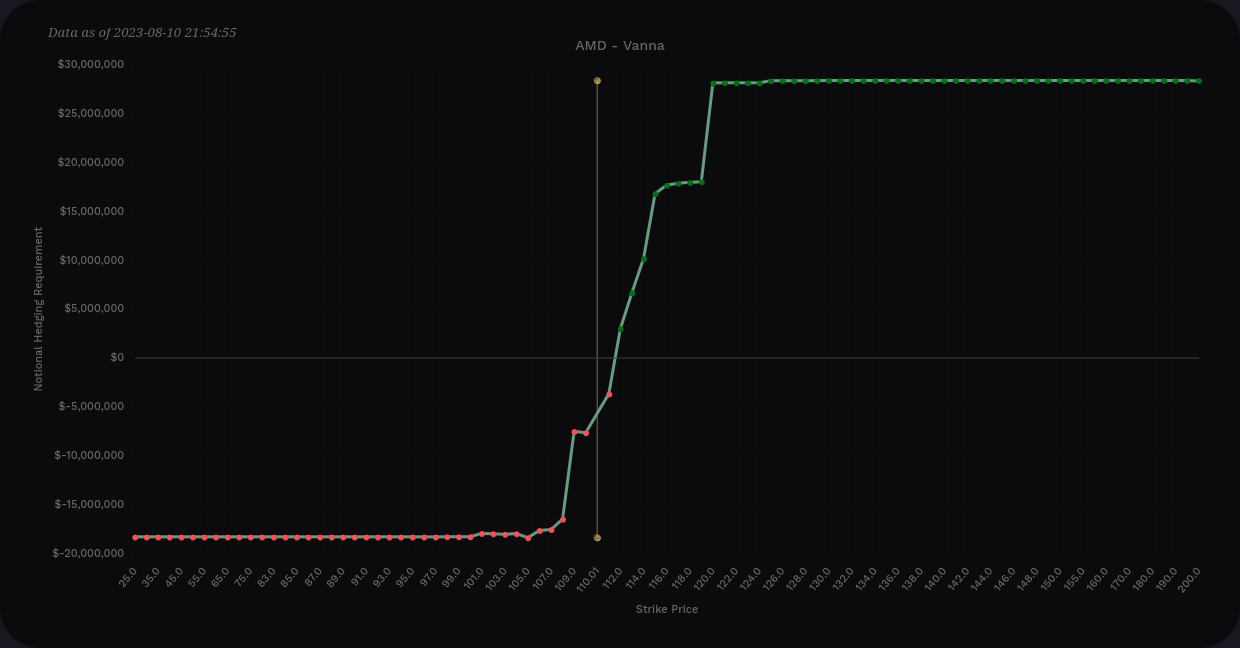

8/18 remains absolutely bananas bullish for AMD, but things seem to cool off after that. Vanna looks positive through 8/18, but remember, positive vanna is a bull's friend when implied volatility (IV) holds steady or drops. Bulls want to see positive vanna plus contracting IV.

However, if IV expands going into 9/15 as some has suggested, the negative vanna from 9/15 could boost AMD's price upwards. That remains to be seen.

