Monday stock and options analysis for August 28

Interest rate hikes might be back on the menu. How is the market planning to trade it? Let's take a deep look at the data.

Welcome back from the weekend! Student loans are waking up from their deep sleep and most borrowers will have money due in October according to the WSJ:

Student-loan borrowers are finding out that restarting a $1.6 trillion federal program is much more confusing than switching it off.

With pandemic relief ending, borrowers will start owing interest as of Friday. They are learning of new payment schedules, often via email, from servicers they might have never heard of—and could be reluctant to pay. That is because about four-in-10 borrowers’ loans transferred to a new servicer during the pause that began in March 2020, according to government data.

Combine this with overpriced housing, high mortgage rates, high gas prices, and increasing automotive repossessions and we have the ingredients for a slowdown. I'm generally trading with a bullish bias, but this has really made me rethink my investments and trades.

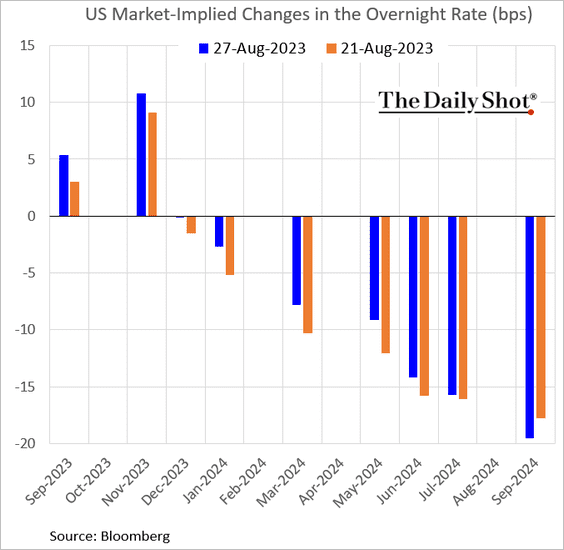

The market is pricing in another interest rate hike soon:

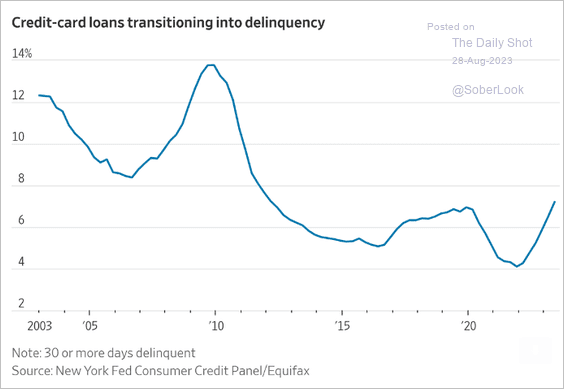

Macy's issued a warning in their earnings last week about delinquent payments from borrowers and the overall credit card delinquency rate is climbing again:

All of these put strains on sales to consumers as they pull back to less expensive products or cut back on purchases. The earnings report from Dollar Tree last week gave me another pause when it became clear that customers were pulling back from even the lower-cost stores as well. 👀

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get a look at this week's data:

AMD

AMD had a pretty good Friday, but it needs a little more bullish push to overtake the five day flow that still remains bearish. It's close, though! 🤏

Here's a quick run-down of other data I see:

- Options volume and OI are both up for AMD especially into the second half of last week

