Friday eve update for 7/27

Did we just see our last interest rate hike? How will the market react? Let's dig into the data. 📝

Because it's not Thursday – it's Friday eve! 🌴

The market was planning for a 25 basis point increase and that's what we got yesterday. With any of these interest rate meetings you really must wait until the press conference so you can pick up on nuggets like these:

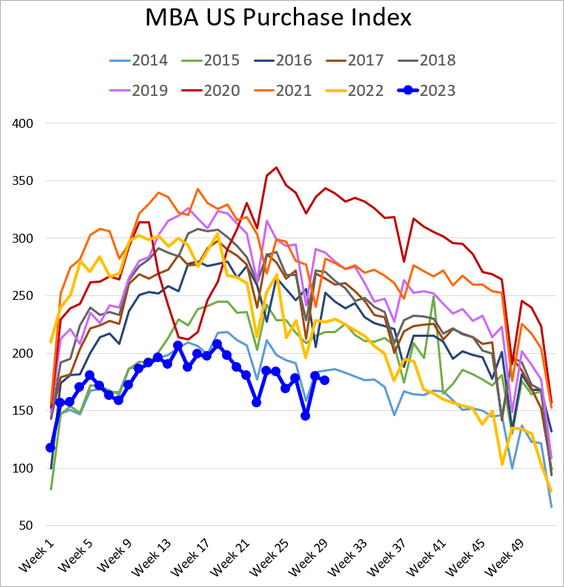

Before you get too excited, remember that prices for homes, automobiles, and food from restaurants hasn't budged much and has gotten worse in some cases. All eyes are on the housing markets now as mortgage applications continue their slide:

I'm interested in how the market reacts to this. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's take a look at the data.

AMD

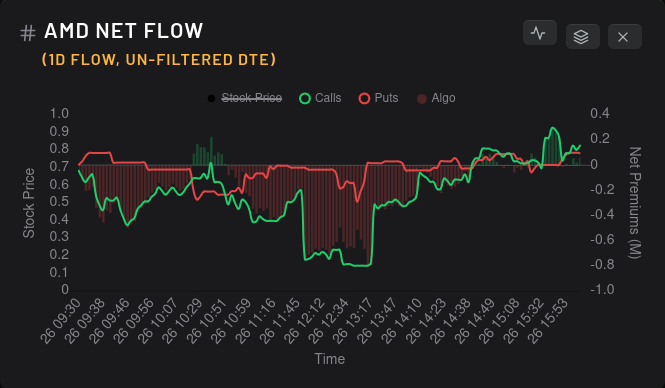

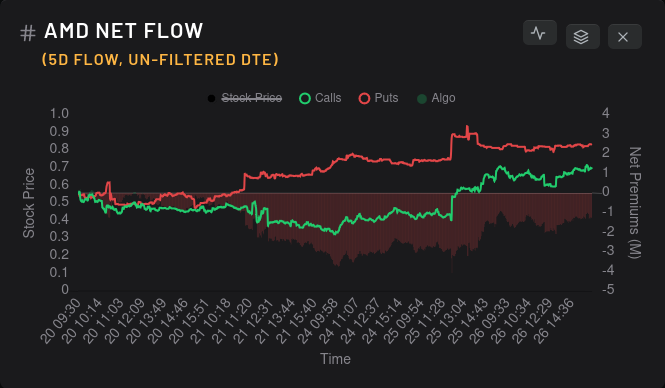

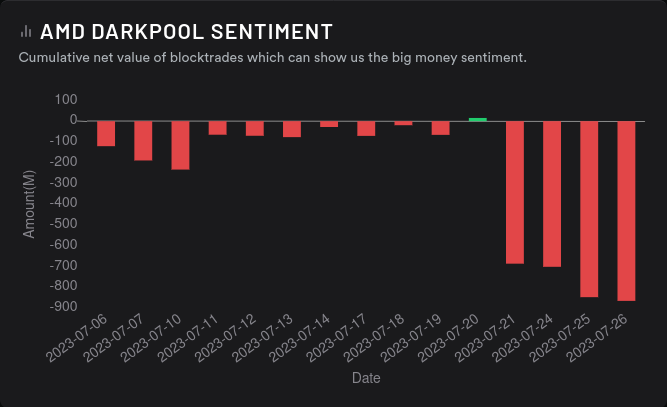

AMD's flow yesterday was all over the place, but it recovered to just about even after the Fed's press conference. It's tilting slightly bearish on a five day chart:

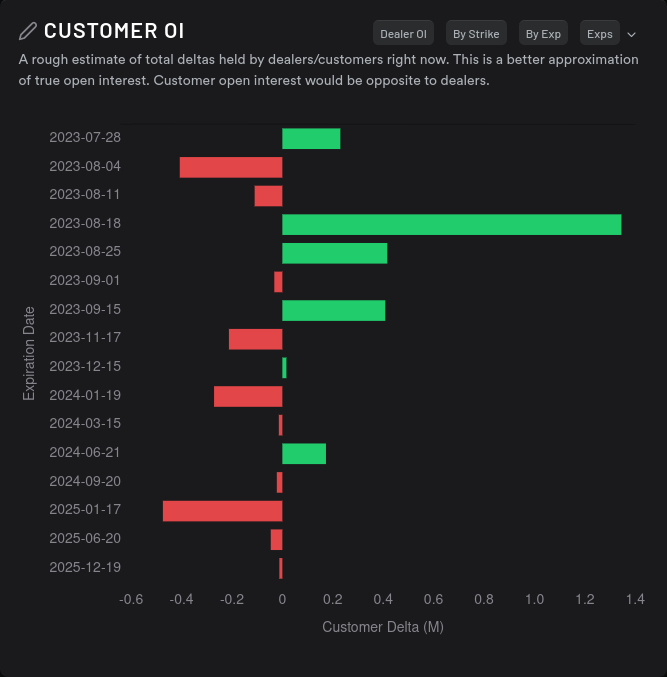

That doesn't tell us much, but how about vanna? Vanna is in a weaker state right now but it can still have some impacts on price. Here's a combined look at AMD's vanna for expirations from 7/28-8/18:

This looks pretty bullish to me, but notice that the positive vanna runs out at $115. There's not much above that level. Remember that vanna's strength goes towards zero as price approaches that vanna level (gamma is the opposite). I'd really like to see some decent vanna levels above $115 before I get excited about a big run.

AMD's 7/28 gamma exposure (GEX) still has a decent-sized wall at $113-$114. The largest negative GEX levels often act like magnets and the $111-$112 combined gamma looks really strong. Sure, the $121 is still out there, but there's plenty of positive gamma in between to slow that price movement:

The $113/$114 level has been strong this week, but $111/$112 have become more negative, which suggests price may want to be pulled down to those levels. Next week's GEX for 8/4 (earnings week!) looks like $110 is the strongest magnet and $115 could be the top.

Bullish traders should be excited about the 8/18 expiration date:

Price for 8/18 looks bounded by $103 and $123, so we might see some larger moves by this time:

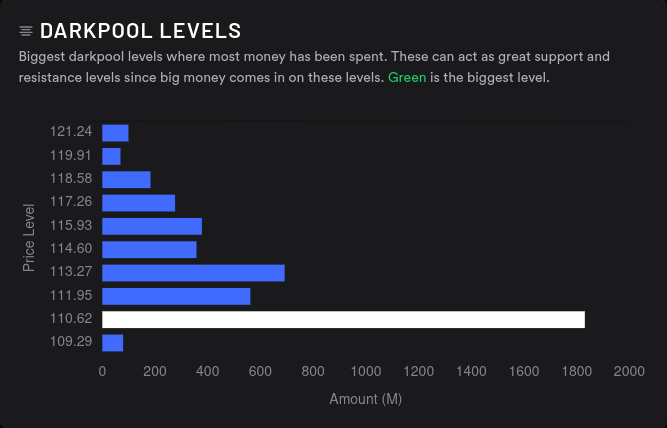

Dark pools confirm these levels as $110-$111 remains a very high volume level. There was also a signature print (dark pool trades with an almost 24 hour delay) reported by Tradytics: 163K shares sold off at $113 worth $18.42M. This reinforces my belief that $113 is AMD's temporary top through earnings.

