Giving credit where it's due 💳

Credit card puns aside, both Visa and Mastercard are making bullish moves since the summer of 2024. Which is the better buy? Let's dig into the charts.

Hey there! 👋 I couldn't help but make a pun in the title today since this post focuses on recent charts for Mastercard (MA) and Visa (V). Both stocks are at their highs and I've been watching both for a potential trade.

Before we get into some charts:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Time for charts! 📈

Mastercard (MA)

Let's start with a weekly MA chart since the big market turn in October 2023. You'll see a 30 week moving average in white, a VWAP (volume weighted average price) line in blue, and two light yellow bands which are two standard deviations away from the VWAP line. Statistically speaking, prices are found within two standard deviations about 95% of the time (but this isn't a guarantee).

MA sits just under $575 this afternoon. Looking back, price hugged the two standard deviation line well into March 2024, but then came back to the VWAP for a test in the summer. It launched after that and corrected slightly towards the end of 2024. It's back into the edge of the standard deviation band today.

There was a doji candle three weeks ago and this week (only one day so far) has another doji for us. This suggests that bullish momentum is being pushed back a bit by bearish trades. Price was very tight around $530 and we might see another consolidation here.

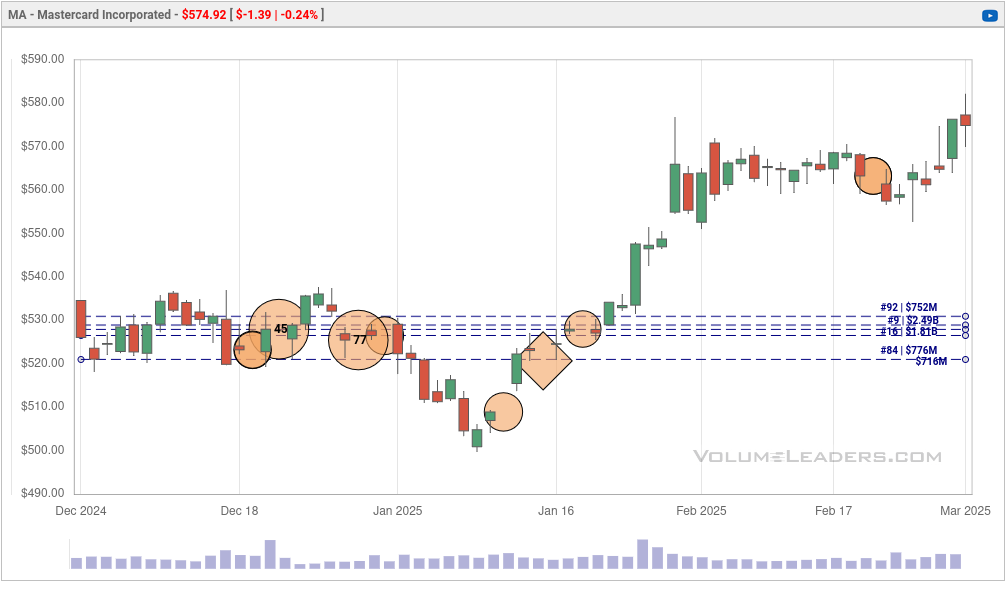

Here's a chart from Volume Leaders showing dark pool trades in the same time frame (since October 2023):

Two big dark pool trades, rankged #45 and #77 showed up here around the $530 level as the price action tightened up. There hasn't been that much happening recently, but let's zoom in just to verify:

The early January 2025 dip looks to have been bought with two dark pool trades plus a sweep. Dark pool trades generally prioritize secrecy, but a sweep (the diamond above) shows that someone was in a hurry to get the trade done.

Visa (V)

The other credit card behemoth is Visa. It kicked off a rally in October 2023 that took prices from the lower $200 range up to $362 as of this afternoon:

Much like MA, V slid into a VWAP retest in the summer of 2024 and then hurled itself back to the two standard deviation bands shortly after. V hasn't been inside the bands since the week of January 21, 2025! That's a heck of a lot of strength but it's also a bit worrisome for going long since it's so far outside the bands.

What's happening in the dark pool trades since October 2023?

Wow, the biggest trades were all packed into the summer of 2024 where the VWAP retest happened. The $260-$285 range saw a ton of volume. Three of the top five most traded price levels are in that range. That gave V a ton of rocket fuel for a run past $300.

Here's a zoomed in chart over the past 90 days:

We can see more dark pool trades, albeit smaller ones, in December followed by another rally. There are two small dark pool trades at the recent highs around $361 and $362. We don't know if these are new buys, new shorts, or someone closing out an existing position. However, with the price being so far outside the bands, I'm thinking these might be some profit taking trades.

Either way, if price drops below $361 with volume, watch out. 👀

Which is the better deal?

When it comes to raw strength, V is the clear winner. MA has taken a more steady pace from bottom left to top right. MA's mutual fund ownership sits at 5,756 (an increase of 1.2% in 2024) and V has 6,865 funds invested (an increase of 1.6% in 2024) according to the data from MarketSurge.

Fidelity's Contrafund has increased its holdings in MA for four quarters in a row (0.89M shares to 1.10M), but its investment in V has wavered up and down in 2024. Shares of V owned by the Contrafund went from 7.35M to 7.59M in 2024.

According to MarketSurge, Visa has a higher relative strength when compared to SPX (93) versus Mastercard (90).

I'd be happy to get in at a good price on either, but neither stock is making a good base right now for a buy. Both seem to have good support underneath the current price, although MA is a little closer to its support level. I have both stocks on watch for a buying opportunity.

Good luck to everyone this week! 🍀

Discussion