- IV rank for AMD is around 39%, which is a little lower than average

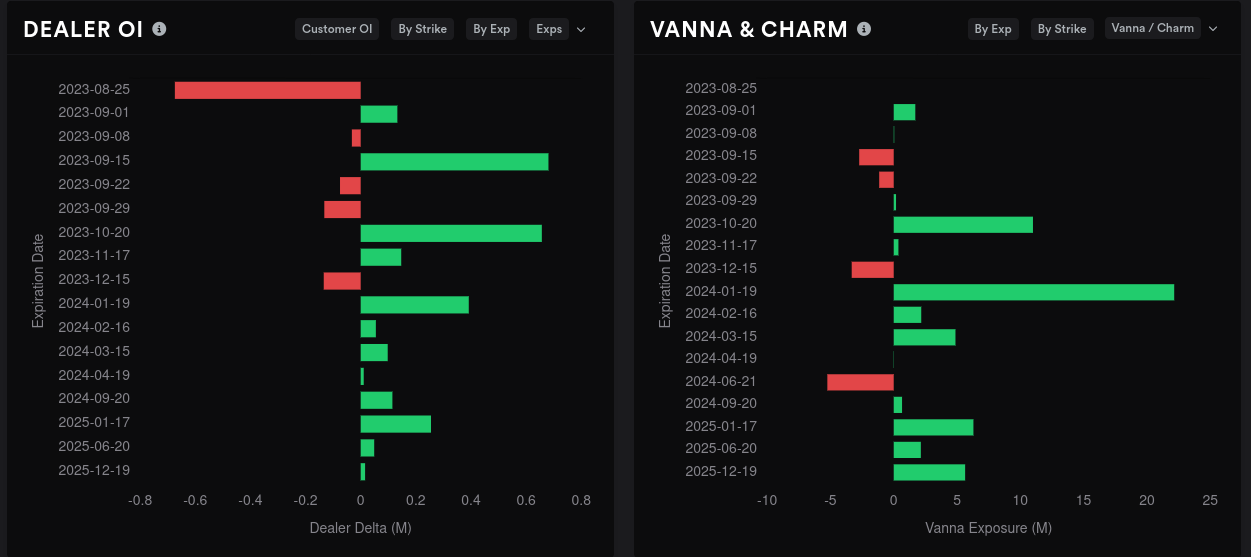

- Dealer greeks buildup on a 15 day momentum from deltas looks bearish (dealers long, customers short) and vanna looks bearish as well from this perspective

- Options are priced for a downward move of 0.0-1.7%

AMD looks bearish for 9/1, 9/15, and 9/20. Vanna for 9/15 is slightly negative (bullish if IV is expanding) and 10/20 is positive (bullish if IV is contracting).

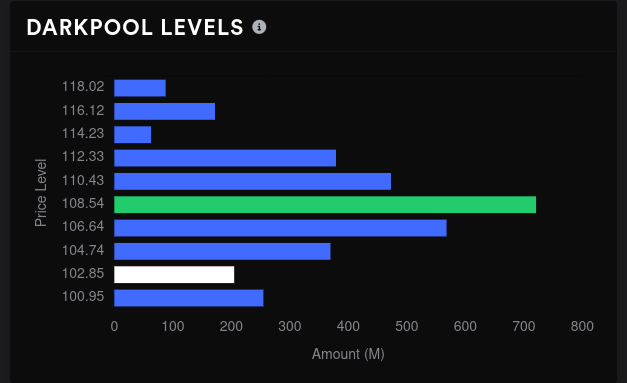

Aggregate GEX suggests a move to $108 with some downward resistance around $100.

9/1 and 9/8 both show strong upward resistance around $110-$112, which confirms that $108 could be our highest move for price before then.

9/15 opens the door for more movement, possibly to $115. I don't like the lack of downward resistance here. If price does drop, there's not much from GEX which would slow down the move.

Although 10/20 is a ways out, $95 seems to be the only target on the chart. There's resistance at $90 and $110.

Let's get a roundup of what the whales (options traders who trade a lot of contracts at once) are doing:

- 9/1: Bullish on $105, bearish on $110

- 9/8: Bullish on $105

- 9/15: Bullish on $105/$110, bearish on $100/$120

- 10/20: Bearish on $105/$110

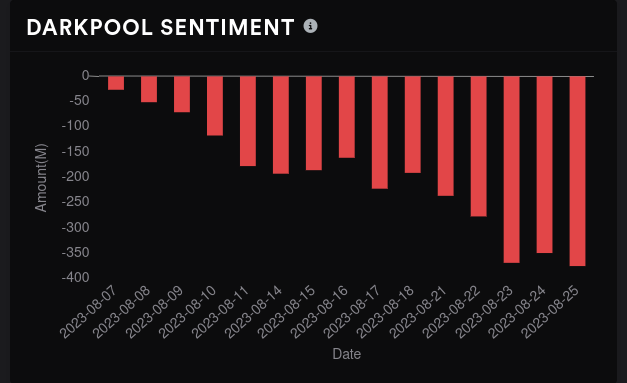

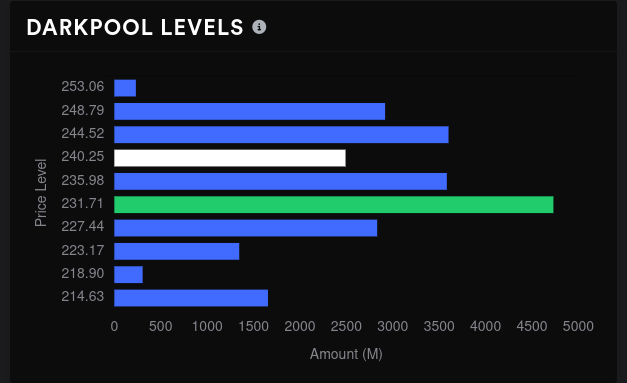

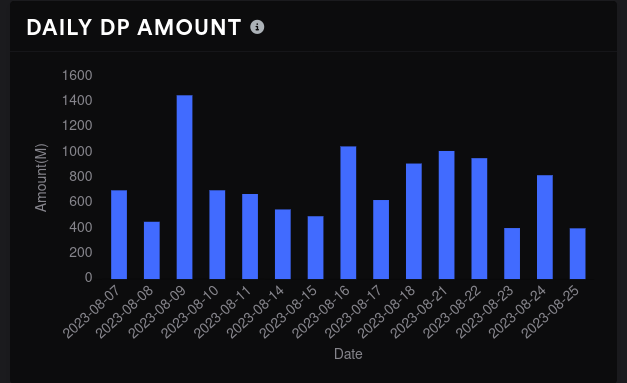

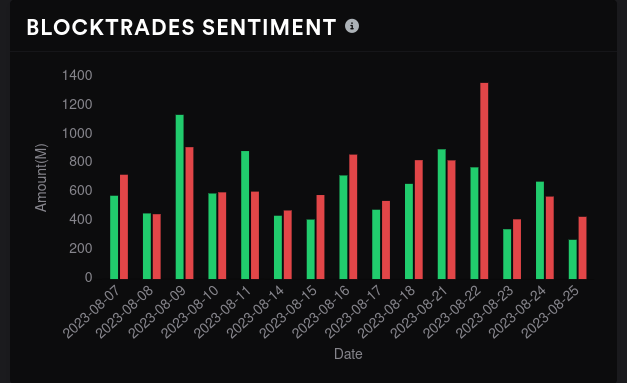

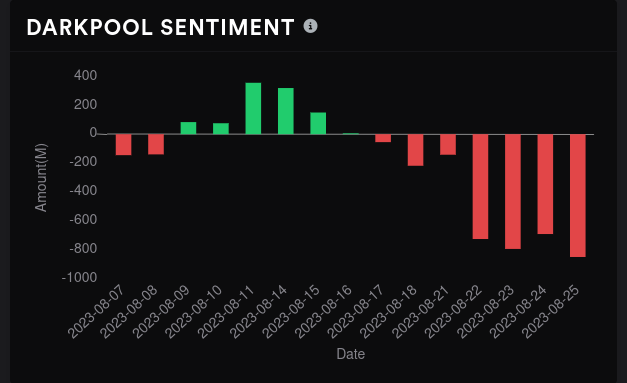

Dark pool data for AMD shows bearish sentiment still very strong with the biggest level at, you guessed it, $108. Levels fall off quickly past $112.

TSLA

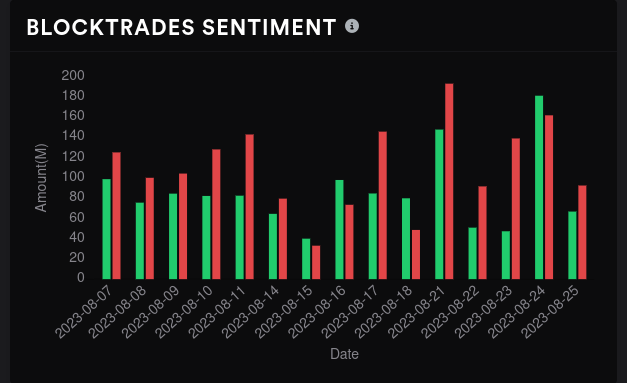

As usual, TSLA does not disappoint when you're looking for crazy swings and volatility. 🙃 The flow was bullish all week and then Friday afternoon saw a massive surge in bullish calls:

Options volume increased last week and TSLA has a tremendously low IV rank of around 7%. Dealer greek buildup looks bullish with dealers going short (customers long) for Thursday and Friday. Options are also priced for an upward move.

TSLA's vanna is overall positive, but mainly due to a ton of bets made for 2025. 9/15 and 10/20 have negative vanna and this should push price higher if IV expands. 9/15 looks bearish from a dealer OI perspective, but it turns bullish for 10/20.