TSLA

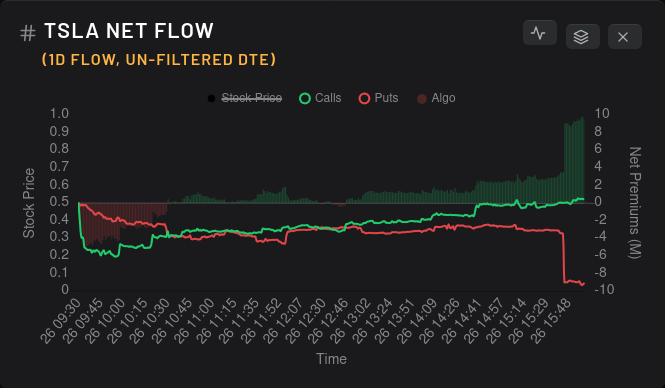

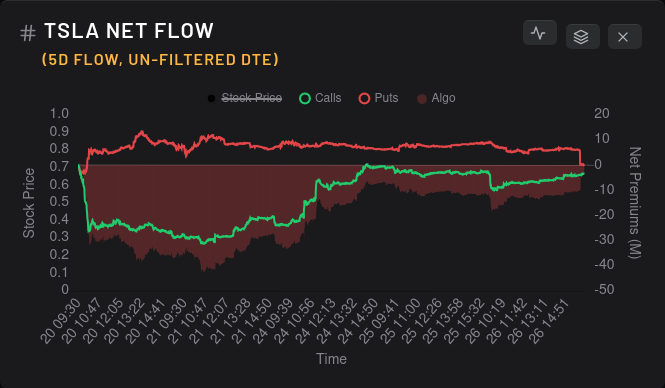

There were puts selling off yesterday on TSLA and its options flow has come together in the middle on a five day chart:

Vanna for combined expirations through 8/18 looks bullish, but I worry that there's not much vanna above the current price. Vanna levels are also highly concentrated as specific strikes:

Dealers are still short TSLA and that's a bullish sign. However, 7/28 might be the last bullish expiry for a while:

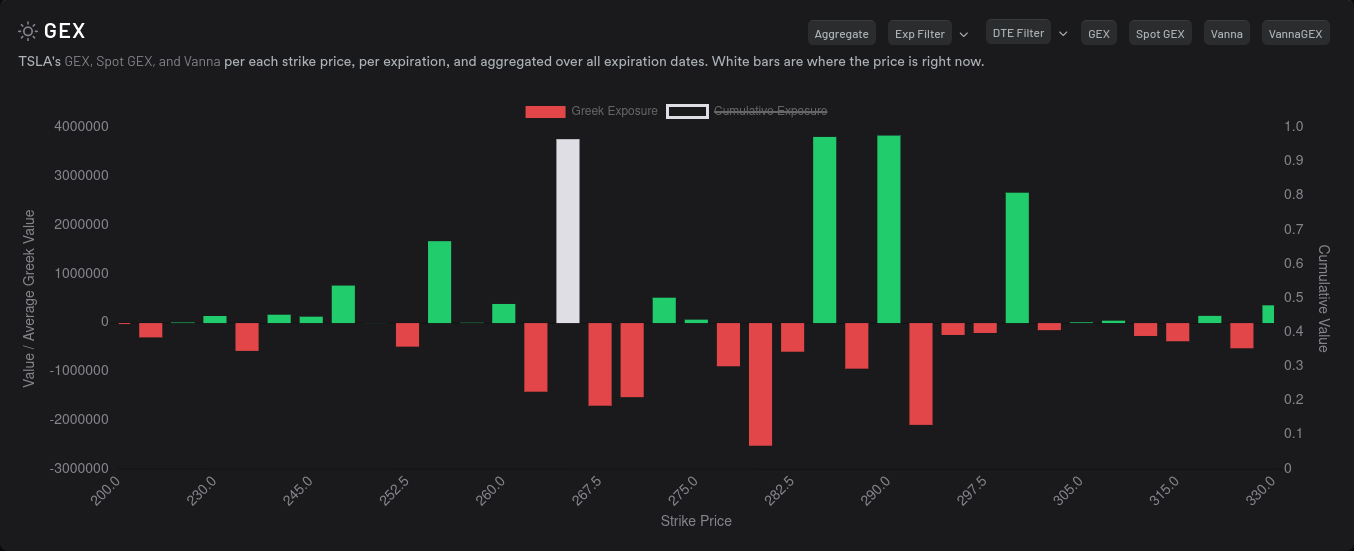

TSLA's 7/28 GEX still has the massive $270 wall that gained strength as the week went on:

Looking out to 8/4, there's some room to run to $285, but we need to get off this $265 strike. If we don't a move down might be slowed around $255. The biggest price magnet on the chart is around $280:

If we scoot out to the next OPEX on 8/18, the data becomes a bit clearer. Climbing over $265 leaves us fairly open for a move higher to possibly $300. $280 and $290 are likely price targets here. Should we move down, we will hit resistance at $260 and $255.

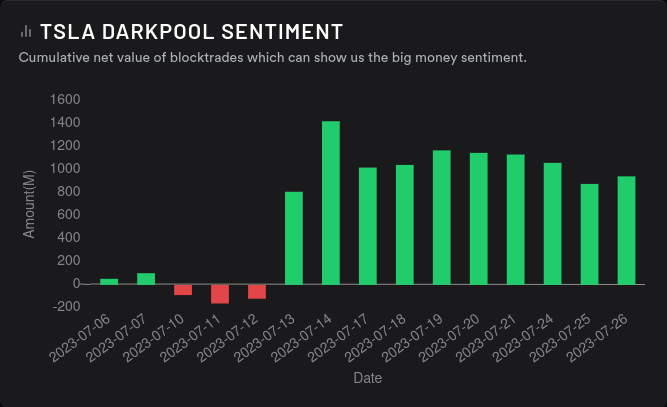

Dark pool data shows strong volume from $265 to $279. This could definitely provide fuel for a move up and resistance to a move down:

TSLA also had a signature print shown on Tradyitcs of 200K shares sold at $268.10 for $53.63M total.

Thesis

Everything around right now is unusual. Interest rates are the highest they've been since 2001 and we might be finally putting real dents in inflation. Recession talk still goes both ways right now. Forbearance for student and other loans has ended or will be ending for many Americans and that could cause swings in employment and retail strength.

Anyone who says they "have the market figured out" should be treated with extra suspicion. 😜

AMD seems stuck in a range until earnings, but there is a runway for a move up provided that AMD provides some good news at earnings time. They've made some huge advances in servers lately and they have a huge consumer/enthusiast following for home use. I plan to make bullish trades each time AMD falls around $110 and I'll go cautiously bearish when AMD approaches that $113-$114 zone.

TSLA's future moves look wild. Is $300 an option again? It's looking more likely today than it has all week. Could we possibly get jammed in a $255-$265 trading zone for a while? That's possible, too. I'll go bearish on it at $270 for this week, but I plan to let it run after this week at least through 8/18.

I have long shares of AMD and TSLA with some short puts on AMD. All of my trades are over on Theta Gang along with my trade notes! Good luck out there today! 🍀

Discussion