Navigating the chop for August 16th

SPY deserves a deeper analysis today and I'll also cover TSLA and AMD. 📈

Economic data keeps pointing to a recovery that looks overall positive on paper but it also highlights a very mixed recovery from a family budget perspective. Retail shopping is up but debt is also up. This can leave financial markets on a rocky footing as we approach another possible Federal Reserve interest rate change.

But first, here's a quick note on how I'm adjusting my trading:

I'm generally short volatility since I sell calls/puts in the market and I am making trades that expire a bit further away to avoid some of the localized choppy price action that we're seeing right now. Some of my analysis will avoid looking at nearby expiration dates and focus a bit more heavily on 30-60 days out. 🐌

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Today's analysis will focus heavily on a broader analysis with some updates on AMD and TSLA.

What is the overall market doing?

Yesterday took a bearish turn, but we're still slightly bullish over five days:

The S&P isn't a good representation of the whole market, but it's very heavily traded and often looked to as a barometer of where we're headed. SPY is the most heavily traded ETF and SPX is the index.

How is SPY doing right now? First off, implied volatility (IV) is extremely low at about 4.65%:

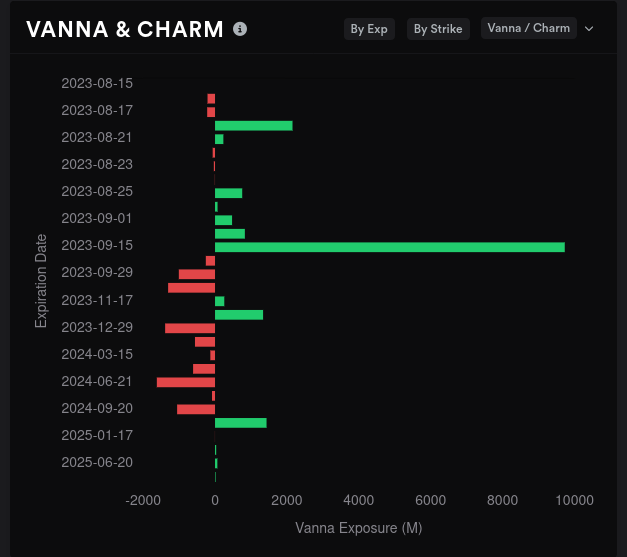

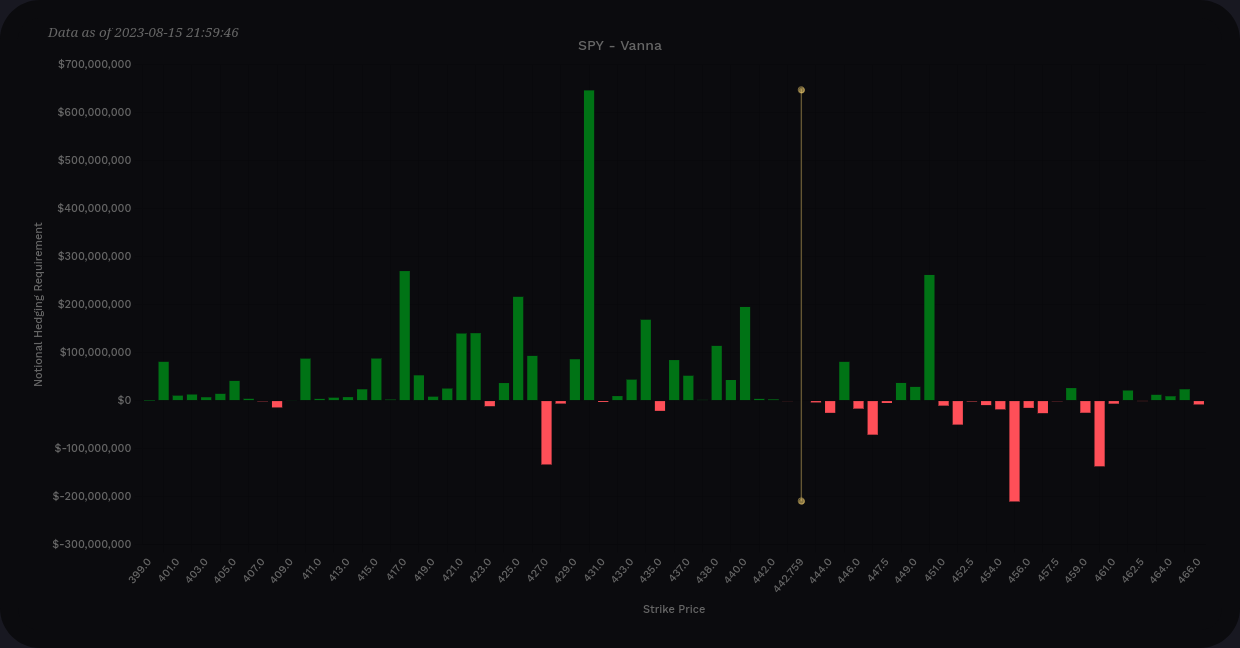

SPY is used heavily for hedging bets, so this data must be used with some caution. SPY's dealer OI is leaning bearish for the next two monthly expirations but we have positive vanna for both expirations. There's plenty of positive vanna for 9/15.

