Let's talk about solar stocks

Is a brighter future for the solar industry on the horizon? Let's go through some relative charts to see where the strength is (and isn't). 🌞

I hope you're having a great weekend. It's been ages since I did a deep dive on solar stocks and this post covers what's been happening recently with some big names, such as ENPH, FSLR, and the now infamous SEDG.

But first:

Let's get into it.

Solar in general

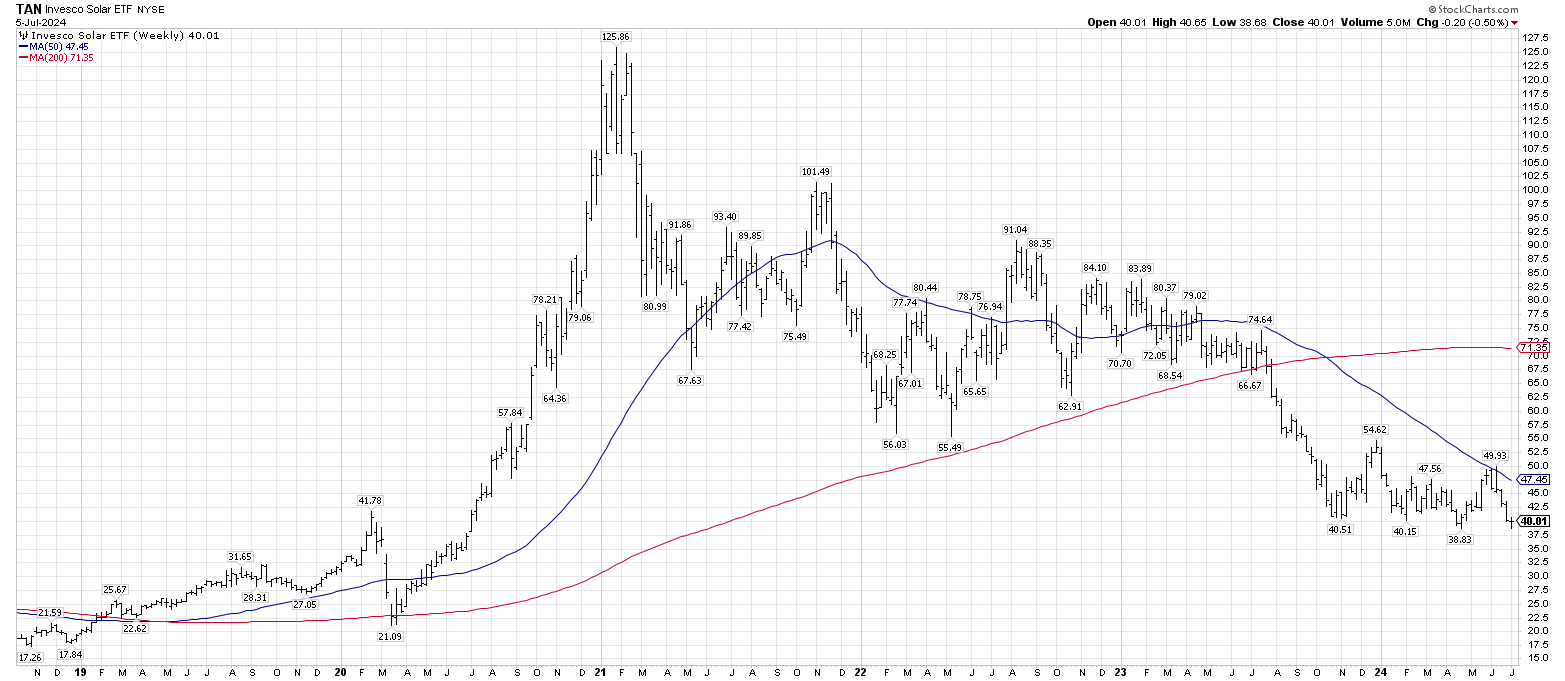

One of the easiest ways to examine the solar industry broadly is to look at TAN, the Invesco Solar ETF. The largest constituents of TAN are FSLR, ENPH, and NXT.

