Market analysis for August 30

AMD and TSLA had a great run yesterday, but are we reaching a top? Is there more fuel in the tank for a run? Let's dissect the latest data. 🔎

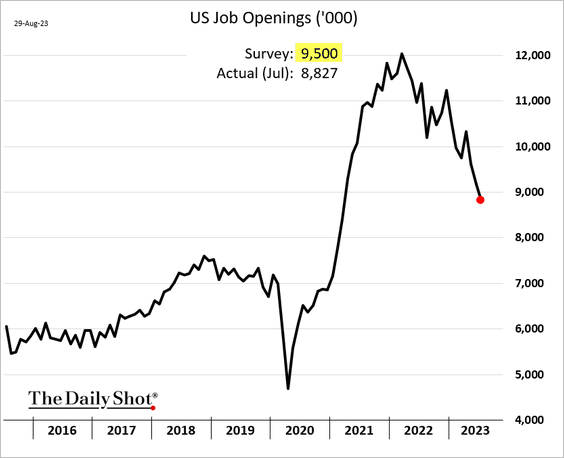

Happy Wednesday! 🌄 Yesterday saw a lot of green across the market with updated jobs numbers, treasury yields dropping, and the dollar losing steam.

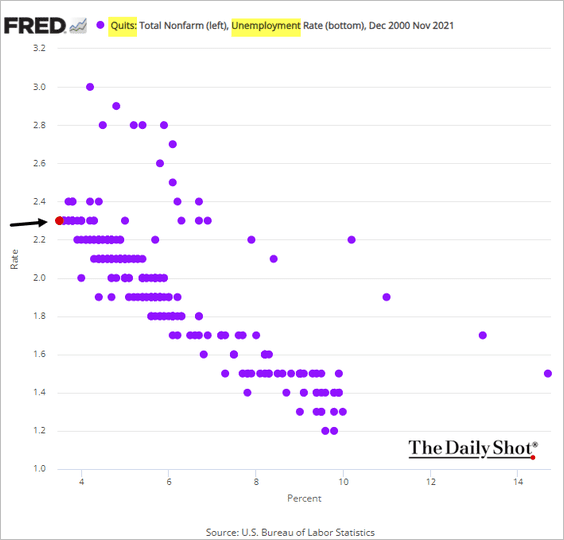

Jobs numbers are cooling down, but as Kyla Scanlon noted, this isn't due to layoffs. This is likely due to a lower quit rate (people voluntarily leaving or changing jobs) and companies pulling back their existing job openings (because they were filled or they eliminated the position).

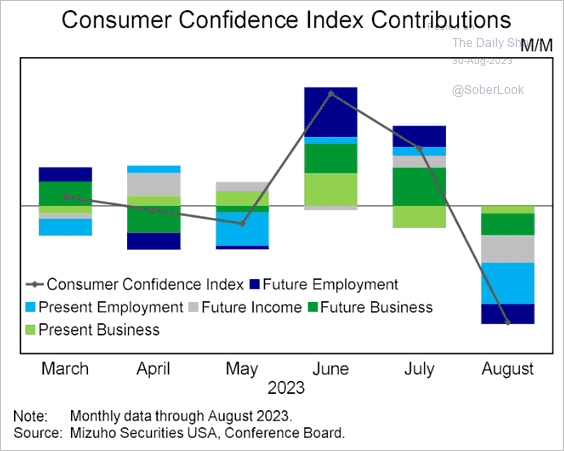

This reduces the Fed's need to hike rates, but it could cause increase unemployment. Combine that with the increase in debt delinquency and that could become a larger problem. As you might imagine, this has impacts on customer confidence, too:

Let's get into some data on AMD and TSLA today! But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Here we go! 🚀

AMD

AMD's flow yesterday was decidedly bullish with a few large sweeps of bullish calls for $110-$115 in November:

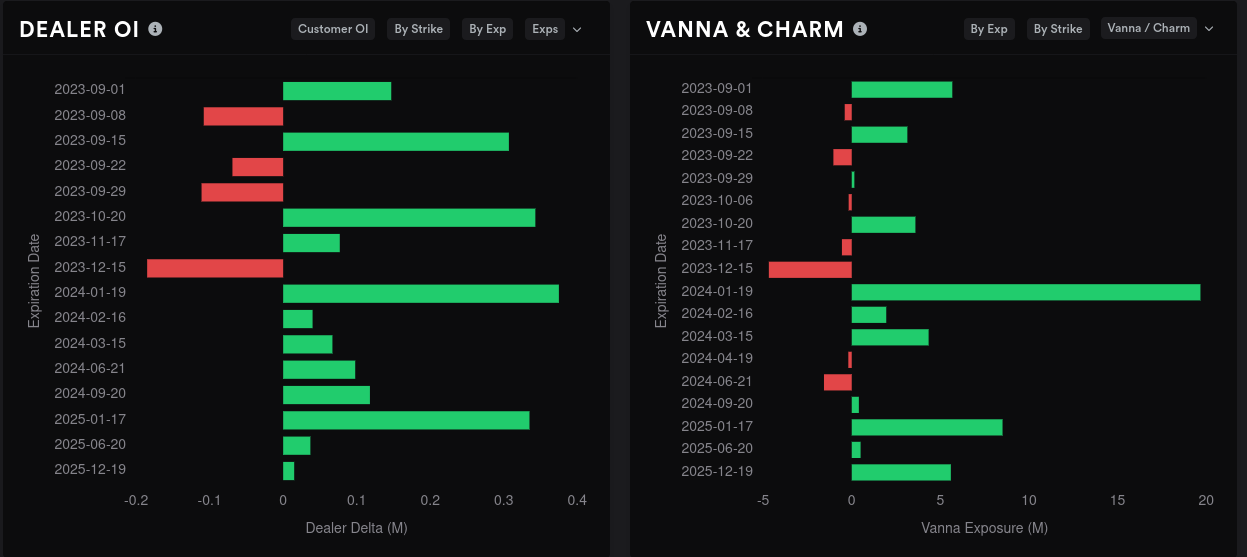

AMD's dealer greeks buildup looks bearish for deltas. Dealers are long and customers are likely short. This chart is bullish for AMD when the latest bars are red.

AMD's vanna buildup on dealers is the opposite. Green here suggests bullish moves by customers and red suggests bearish moves. We turned green (bullish) for a couple of days but the momentum has shifted bearish again.

AMD's dealer open interest is opposite customer interest and boy does it flip flop over each week. However, have a look at the x-axis. The biggest bars barely make it past $0.3M in dealer deltas. I usually ignore these until they run out to at least $1M.

Vanna generally looks positive across the board except for a small amount of negative vanna for December. Keep in mind that positive vanna plus contracting implied volatility is bullish.

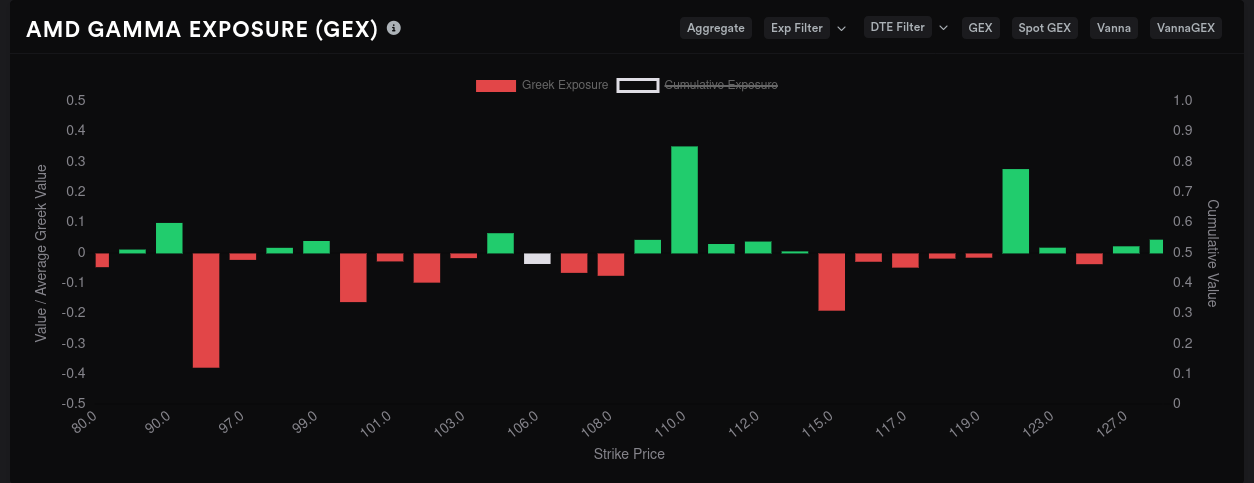

AMD's aggregate GEX has shifted some. The big level at $108 has dwindled and now $95 has taken its place as the biggest magnet for price. $115 looks fairly weak and $110 shows up as resistance. (Remember that $110 is the location of that volume shelf we saw yesterday.)

