SPY/SPX options analysis for September 6

It's time for a look at the broader market outlook with a deep dive into SPY and SPX. 🤿

Happy Wednesday! I'll check in on SPY and SPX options analysis and get back to AMD and TSLA tomorrow.

Much of my focus in this post is through 10/20 because that's as far out as I'm selling options right now. 📅

But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get started! 🚀

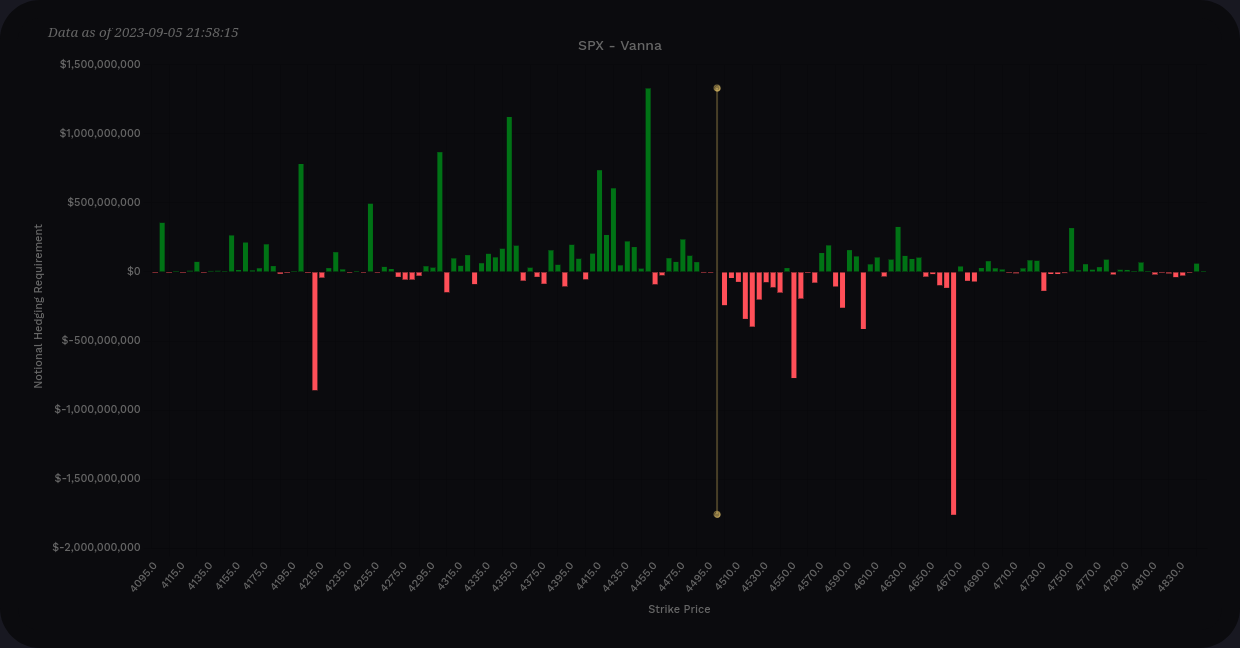