Solar looked unstoppable after the COVID drop when it rallied from the low $20's up to $125. That 5x run came to an end and led to a slow downwards consolidation until mid-2023. Then the industry fell off another cliff into yet another consolidation since November 2023.

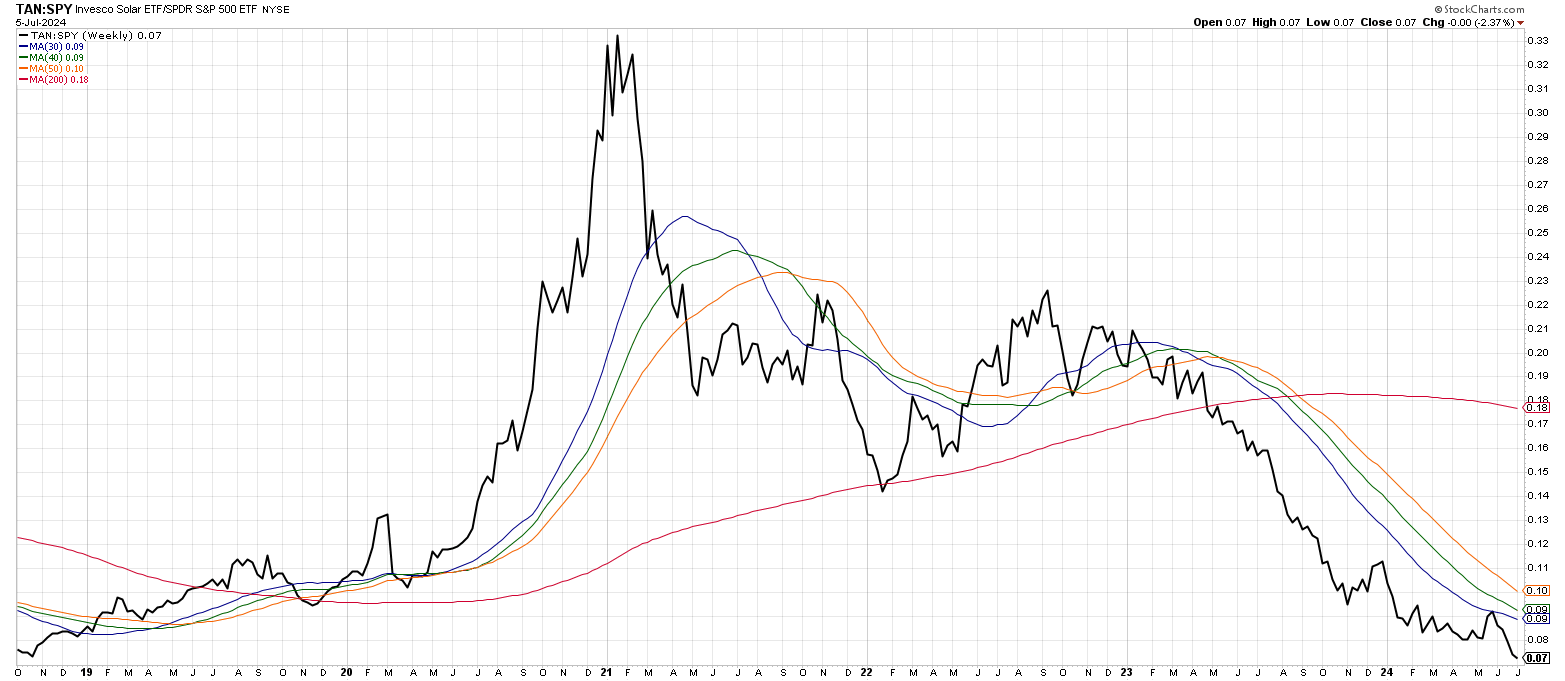

How does TAN perform relative to the market in general? Let's compare it to SPY on a weekly chart. The solar industry has lost a lot of strength against SPY and sits at lows not seen since the end of 2018.

This really helps us put that recent consolidation in context. In isolation, TAN looks like it's consolidating for its next move. However, when compared to what the rest of the market has been doing, it's rapidly losing strength.

What's the deal with the drop in 2023?

