Quick update for 7/18

TSLA earnings are rapidly approaching and AMD finally made it over its resistance level at $117. What's next? 📈

The market remains bullish and the majority of the economic data continues to look promising. However, the prices of food outside the home (eating out at restaurants) and property prices (rents and sales) have not seen any relief.

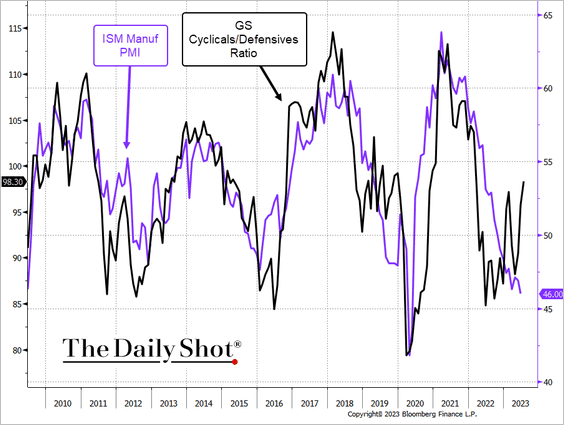

On the positive side, manufacturing is likely going to rally back soon as it follows the market:

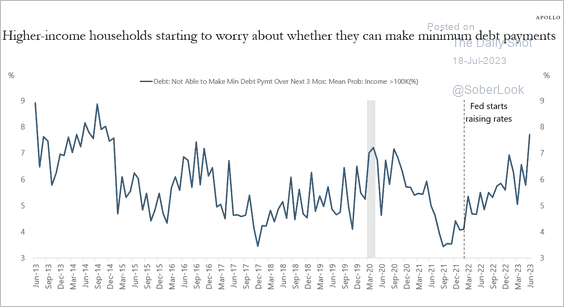

However, more households, even ones with higher incomes, are getting worried about paying back their high interest debts with increasing interest rates:

I'll take a look at options flow and changes in dealer positioning today, but first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's go! 🚀

TSLA

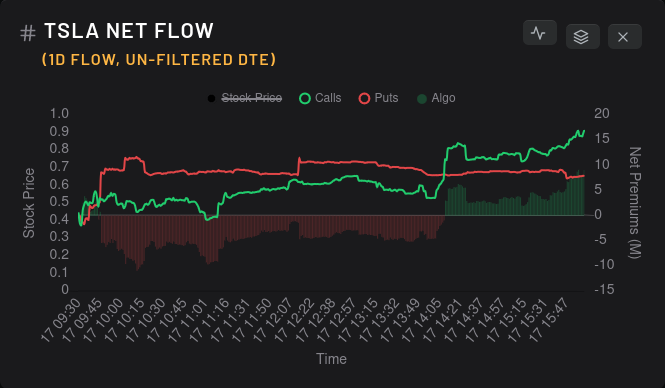

We have earnings on Wednesday afternoon and TSLA looks like it held above the $280 resistance level all day yesterday and during today's pre-market trading. Traders were a bit doubtful about bullish movements until after lunch and then calls took off again:

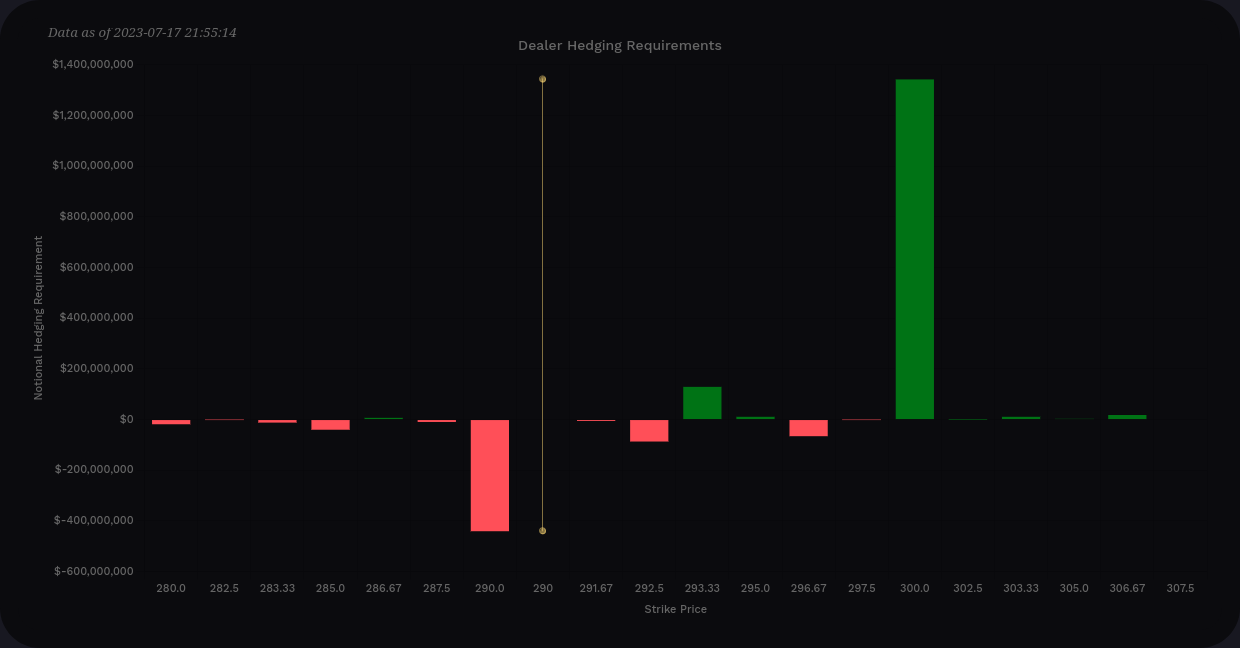

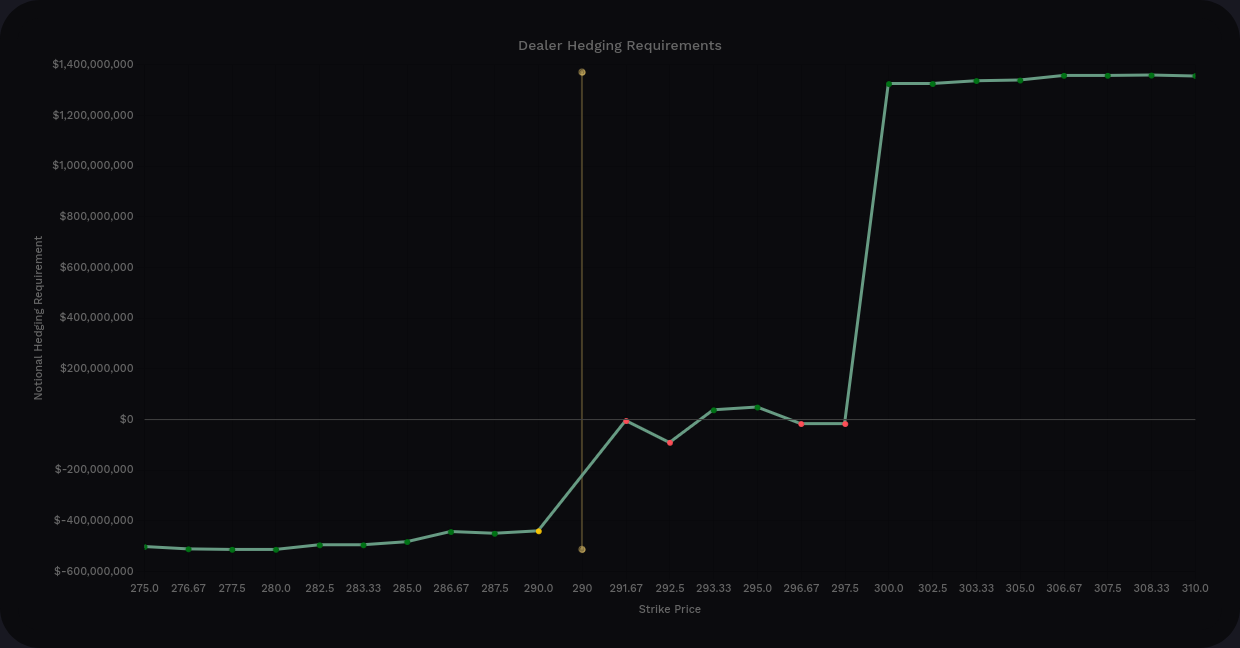

Vanna is heavily concentrated on that $300 strike and the charts here could not possibly paint a more bullish scenario:

In addition, vanna seems to be back! The $300 bar has almost $1.4B in notional value. That bar had only $200M yesterday! Delta-adjusted gamma strengthened a bit with some local resistance at $300 and support at $280.

