The month of January is almost over and I hope it's been a great month for you. Things looked a little rocky for a while earlier in the month, but we're back at highs again.

In this post, I'll go through several of the charts that I find interesting as a trend follower. My main goal is to find stocks that are seeing lots of money flowing in from large firms and then jump on that trend. If you're in a hurry, here's my list for the week:

- Current holdings: ANET, AVGO, HOOD, VST

- Potential new trades: RKLB, LUNR, LRN, KD

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's dig into several of these.

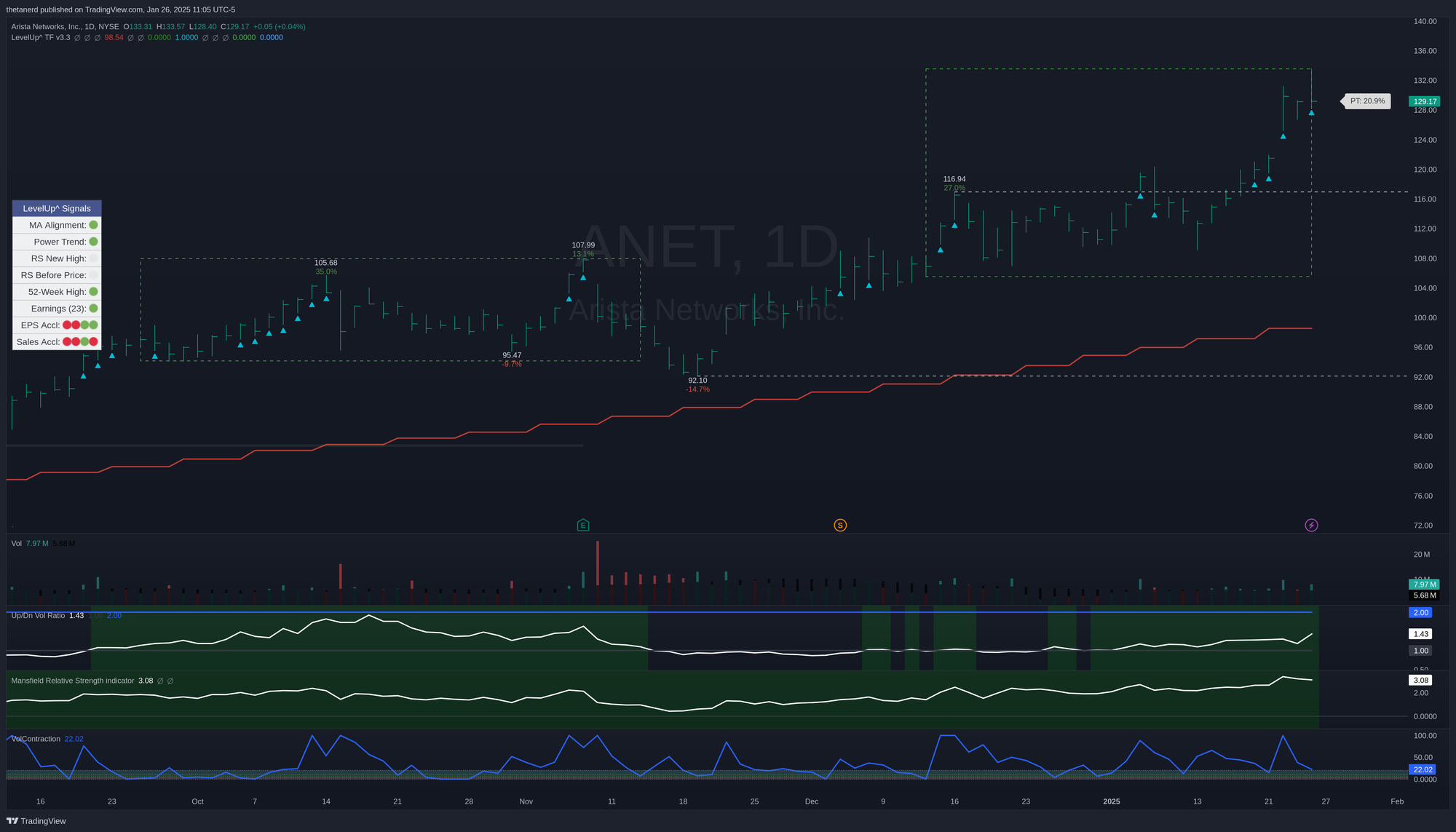

ANET

This is one of those charts that ticks all the bullish boxes for me:

- 30W moving average (stair stepping red line) still going up with price well above it

- Multiple recent all time highs (blue triangles)

- Up/Down volume over 50 days has been increasing during ANET's consolidation (hints that someone is trying to buy quietly)

- Strength relative to SPX continues pushing higher

- Broke above the resistanc elevel at $117

I'm using LevelUp indicators from John Muchow as it automates away much of the measurements I was doing manually before. The rectangle with the dashed green lines highlights a power trend. Several conditions must happen together before a power trend starts, and ANET has been in one since mid-December.