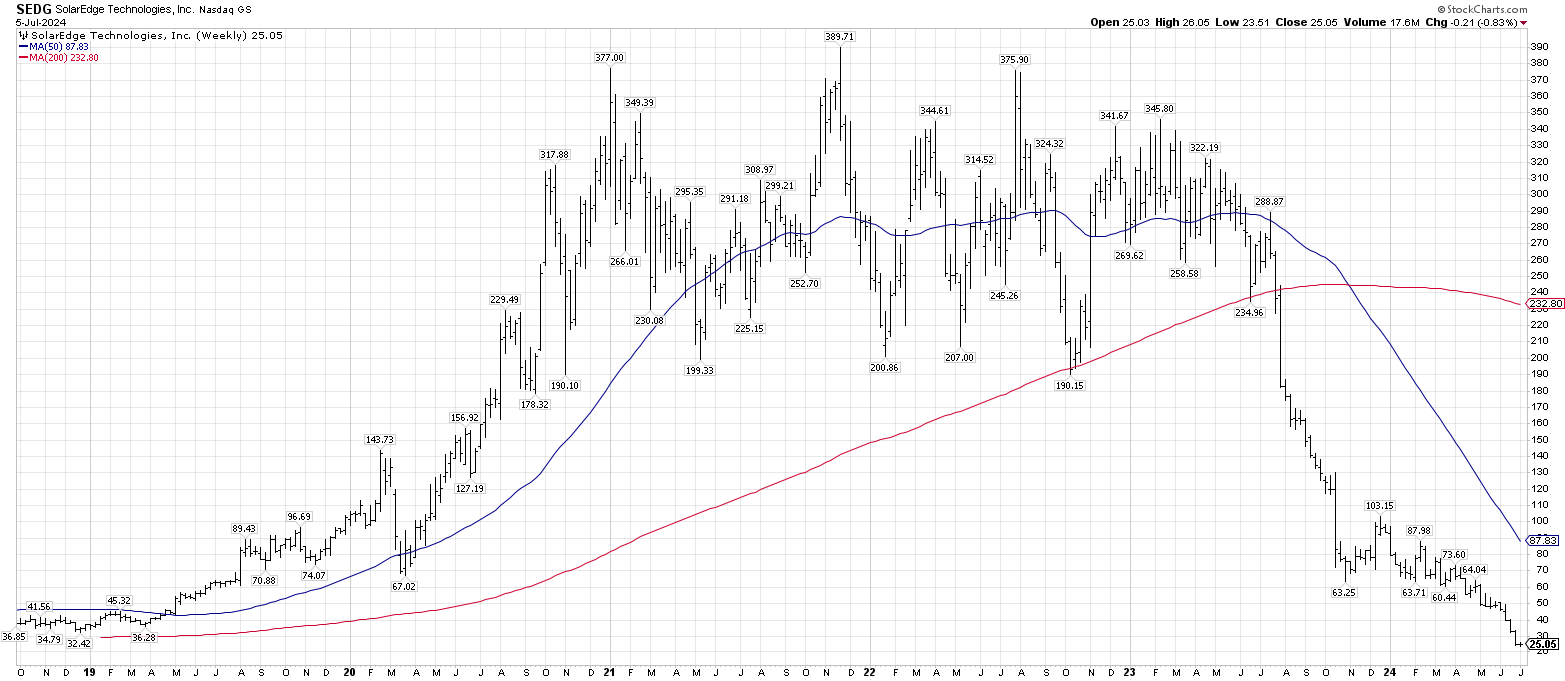

The cliff in 2023 is mostly due to one constituent: SEDG. SolarEdge has been absolutely crushed recently with a massive drop last August. It now sits at levels not seen in over five years.

They've had trouble with revenue recently and their growth forecast hasn't been where investors expected it to be. To make matters worse, news came last week that one of their largest customers is likely filing for bankruptcy and they owe SolarEdge quite a bit of money. If this is a bigger pattern across the industry, this could be a dark future for solar stocks.