The 9/15 expiration has the largest amount of impact on GEX right now, so let's get a look. Clearly $120 is set up as the "do not pass" zone for a while, but that's not news to anyone who has been reading this blog for the past month. 😜

Here's what I notice:

- Very indecisive on price magnets. Multiple negative GEX lines are around the same level.

- Very little downside resistance. There's not much positive GEX here to slow downward price movement.

Put all this together and it's entirely possible for AMD to whipsaw from $90 to $115 without GEX to slow it down.

If we take a detailed look at vanna, it looks like contracting IV could pull us up to $110 at most. Expanding IV could send us down back to the $100-$103 zone.

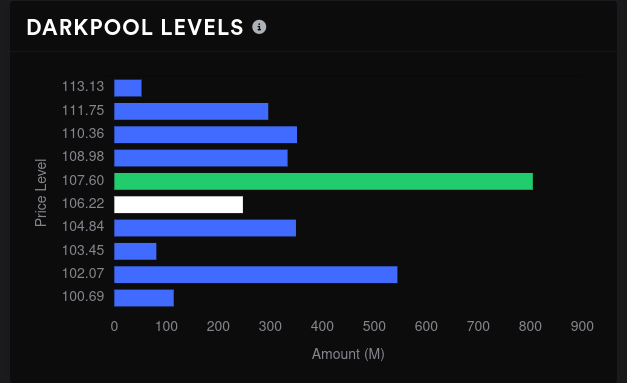

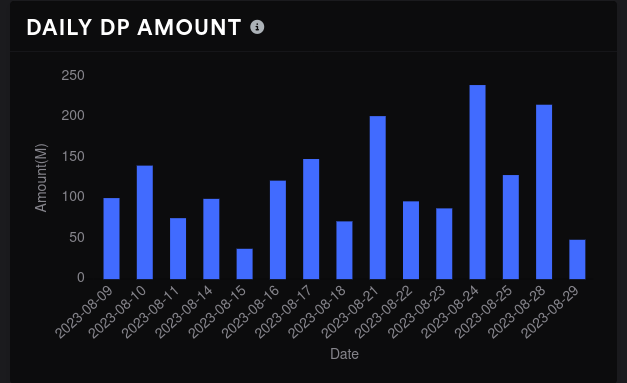

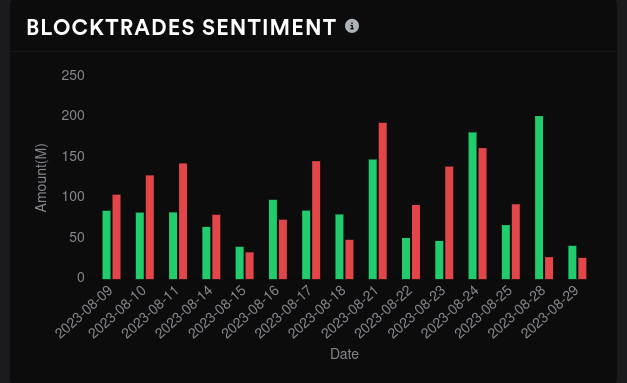

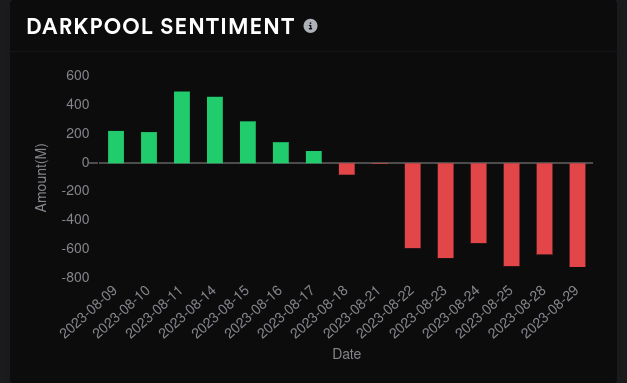

Dark pool volume remains high around $107 and $102. Monday's big jump in sentiment was continued yesterday, but on fairly low volume. If AMD is meant to go on a bigger run, I'd expect to see a bigger correction on sentiment and much more volume. This makes me think that we're topping out and we don't have enough volume to keep going.