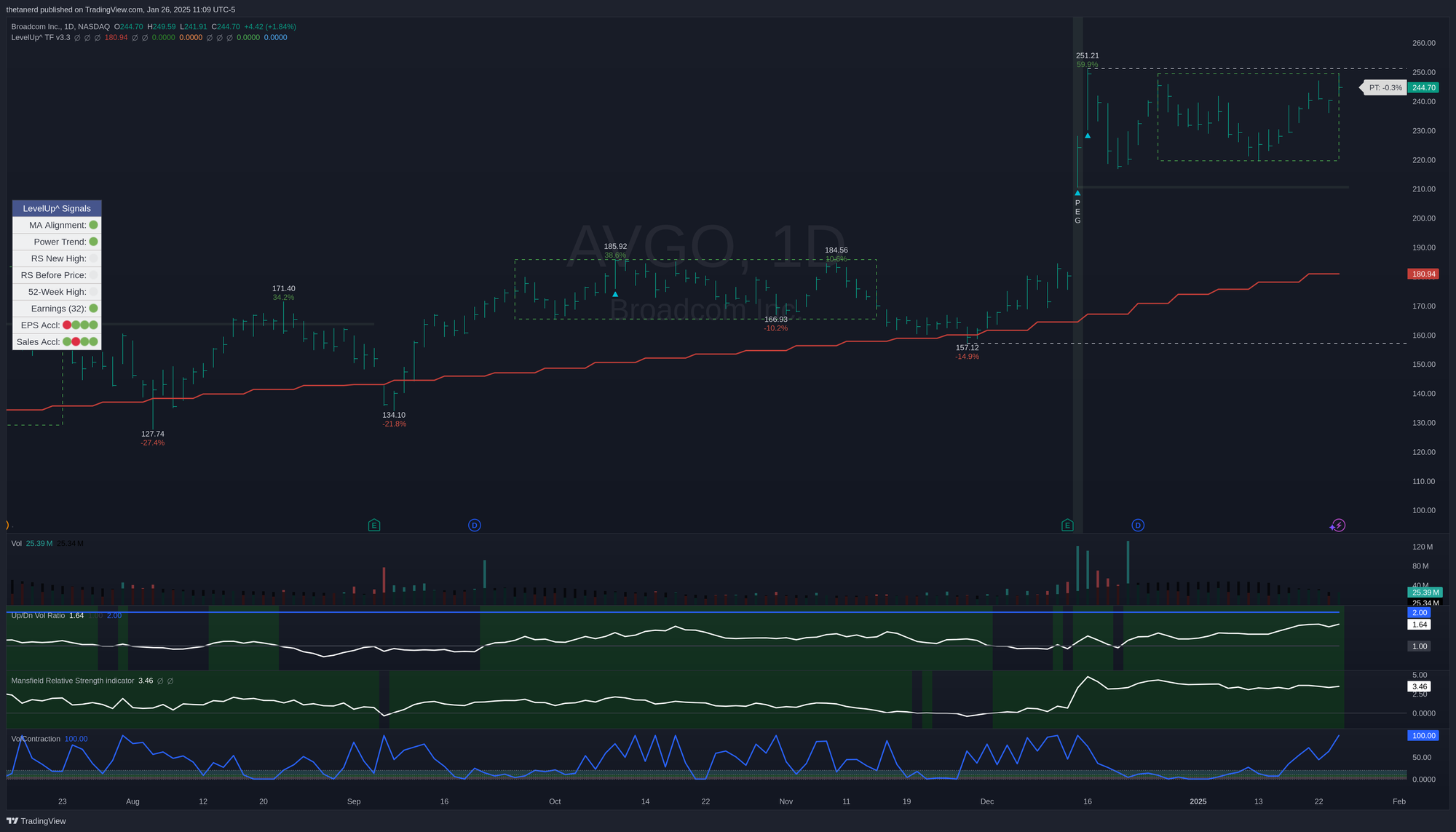

AVGO

Much like ANET, this chart ticks almost all the bullish boxes. It had some tough bumps on the 30W moving average, but it popped over the line every time. Up/down volume and relative strength both look excellent here. This suggests that someone is actively buying AVGO during the consolidation but is likely trying to hide their purchases.