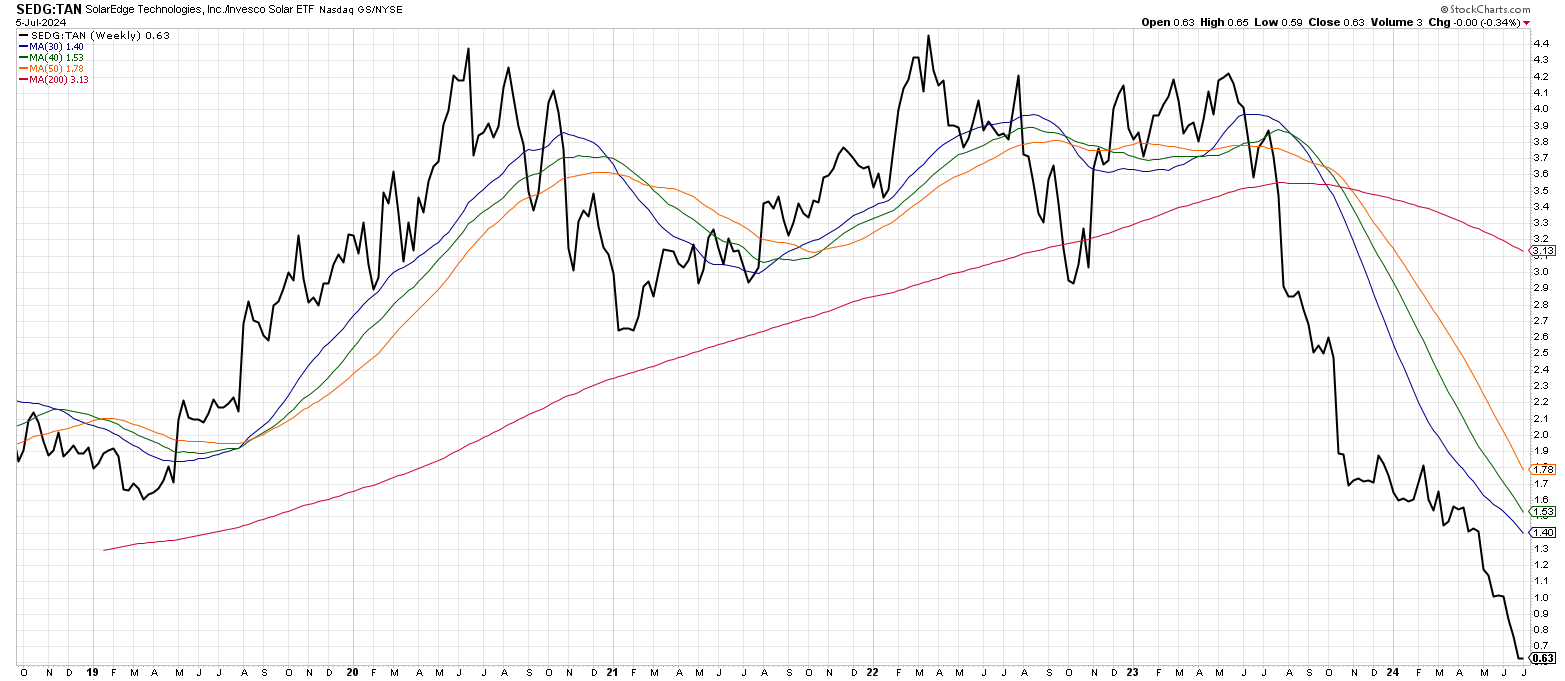

Looking at SEDG relative to TAN shows how poorly SolarEdge is performing against the industry at large:

What about the other big players?

When I look at an industry for a potential investment, I'm usually looking for those companies that are gaining strength against that industry and the market in general. One of my favorite ways to do this is to look up the list of constituents in the industry's biggest ETFs and then charting their performance relative to the ETF.

