The wild week of January 10th!

What a wild start to 2025! The markets are giving us a bumpy ride but this is a great time to find the stocks that are floating over smoother air. ✈️

Hello, friends! This week was a wild one inside and outside the markets.

The new presidential administration here in the US is filling the news wires with highly unusual and conflicting goals for the next four years. 🤪

We said farewell to former President Jimmy Carter. ❤️

And economic data came through that suggests inflation might remain sticky for longer while some in the Federal Reserve say that cuts are likely. 💸

Let's break down the numbers to see where we are right now. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Nerdy chart time!

A shift in my HVC strategy

As I wrote in my previous post about high volume closes, I am looking for exceptionally high volume days in various stocks and ETFs to plan my trades. However, I've come to realize that horizontal lines don't seem to track the prices well enough. I decided to give VWAP (volume weighted average price) lines a try and the results are pretty good:

SPLG is the cheaper version of SPY with slightly lower expense ratios. It's traded much less often than SPY and I like to examine it for wild volume fluctuations. SPLG remains very close to the VWAP from the September HVC. However, it did make a lower low and entered the election gap which runs down to about $67.60 here.

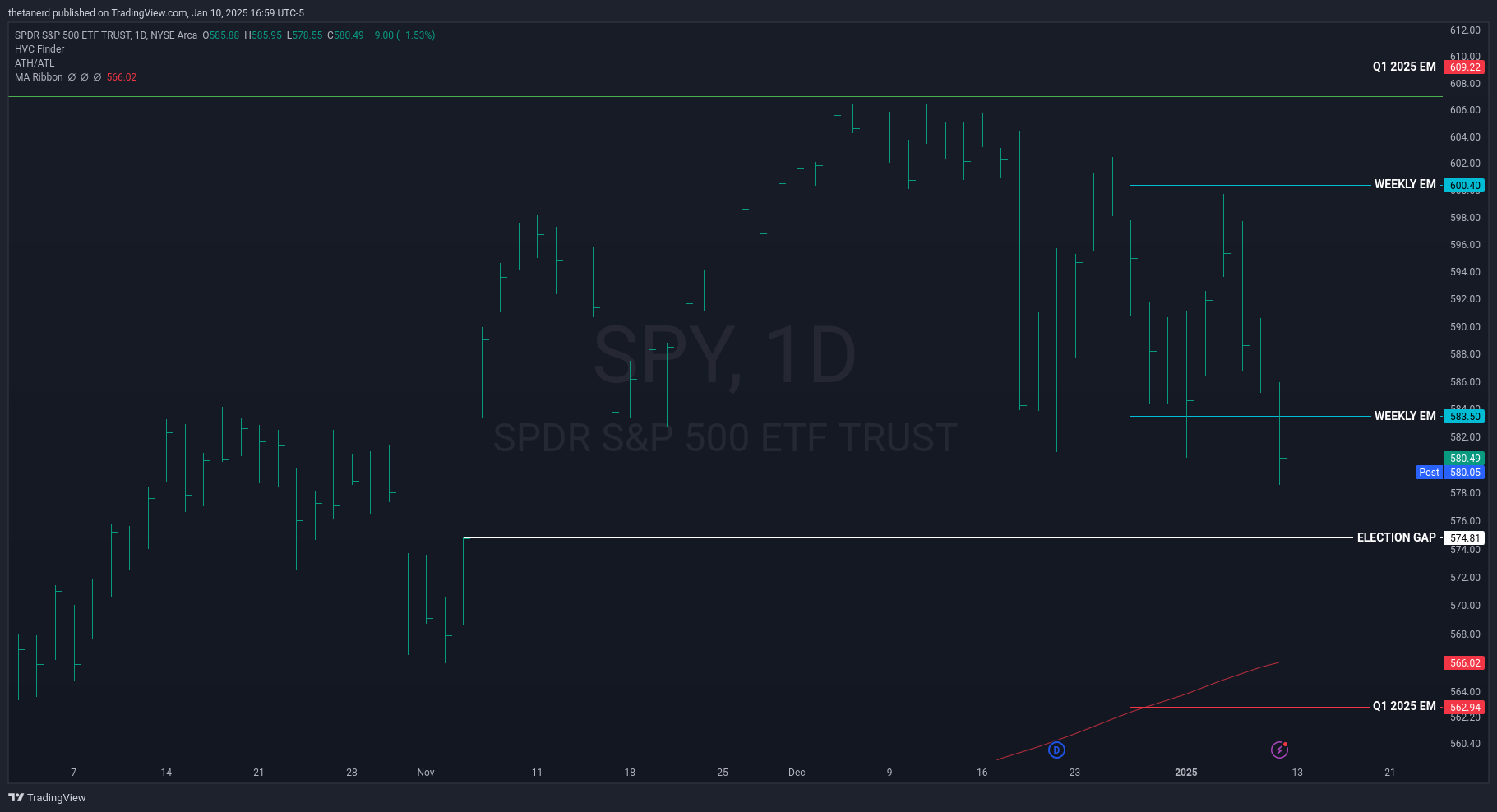

On the more common SPY chart, this election gap runs down to $574.81:

We are still well above the 30 week moving average (a favorite of Stan Weinstein) and our cross below the 30W MA in the 2021-2022 transition was a clear sign that something was wrong in the S&P 500.

