Interesting stocks for the week of November 11th

Let's look through some of the stocks that showed up in my screener this weekend. 🌞

Hello there! Monday is a Federal Holiday here in the US as we celebrate and remember our military veterans. Thanks to all of those who have served, are still serving, and those who support them. 🫡

I'll be taking a look at the results of a screen I ran in MarketSurge this weekend in this post and I'll be working through some potential entry points. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get into the data.

Criteria

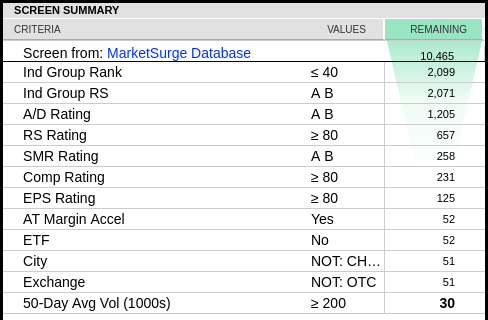

My goal was to build a screen that has a strong list of stocks in the best industry groups. Great fundamental and technical results are a must for this group. Here's the scan in MarketSurge in case you want to reproduce it yourself:

Going from top to bottom, I'm looking for:

- Stocks in the top 40 industry groups and that group must have a relative strength rated as A/B

- The accumulation/distribution rating must be high

- Relative strength (to all the stocks that MarketSurge tracks) must be above 80%

- SMR looks at sales growth, pre-tax profit margins, after-tax profit margins, and return on equity

- The composite rating for the stock across all categories must be better than 80% of the stocks in MarketSurge

- EPS growth must be better than 80% of stocks

- After-tax margins must be accelerating

- No ETFs, no China stocks, and no OTC markets

- The 50-day average volume must be over 200,000 shares

This brings up a list of 30 stocks. Use the link below to download the CSV:

Palantir (PLTR)