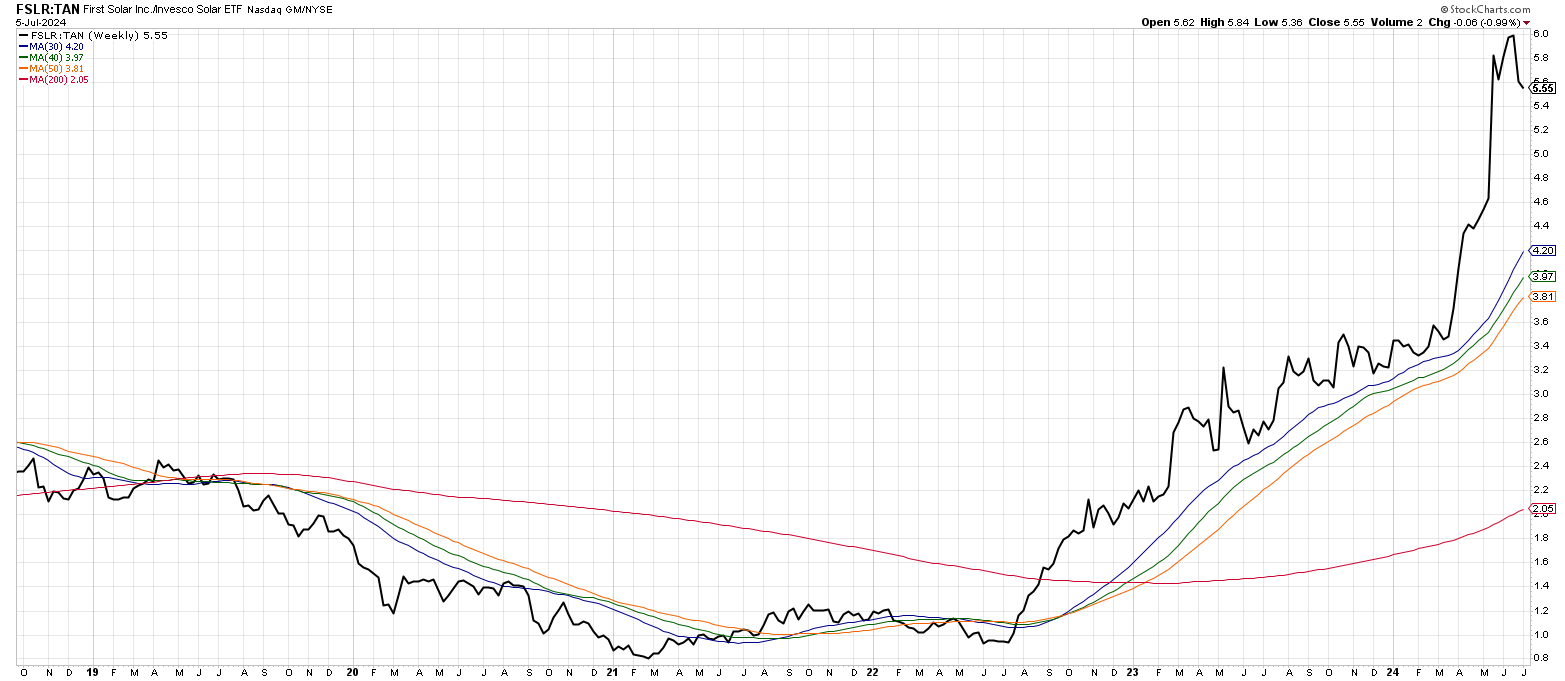

Here's a chart of TAN's biggest constituent, FSLR, relative to the industry:

FSLR started moving in the middle of 2022 and never looked back. Every moving average continues moving higher and it's relative strength has increased significantly. It's important to remember that FSLR is grabbing a bigger share of an industry that is losing strength overall.