Interesting ETF moves today

QLD, the Ultra QQQ leveraged ETF, had an HVC today with 363% more volume than the 20 day moving average of volume:

QLD remains above its two most recent VWAP lines. Also, note that the Oct 2023 and July 2024 HVC days were on the lower part of the downside of a V-shaped recovery. Will today's HVC signal an upcoming V-recovery or will be break the trend? I'm not sure yet.

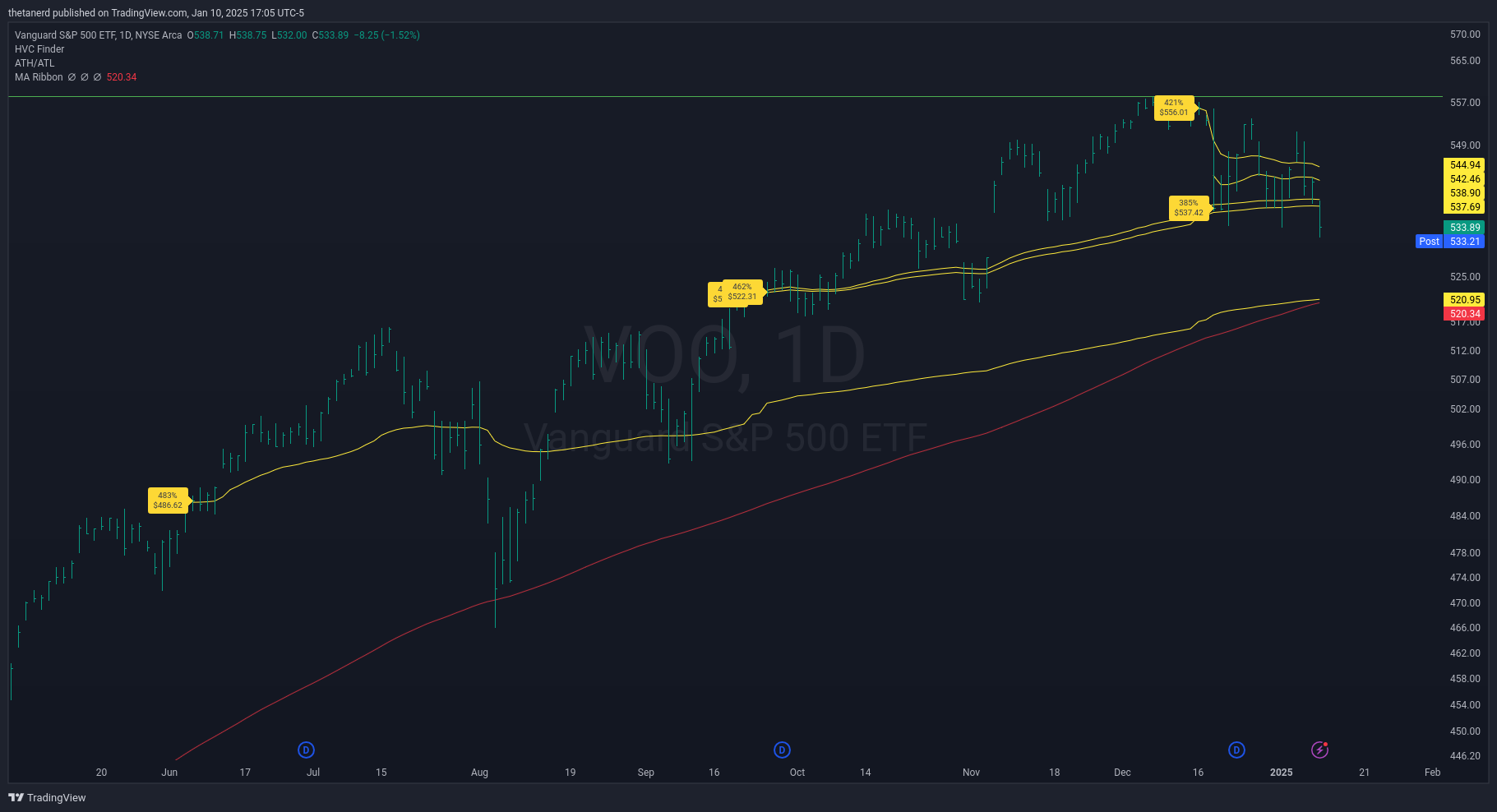

VOO, Vanguard's SPY equivalent, broke down through four of its most recent HVC VWAP lines and the next one is from June around $520.

