Pre-CPI outlook for July 12

As we await the CPI release, let's see how options positioning stacks up right now. 🤔

The Consumer Price Index (CPI) data comes out this morning, July 12th, and it will likely have an impact on the Federal Reserve rate decision earlier this month. Predicting the number we will see is tricky business and predicting how the market is nearly impossible. 😉

There is some optimistic data out there around pricing:

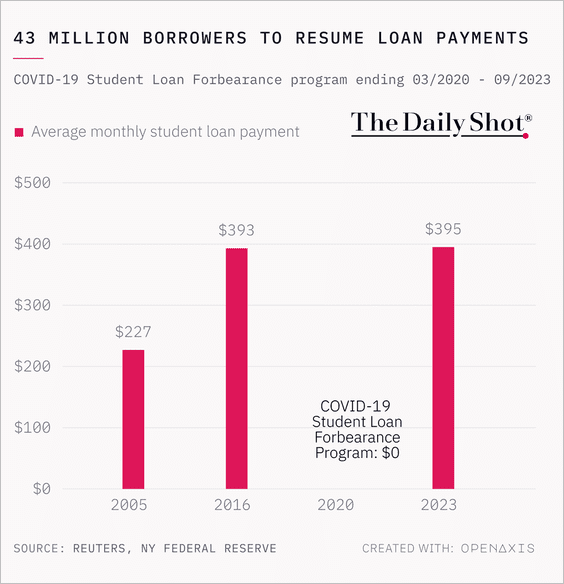

However, home and new car pricing remains stubbornly high. Also, plenty of student loan repayments are about to start in September:

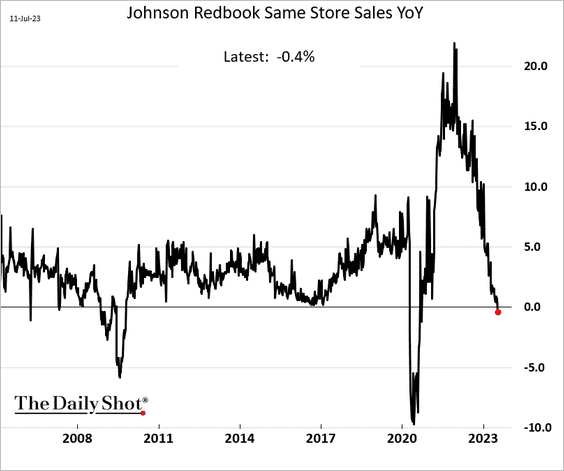

Retail sales also remain challenging:

Let's take another look at AMD and TSLA today to see how their options data looks going into the CPI release. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Time to go!

