Market analysis for August 29

As AMD approaches an interesting area, let's get a look at the chart, options data, dark pools, and more. 🌄

Happy Tuesday! 🌄

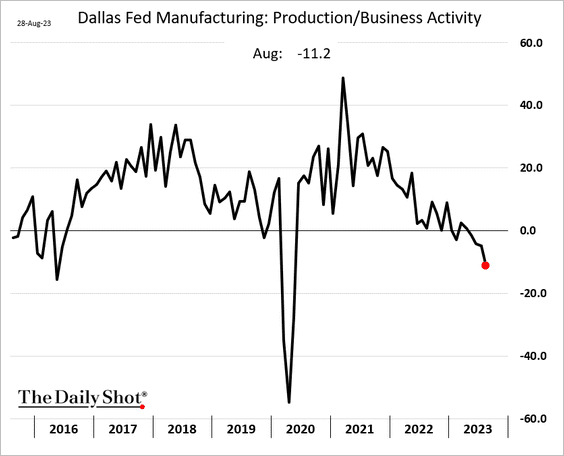

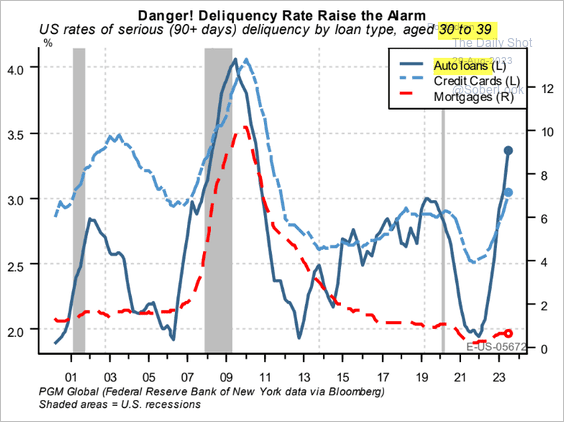

Macroeconomic news continues to worry me as manufacturing activity continues to trend down and the cost for materials is expected to go up:

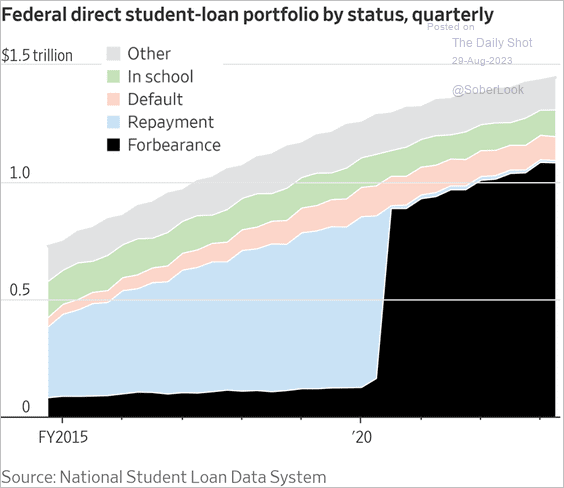

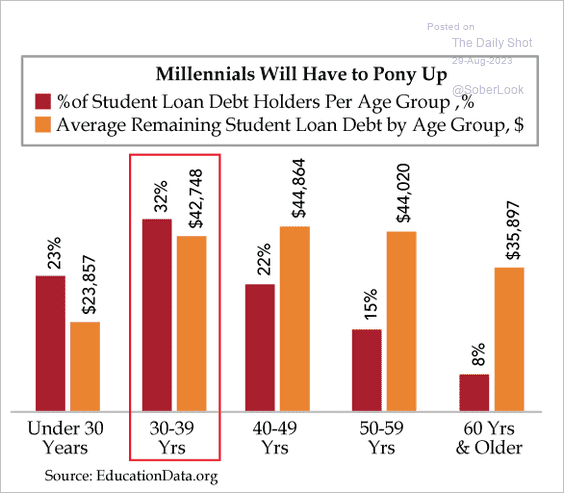

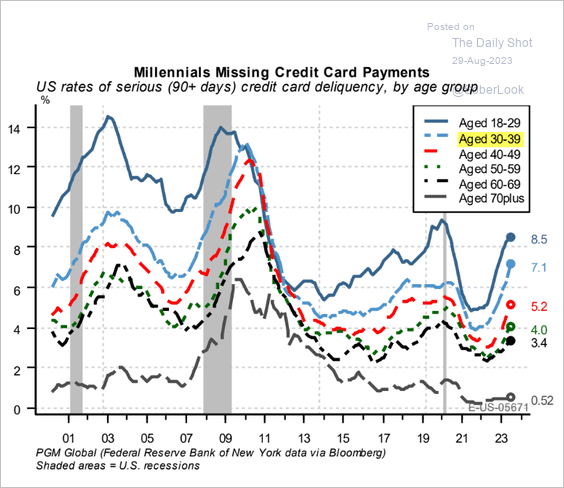

There's a storm of debt brewing and it starts with shorter term credit cards and automotive loans. Mortgage delinquency is just barely beginning to rise. Add in the end of student loan forbearance soon and this could impact family finances across the country soon.