However, if you remember from my previous posts, positive vanna is bullish when IV contracts. Bullish traders want to see positive vanna with contracting IV or negative vanna with expanding IV.

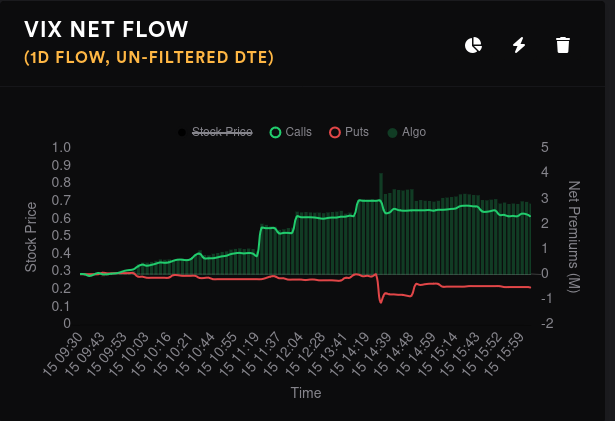

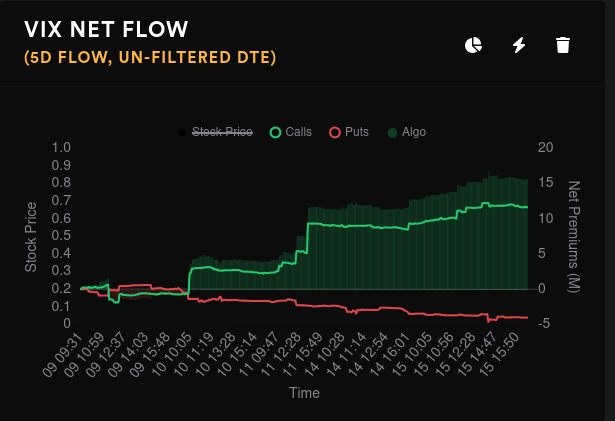

A quick sidebar: What's going on with IV? Options traders are betting on IV to increase in the market and they've been steadily increasing their bets on that for the past four days:

So we've got:

- Positive vanna

- Bets on IV to increase

- Bearish dealer open interest

This doesn't feel bullish. 🐻

SPY's aggregate GEX shows the largest price magnet around $445 with secondary levels around $450, $440, and $432. Resistance appears on upward movement around $446 but there's not much resistance for moves to the downside right now.

Scooting out to 9/15 reveals a big price magnet at $432 that sits in a range from $430-$440. The absolute highest negative GEX line shows up around $445 with a minefield of resistance above from positive GEX lines.

The vanna chart including 8/18 through 9/15 paints a similar picture. Although this chart would be bullish in a contracting IV environment, it looks bearish in an expanding IV environment. $430 shows up as a big potential target if IV expands (similar to what we saw in the GEX charts).

Sometimes I like to double check with SPX to ensure I'm not looking at a bunch of hedging in SPY's chart. Sure enough, I see a similar overall pattern of positive vanna with downside resistance appearing near 4400 and 4350. The upside range goes up to about 4500 and then runs into trouble past that level.

Whales in the market are going bullish on strikes from $440-$450 but these could certainly be hedges, too.