TSLA

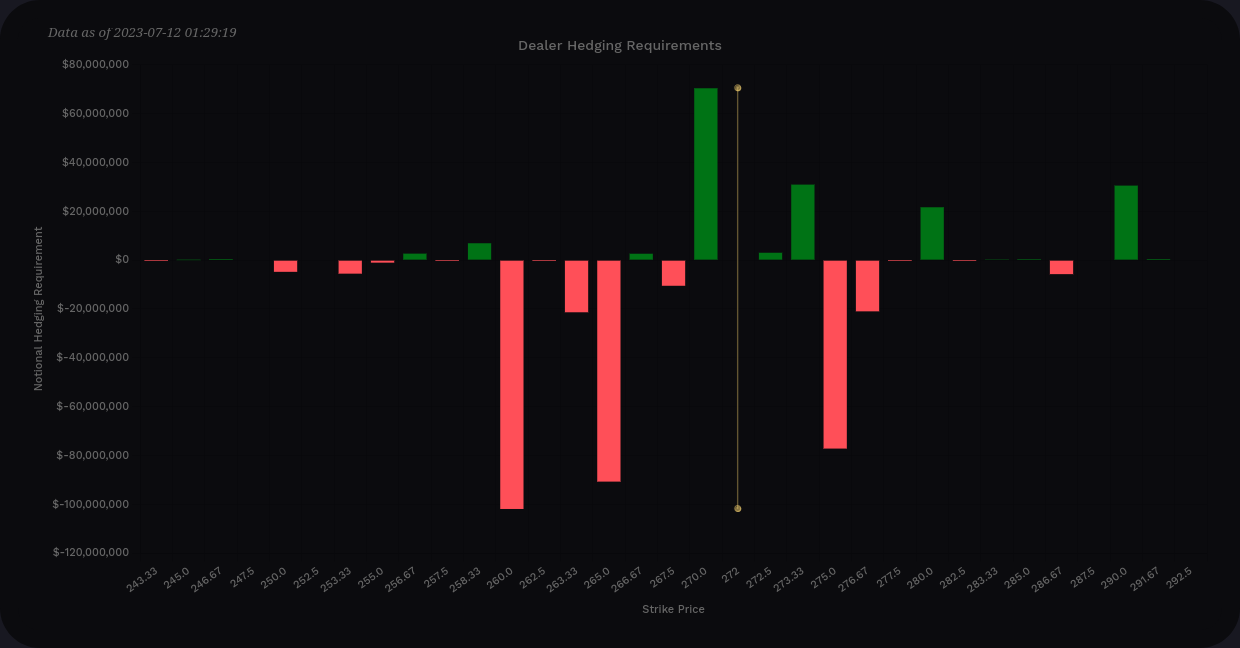

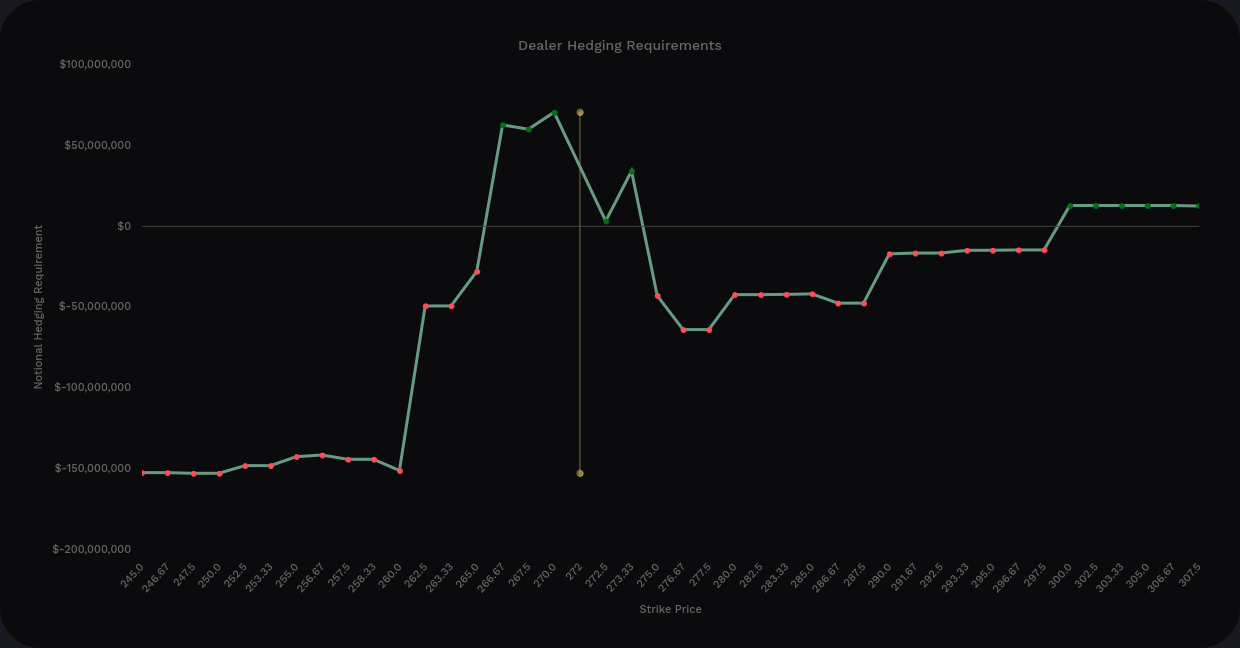

The vanna curve for TSLA, although weakened significantly, has taken on a less bullish pattern:

I like seeing the negative vanna below price around $260 and $265 as it will push price upwards as IV comes down, but that negative vanna at $275 will apply selling pressure at the same time. I'm not putting a lot of faith in vanna right now since our tallest bars are under $100M. (We recently saw vanna exceeding $2.5B for TSLA in a single bar.) 🤯