Delinquent auto loans can put local credit unions into difficult spots which reduces local lending. It also floods the auction houses with repossessed vehicles that then forces used car prices down. New car prices come next.

Sure, reduced automotive prices sound great, especially with today's prices. However, once you go through a repossession, getting another bank or credit union to offer you a loan for a car will not be easy.

I'm not sure what the effects will look like this time around, but I remember some difficult times around 2010. Let's hope it's not that bad this time.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get into some data.

AMD VWAP excitement

Everyone on Twitter (X?) seems to be excited about AMD's VWAP since January 6th:

That was a big pivot point for the stock after 2022's slide and AMD has bounced off it pretty reliably several times. As we've seen lately, AMD has some decent positive GEX support around $99-$100 (where the VWAP now sits).

If we take it one step further and add volume by price since January 6th, the point of contention shows up around $110. That's right around AMD's biggest negative GEX lines around $108-$109. This level is often called a volume shelf and they can act as resistance zones or as areas where price can move up as a support.

Let's see if our options data has changed.

AMD options positioning

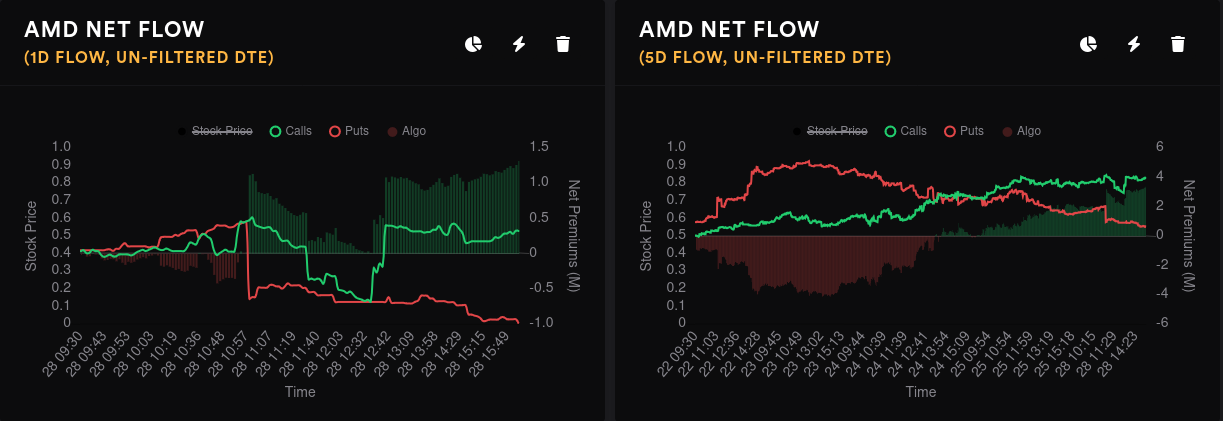

AMD has some big flow changes yesterday that happened in abrupt motions. The five day flow is now fairly bullish.

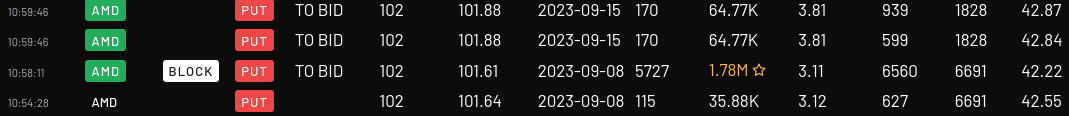

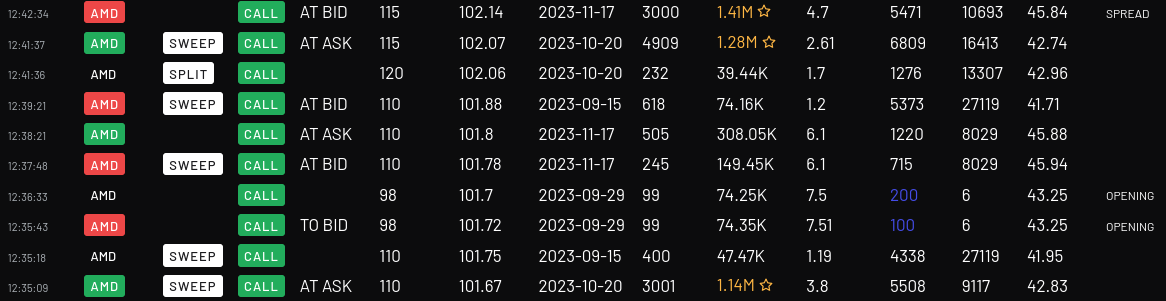

What were these big changes? Well, the early morning started with $1.78M worth of short puts on the $102 strike for 9/8 (bullish trade):

