TSLA and AMD update for July 6th

We're over halfway through the short market week and there's been some decent price moves so far. I'll take a quick look at AMD and TSLA this morning.

We're over halfway through the short market week and there's been some decent price moves so far. I'll take a quick look at AMD and TSLA this morning.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get into it!

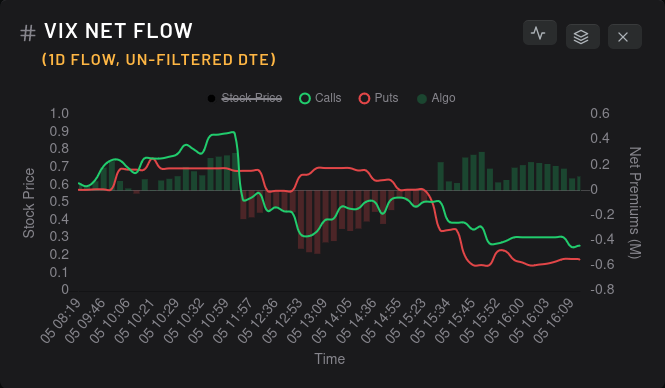

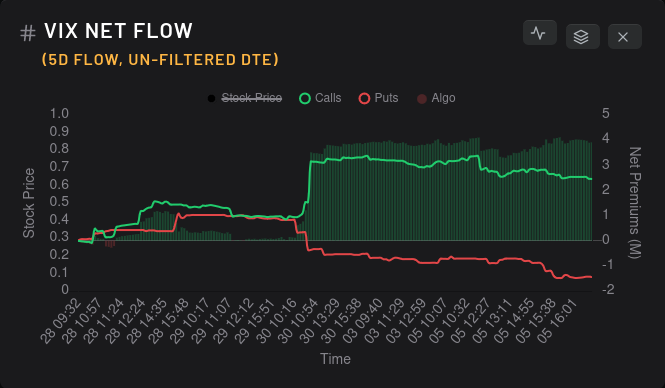

VIX

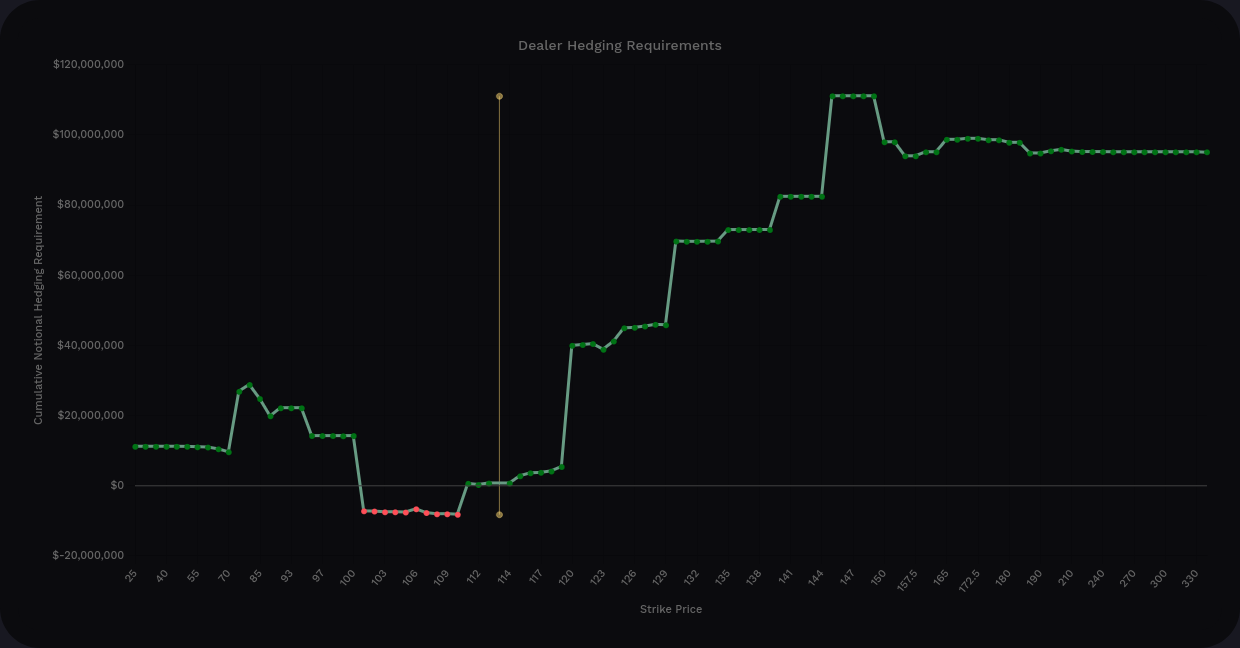

I rely a lot on vanna for trades and knowing where the VIX is likely headed can help make those trades a bit better. One of the best bullish setups for me is when:

- There's plenty of positive vanna above price

- Positive vanna below price is light

- VIX bets are bearish or steady

The big bullish VIX bets from 6/30 are still on the board and yesterday's sell off of calls and puts didn't put much of a dent in it. The call premiums are on a slow march downwards and that's a good sign for bullish traders.