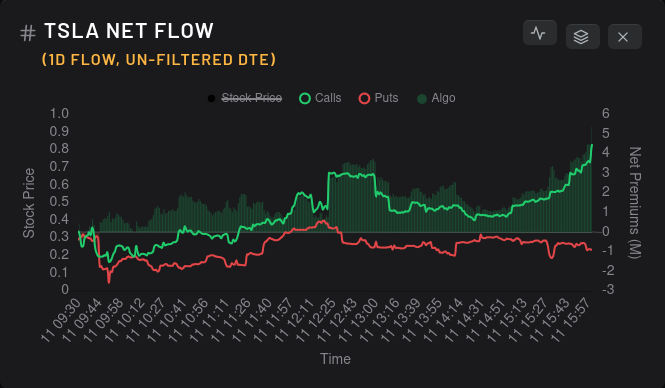

There's not much to talk abut with regard to TSLA's gamma, but we can see a bullish tilt to the options flow:

Puts vaulted upwards on Monday, possibly following that big drop from Friday afternoon. Calls are definitely outpacing the puts. But let's get to the thing I'm really excited about:

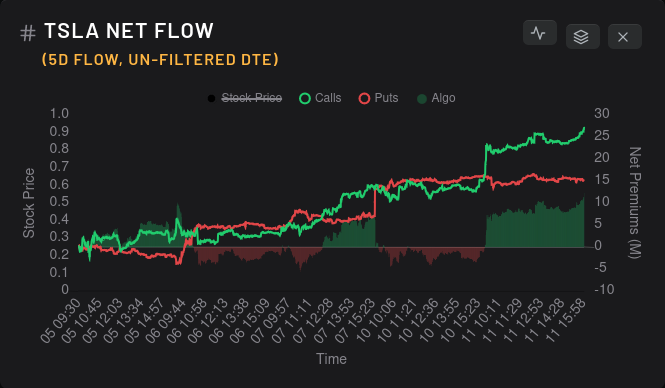

It's very hard to see, but if you look on the far right of this chart, there's the tiniest little red bar showing that the 15 day momentum of dealer greeks went short for the first day in two weeks. This means that the bearish options flow from market particpants (not dealers) has moved slightly bullish. I'd like to see a continuation of this after today.

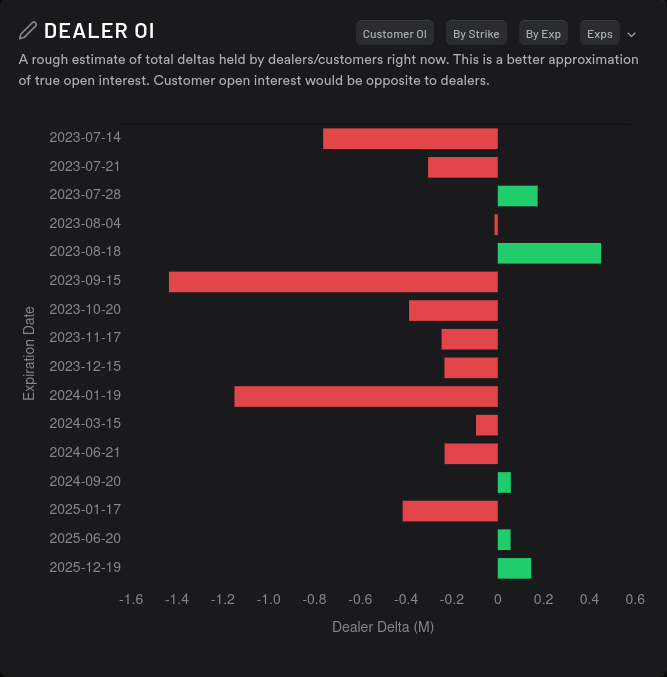

This isn't something I'd run out and make a trade on right now, but if this trend continues, it could signal upcoming bullish moves for TSLA. Let's look at dealer open interest for some hints on timing:

We have bars crossing 1.0 for the first time in about a month and the bullish premium is growing. These could simply be pre-CPI bets being made, but it also could mean that more people are betting on bullish moves at least through the fall of 2023.