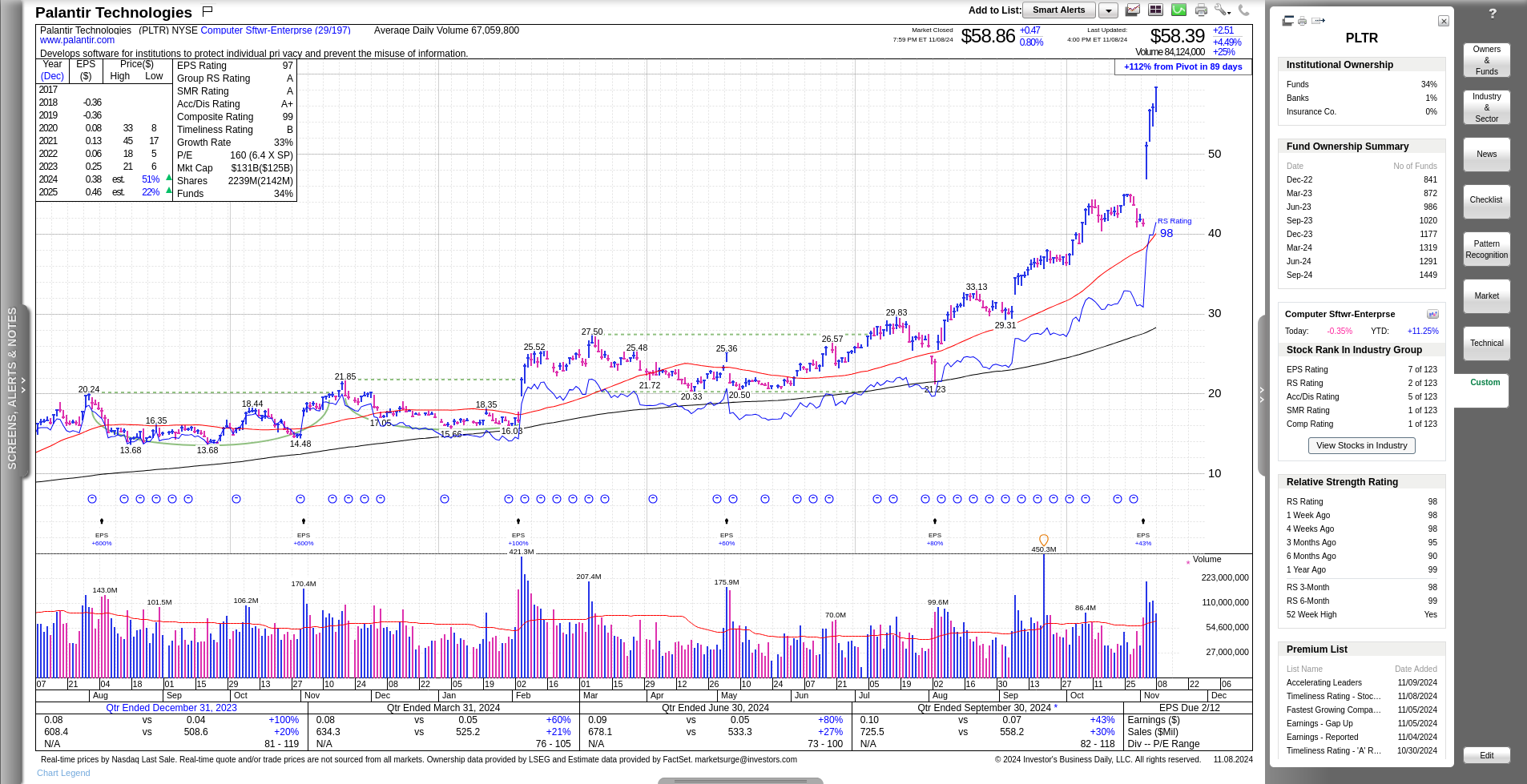

No matter how I slice and dice my screeners, PLTR always seems to show up in my searches. Here's a look at the daily chart in MarketSurge:

This chart is a little busy, but here's what I like:

- The RS rating is 98, which means that PLTR is stronger than 98% of the stocks in the market. Price is also above the 50 and 200 day moving averages. If you look at the Relative Strength Rating in the bottom right hand corner, you'll note that PLTR hasn't had a relative strength below 90 in the last year.

- Volume is well above the 50 day moving average, but it is calming down a bit after a big run from earnings. this is where we might see a new base forming.

- Fund ownership (look on the right) has increased quickly. Fund ownership is up almost 50% since the same time last year.

- Although PLTR's EPS has slowed a bit, the sales growth keeps rising.

I'm currently short some $55 puts for PLTR in December.

DocuSign (DOCU)

