Friday morning options analysis for September 1

Happy Friday! 🎉 Let's dig into AMD/TSLA data and see if we can make some good trades going into 9/15 and 10/20. 💪

Welcome to September! 🍂

We're still seeing temperatures of 100°F / 37°C where I live, but I'm hoping we get some relief into the fall. The pumpkin spice latte must wait. ☕

The stock market is showing some great strength recently and it wavered a bit yesterday. Let's dig into some data for today and see what's changed as we roll towards the September OPEX in two weeks.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's go! 🚀

AMD

AMD sits in a precarious position where all of its trend lines are starting to come together. Moving averages (yellow, orange, red) are coming together. The top purple line is the VWAP from the June high and the bottom purple line is the VWAP coming up from the January 6th pivot.

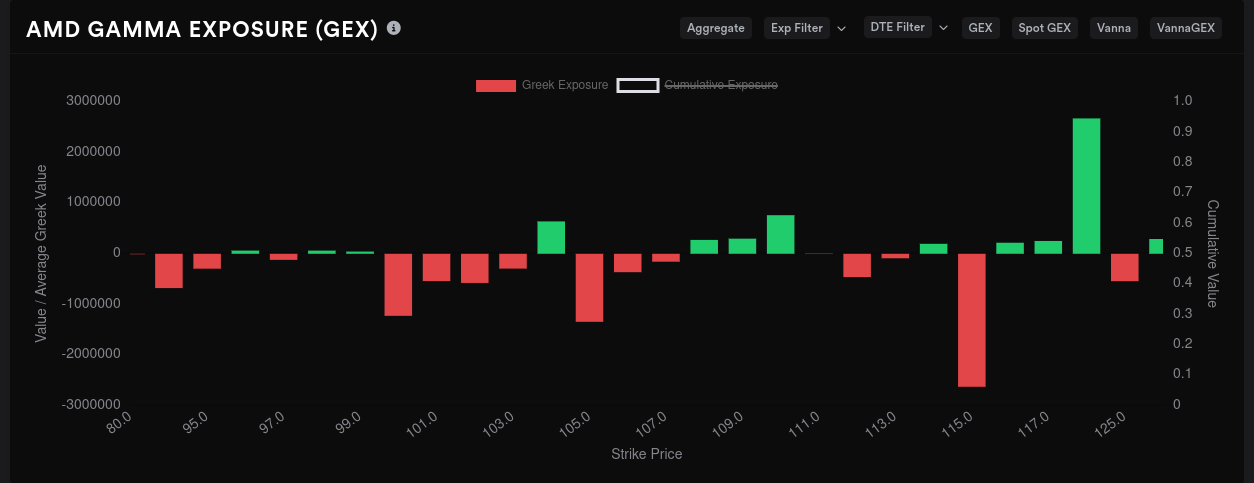

$110 is a critical level here as we have 20/50 moving averages here, plenty of positive GEX (usually will repel price in both directions), and volume by price shows the point of contention here, too. If AMD can climb over $100, it will get a boost from all of these trends, but there's a good chance it could bounce off and come back down a bit.