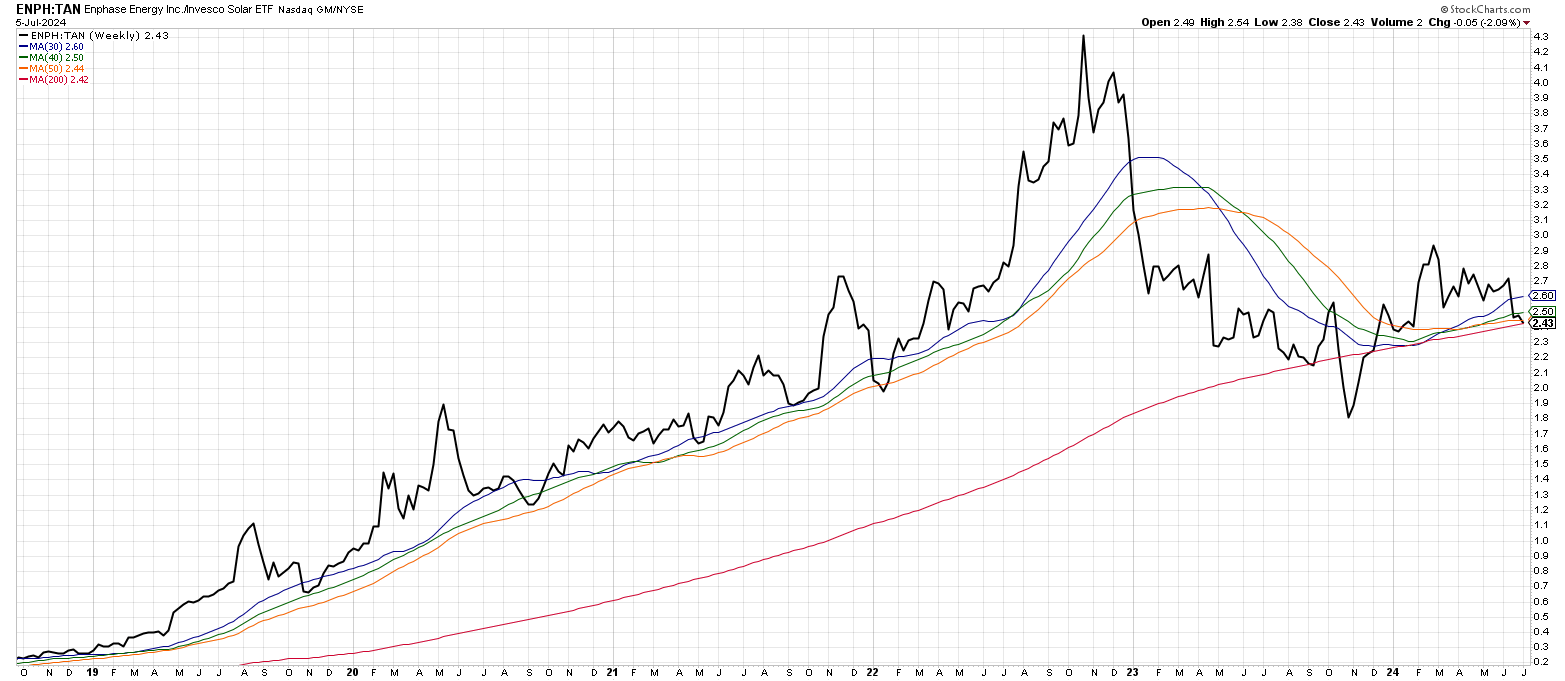

Let's take a look at ENPH:

The relative chart shows a much different pattern for ENPH. It gained strength until the end of 2023 when it started losing ground abruptly to the rest of the industry. It made some lower highs and higher lows recently.

ENPH has maintained good margins over the past several quarters, but revenue, earnings per share, and free cash flow have all been crunched badly. This might be due to higher interest rates affecting ENPH directly or there may be fewer buyers of solar panels in the market due to interest rates affecting them as well.

Thesis

Here's what we know right now from the charts and the world right now:

- Higher interest rates make it challenging for these solar companies to finance their debt

- Their customers are challenged by high rates as well because there's less money to spend on solar panel installations (and they are buying less property)

- Many state and federal tax benefits in the US for solar panels have disappeared or they shrank over the last few years

- The US Presidential race is very tight right now with one of the candidates not putting a high priority on solar and the other mostly against the industry

- The solar industry is losing strength relative to the market in general, so investors are putting their capital elsewhere

I've been trading ENPH with some small wins and large losses lately as the solar market is incredibly volatile. FSLR looks quite interesting for a trade, but the industry strength remains weak and I've avoided trading that stock.

If interest rates begin coming down and we see a turnaround in the housing market (more buyers with more affordable homes), we could see improvement in solar stocks. Incentives from local, state, and federal governments would also be a big help. Until then, I'll likely be on the sidelines.

Good luck to everyone in the market this week! ☘️

Discussion