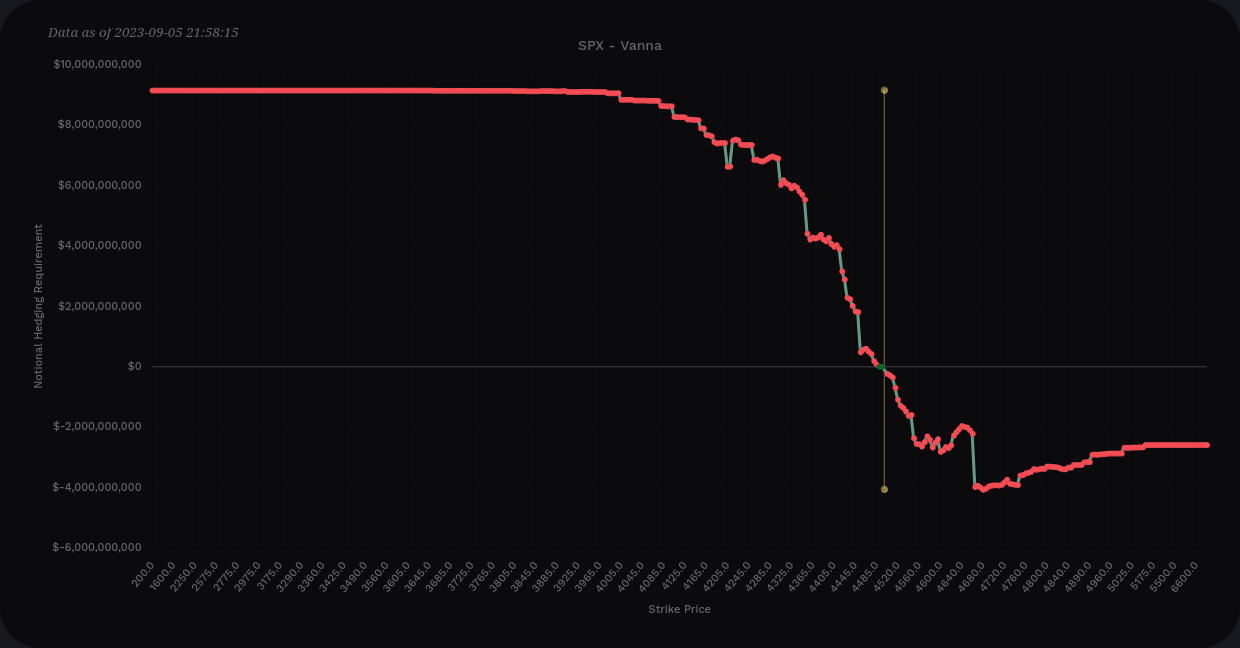

Vanna

SPX vanna through 10/20 doesn't show much positive vanna above the current price, which gives me a bearish feeling. The nearest big vanna level above price is around 4550 with a much larger one around 4665.

On the downside, we have some big positive levels at 4450, 4350, and 4300.

Keep these levels in mind as we keep digging because we might find more data about what makes them special. 😉