Earnings are coming up in a month and AVGO seems set up well for that so far. It has held above the earnings gap level around $210.

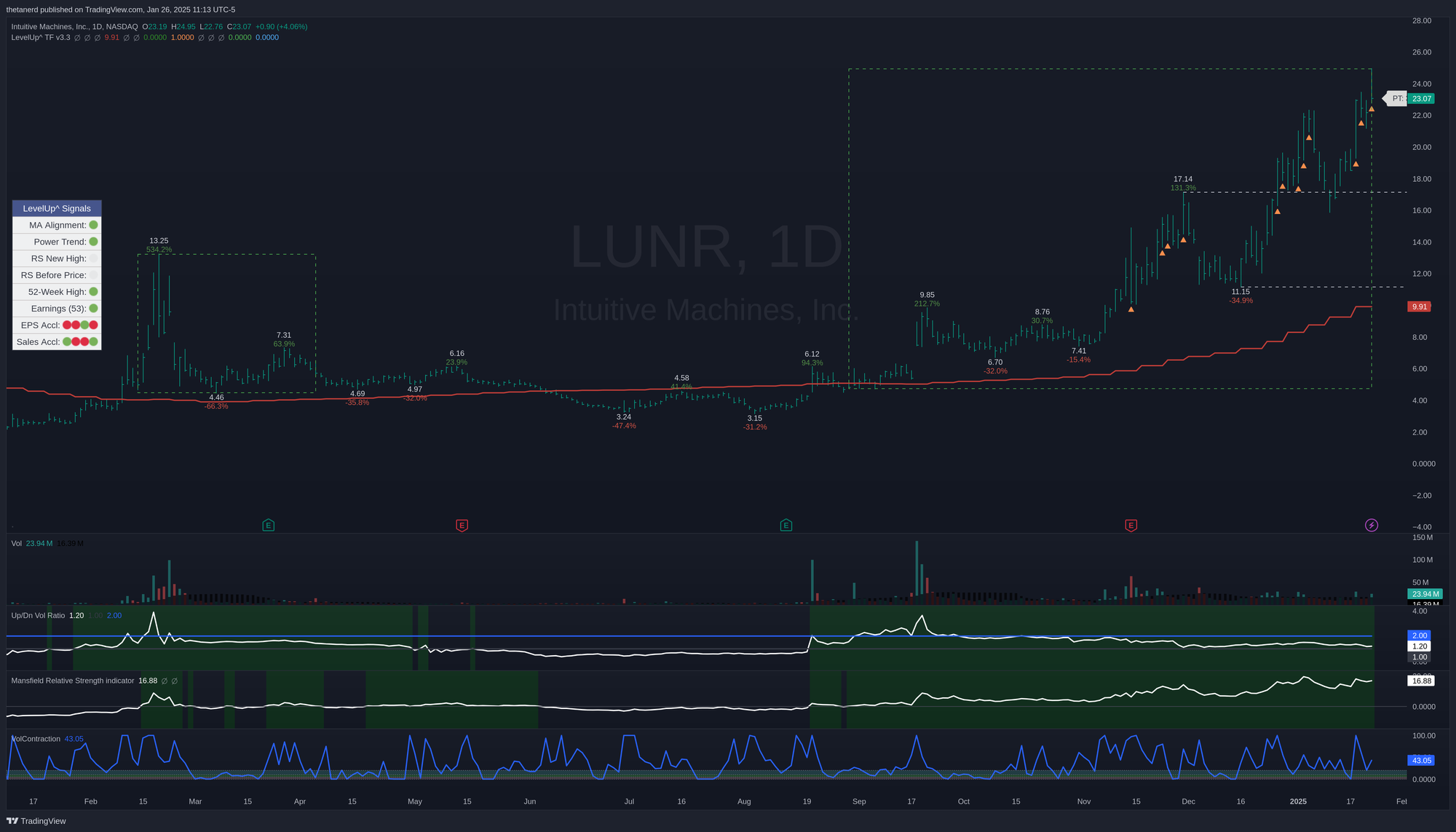

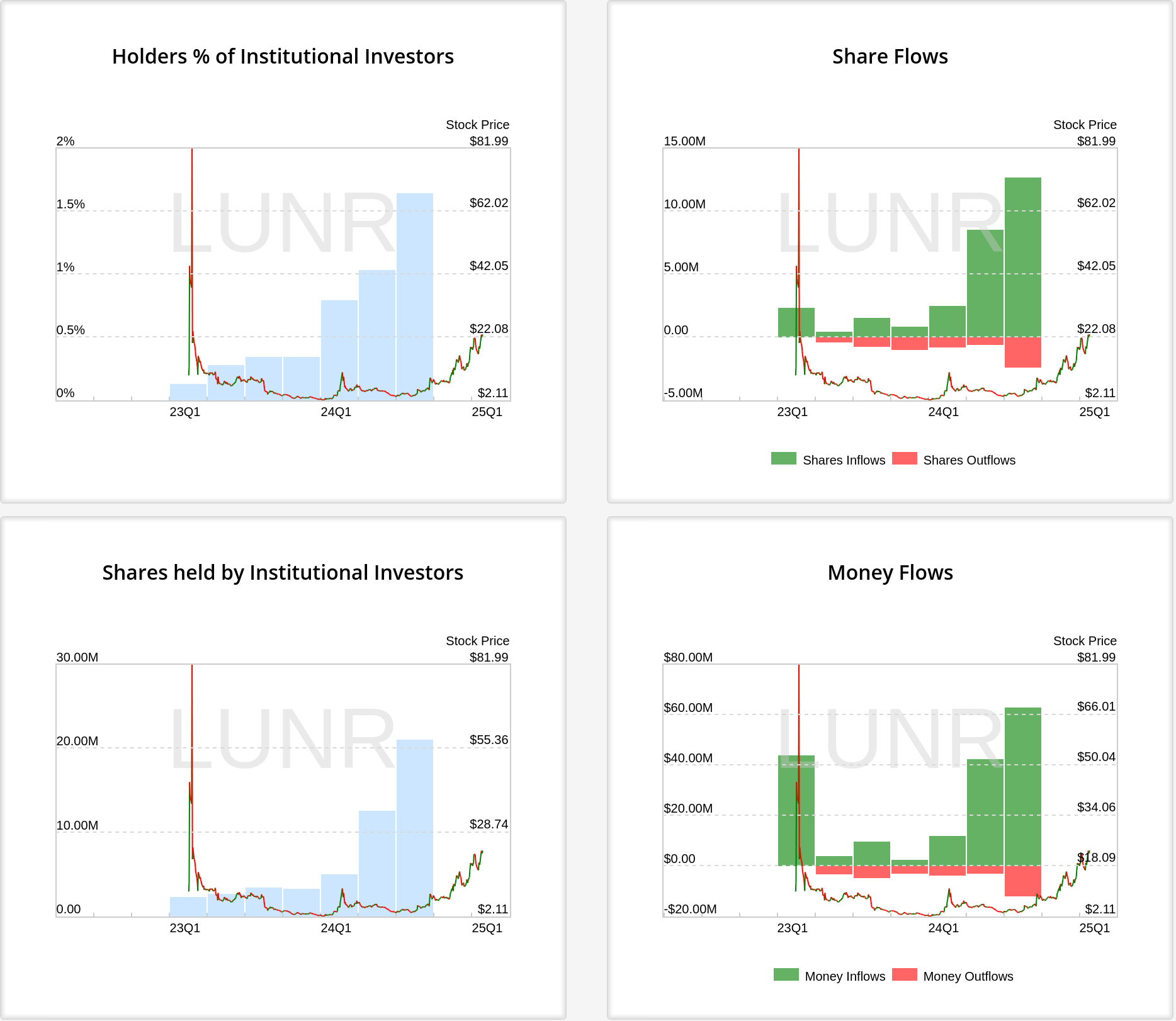

LUNR

I always try to keep my eye out for the smaller stocks that are doing something interesting while most people focus on the bigger names. LUNR is one of those that had a run up early in 2024 that failed. However, that might have put LUNR on the radar of some firms with deep pockets since LUNR leapt over the 30W moving average line and never looked back.