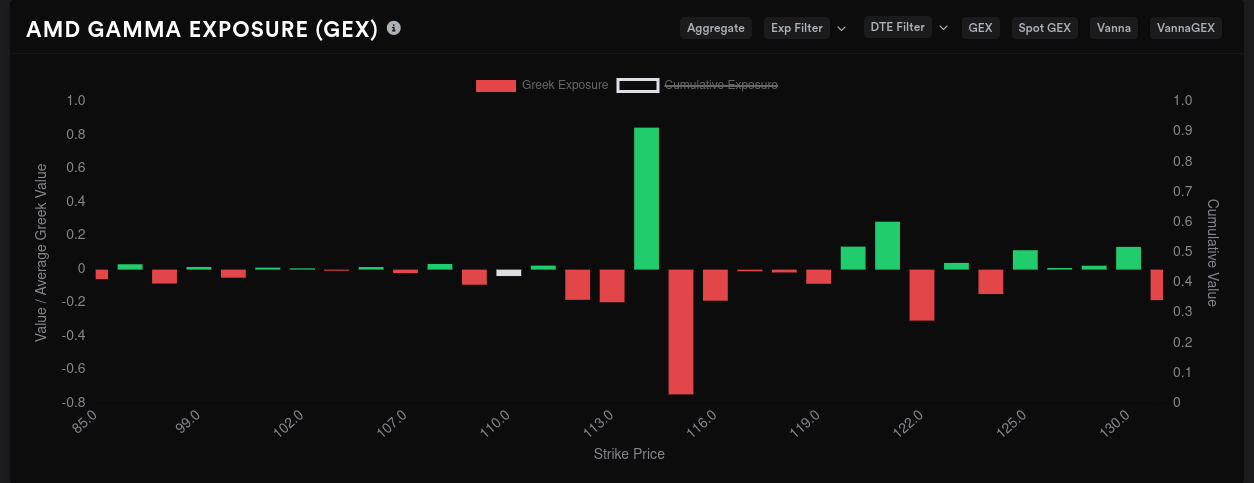

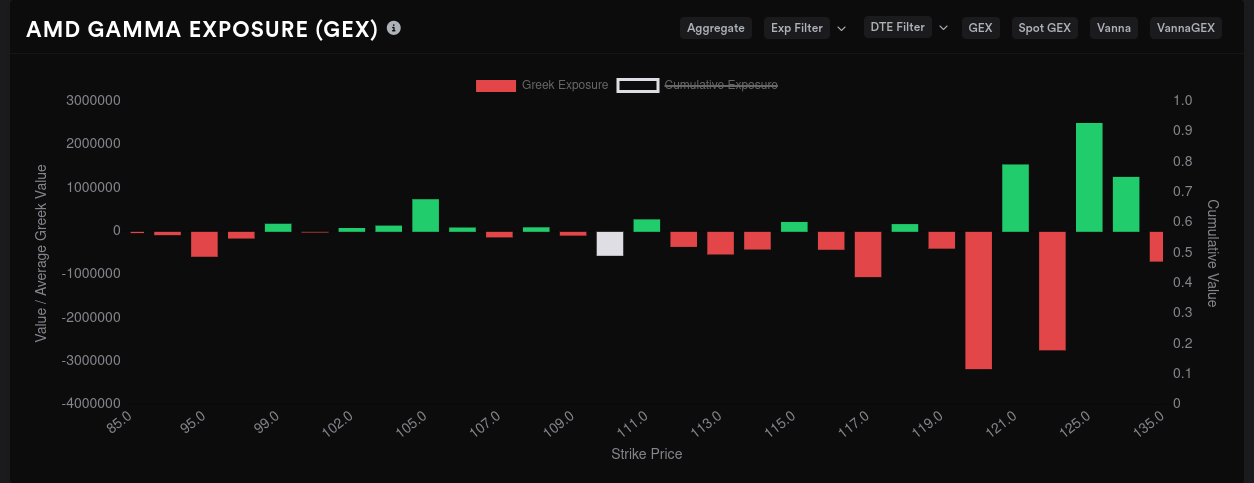

As for the aggregate GEX, the biggest magnet for price remains at $115 with a big wall of resistance at $114.

AMD's GEX flattens a lot for 8/18 and this could allow price to run around a lot – up and down. Biggest price draws show up at $120 and $122 with some resistance there blocking higher moves. On the downside, there is very little protection outside of a small resistance at $105. Remember that AMD could break out of its current range abruptly, but that breakout could be up or down.

GEX for 9/15 is still difficult to predict since it's a ways out, but $115 seems like a solid magnet for price. Note that the positive GEX lines are very small in comparison. This chart tells me that price is much freer to move here.