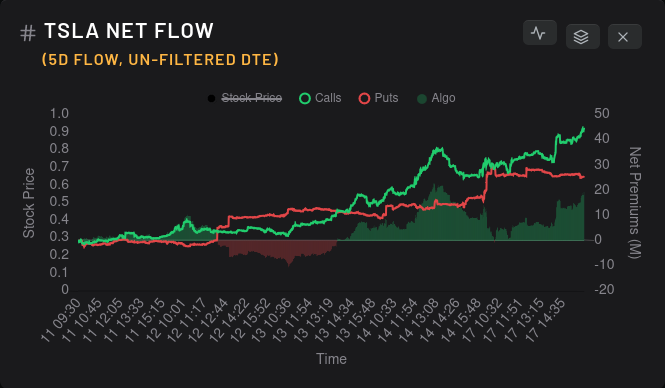

Not everything is perfect here, though. Customers in the market have picked up more bearish contracts than bullish ones over a 15 day period:

Also, big money options traders seem to be going sour on $280 and $290 but they're more bullish on $260 and $270. The bets on $250 have been quite steady and that's a big support level I see below $280:

As for dark pool trades, that $280 level looks incredibly solid now:

AMD

AMD climbed over its $117 resistance line yesterday just before the close after a few attempts. It fell back to that line pre-market today but is holding above for now.

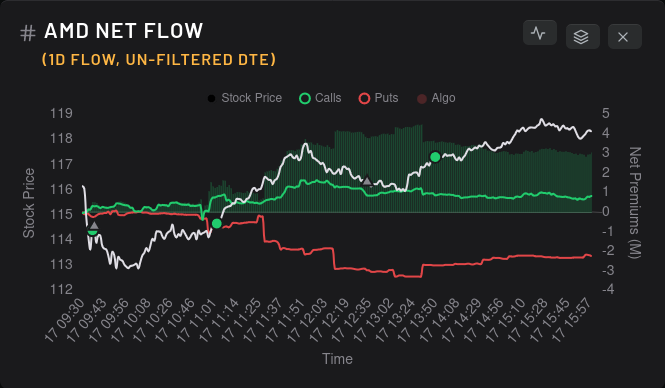

The big thing that caught my eye yesterday was that as price approached the resistance at $117, we didn't see a large uptick in calls. Sure, puts sold off a bit, which is good, but I was hoping to see the green line grow more than this:

AMD vanna grew in strength by a small amount and it seems like the far away strikes are smaller in notional value. TSLA's vanna consolidated closer to the price as earnings approached, so we might be seeing the same pattern here. Either way, AMD's vanna setup is about as bullish as they come:

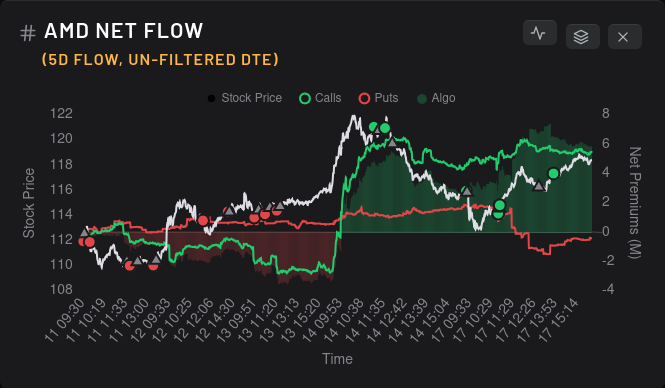

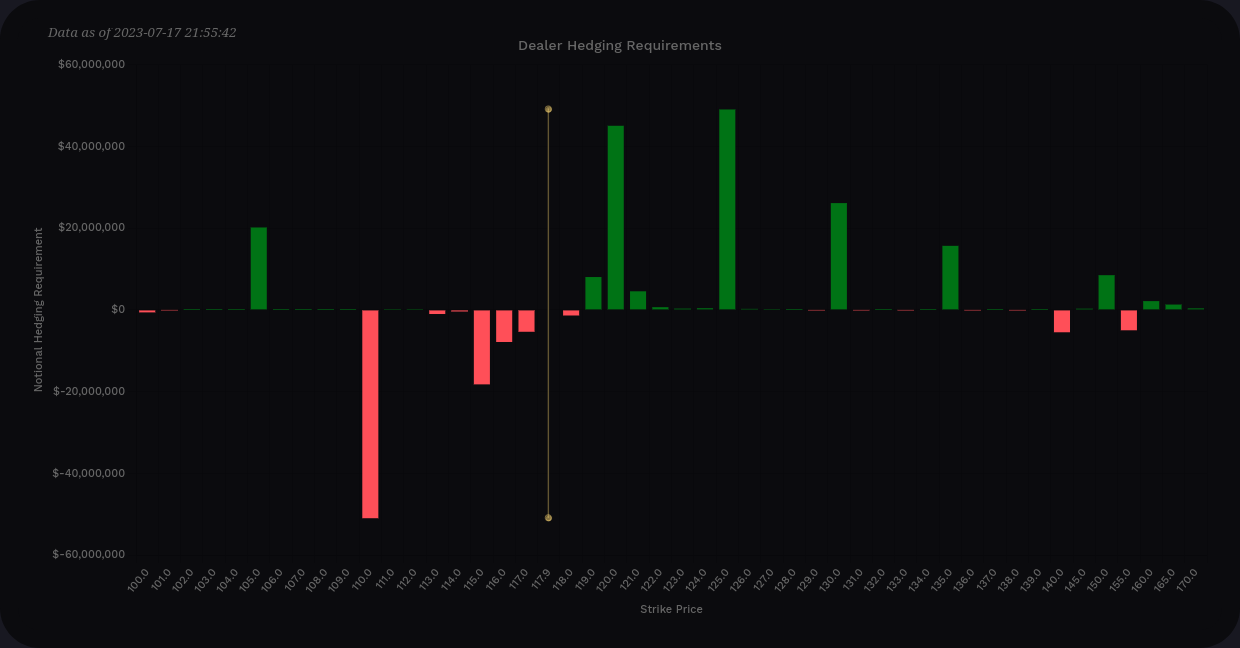

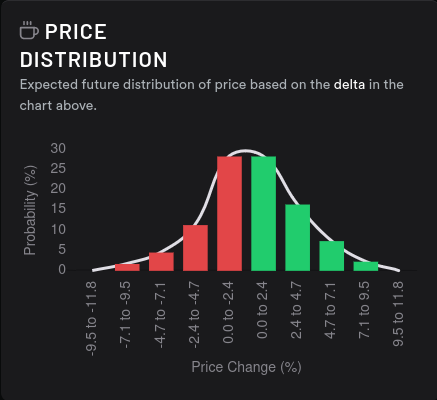

Delta-adjusted gamma is quite weak for AMD and might apply some localized resistance around $120. But it's not as gloomy as you might think! Customers are picking up more bullish contracts and have been doing so for five straight days:

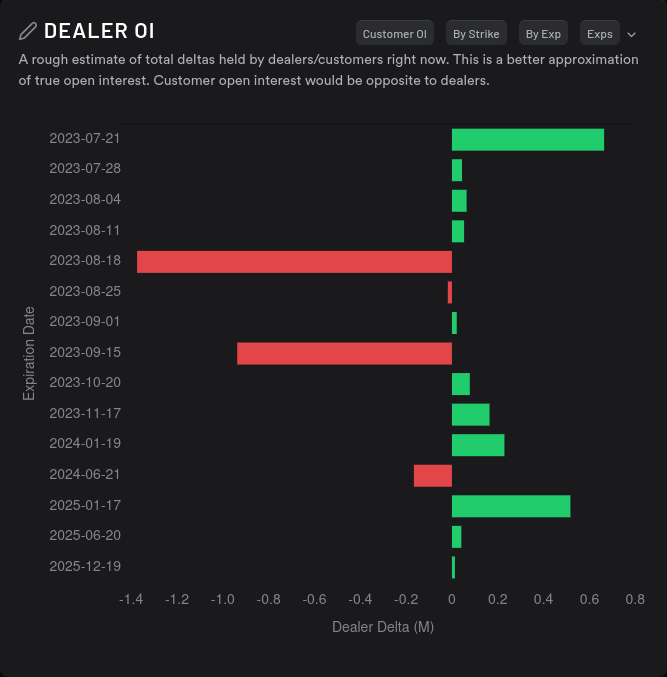

Options are priced for an upward move and 8/18 is setting up to be more bullish:

Big money options traders seem to be holding steady or getting bullish on almost all strikes. That one on the bottom is the $115:

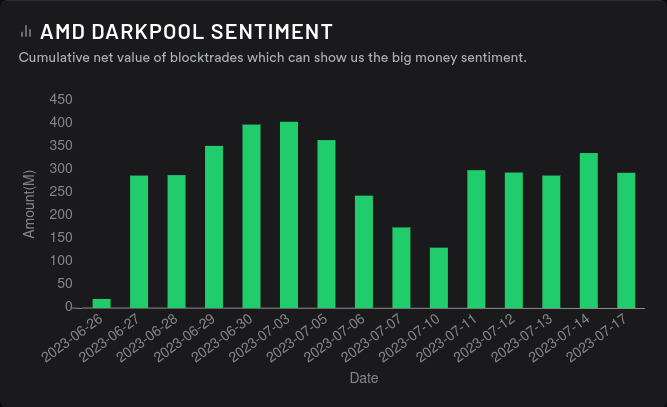

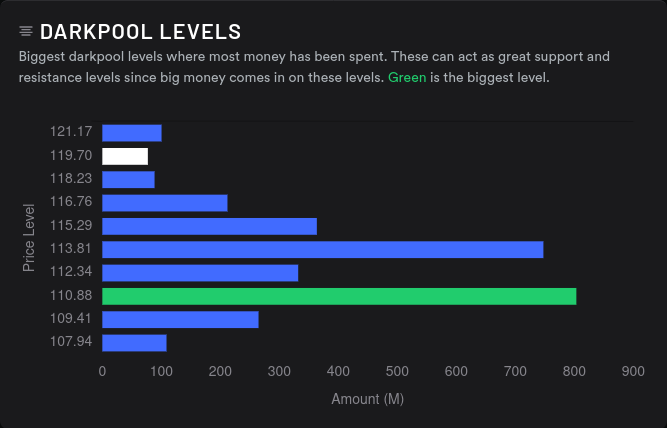

Dark pools show a slow and steady buildout from $110-$115 and this seems to correlate to the slow and steady buildout of bullish contracts on the dealer greeks chart:

Thesis

Both AMD and TSLA have bullish setups, but they might have different outcomes. TSLA traders seem to be more eager to hedge their bets right now and there's not much clarity about what happens after $300. On the other hand, AMD is taking the slow and steady wins the race approach with gradually improving dealer greeks, a wider spread of vanna strikes, and slow buildouts of dark pool levels.

I still have my TSLA covered call at $295 for 7/21 on the board with a breakeven right at $300. I'll be happy to take my profits if I'm assigned and look for a new entry afterwards. The setup here doesn't look like one I want to enter into, especially with earnings so close.

I was able to pull some of my AMD covered calls down for a small profit yesterday so I could capture more of the upside movement past $117. Selling puts around $115-$117 seems like a good play right now but it's a high risk trade due to earnings coming up on 8/1.

$120 is the next big test for AMD since we had liquidity issues around $118-$120 recently. If we make it past that level, I see $128 and $136 as the next resistance levels.

You can track my trades in real time over on Theta Gang.

Good luck! 🍀

Discussion