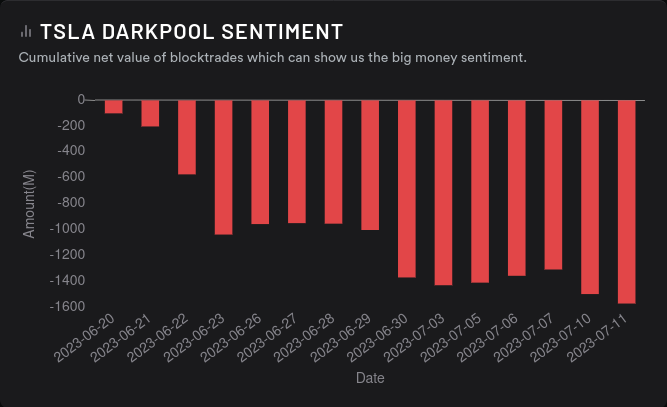

As mentioned previously, I don't put much faith in dark pool trades, but I do like to see if they correlate with some other data that I find:

Overall sentiment on the dark pool side doesn't look great, but it's not increasing on the bearish side aggressively right now like it did late in June. The $256-$269 range has a ton of volume and that could provide some support as price fluctuates before earnings.

AMD

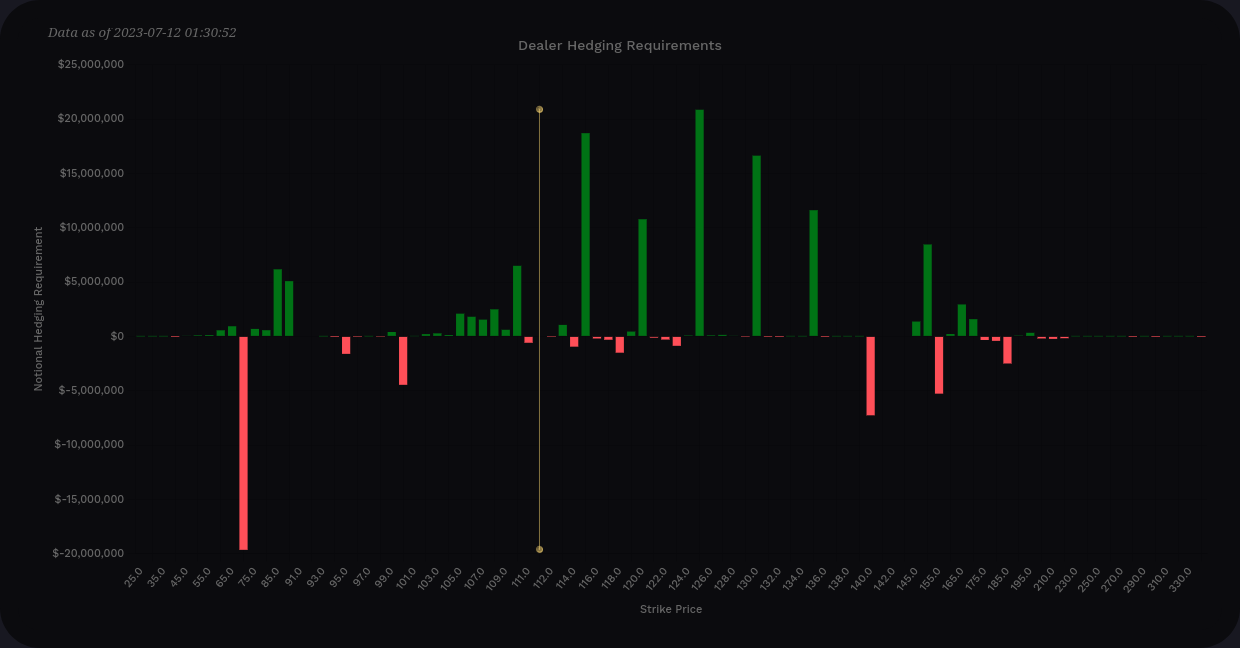

The vanna setup for AMD, although weakened, looks bullish:

That bearish $70 bet is the only thing I dislike about this chart. I like seeing the positive vanna split among multiple strikes from $115 to $135. That suggests continued, steady buying pressure for AMD over a wide range as IV comes down.