TSLA

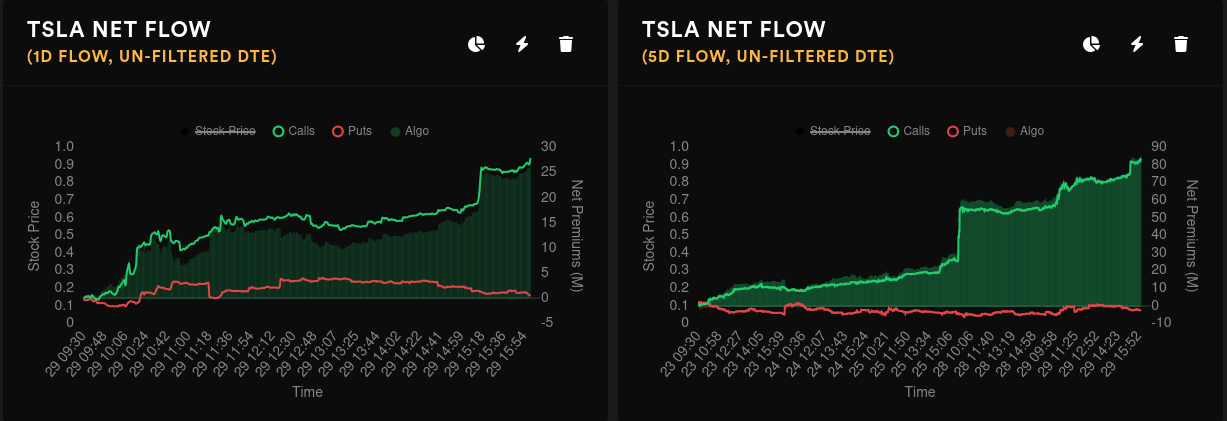

Boy, TSLA had quite a day yesterday. However, if you were watching this blog, you could see that the options flow for the last five days was very clear about what was coming:

Dealers are a bit short on deltas for TSLA, which suggests customers are still leaning bullish. 9/15 is supposed to be a fairly bearish expiration based on dealer open interest.