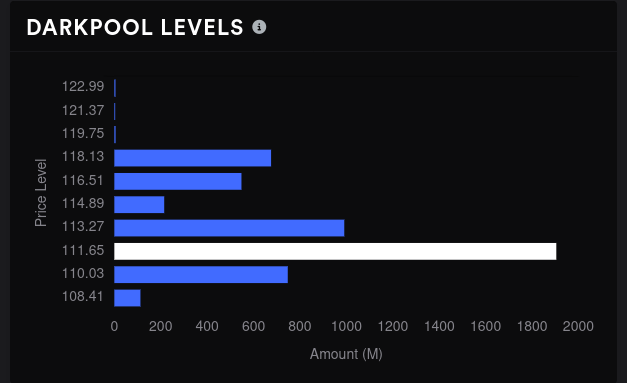

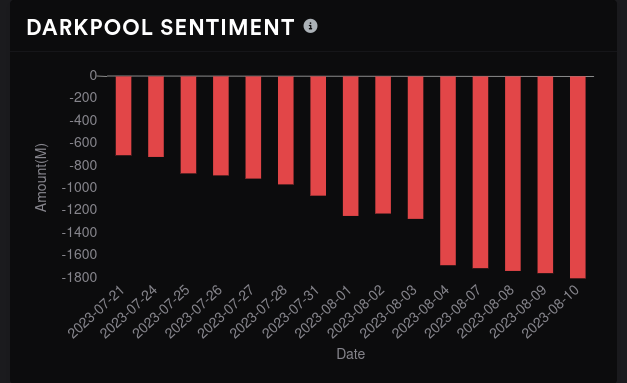

Dark pool volume continues to be heavy at $111.65, but it has reduced slightly from 2B to about 1.9B. The $113.27 level is slowly growing each day. However, overall sentiment in big dark pool trades remains negative.

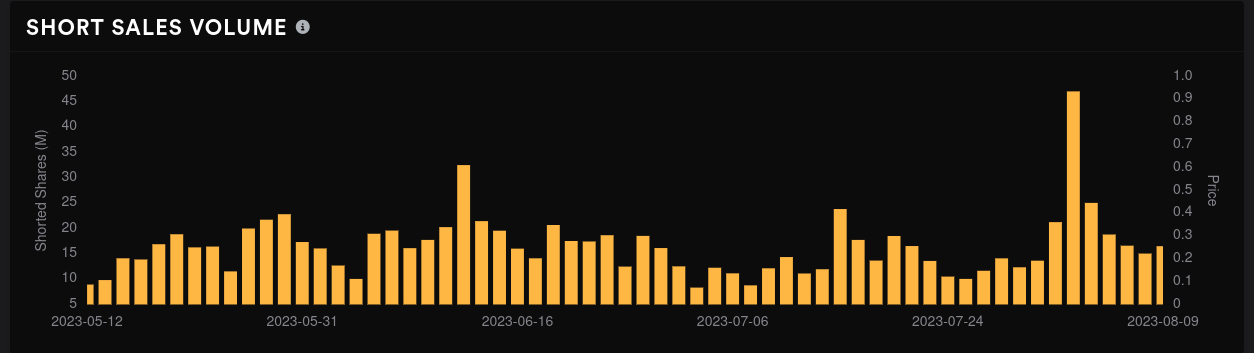

We noticed that bearish options traders headed for the exits earlier this week and short options traders seemed to make a similar move:

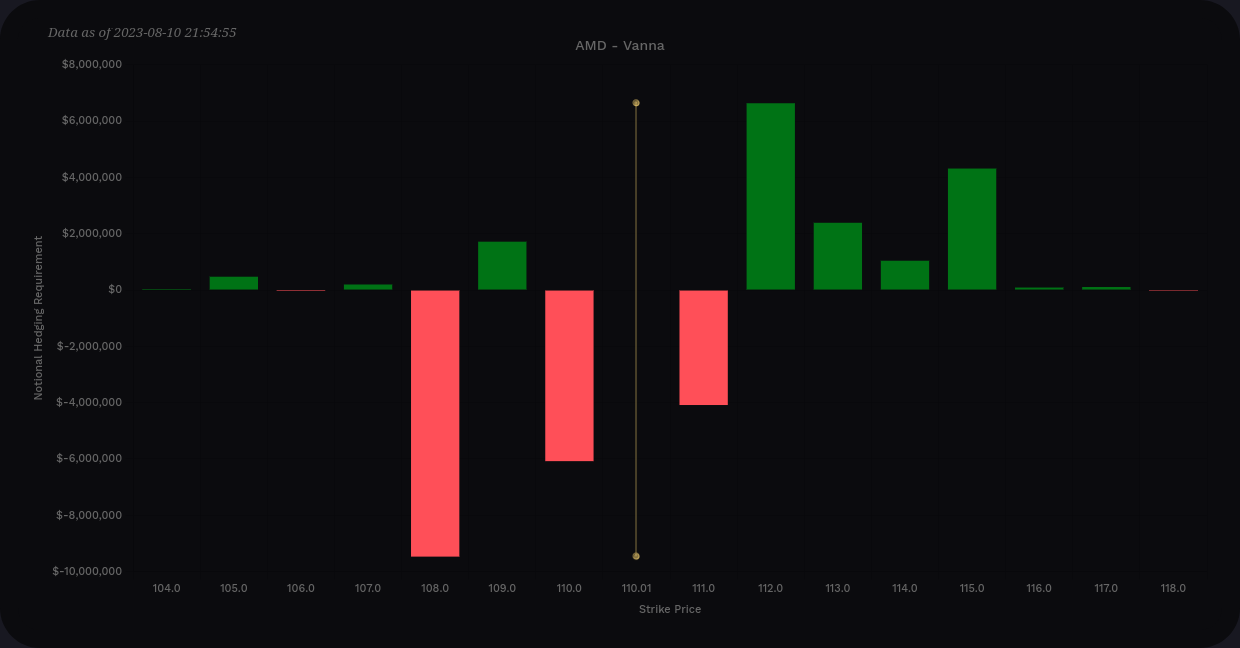

AMD's vanna from now through 8/18 looks fairly balanced without any strong pressure in either direction. We're bounded by $108 and $115 here.

If we include data up to 9/15, we see a slightly different picture. Positive vanna increases and $120 suddenly appears as our tallest bar. This looks bullish, but remember that an overall positive vanna will be bearish if IV expands.

TSLA

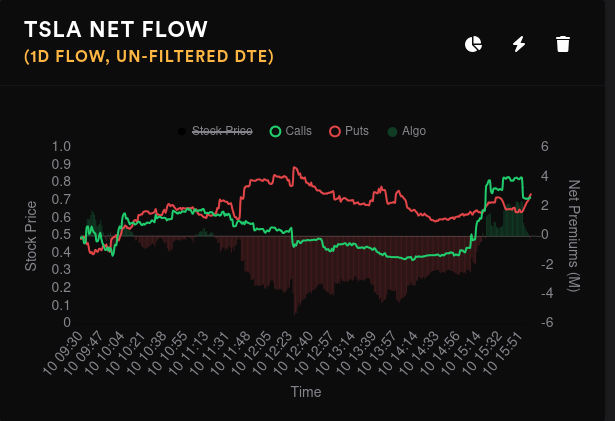

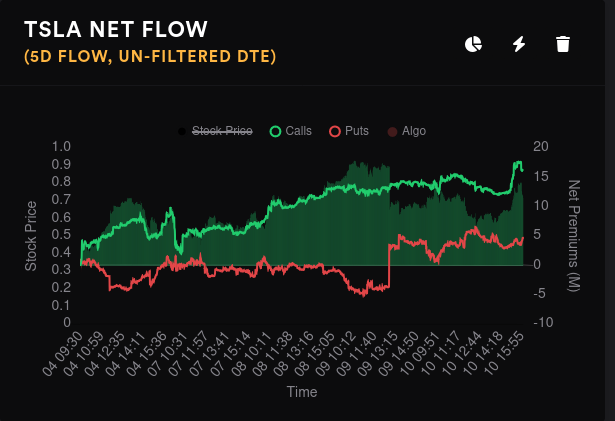

It's been choppy for TSLA lately. Flow looks bullish overall for the past five days but options traders are definitely adjusting their bets constantly. TSLA lost a support level this week.

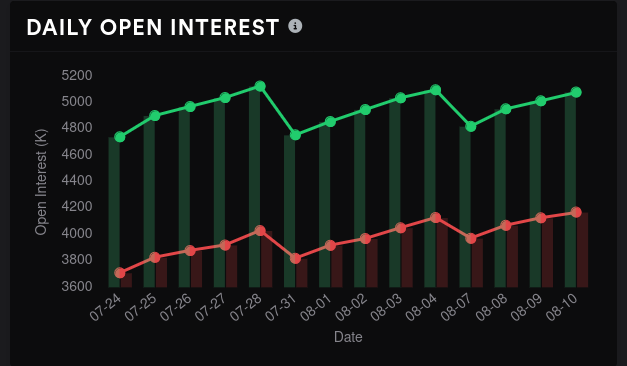

Open interest remains fairly steady, but volume has varied a lot:

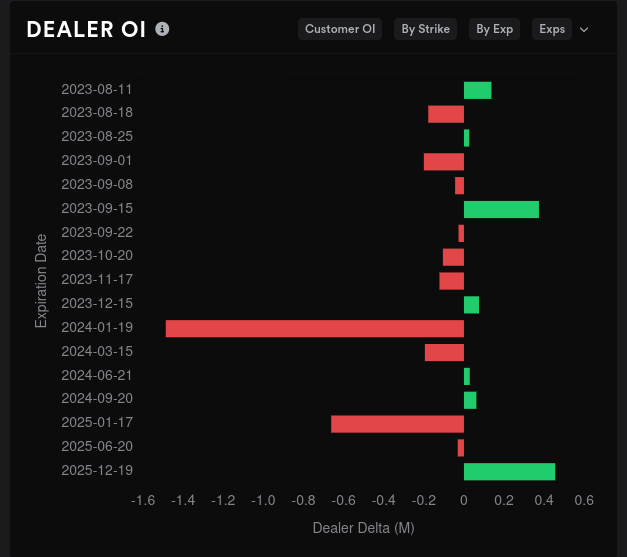

Dealers are quite long on TSLA, which suggests customers are quite bearish. We are at levels right now that we haven't seen since April 6th. On that day, TSLA's price fell below the 50MA just before the big May rally.