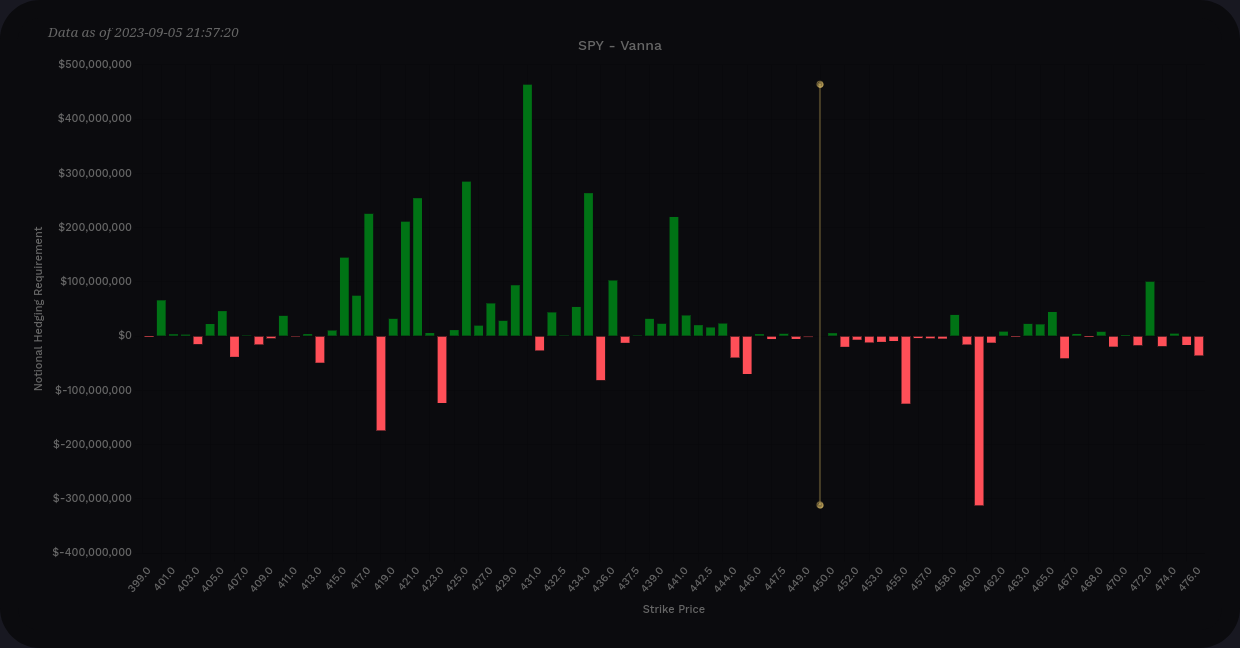

SPY sometimes looks a bit different due to hedging characteristics and options volume, so it's worth a look to confirm. We see large negative vanna lines above the current price at 460 and 455 (same as SPX).

On the positive vanna side, we have large levels at 440, 434, and 430. This matches SPX data fairly closely.

Let's break this down:

- SPX/SPY both show a chart with very positive vanna overall (bullish in contracting IV environment)

- There's very little positive vanna above price to act as a magnet should IV begin contracting (not exactly bearish but it shows a distinct lack of bullishness)

- SPY $455 and SPX 4550 look like big barriers to upwards price moves

- We might catch some slowdowns on the downside from $430-$440 (4300-4400)

At this point I'm leaning bearish on the overall market headed into 10/20. Can we dig up more data to confirm or negate this thesis? 🤔

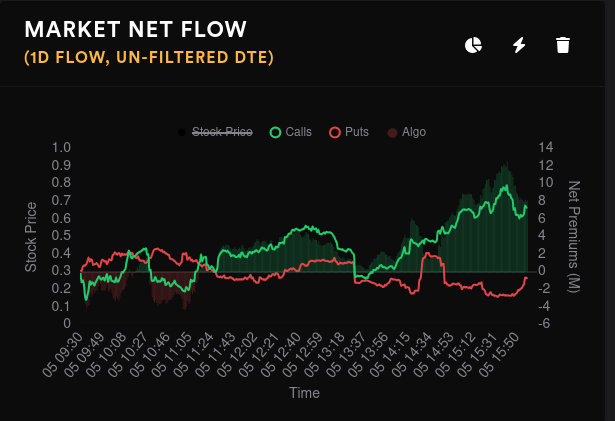

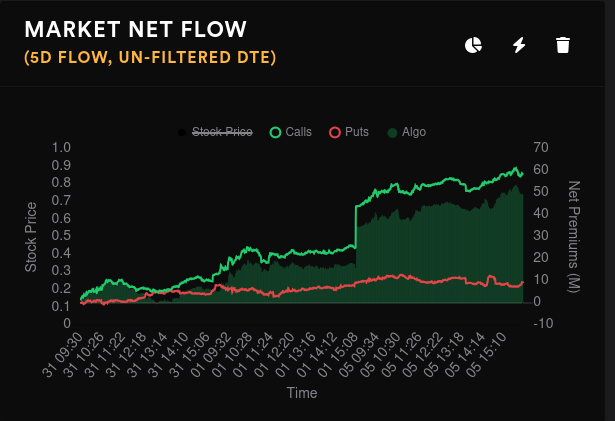

Options flow

Overall market flow looks quite bullish over one and five day timelines. The five day chart shows a 50M differential between bullish and bearish premiums. However, these setups can rapidly change.

SPY's daily options flow has gradually fallen since 8/29 and it's IV rank remains a paltry 14%. Options flow only tells a short term story and we're looking out to 10/20, so let's find more data.