There are two things to watch out for here:

- AMD has earnings coming on August 1 and that should cause IV to increase

- Vanna for AMD, as with TSLA, is quite weak right now

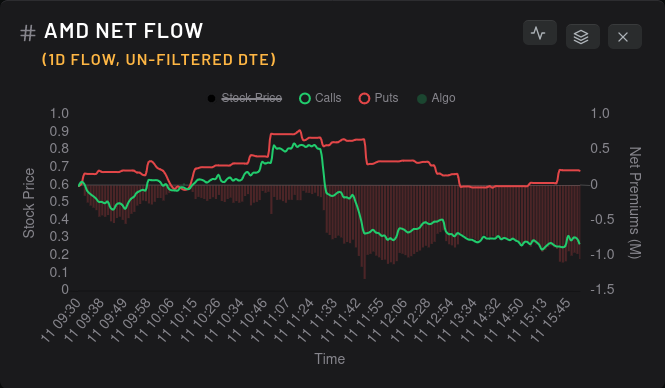

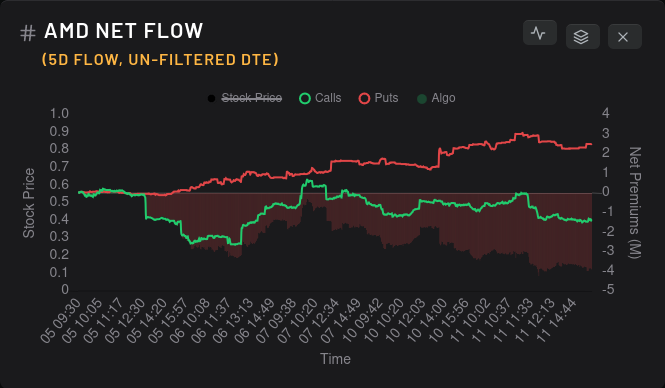

I wish the options flow looked better. Calls have floundered and put volume has steadily increased. What can dealer greeks tell us?

AMD has had bearish momentum from market participants for weeks but it looks to be turning a corner. Yesterday saw a momentum shift to the bullish side. As with TSLA, I'd like to see AMD continue this trend a bit longer before I make bigger bets.