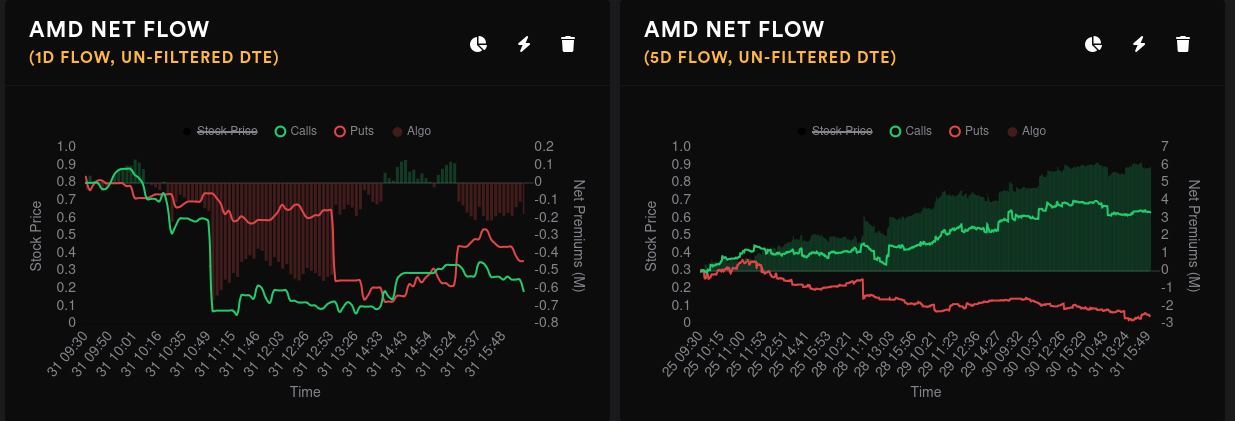

Yesterday saw some sold puts and sold calls as part of some longer term spreads, but AMD's overall net flow for five days is quite bullish. I'd like to see a stronger Y-axis here, but the trend is pretty clear.

Volume is coming down a bit on AMD's options, but open interest remains high. IV rank is around 42.5%. 9/15 GEX still suggests a move to $115 with price action stopping at $120:

10/20 has shifted a lot with $125 getting almost an equal chance as $95 as a price magnet.

On the vanna side, AMD's vanna from now through 10/20 looks like $120 is the target (provided that IV remains calm). IV expansion looks like it has the potential send us lower to $90-$95. This matches the GEX charts.

One notable mention is that big money options traders, or "whales", have gone crazy bullish for $95 on 10/20. Sure, this could be an in the money bet on AMD where you get options contracts that perform a lot like stock without the cost of buying shares. It could also be a hedge for shorts, but I find that doubtful with AMD's current price.

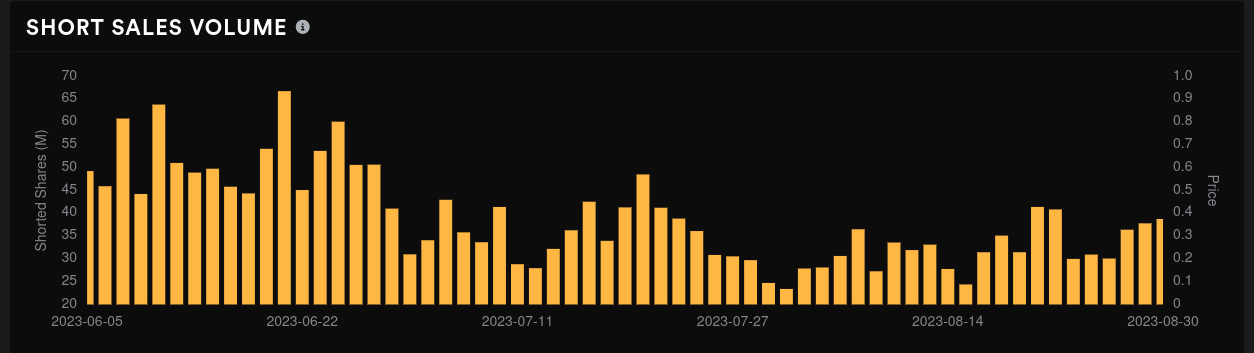

AMD's short interest remains relatively low:

Dark pool data shows a good volume day with bullish traders winning out four days in a row. Sentiment has shifted well above the middle line and our strongest level is now just under $106. I really like seeing a consistent move here along with high volume.

TSLA

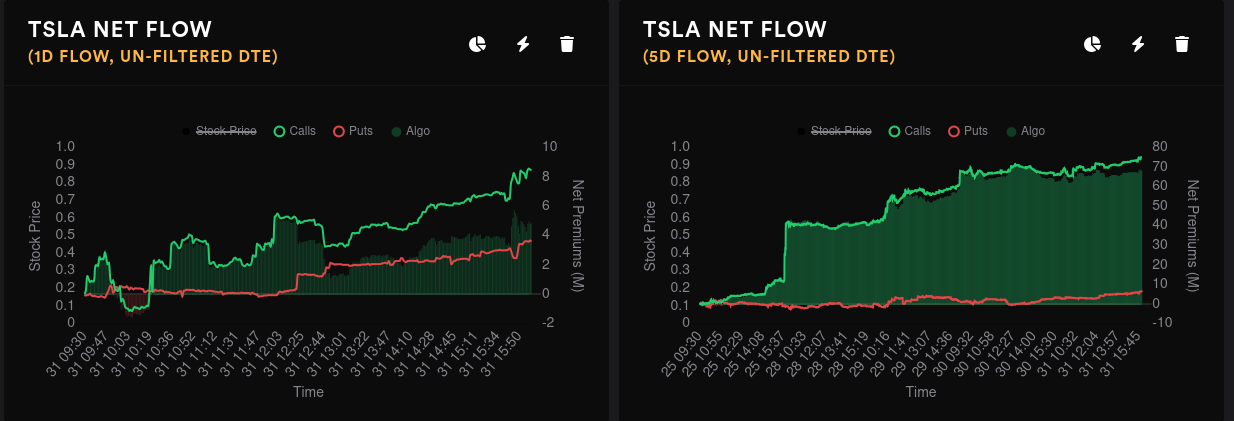

Options flow remains incredibly bullish here, but puts started to slowly ramp up yesterday. They barely register on the five day flow:

9/15 GEX suggest a move to $270 is still in the cards, but there's a speed bump just before at $265/$266.67. $280 is possible, but I don't think I'd bet on it.

Did I mention that TSLA is bananas sometimes? 🍌 10/20 suggests we're headed to $290 with some room to run from $285-$310. Good gosh!

Let's slice the banana using vanna. (Sorry, I tried, but it's early in the morning.) 🤣

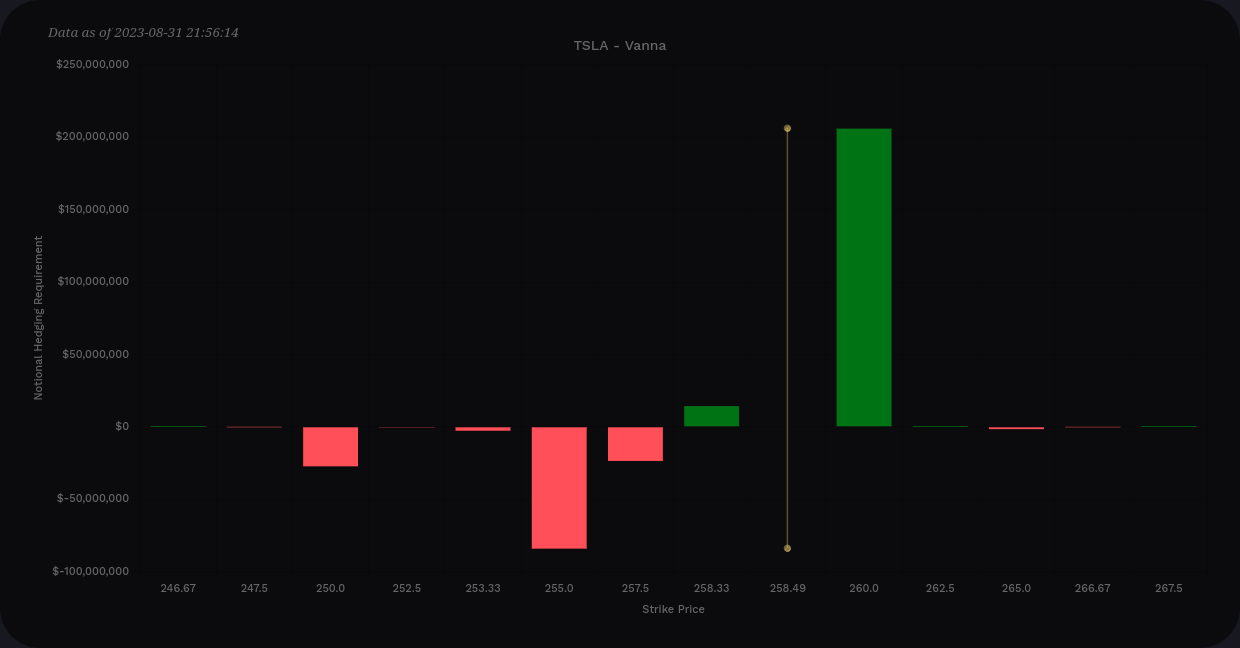

TSLA's vanna from now through 10/20 is more concentrated than it was previously and it paints a bit more conservative picture than GEX. $260 seems like the upper boundary here for getting help from vanna. Remember, vanna has no effect when price is sitting on the vanna level and we're quite close to $260 now. IV expansion would likely take us to $255.