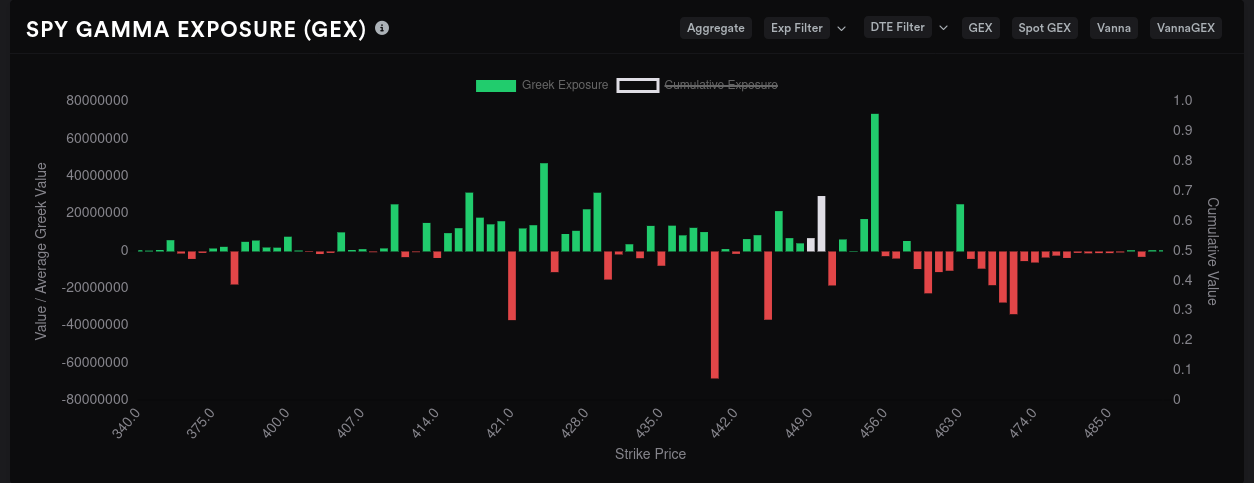

Gamma Exposure

Aggregate GEX for SPY shows SPY sitting on the biggest GEX level around $451. There are also some big price magnets from negative vanna around $432, $440, and $452. We have a wall of resistance from $453-$456. This lines up well with our $455/4550 level from the vanna chart where we saw significant negative vanna levels.

One other thing I notice here is that we don't have much to slow the fall should SPY get pulled to the downside. $432 hangs out there as the lowest GEX level, but that's a significant drop from where we are now.

9/15 looks quite interesting and it looks like $432 is the largest magnet for price by far. We have an upward resistance wall from $452-$456.

Looking out to 10/20, the biggest price magnet is around $440. Upward movement is doubtful past $455 as there's a massive positive GEX bar there. $424 offers a good single point of downward resistance here, but there's a general area of resistance from $429 down to almost $400.

GEX confirms some of what we found in the vanna charts. Getting past SPY $452 will be a challenge, but there's room to move down into the $430-$440 range if we start moving that way.

Dark pools

I don't necessarily trust dark pool data a lot, but I do like it when it helps me build (or tear down) my thesis. The most notable thing yesterday was that Tradytics spotted some massive bearish dark pool trades on SPY that were split up in big chunks and reported with almost a 24 hour delay. 👀

It was about $1.36B worth of trades (about 3M shares) at $451.20. Remember when our GEX chart showed $452 as upward resistance? Vanna showed upward resistance around 4450 as well, but remember that vanna needs some distance from price to have an effect (greatest at 0.15-0.35 delta).

All of this lines up to confirm that $452 seems to be the top for SPY (at least through 10/20).

SPY's biggest dark pool level remains at $440, but $450 is fairly large, too. If we drop a bit, $450 could be resistance for us purely based on a volume shelf.

Chart

Let's look at a SPY daily chart since the recent high:

My takeaways from the chart:

- RSI is headed down along with the ADL (Advancers/Decliners Line), which shows some market weakness (leaning bearish)

- MACD is above zero, which is good, but it's not making a strong move above the slower line (bullish but likely a sign of weakness)

- We broke above the VWAP line since the most recent high (bullish)

- We had give straight Heikin Ashi candles without bottom wicks, which shows a strong upward trend, followed by a doji (sign of a market turn)

- The point of control from the volume by price indicator shows we've had the most volume around $451 since the recent high and this volume shelf might turn into resistance for us if we turn lower

- The last four days of the recent rally saw lower volume each day and that shows the weakening trend

Thesis

Based on all this data, I see bullish factors weakening and bearish indicators growing stronger. $452 really feels like our top-end cap through 10/20 in the absence of other news which changes how traders feel about the market.

The downside is where things get murky. There are multiple spots from $430-$440 where we're likely to see price slow down a bit or perhaps get a light bounce.

Vanna and GEX data suggest we might see our lowest levels around $430-$432 between now and 10/20.

Good luck to everyone trading out there today! 🍀 You can find all my trades over on Theta Gang along with my trade notes.

Discussion