Sticking to a system

April was rough, but I've taken time to work on my trading psychology since then. This post covers my system in detail and what I have planned for the future.

Hello there! 👋 It's been a while since I last posted. Family and work life went into overdrive lately and I'm just now catching up with quite a few things that slid off my plate during the last several weeks.

I've settled on a trading system (more on that later) and learned quite a bit about myself by reading Jack Schwager's Market Wizards book series. I emailed Jack when I finished the last one to thank him for all the hard work and he replied immediately! 🎉

Learning from Market Wizards

There are five books in the series and Jack interviewed all kinds of professional traders who found their edge in all kinds of places. Some of the interviewees completely contradicted each other on how they read indicators, whether they use indicators at all, and how they quantify risk. This led me to realize something pretty quickly:

Analyzing charts, trades, and risk is a highly individualized activity. Nobody else can do it for you and adopting (or worse, buying) someone else's system will only lead to confusion later on when to enter and when to exit.

One common theme throughout the books with both discretionary and systematic traders is that you need to build a set of rules for yourself – a system – and stick to it. If your system has an edge and it fits your trading style, there are times when it will win and when it will lose.

Your winning trades should be larger than your losing trades over the long run and that may require making tweaks to the system over time.

One thing I wondered was: "How do I know when I have a system that works?"

A friend of mine who has traded stocks for years answered this for me:

"You'll know it works when your winners are bigger than your losers and making the trade feels effortless. There's almost no discretion involved. You know your risks, you know your conviction, and you know when to get in and out."

I made bad choices in April

My usual system of selling short puts fell apart in April as the market corrected. Instead of zooming out a bit and seeing the bigger picture of the market, I felt like I had to play the bearish side. The only problem there is my winning percentages and profits on the bearish side have been much, much lower than all of my other trades. I've been blown up by call credit spreads and covered calls countless times whether I follow a system or not.

I dove into Tom Sosnoff's short strangle strategy and started selling strangles on high IVR (IV rank) stocks. The only problem there is that implied volatility (IV) continued expanding as the market fell and both sides of my short strangles were under pressure. I ended up managing the short call side too early and ended up in a tough spot once the market rebounded and IV began to fall.

Long story short: I abandoned my winning system and jumped onto a new one out of fear.

I figured my short put system (which was profitable in 2022 and 2023) was done after a single correction. I read too many bearish posts on X and got worried about inflation coming back. Every day was another journey in overthinking the market rather than playing on the side of the market where I do well.

Back to the system, with tweaks

I'm back on the short put system, but I've made a few tweaks to the process. Here's a short summary of what I'm trading now:

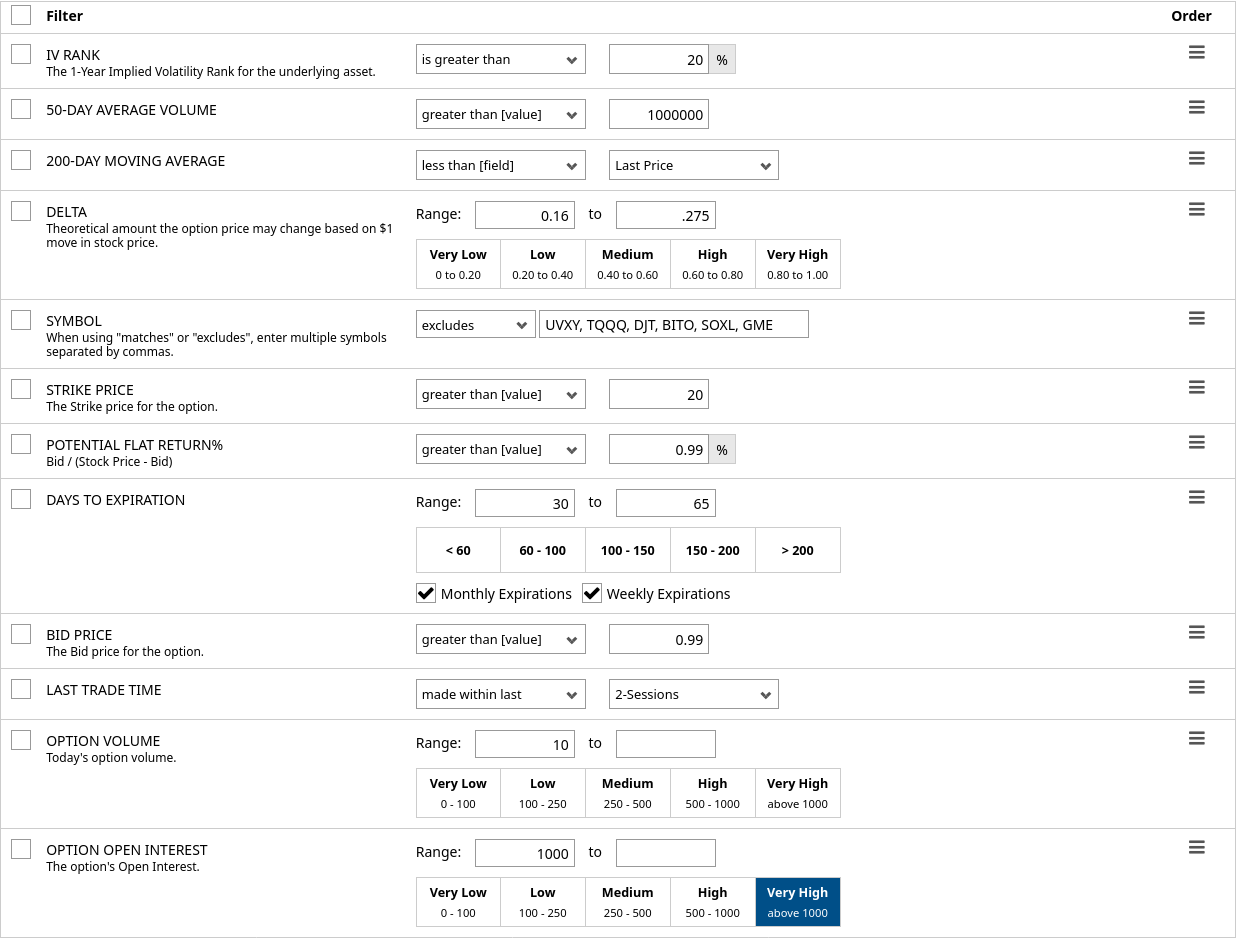

- Sell puts on stocks with an IV rank over 20%.

- Target monthly expiration dates only. No weeklies.

- Delta must be between 0.16 (one standard deviation) and 0.30.

- Days until expiration should be between 35 and 65 days.

- Stock price must be over $20 and over its 200 day moving average. No exceptions.

- Stock needs to have a 50 day average volume of 1M shares traded per day.

- The short put should pay at least $1.00 in premium.

- Open interest on the put option must be over 1,000 contracts (open interest is the measurement of open options contracts of yesterday's close)

If the options contract doesn't meet these requirements, I don't even see it. I'm using a screener on Barchart to help with this:

If you pay for two years of Barchart in advance, access to all of their data costs about $15-$16 per month. Here's my criteria if you want to set up the screener for yourself:

Management changes

In previous years, I would run the wheel strategy. That involves:

- Sell puts and collect premium and close the put at 50% profit.

- If the stock price falls below the put strike, take assignment of the stock.

- Sell covered calls on the stock and close the call at 50% profit.

- If the stock price rises above the call strike, let the stock get called away.

However, as I dug further into my previous performance, my biggest losses were on covered calls! Stocks regularly blasted through my covered call strike and I ended up with shares called away where I could have made thousands more off the shares. In addition, holding shares ate up so much of the margin in my account that it limited my ability to sell more puts.

So what now? I've adopted some pieces of the TastyTrade methodology and here's how I manage my trades now:

- Sell a short put between 35-65 days to expiration (DTE) and immediately put on a 50% profit order good-to-close.

- As the options contract approaches 21 DTE, close the trade or roll it out to the next expiration. Rolls must meet the requirements that I set in the previous section.

This gives me some nice benefits:

- I don't hold stock, so my account balance is freed up for more short premium trades.

- I avoid the wrath of gamma as expiration approaches. The closer a trade gets to expiration, the more whipsaws in price appear and the risk of assignment grows.

- Wash sales are very rare, if they happen at all.

My profit and loss in my trade log is my real profit and loss. No other calculations are needed.

Looking forward

I've also moved most of my charting from TradingView to StockCharts. I found myself spending way too much time tinkering in TradingView and digging into patterns that didn't exist. The sheer number of indicators felt overwhelming and I spent too much time digging into them.

StockCharts lets me focus heavily on the same chart styles with multiple stocks and time frames. There is a lot less distraction on their platform.

I still plan to write in-depth posts here on certain stocks or other stock market phenomena. Expects to see a heavier focus on price and volume since those are the only two things in the market that won't lie to you. They'll confuse you, sure, but this data puts you on a level playing field with most other traders. 😉

I'm also continuing to log trades on Theta Gang:

You don't need to log your trades on that site, but it's free and it makes it easy for me log things quickly. I can review them later when I need to. You can use spreadsheets or other logging platforms if you want, but make a note of each trade. It's good to reflect on what has worked and what hasn't from time to time.

Good luck to all of you! 🍀

Discussion