Short interest in TSLA remains relatively low, but it's on the upswing:

Whales are betting on TSLA $230 and $250 as I look across all expiration dates:

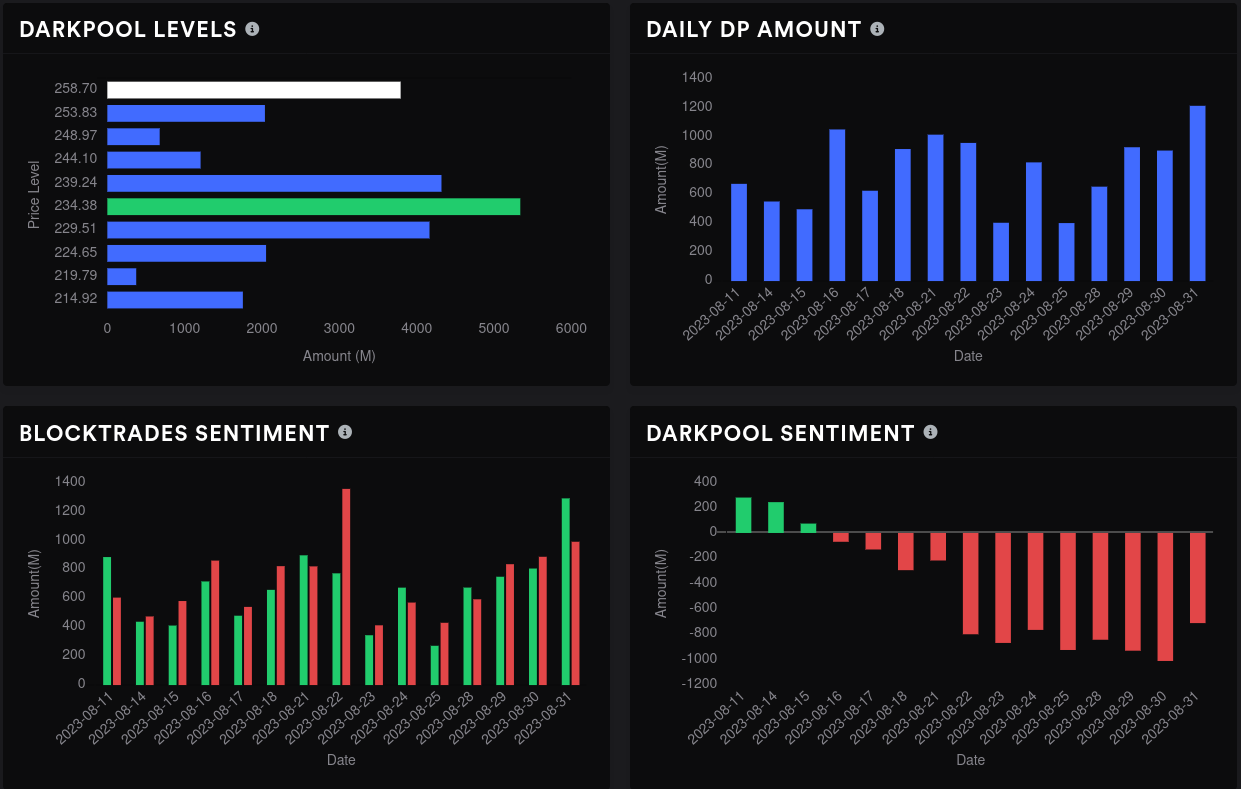

Dark pool data shows increasing volume with the bulls finally winning a day after bears won two in a row. Our biggest dark pool level is pretty far down around $234, but the $258.70 level is fairly large. Sentiment is moving towards the middle line but it has some work to do:

Thesis

I made the mistake of trading too much on news and macroeconomic data for a while and missed some of this rally. It goes to show that following the data that is right in front of you is often the best plan. It reduces my stress a lot and keeps me focused on what others in the market are betting on.

AMD still looks like it has potential to hit $115 for 9/15 and possibly higher for 10/20, but it has some roadblocks in the way. $110 is critical for many reasons as mentioned earlier and that $117-$120 zone has been a real liquidity problem multiple times.

I'd still be bullish on AMD during any dips into the $95-$103 range. If AMD rallies to $115-ish, I'd look for a breather before it climbs higher. I sold a bunch of covered calls already and I wouldn't mind getting some of them back if we get a brief dip.

As for TSLA, vanna supports a range from $250-$260, but GEX suggests something higher to $270 by 9/15. Dark pool sentiment improved, but I'd like to see it continue before I make more bullish trades. Also, short interest is building slowly again.

As always, you can follow my trades on Theta Gang. You'll find all my trades, trade notes, and lessons learned there. Good luck to everyone today! 🍀

Discussion