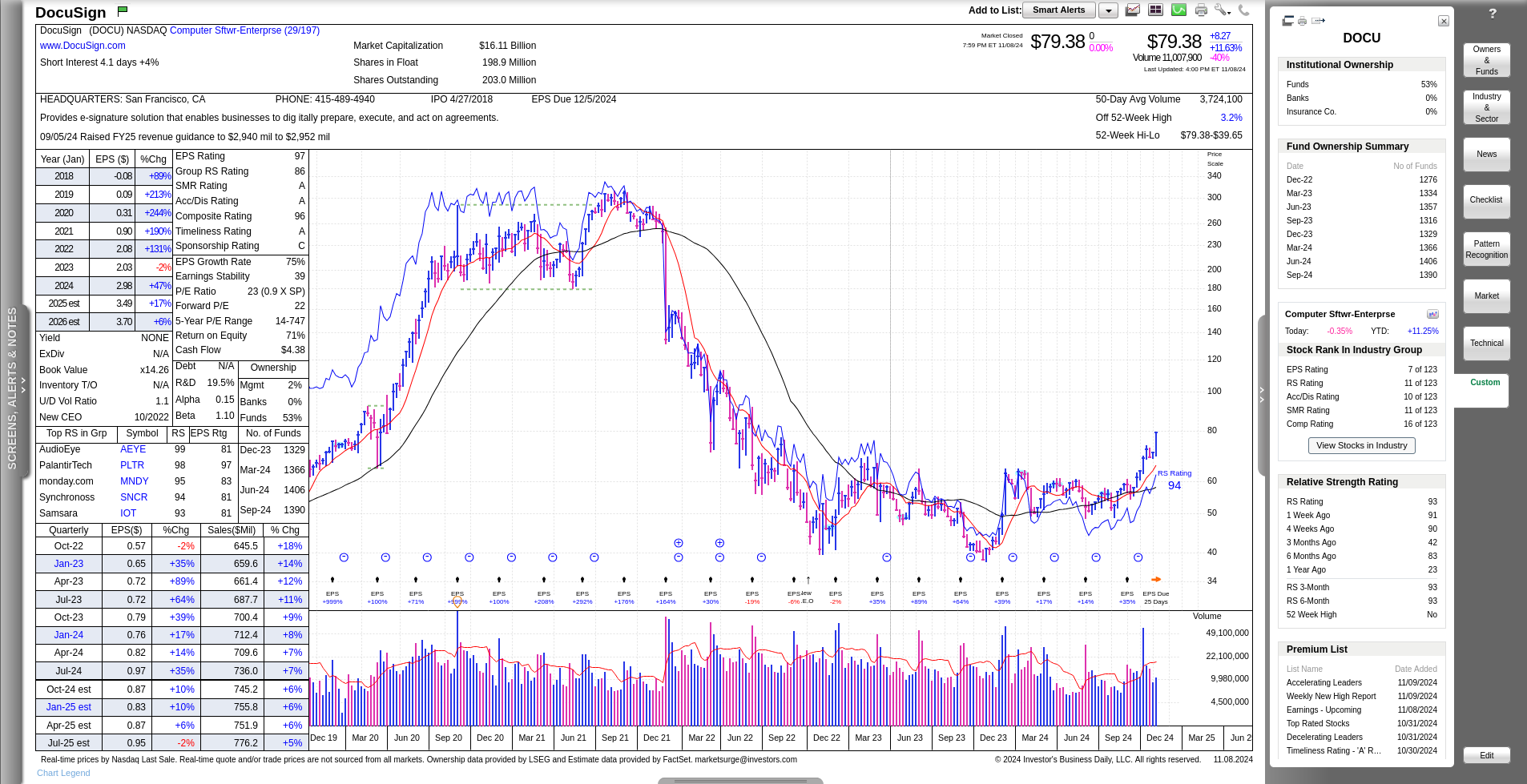

Many of us remember how much DOCU surged during the COVID pandemic. With everything being done online, including legal documents and employment offers, the stock went on a wild run. However, it might be slowly making a quiet comeback. Here's the weekly:

That failed breakout from a consolidation base in 2021 led to a tremendous downfall, but DOCU currently sits at a 94 RS rating and it has taken out some old resistance around $60. The fund ownership hasn't really come back yet, but EPS is increasing and sales are bottoming. Note that sales remained great from October 2022 onwards even as EPS slid down into the negative.

DOCU didn't show up on many screens but it appeared on this one as it's in the upper end of an industry group that is performing well. It landed on MarketSurge's "Accelerating Leaders" list this week as well.

I am short some $72.50 DOCU puts for December.