LUNR gained over 378% since the current power trend started back in late August, but the relative strength to SPX keeps getting stronger and the up/down volume is above 1. HedgeMind reports that institutional investors are buying up LUNR lately:

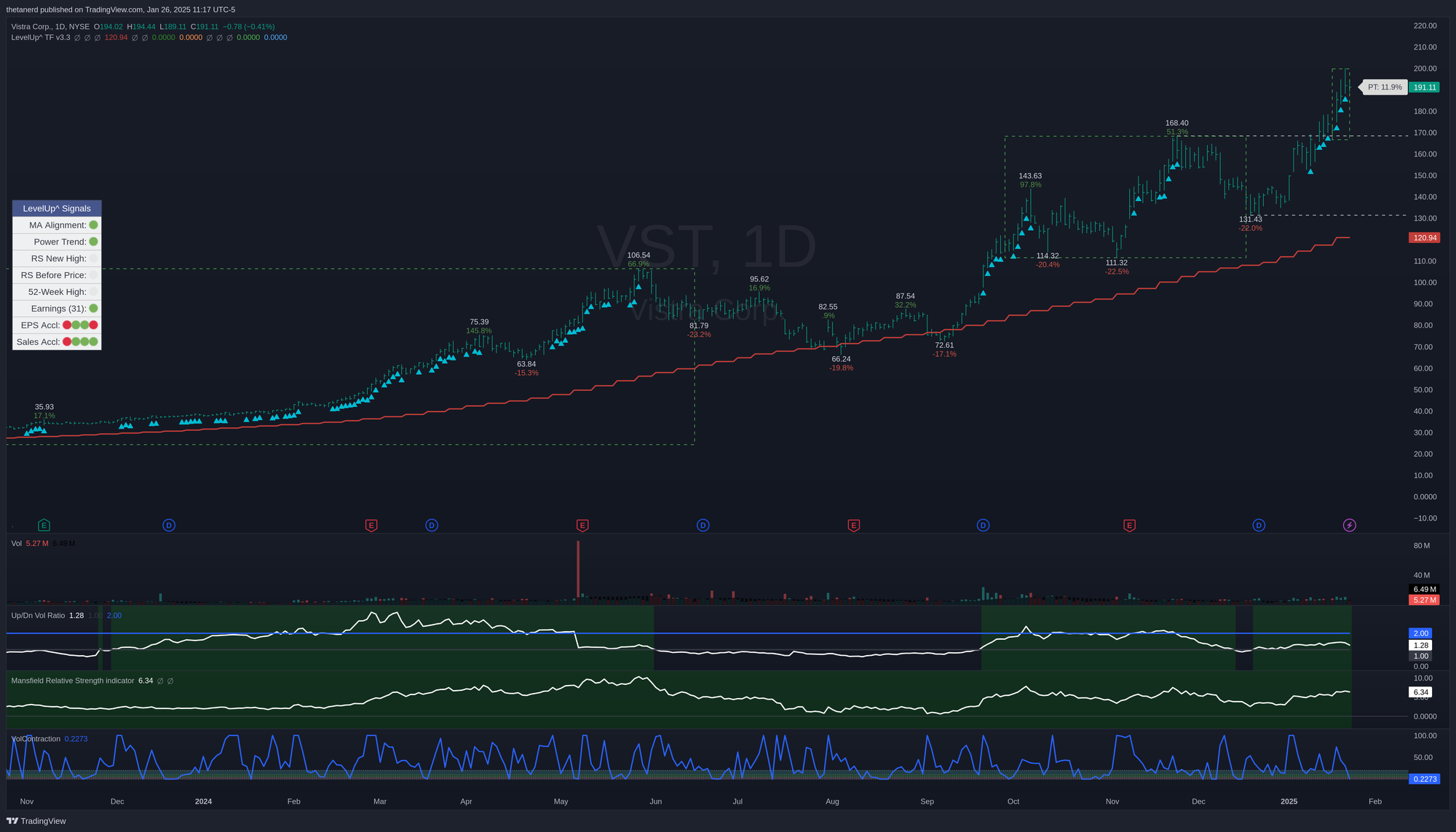

VST

Lots of people are talking about VST lately, especially after Nancy Pelosi disclosed that she has a bullish position in the stock. However, with a chart like this, you can see why it's getting some attention:

The price remains well above a steadily climbing 30W moving average and the strength relative to SPX remains high. Up/down volume hasn't dropped below one since mid-December's shakeout.