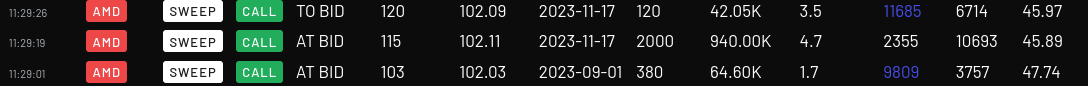

A little while later, someone sold about $1M worth of $115 calls for 11/17 (bearish trade):

The second bullish jump turned out to be a calendar spread (sold $115 calls for 11/17 and bought $115 calls for 10/20) along with a big sweep of $110 calls for 10/20:

I've been talking for a little while about how AMD looks like it may go on a run up before 10/20, but it might turn bearish into 10/20. Someone is making some decent sized bets on this idea.

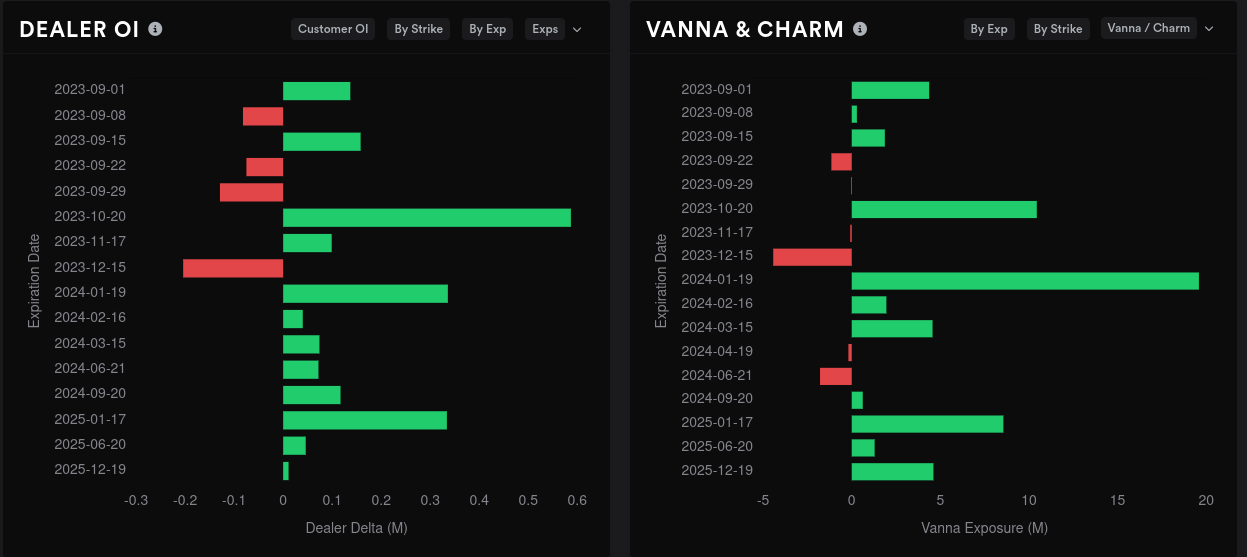

AMD's IV rank crept up to 42%. Dealer deltas suggest customers are still bearish on AMD for right now. However, dealer vannas suggest customers are just barely turning bullish. Dealer vanna buildup has been a great indicator for AMD's performance in the last 18 months.

AMD's 9/15 strike still looks bearish and 10/20 looks even more so. Check that x-axis, though! These OI levels are relatively small, so I don't know how much faith I'd put in these numbers for now. On the vanna side, AMD has predominantly positive vanna and this is bullish in an environment where IV is contracting.