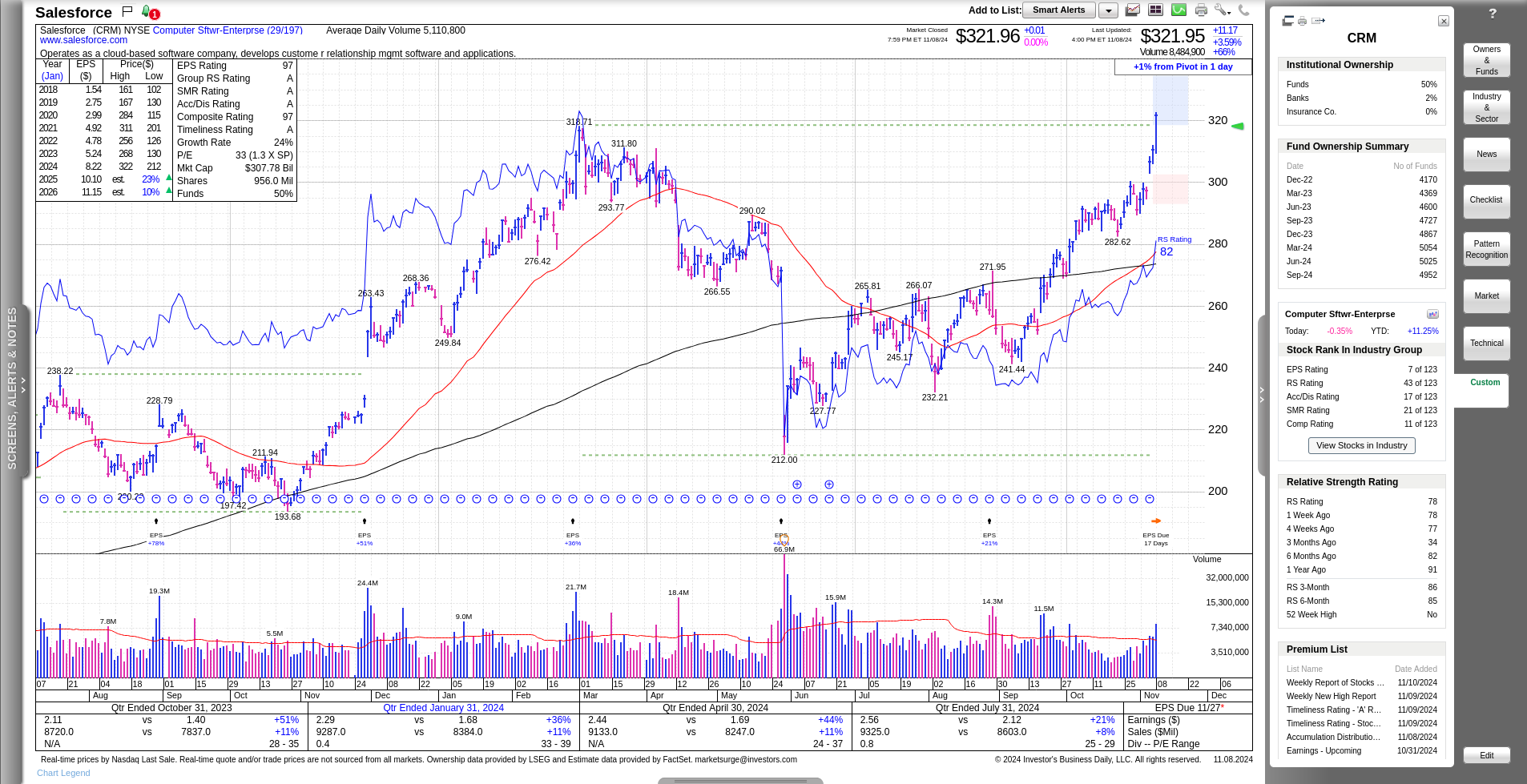

Salesforce (CRM)