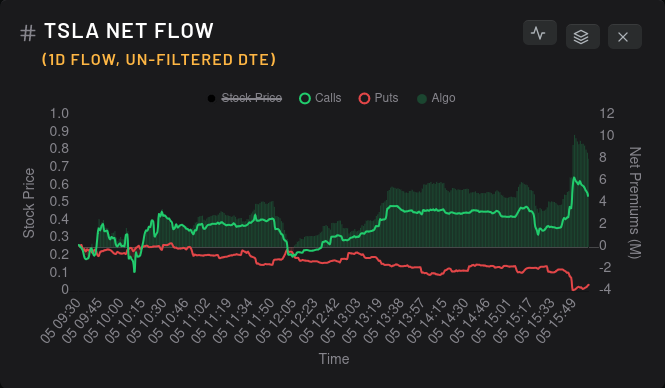

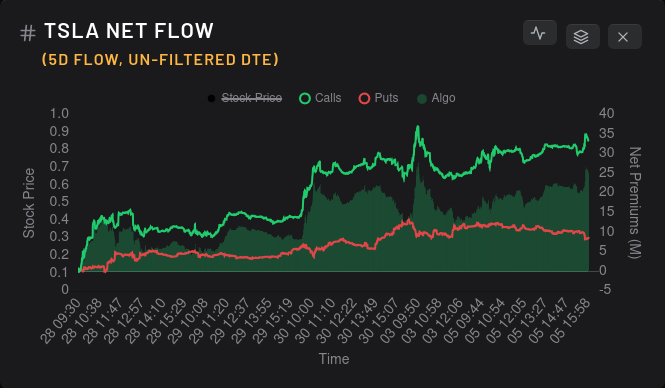

TSLA

TSLA flow remains formly bullish with puts beginning to sell off yesterday:

Puts are beginning to sell off slightly but that hasn't had a big impact on the five day flow so far. With the VIX potentially coming down, how does vanna look for TSLA?

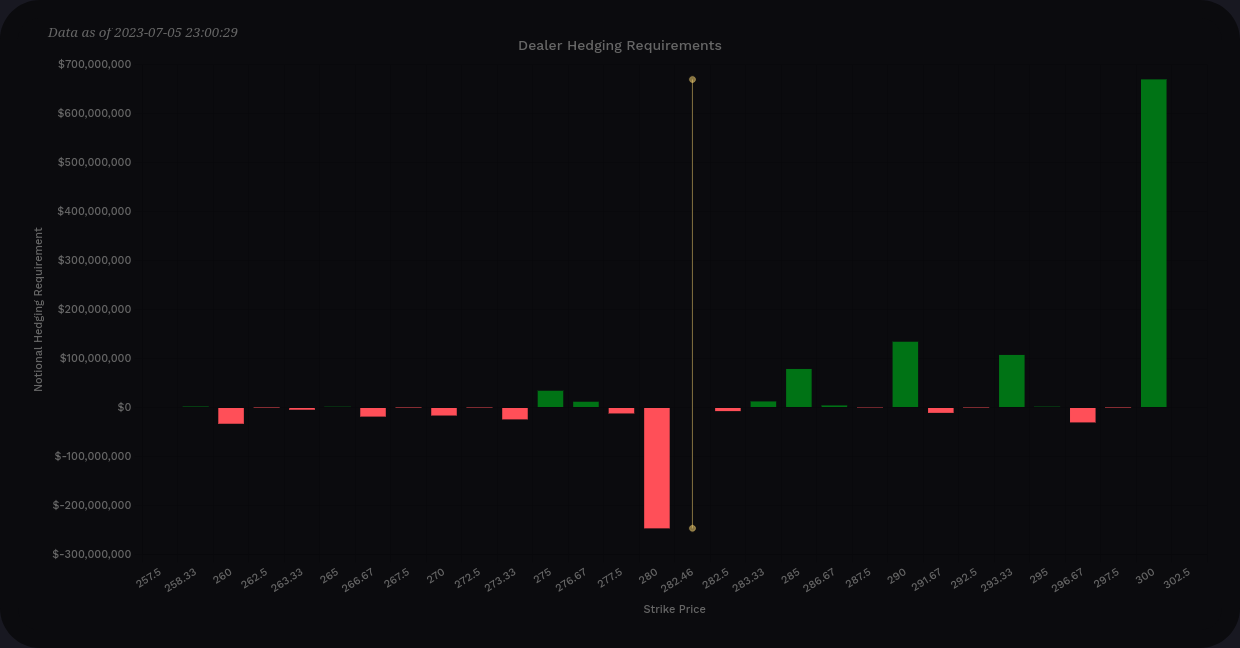

The $300 strike still has almost $700M of value still in it, but vanna's strength in TSLA has come down somewhat. It has one of the best vanna curves possible for bullish traders and if volatility drops, that $300 could turn into a price magnet.