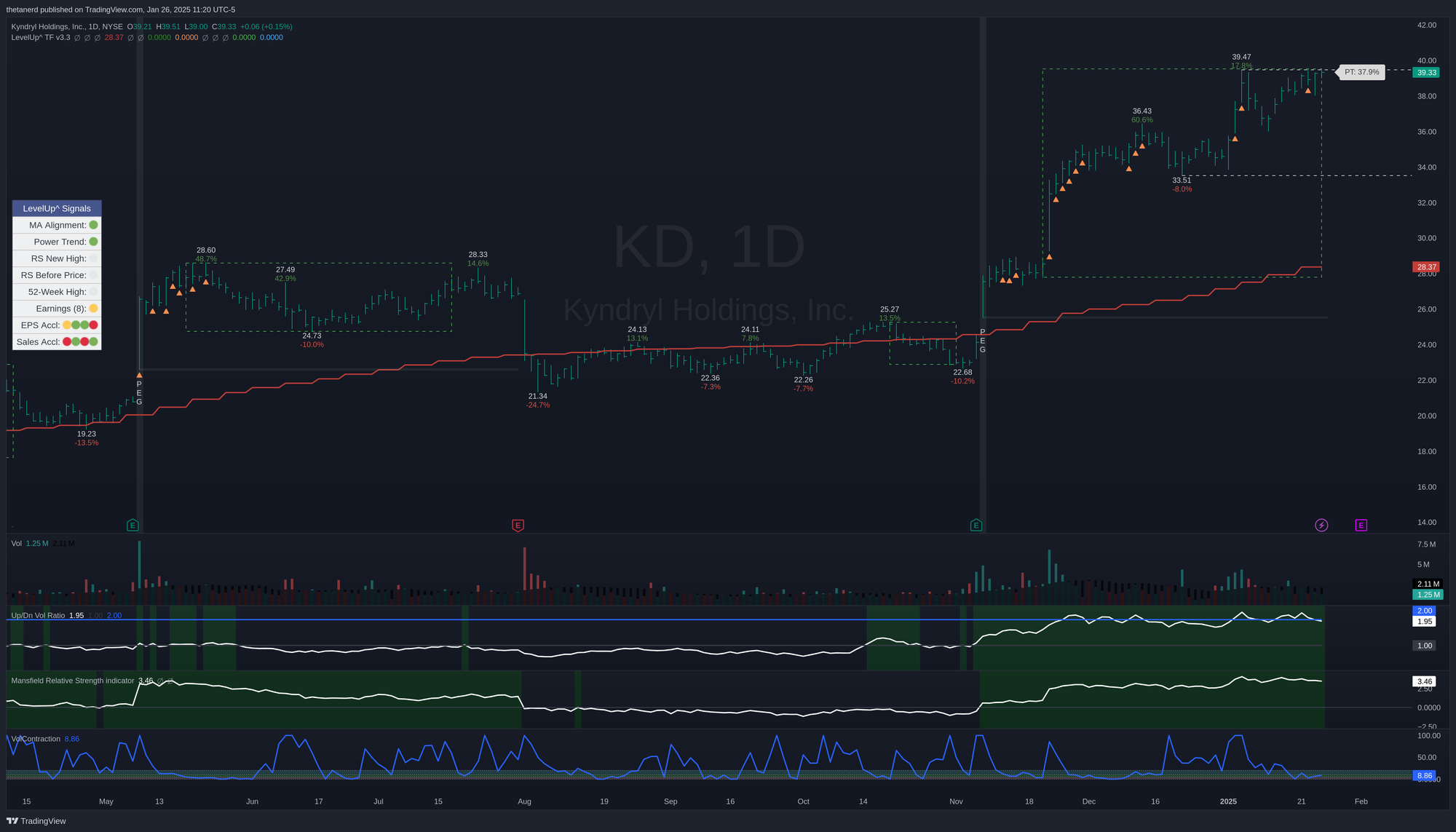

KD

This chart is full of drops and jumps, but something has been going right lately. May's earnings gap held for a while, but then failed with the next earnings call. Note how KD became stuck on the earnings gap low from May and tried multiple times to break below it. There were some small overshoots below that level, but it popped over the level repeatedly.

