How I gave back my trading profits for 2024

Recent market moves taught me some difficult lessons about most of my positions in my account. Hopefully this post helps others avoid the same mistake. 🤕

Sometimes we make mistakes. Sometimes we make a lot of mistakes in a row. And sometimes we make mistakes in a row at the most inopportune time. This post is a story about the latter.

Why write a post about an unexpected failure in the markets? My goal with this post is to remember this experience later and also to help at least one other person avoid making the same mistake. After all:

Traders don't like to admit mistakes. As you might expect, there's a great quote for this specific situation, too:

My mistakes hit me in both places. This post will cover my mistakes and serve as a guide for me to make better choices in the future. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

On with the show.

Complacency

The stock market has been in a terrific rally since late 2023. The S&P 500 index was up over 35% and semiconductors climbed an amazing 229% since the fall. That's an incredible run! Almost any bet on a large cap stock since then has paid off well.

However, trends change. There's an old quote attributed to Ed Seykota that says "the trend is your friend until it bends." The trend began to bend and I wasn't paying attention. I believed that my yearly profit and loss spoke for itself and I began increasing my size.

The only problem was that warning signs were on the horizon. As an example, Microsoft was on an incredible run, but the RSI and PPO indicators were making lower highs as the stock ran higher:

MSFT is the biggest component of the S&P 500 index, so watching how it trades is critical. Even a basic chart comparing MSFT to SPY shows a triple top where MSFT couldn't keep the same strength against the index:

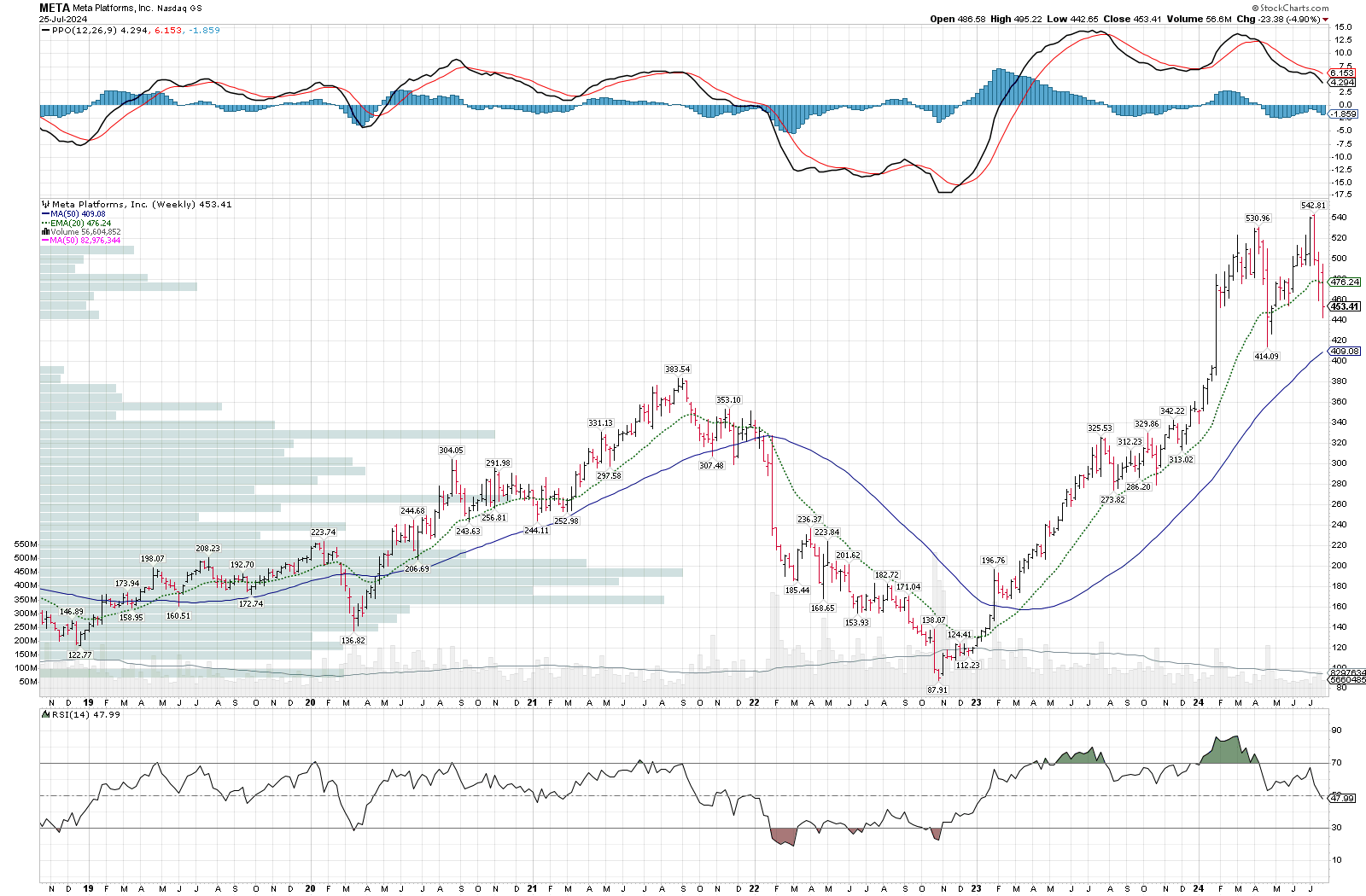

I made some big bets on META at the worst time, too. Multiple indicators hint that new highs were being made on lower momentum and relative strength:

Hindsight is 20/20. Looking back at the charts now makes everything seem obvious. However, I wasn't checking these charts as frequently as I should have been (you can see that by the slowdown of posts on this blog!) and I was increasing the size of my trades at the worst possible time.

It's easy to keep making bets when the market is rallying, but if you miss the signs that there's weakness under the veneer of the rally, the market will teach you a painful lesson, as it did for me.

Sizing

If there's one thing that I learned from the Market Wizards book series, it's that sizing is critical. Some traders argue that it's more important than what you trade and when you trade it.

The size of your trades should reflect your confidence in the trade. If you're very confident about your trade and the trade fits your system, then bet bigger. If you're not confident, make a smaller bet.

I was making larger and larger bets with confidence, but my confidence wasn't based on charts or market mechanics. It was based on my trading record for the year and my record profit and loss. I increased my trade size at the worst possible time because I wasn't paying attention to where the market was going.

Getting out

When you're wrong on a trade, admit it and get out. There's another great quote for that:

As I was betting larger, I had a vacation looming. I went on vacation with some large positions on the board and the market was weakening. All the market needed was some kind of catalyst to send it downwards. Crowdstrike delivered the catalyst with a worldwide IT outage.

Trades sometimes don't work. Even when you've researched everything, pored over charts for hours, and carefully made your bets, sometimes they don't work. When this happens, just get out. Don't worry about learning from it immediately – just close the position and revisit it after taking a break. You might have done everything right and followed your system to the letter but you still ended up with a loss. That's okay.

The key to any trading system is having capital left over to make trades the next day.

Getting back into a trade is easy and cheap. Getting out of a bad trade late is extremely costly.

Conclusion

In the end, it's not the market's fault. Crowdstrike delivered one heck of a catalyst, but they're not at fault either. Sure, the market's move down was very abrupt, especially for tech stocks, but there's no fault there, either.

The bottom line is that I left on a vacation while I was over-leveraged and over-confident. I was complacent about a weakening market when I saw the signs on the charts and I ignored them. I wasn't doing my homework. I wasn't marking up charts and thinking about some of the widespread changes I was seeing. I wasn't in a position to take action on my positions when they turned out to be wrong.

The market showed up, highlighted my long string of mistakes, and it taught me a lesson.

In the short term, I will reduce the size of my trades until I can build steady profits once more. I also plan to take positions off the board before being away from the computer for long stretches. My system will need some updates for potential stop loss orders.

Look for some updated posts as I adjust my system and regroup for an approach to the second half of 2024.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Good luck to you in all of your trades this week. ☘️

Discussion