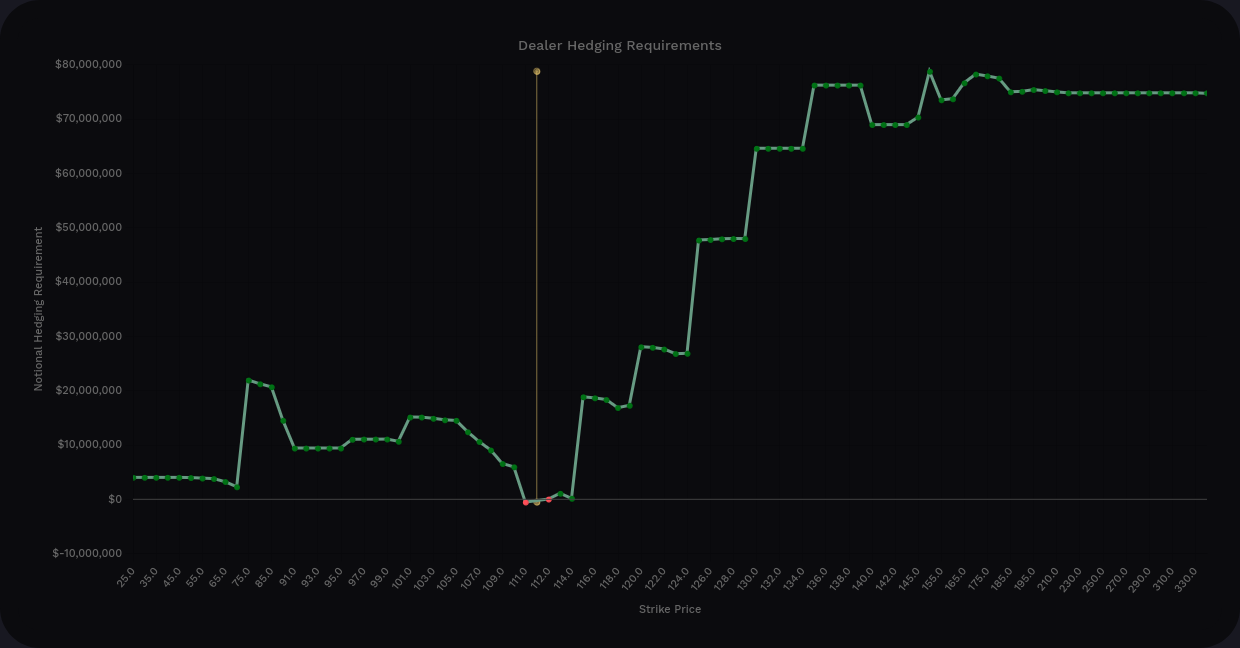

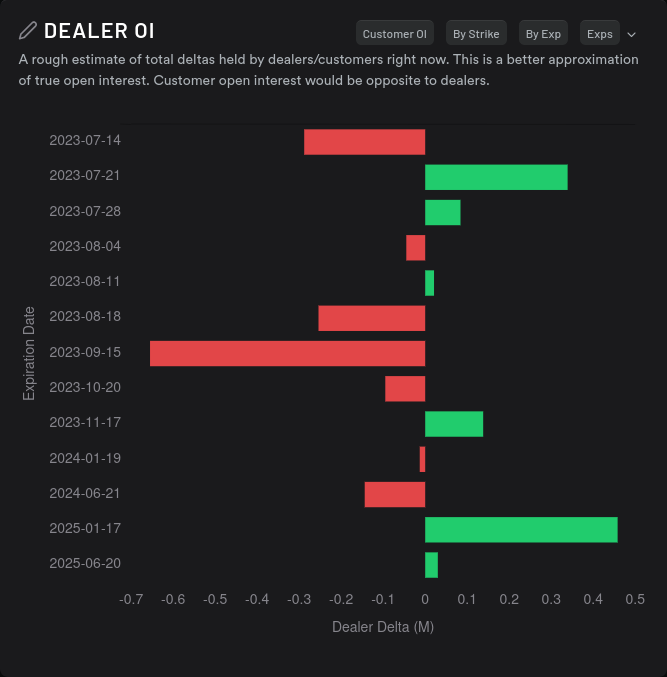

Dealer OI for AMD is still a bit all over the place. 8/18 looked solid recently, but now the bar shrank. 9/15 has not moved much. The 2025-01-17 bar is quite bearish due to that big $70 LEAPS put buy that I've been talking about for weeks.

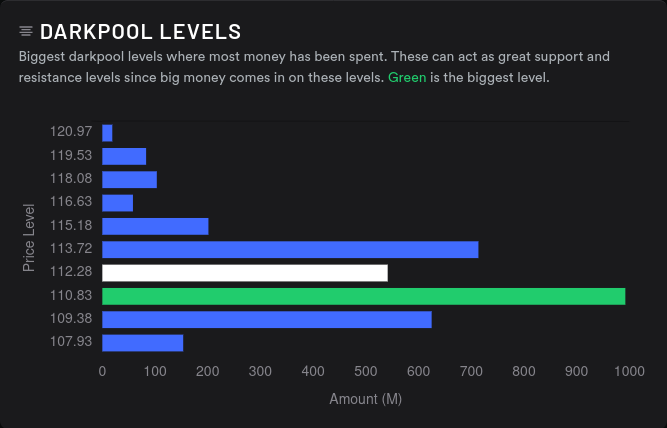

On the dark pool side, the volume around $110 is incredible. Overall sentiment looks good and if price can keep at or above $110, we should be able to get some support at that level. We also have some light buying pressure from gamma at $110.

Thesis

Both stocks look poised for an upwards move if IV comes down, but vanna effects are weak right now. TSLA and AMD both seem to be turning the corner towards bullish moves according to contracts held by dealers. AMD will likely find support around $110 and TSLA's $250-$260 range looks solid.

🔧 However, the CPI release and subsequent Fed interest rate announcement can (and likely will) throw a wrench into the market.

I've been selling $110 puts on AMD multiple times over the past week or two and those bets have paid off repeatedly. I'm long plenty of AMD shares right now.

As for TSLA, I'm long 100 shares with a short put at $265. I also sold a call at $295 for 7/21 with a break even of $300. If TSLA happens to shoot past $295 after earnings, I'll gladly take my profits and find another entry later.

As always, I log my trades over on the Theta Gang site shortly after I make them. You can find my trade notes there.

Good luck! 🍀

Discussion