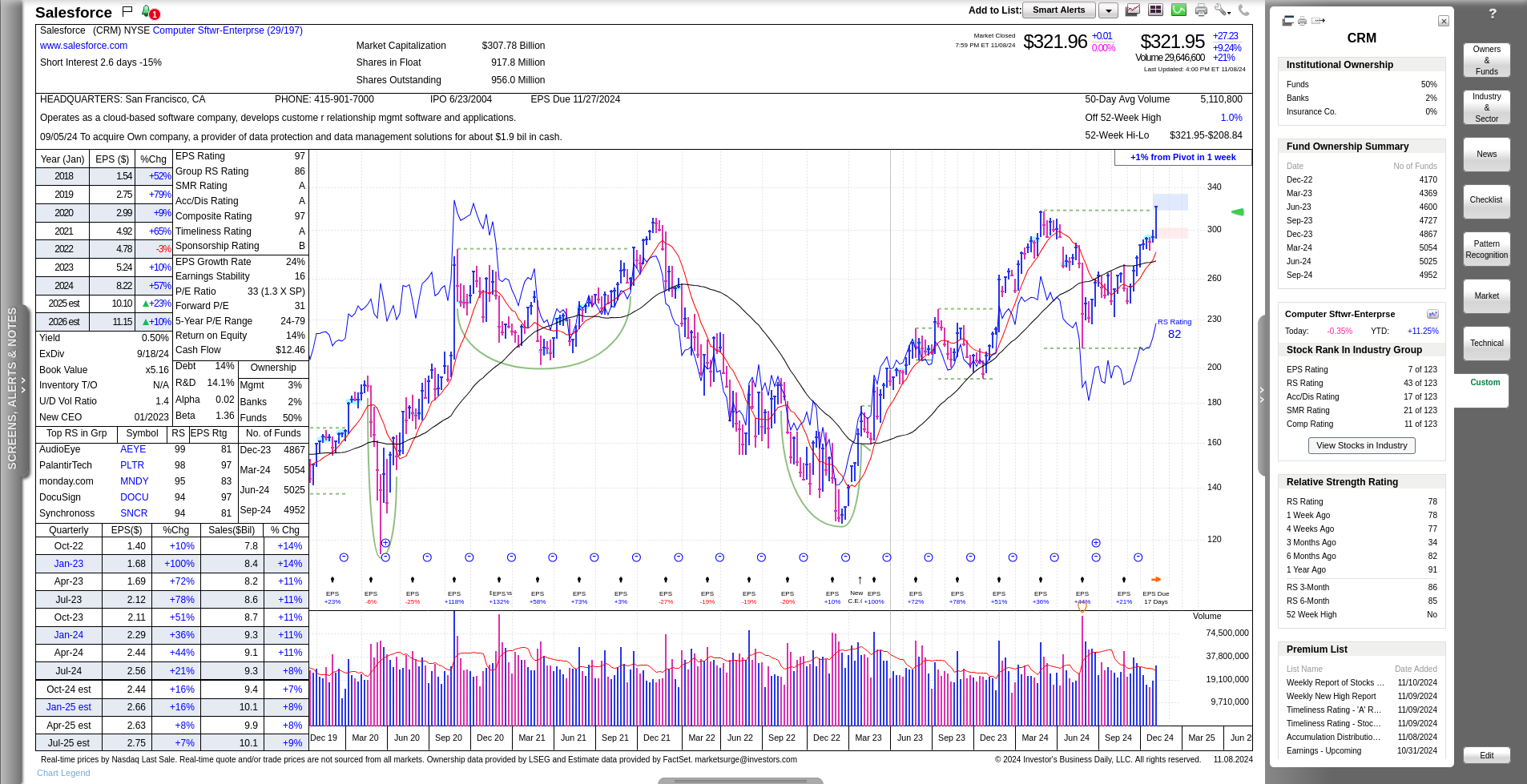

Salesforce is a great metric for the health of the business-to-business (B2B) market. When CRM is looking good, you can have a little more confidence that business health overall across the market is good. Note the deep gash in the weekly chart that began a huge rebound in 2023:

CRM recently broke out from a consolidation base with a pivot point of $318. This also takes out the old high from 2021. Volume is up on a week over week basis as it leapt out of the base. Things are a little more clear on the daily:

We have insider buying at the lows from June/July and the moving averages recently made a bullish cross when the 50 crossed above the 200. Volume is up and the RS is increasing. I don't necessarily like the 82% RSI number here, but CRM is a big ship to turn in the market. Earnings are coming up in 17 days, so use caution playing this one.

I don't have any trades on CRM right now but I'll be watching to see what happens after earnings.