Just bear in mind that earnings are on 7/19 and anything can happen.

The delta-adjusted gamma (DAG) for TSLA looks pretty good as well. $282.50 is in a zone where dealers are likely going to buy to hedge their holdings. We might catch some resistance around $285, but there aren't any big brick walls of gamma levels that I can find right now.

AMD

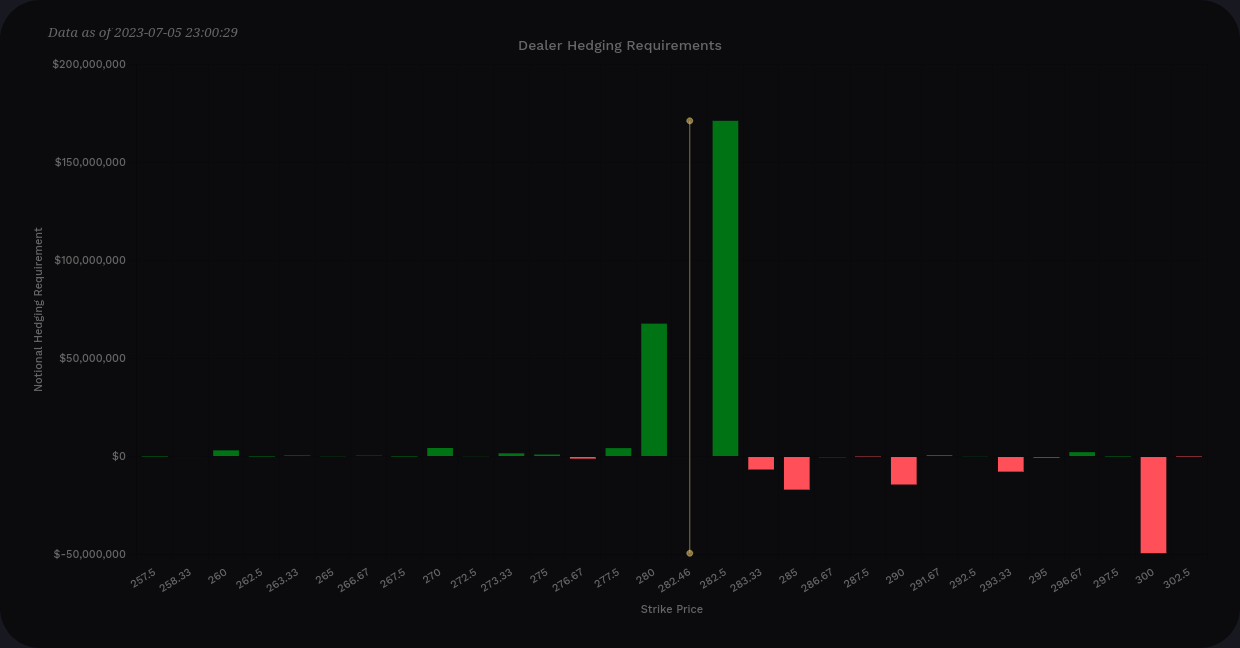

If you've been following along with my AMD charts lately, you'll note that I've been a bit worried about that massive $70 put bet made in a LEAPS contract. Well, I'm quite a bit less worried now:

My first question this morning was "Where did it go?" It was once so massive that it dwarfed anything remotely positive on the vanna chart, but now it's one of the smallest negative vanna levels on the entire chain. I'm looking at this as a bullish sign, especially with AMD's vanna curve now looking much more bullish than it has in a while.

AMD's DAG is relatively small relative to vanna, but $120 looks like a big resistance level. There needs to be significant volume to push through that level, but we do have a decent amount of positive vanna above that line. We also have some buying pressure from $110 that might be a good entry point if we dip there.

Other data

Dealer momentum shows that market participants are still going into bearish contracts on a 15-day average. Dealer OI charts show both AMD and TSLA looking bullish going into the 8/18 and 9/15 expirations but there's plenty of indecision between now and then.

Thesis

Both AMD and TSLA have bullish setups based on vanna/gamma, but the overall setup for AMD has improved a bunch. Most stocks are down pre-market today, but the VIX is up almost 5% just this morning alone.

I have some TSLA shares with a cost basis of $261 and a covered call at $277.50 for Friday (with a $281.50 breakeven). I'll consider adding shares if TSLA goes past $282. $300 seems like a potential target prior to earnings.

As for AMD, I have quite a few long shares with a cost basis in the $90s and some covered calls sold in the $120s that expire on 7/21. Adding shares in the $108-$112 range looks like a great idea for me and I might consider selling puts around there today.

Good luck out there! 🍀

You can track my trades on Theta Gang. Be sure to sign up for my newsletter to get these updates in your inbox! There are no paywalls here, but if you like what you see here and you learned something, there's an option to offset some of my costs when you subscribe, too. 💙

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Discussion