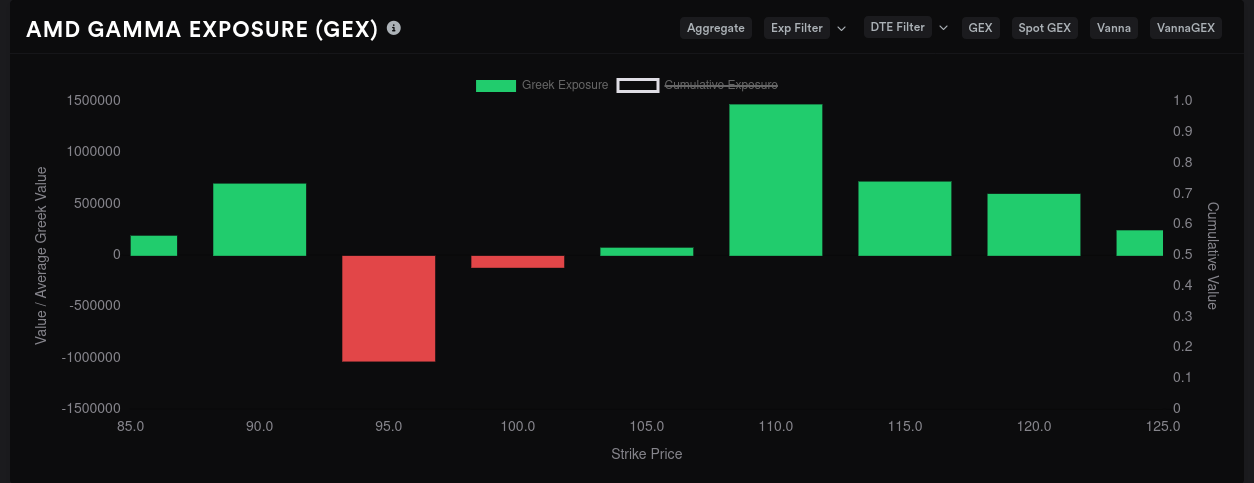

Aggregate GEX suggests a run to $95 or $115 with $95 being the more likely target. But look at that $110 – do you remember what I talked about earlier? That's the volume shelf from the AMD chart since January 6! If we get enough buyers to cross $110, then $115 is a definite possibility.

Bulls might argue that the 9/15 GEX shows a run to $115 without much stopping the price movement in between. Bears might look at this as a great opportunity to short because there's very little to get in the way of price movement from $90 to $120. Either way, I really dislike how flat this GEX chart is. I like to see support on both ends with positive GEX lines.

10/20 is still far out, but it's clear that $95 is the current target. If AMD can climb over $110 by 9/15 and hold that spot, there's a potential for getting stuck around $110, but this GEX chart makes me think we slide back to $95.

9/15 has the most GEX expiring, so keep your eyes on that chart for now.

AMD Whales

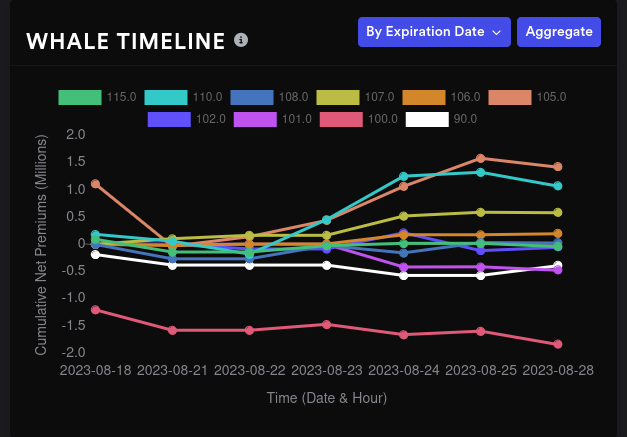

Big money options traders also give me some interesting insights from time to time, especially when I can't decide on a GEX chart. On aggregate, whales have gone bearish on $100 and bullish (less so) on $105.

9/15 paints a similar picture with bearish moves on $100. The $105 and $110 strikes were running bullish but they turned bearish starting yesterday.

10/20 shows $115 going bullish quickly. $110 is turning bullish as well. The most bearish strike is $105 at the bottom.