Individual stocks I'm excited about

One of my new favorite activities to do on very red days is to find stocks which are bucking the market trend. Stocks which are flat or even advancing on days like this deserve special attention. Let's run through a few that caught my eye:

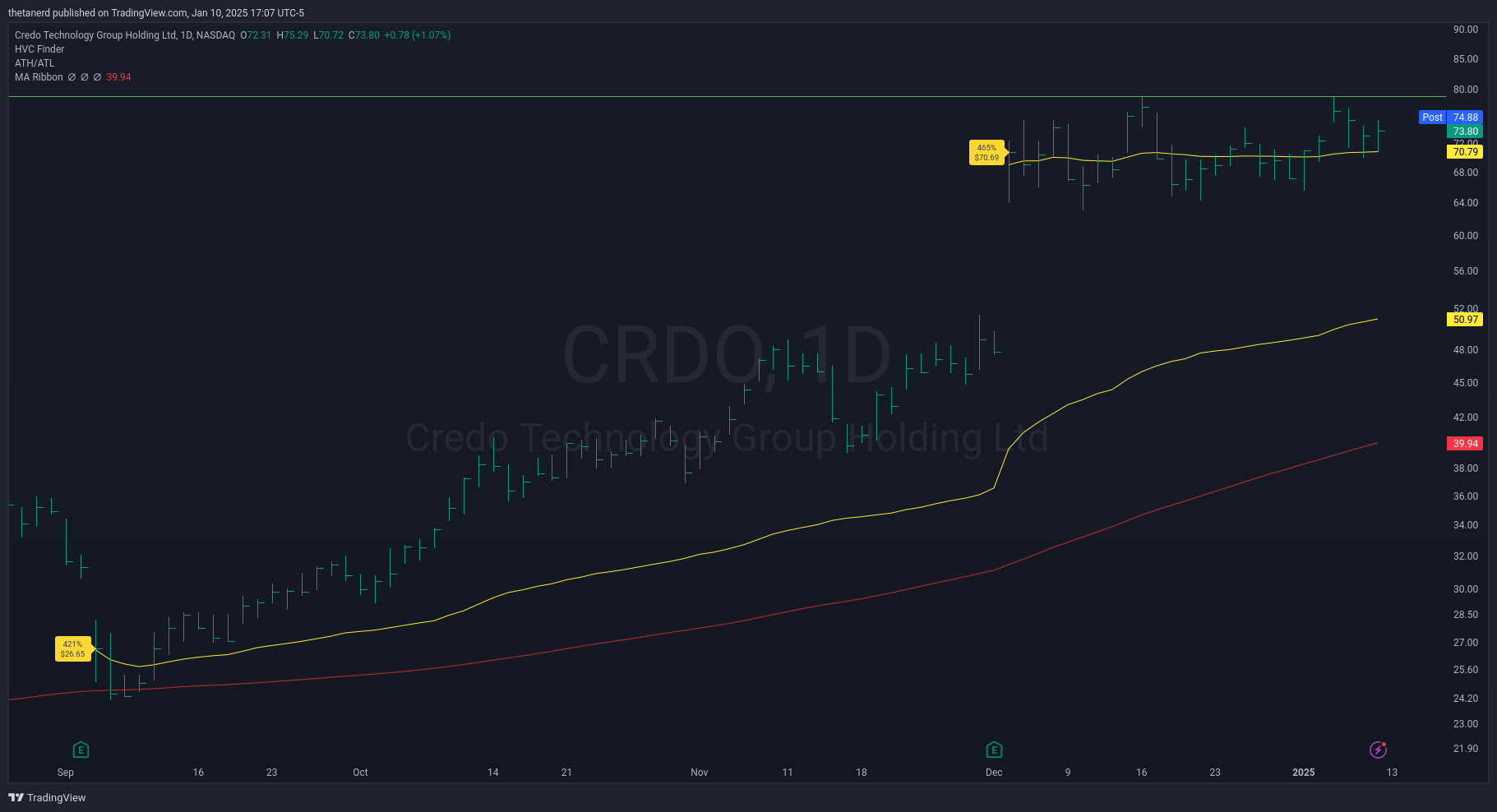

CRDO sits in the Internet/Network Solutions industry group (with FFIV and others) and it has seen some hefty mutual and hedge fund accumulation lately. Sales are rapidly increasing quarter over quarter and its performance since early December has largely been quiet as the market became very rocky:

RKLB made more news this week and its getting more attention from mutual funds, too. Sales numbers look good and earnings are moving in the right direction. This one is a bit of a risky play, but it remains above an upwards 30W MA, above its most recent HVC VWAP, and it's making higher highs and higher lows:

VST is in electric power and it recently made a small cup-like base and then broke out. This is another one that is holding well above its recent HVC VWAP and made a new all time high today:

ANET remains strong above an upwards 30W MA and is well above its most recent HVC VWAP. Fund ownership increased again in December and it recently had a tight area for three weeks before moving higher again from a stage 2 base. It leads the computer networking segment in almost every category.