The price hopped again in November. Notice the up/down volume ratio and relative strength. Both jumped and held in bullish areas since the last earnings call. The up/down volume ratio held right around 2 since then and that indicates a significant amount of accumulation:

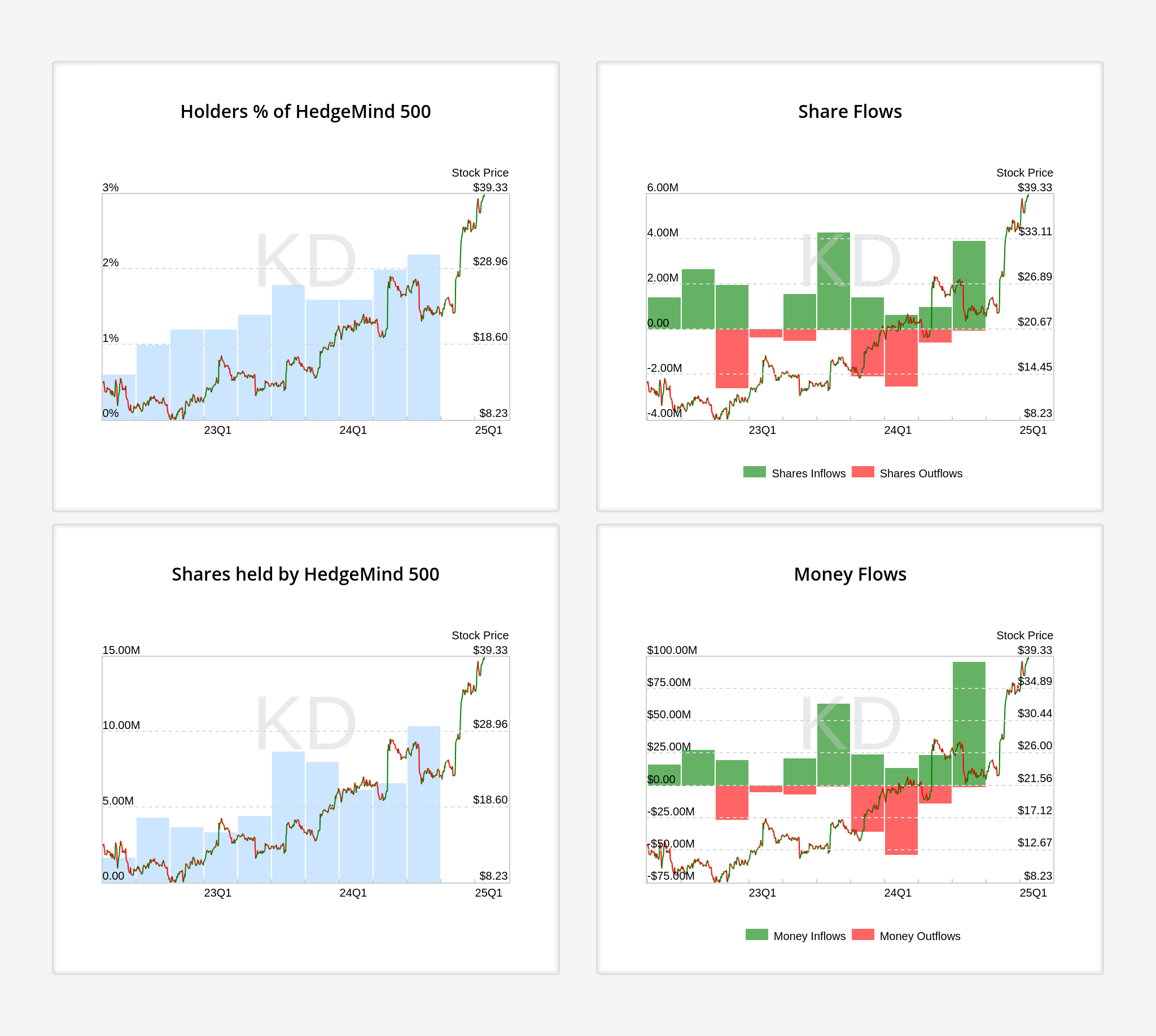

HedgeMind's data suggests that KD is definitely getting attention from some of the better hedge funds recently, too:

Wrapping up

As always, make sure you have some risk control in place whenever you make a trade. Even the best stocks have unexpected news or market activity that can suck the wind out of the strongest rallies. If your stock is acting right and you're following your rules, be patient!

Good luck to everyone this week! ☘️

Discussion