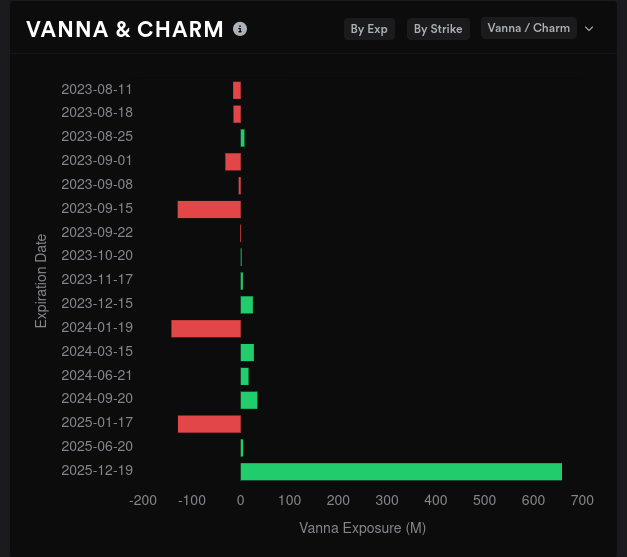

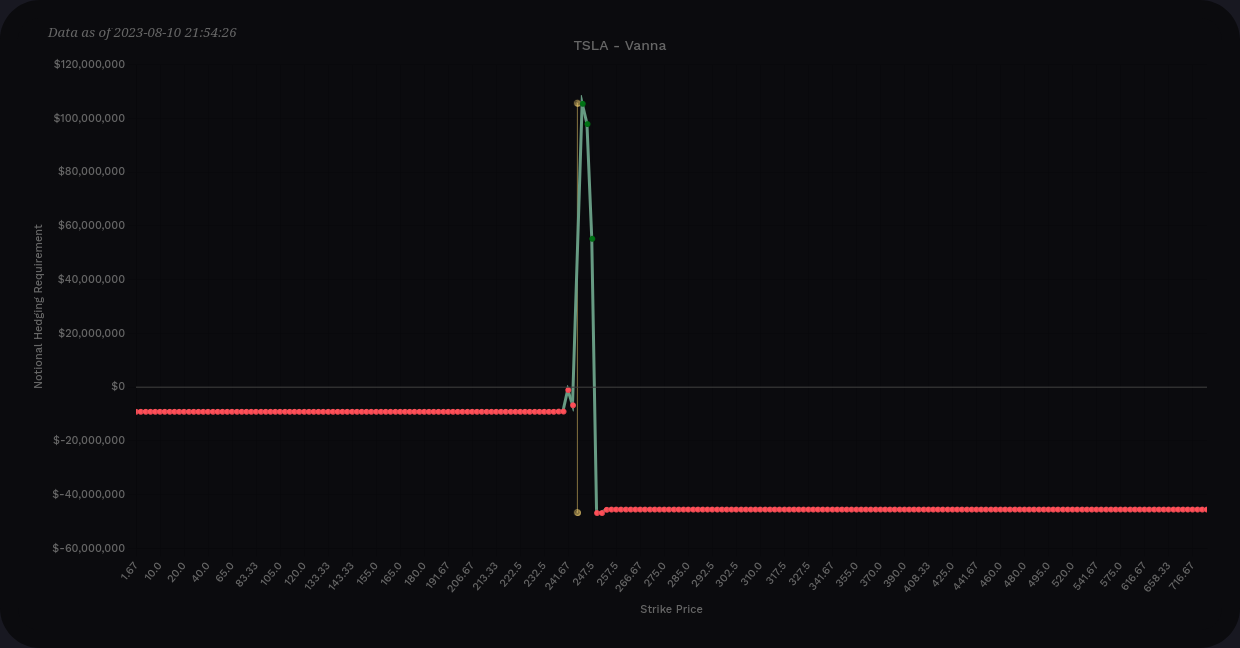

TSLA's vanna is piled up heavily in 2025 LEAPS contracts and there's not much between now and then. 8/18 looks a bit bullish and 9/15 turns bearish. If IV expands as we approach 9/15, TSLA should get some buying pressure from vanna:

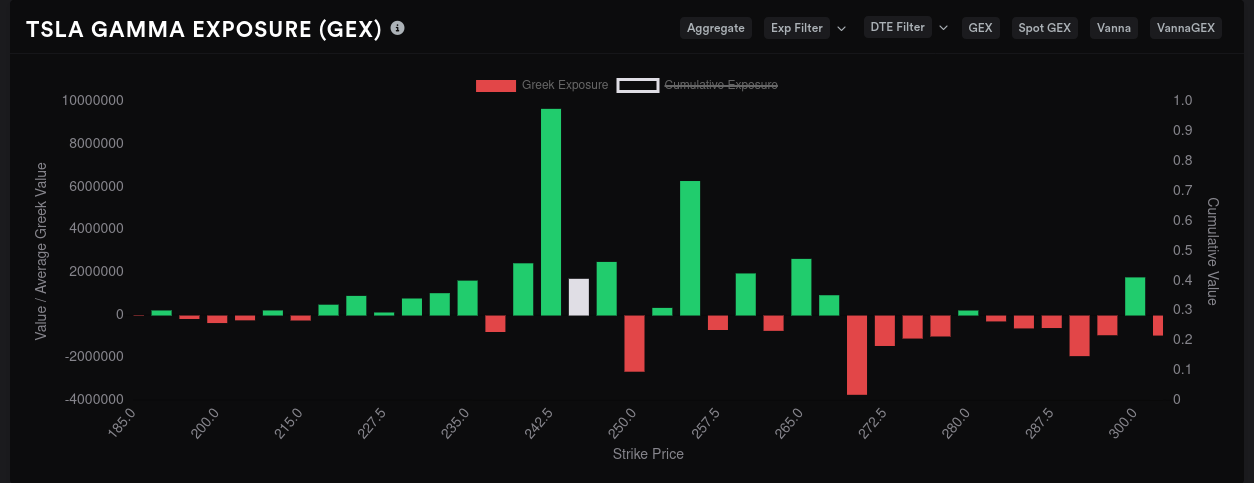

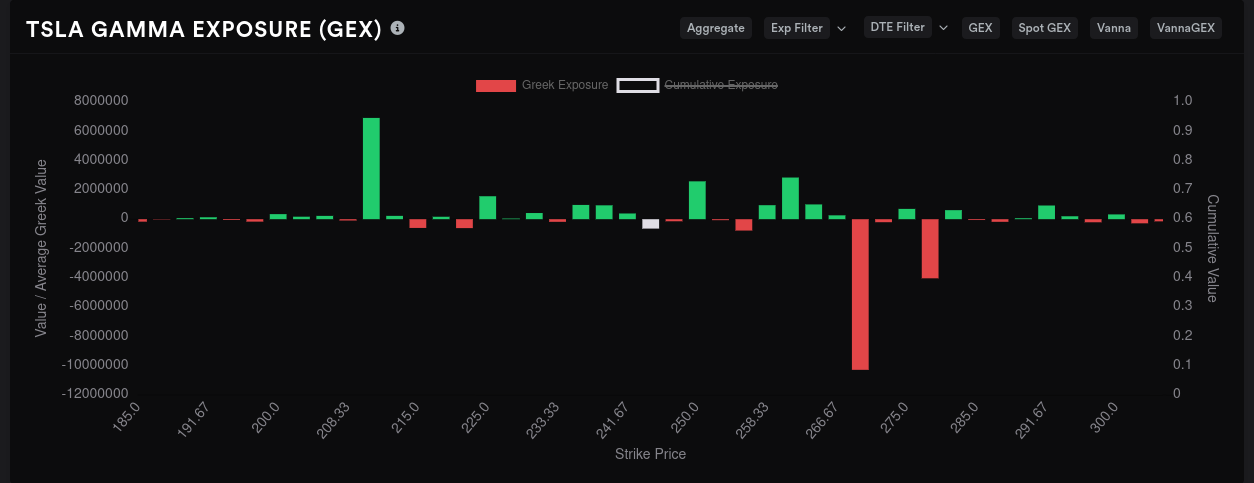

Aggregate GEX shows price pulling towards $270 with some secondary price magnets around $240 and $250. We're stuck on our largest positive GEX line right now.

8/18 GEX looks like we might be held in place by positive GEX. There's a ton of it surrounding $250. $270 seems to be the biggest magnet here but there's too much resistance in the way.

9/15 looks a bit clearer and the positive GEX settles down here, too. Our biggest price draws are around $270 and $280 and we get some downside protection around $210.

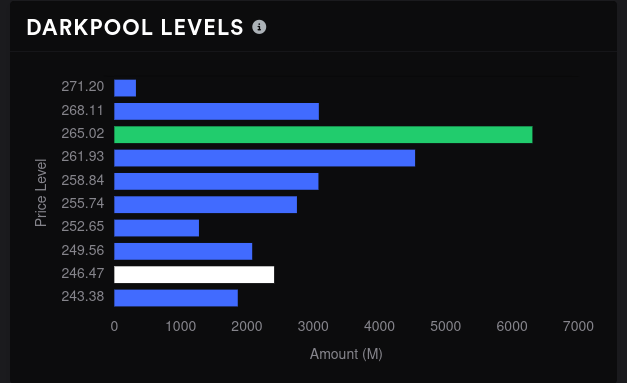

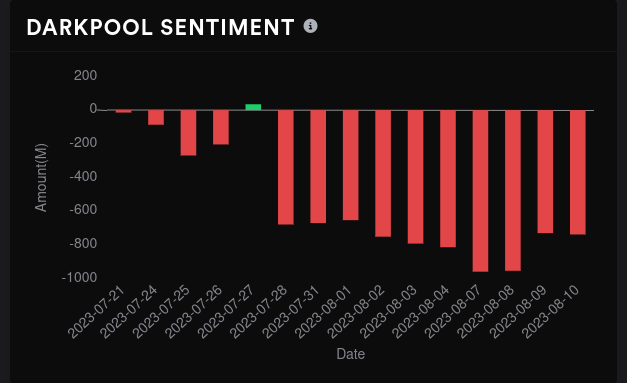

TSLA's dark pool sentiment turned a bit less bearish yesterday and our biggest level remains at $265. This was closer to $262.50 recently, so that's an improvement. We might be building out a base around $246 and that's something to watch.

TSLA's vanna from now through 9/15 is negative like we saw earlier and it's flipped relative to AMDs with positive vanna hanging out below the negative vanna. This looks bullish if you think IV will expand, but it looks bearish if we expect IV to remain the same.

Thesis

I keep seeing data that shows me that stocks have more room to run as we get past 8/18 but I'm not sure there's enough fuel to do it. This might be due to reduced liquidity in the market that I've noted recently on charts. Less liquidity leads to challenging price discovery and wild swings in price. This can also increase volatility.

My gut says that increased volatility is likely coming before we reach 9/15, and if that's the case, both AMD and TSLA might get some modest bullish pressure from vanna.

The market is really indecisive right now past 8/18.

As an example, I kept receiving AMD options sweep alerts this week and each time I looked at them, they're all for November and December. Most of TSLA's big bets are in 2024 or later. All of this points to a potentially wild 9/15 OPEX.

At the moment, I'm still bullish on AMD from $105-109 and bearish at or above $115. For TSLA, I'm bullish around $240 but bearish over $265.

Good luck to everyone! 🍀

Discussion