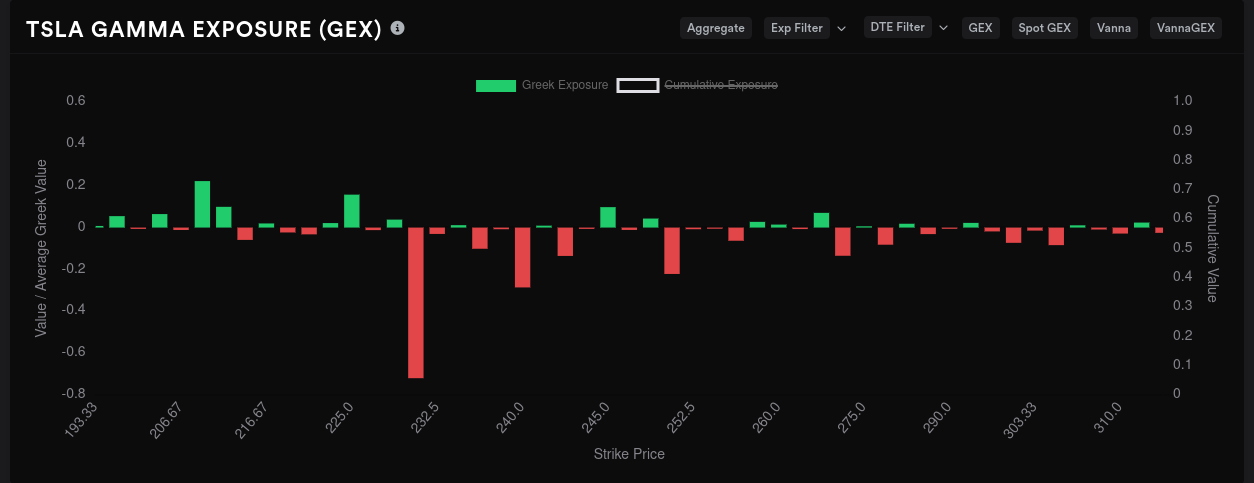

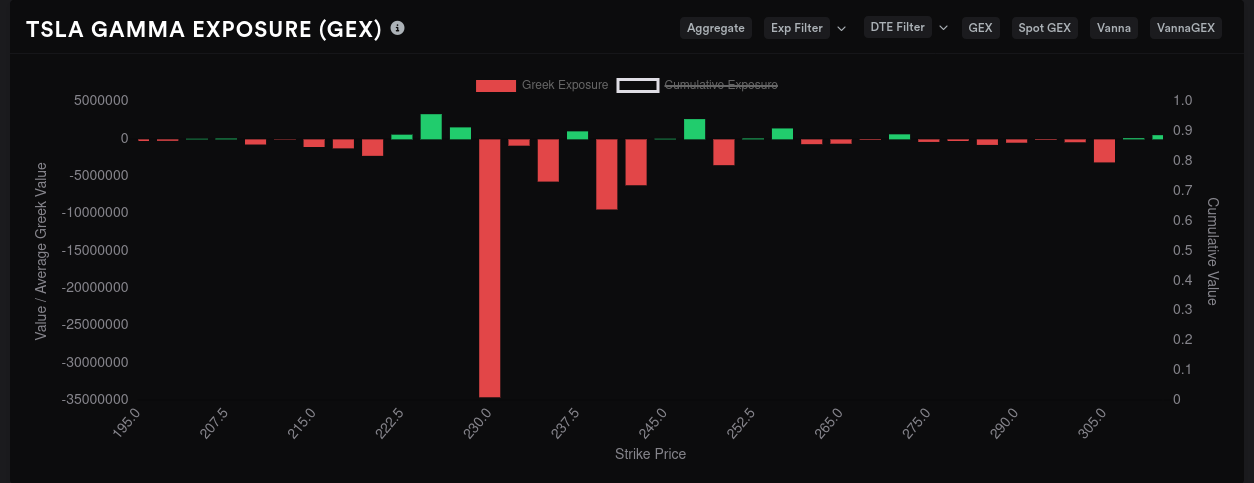

Let's start with aggregate GEX. Earlier this month, it looked like TSLA $270 was totally possible, but this GEX chart makes me think we're headed to $230 again soon. There's a strong lack of downside resistance until we reach $225 and $210. That makes me a little nervous.

For TSLA, the biggest GEX expiration is 9/1. It's much, much larger than 9/15. This 9/1 chart looks fairly clear: $230 is the target. Resistance in any direction is almost non-existent. This seems a little crazy with TSLA riding $255 this morning.

Scooting out to 9/15, this is where the $270 still lives. I can't tell whether we get another dip before we go higher, or if there will be no correction before 9/15.

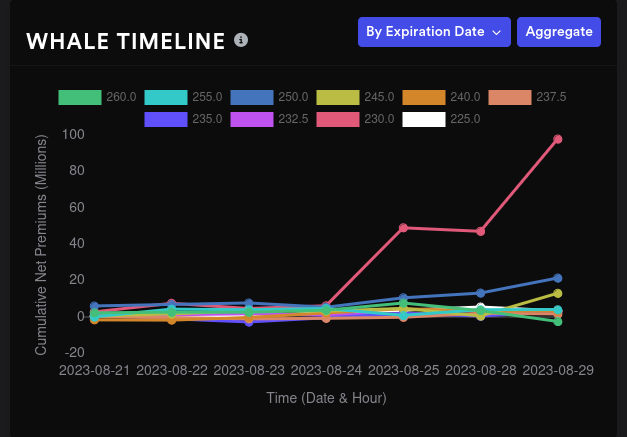

One other thing to note is that someone has gone bananas with some huge bets on TSLA $230 that expire on 9/1:

For 9/15, traders have gone very bullish on $230 and held that level. $240 and $245 are on their way up. However, the $260 fell off like a rock:

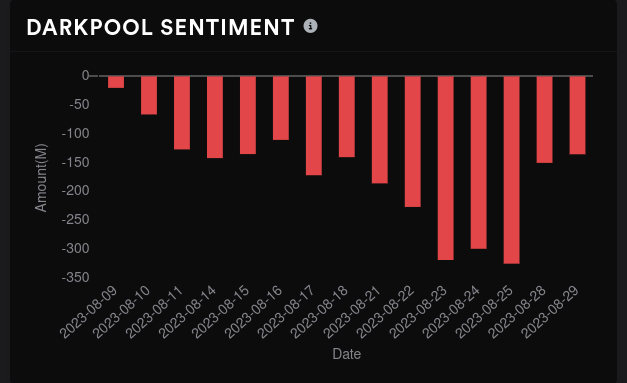

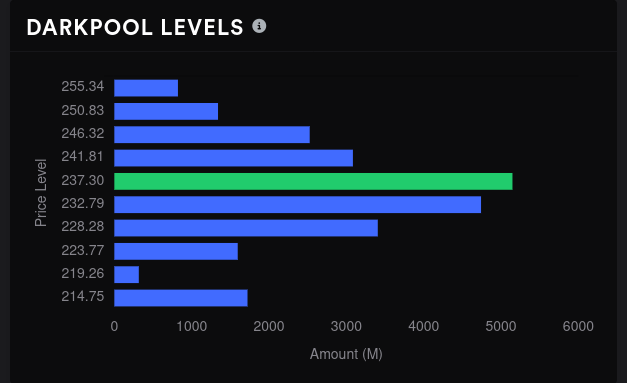

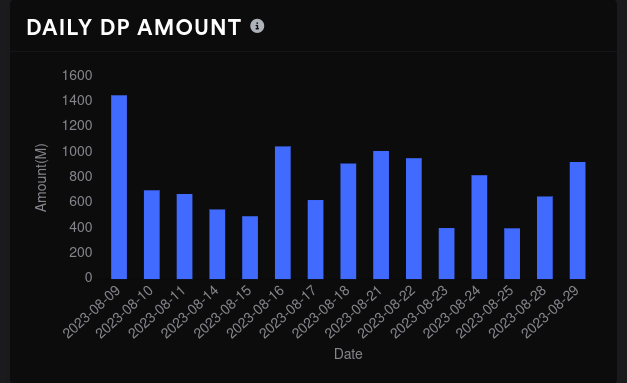

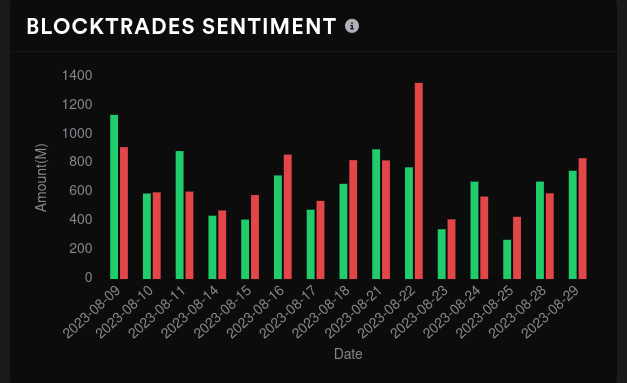

Dark pool volume remains heavy around $237. Volume increased this week but nobody seems to be winning the sentiment battle yet.

Thesis

AMD looks like it might have a little gas left in the tank for a grind up to $108 or $109, but anything past that seems doubtful without some news impacting the market. If it does fall back, it doesn't have as much support underneath the price as I'd like. I would start to turn bullish on AMD if it dips into the $95-$100 range.

The AMD VWAP line from January 6 that everyone seems excited about is lingering right around $98. It has bounced off that line multiple times and it sure would be nice if we caught another bounce there. 😉

My AMD trades include covered calls scattered from $108-$114 for 9/15. I still have one short $105 put on the board for 9/15 but I'll try to get that off for a small profit if I can.

As for TSLA, could we reach $270? Sure. Could we reach $230? Sure. This thing is wild and difficult to predict. I'm thinking we could approach $260 before 9/15 but I doubt we will make it all the way to $270.

I jumped the gun on some covered calls at $255 and $260 for 9/15, but I like these strikes. I could have gotten a lot more premium if I'd been more patient through yesterday's rally, but profit is profit.

As always my trades are up to date on Theta Gang along with trade notes. Good luck to everyone today. 🍀

Discussion