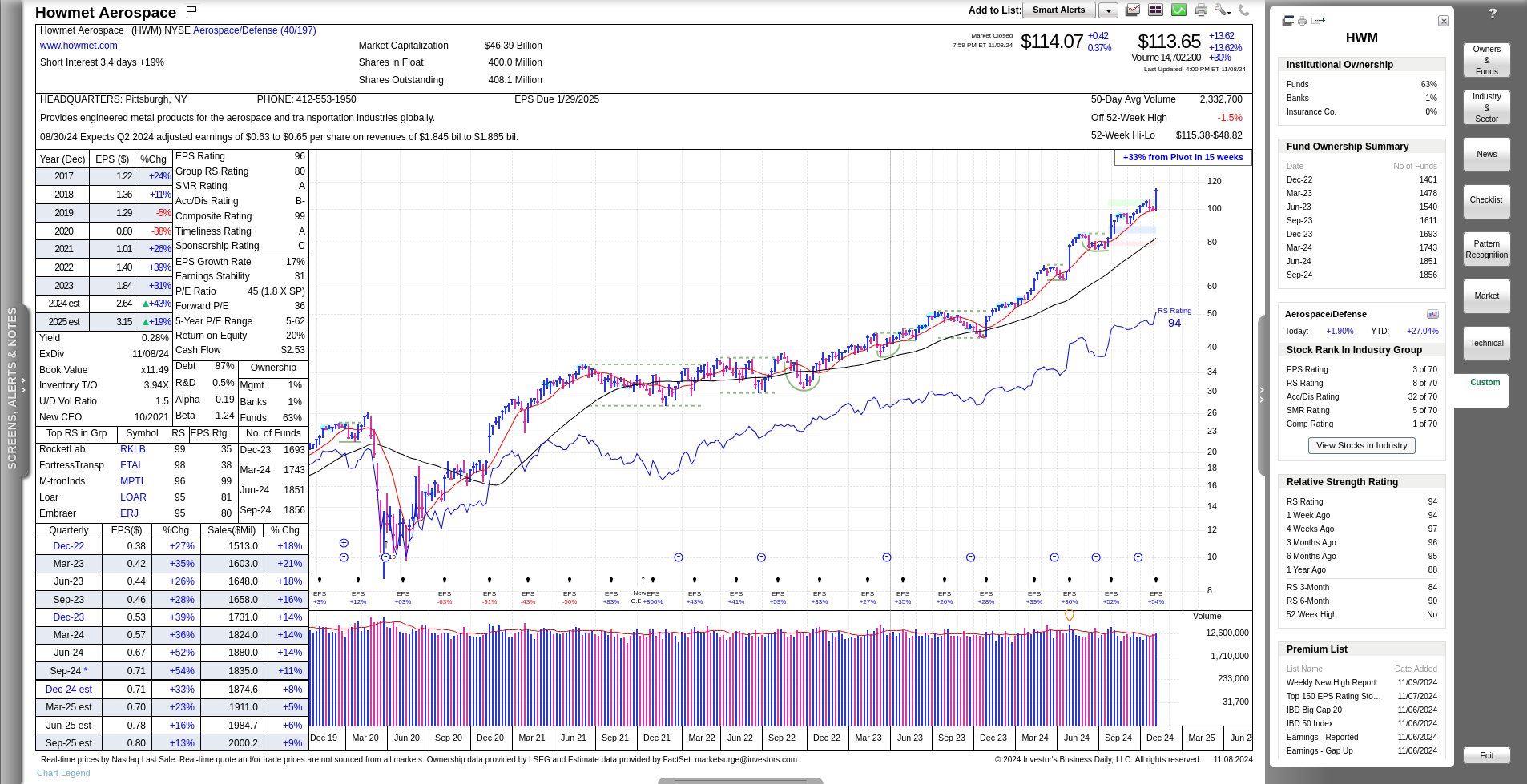

Howmet Aerospace (HWM)

If you're looking for an aerospace play while Boeing (BA) stumbles, HWM might be a good one. It keeps making more and more bases as it rallies upwards:

HWM just came out of a stage 4 base and although that's bullish, the risk of a breakout failure increases once you reach the fourth base. This is the eighth bullish base breakout in a row!

RS sits around 94% and EPS is increasing. However, one thing to note is that sales are slowly decelerating. That could cause some institutions to slow the pace of buying. Either way, funds have been buying HWM for quite some time at a fairly steady pace. Funds own over half of the available shares and that's something that gives me pause.

I don't have any trades on HWM right now, but I did sell puts on FTAI, another aerospace stock.