AMD dark pools

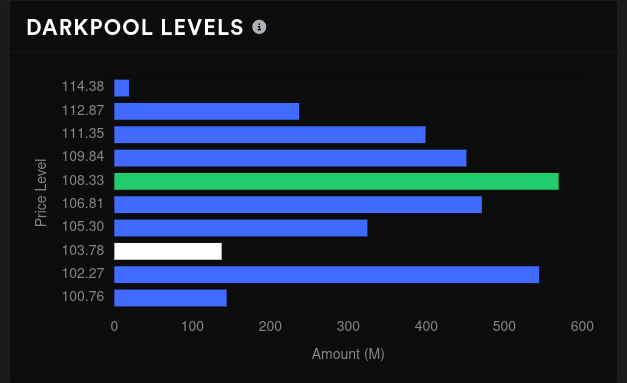

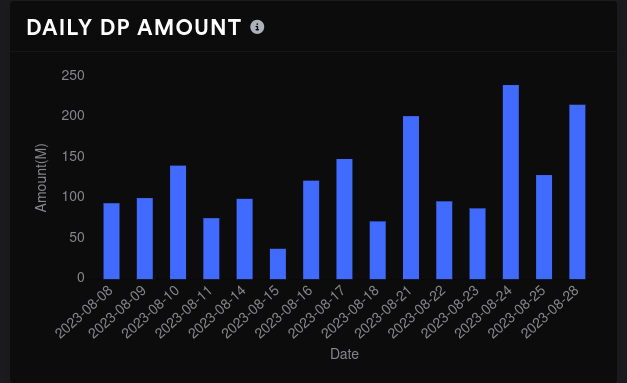

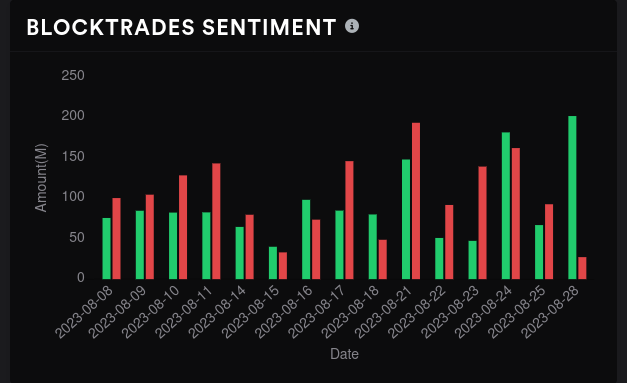

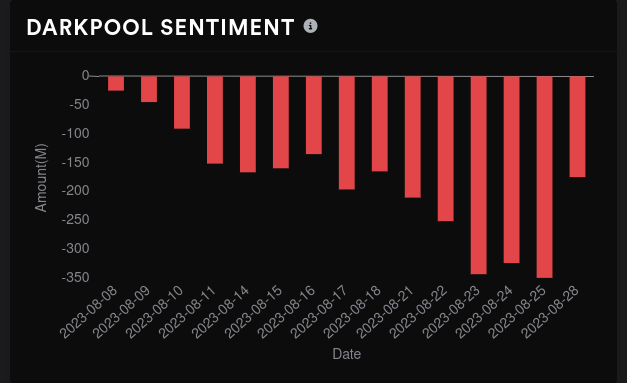

I like looking at dark pools to confirm my chart work and options analysis. From these charts, it's clear that AMD's big volume levels are around $108 and $102. We're sitting in a bit of a low volume spot right now.

Dark pool volume is increasing, which leads me to trust the direction of the sentiment. Yesterday's senitment was clearly bullish and it cut the bearish overall sentiment in half. 🤯

Thesis

Bear in mind that there's a lot in play with AMD's price, especially all the hype within AI. It seems like big options trades are noting that and they're preparing for wide swings in price. There's lots of evidence of that:

- 9/15 GEX is extremely flat, opening the door for whipsaws in price

- Short interest is coming down which suggests that shorts are eager to avoid being caught in a squeeze

- Options volume is up on AMD recently

- Dark trade volume is up and sentiment just moved a lot

- We're about to hit a trend line (VWAP since Jan 6) that has been good support for AMD many times

- AMD's Zen 4 CPUs are reaching more and more laptops (this likely has nothing to do with the stock but I'm excited about it anyway) 🤣

This is a great time to make money on both ends of an AMD trade! Remember, there's no right or wrong side of the market, just the side that makes money. 😉

I'd get bullish on AMD about any drops into the $96-$101 range. This is where I would likely sell (more) puts with an expiration of 10/20 or earlier.

On the top end, you have some choices. If you want to be aggressive, GEX suggests we get resistance before $110 and the volume shelf is lingering there. If AMD makes it up to this level, you could go bearish on it.

If you want to be a bit more conservative, consider that negative GEX ends around $115 and there's lots of resistance at $120. AMD has had issues with the $117-$120 zone multiple times. Making a bearish play on or before 10/20 on $115-$120 seems like a conservative bet.

For now, I have a bunch of trades for 9/15 including short puts at $102 and $105. My short calls around $108 with break even points over $110. All of my trades and trade notes are kept up to date on Theta Gang! I share data about all of my trades – the winners and the losers.

Good luck to everyone today! 🍀

Discussion