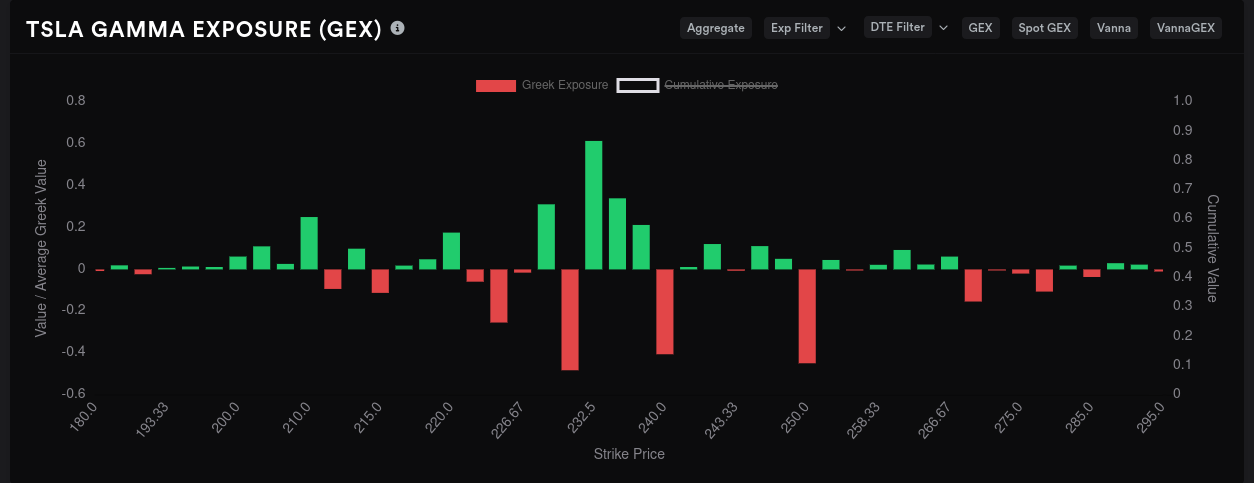

I've been paying attention to TSLA's $270 strike lately as it keeps coming up on GEX charts, but the aggregate GEX points to something different today.

The biggest price magnets show up at $230, $240, and $250. We're at $242 during pre-market trading today and there's a fair amount of resistance just underneath the current price. A run to $250 is certainly possible.

9/1 and 9/8 GEX strongly suggest a move to $250. However, $270 shows up as the biggest level for 9/15:

10/20 is still far out, but our biggest magnets for price sit around $230-$240. Dealer OI suggests this expiration is bullish, so this is going to be interesting to watch. Then again, TSLA has so much mixed data and it's a difficult one to trade.

What are the whales doing?

- 9/1: $230 has gone bullish through the roof starting Friday

- 9/8: $230 is the most bullish, but almost all strikes are trending bullish

- 9/15: Extremely bullish on $270. Off the chart bullish. Seriously bananas.

- 10/20: Bullish on $220, bearish on $250 (but $250 is trending bullish)

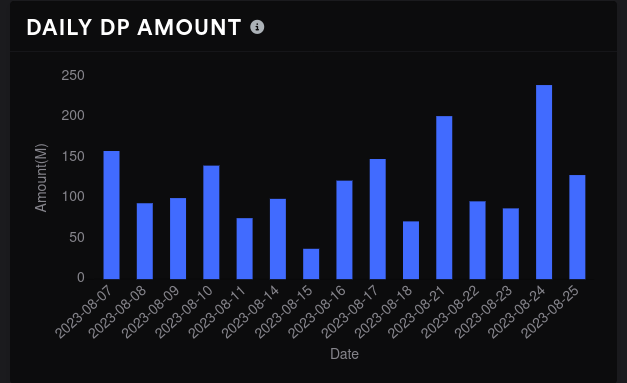

Dark pool data shows bearish sentiment with the biggest level around $231. Volume gets very light above $249.

Thesis

AMD and TSLA both look like they want to make small runs before falling back to their current levels.

For AMD, this looks like a run to around $108-$110 by 9/15 and then perhaps back to $95-$100 by 10/20.

For TSLA, a run to $250 looks like a decent probability by 9/15. I'm doubtful on $270 by that time, but TSLA has surprised me many times before. 10/20 suggests we're getting stuck back around $230-$240.

My trades are fairly light right now and they're all targeting 9/15. I have a short put for AMD at $105 and covered calls at $108. My TSLA shares are uncovered. My investment moves over into SGOV look like they might be in a good spot for a little while.

Although earnings season is winding down, there is a lot happening in the world right now that is worth watching for changes. Interest rate hikes are certainly top of mind for me. Increasing consumer debt is another problem that manifests itself in different ways.

If you want to see what's really happening in the automotive market, especially with reposessions and a potential UAW strike, I recommend Car Questions Answered over on YouTube. (I'm just a fan of his content and honesty. I don't have any affiliation with his channel!)

Good luck to everyone! 🍀

Discussion