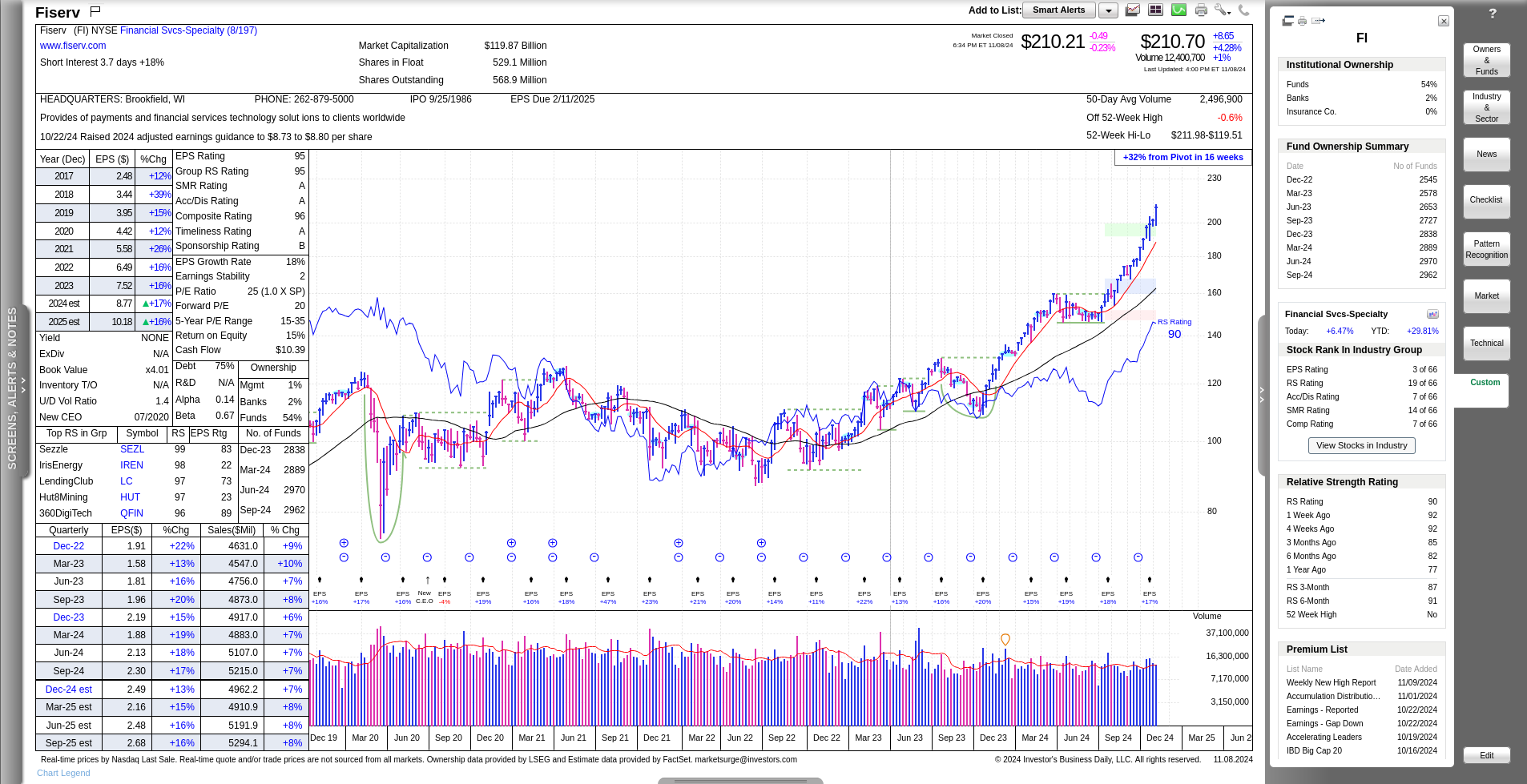

Fiserv (FI)

The last stock I'm looking at today is FI. It went sideways for ages before burning a corner in 2023:

FI has steady EPS and sales growth, steady increase in funds buying it, and an improving RS rating at 90. Funds own over half the available shares as well. It recently ran right out of a stage 2 base and gained over 30% since that pivot point at $160.

I don't have any trades on FI at the moment.

Final thoughts

The overall market trend is up with IBD suggesting an 80-100% exposure to the market for now. Chris Ciovacco breaks down some of the previous election moves and compares them to today's market in his excellent weekly video:

My last post on trading psychology is a good read if you haven't seen that one yet. I began to realize that the main limiter for my success was myself. There are a ton of good book selections there that might help you if you're in the same rut. 🫂

Good luck to all of you this week! 🍀

Discussion