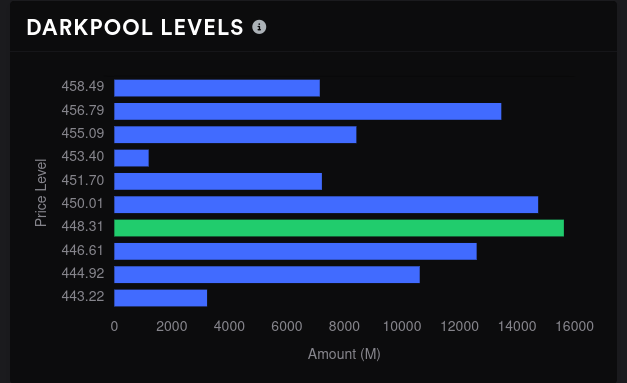

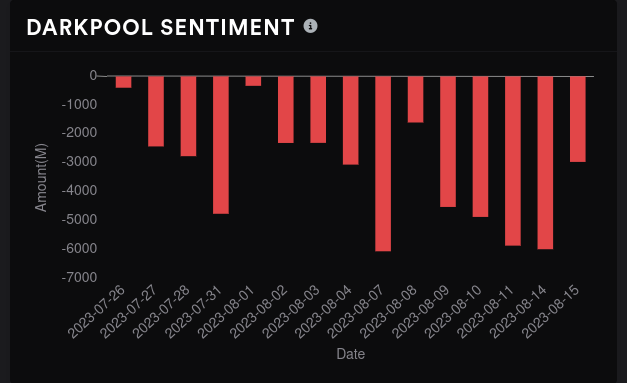

So we have decent correlation from gamma and vanna so far, but can we correlate this with any dark pool trades? SPY's dark pool sentiment remains bearish with the biggest level at $448. $444-$450 is a strong range where we might move around and the area closer to $455-$456 looks like it could be resistance.

AMD

What's new with AMD since my last update?

- Options flow remains very choppy

- Dark pool volume from $110-$113 shrank further and left $117 standing as the biggest level. That may be a new strong resistance level.

- Dark pool sentiment has increased in bearishness since July 26th

- 8/18 remains bearish based on OI but I'm having trouble believing that will be reflected in price this week.

- Vanna remains negative for 8/18 and 9/15 which could be bullish in an expanding IV environment

- Aggregate GEX wants to hold AMD between $111 and $118. That matches up perfectly with dark pool data.

- Vanna through 9/15 tops out around $120 and bottoms out around $110.

- Whales remain bearish on $90 for 9/15 and are going slightly bullish on $115. Someone has made an incredibly large bet on $80 for October's expiration. 👀

TSLA

Let's get a roundup of the latest data on TSLA:

- Choppy options flow shows up here with a bearish tilt lately.

- Dark pools remain bearish with the biggest level around $263. There's another lump of volume around $245.

- Dealers are still net long, which suggests customers are net short.

- 9/15 looks quite bearish based on dealer open interest.

- All of TSLA's vanna is packed into the 2025 expiration. 🤷♂️

- Aggregate GEX shows price magnets at $240 and $270 with the biggest downside resistance around $210. The largest resistance level is $235, which is above the current price.

- Whales are going bullish on $250 and bearish on $230 for 9/15. There's more volume on the $250 by almost double, however.

Thesis

We are definitely in a choppy market. SPY looks wedged in between $430-$445 with a possible run to $450 based on some data. IV remains very low right now and although that doesn't mean it must go up, I'm watching bets hit the market that IV will expand going into 9/15.

If that's the case, anything in the market with positive vanna (such as SPY) will have some selling pressure applied from dealers. It could be a little or a lot, but it's likely that we will see it.

My current strategy is looking at 9/15:

- Selling SPY puts under $430 (I sold a $423 yesterday)

- Selling SPY covered calls in the $445-$450 range if I'm feeling aggressive, but maybe $455 if I want to be a bit conservative.

- Selling AMD puts in the $100-$105 range and covered calls around $115-$120.

- TSLA is doing some unusual things right now. I did sell a $210 put but I'm not looking to sell any more until I see a change in sentiment. I may try to sell a call around $235-$240 if we get a jump up in price.

Good luck out there. 🍀

Discussion