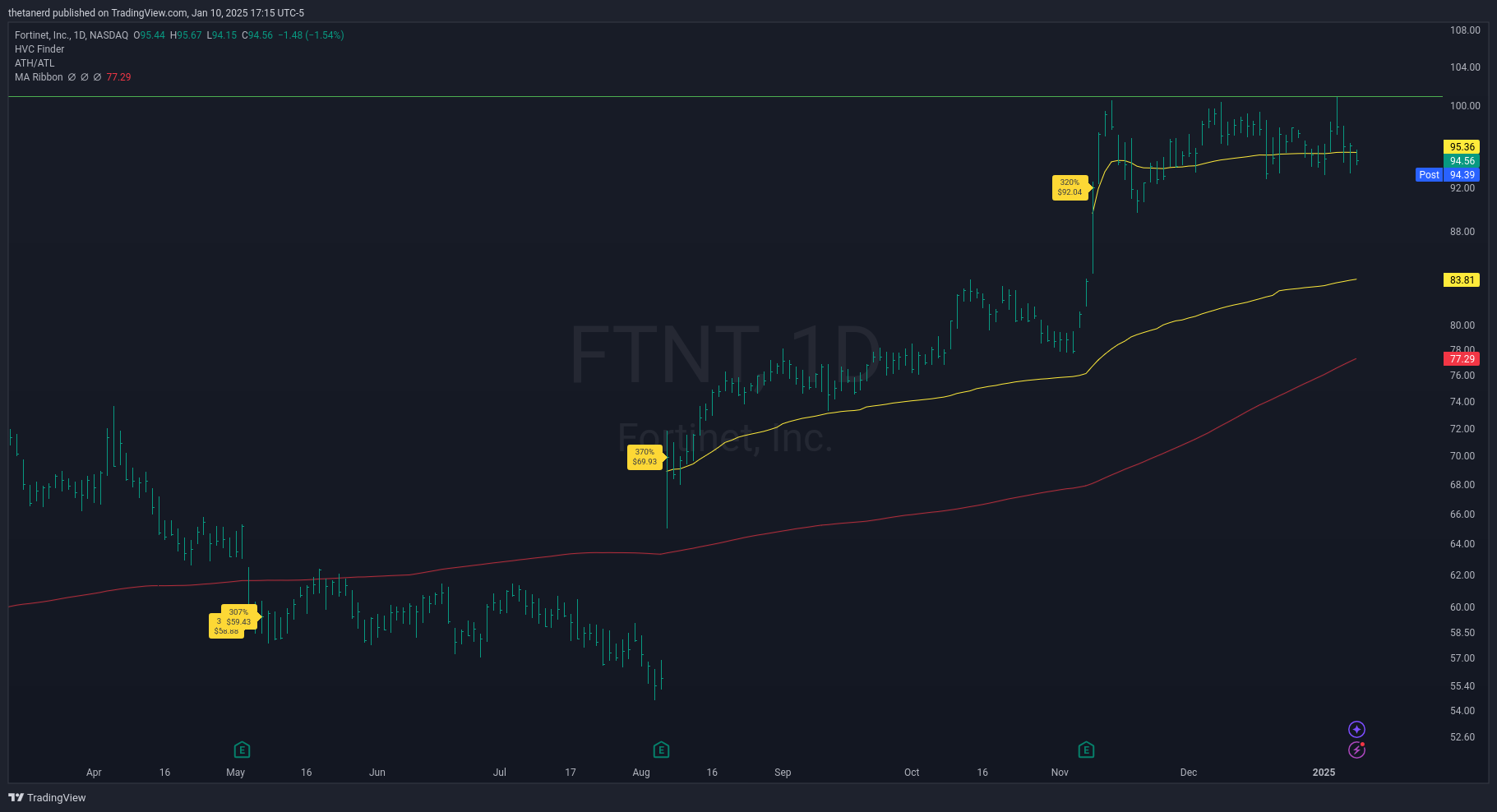

FTNT had a wild 2024 but it started getting a ton of bullish attention last summer. It now leads the security software segment according to MarketSurge's compose rating, which takes several technical and fundamental factors into account.

Summary

The market is going through some wild moves right now and we have plenty of unusual events in the pipeline right now to keep it volatile for a while. I don't try to predict the future, but I do try to position myself well for what the market is likely to offer.

With that said, I have positions in each of the individual stocks above as well as the SPLG ETF. I'm looking to be patient and keep track of the larger market trends.

Have a great weekend and good luck next week! 🍀

Discussion