TSLA analysis for September 12

It's TSLA time! Will yesterday's move hold? Was yesterday's news a bank manipulation play? There's only one way to find out and that's with real data. 🔎

Good morning! 🌄 I'm back today with a deep dive on TSLA stocks and options analysis. If you're looking for AMD updates, check yesterday's post.

TSLA had quite a move yesterday to the lower $270's, but will it last? 📈

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's go! 🚀

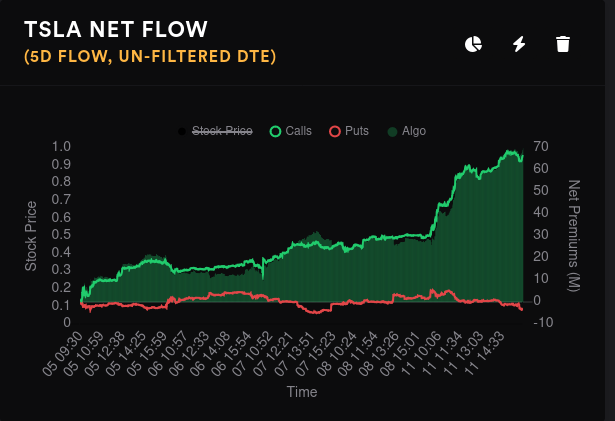

Options flow

There's no disputing TSLA's bullish options flow yesterday and over the past five days. I get excited about 20M premium diffs for a single day, but TSLA managed to exceed 35-40M between the bullish and bearish flow lines yesterday. The five day gap exceeds 60M! 🤯

TSLA's options volume was lower yesterday than on Friday, if you can believe it. The volume that was there was quite bullish, though. TSLA's IV rank sits at an incredibly low 6%.

Does that mean TSLA's implied volatility must go up? Not necessarily. Stocks can hold at certain IV rank ranges for extended periods.

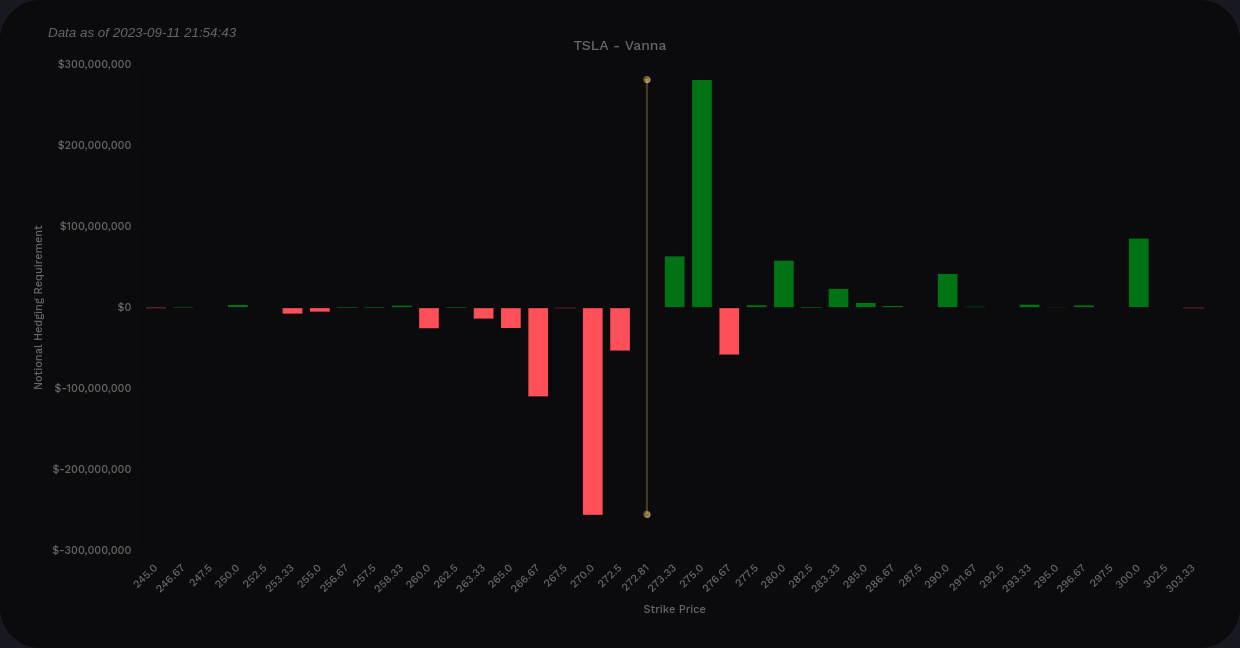

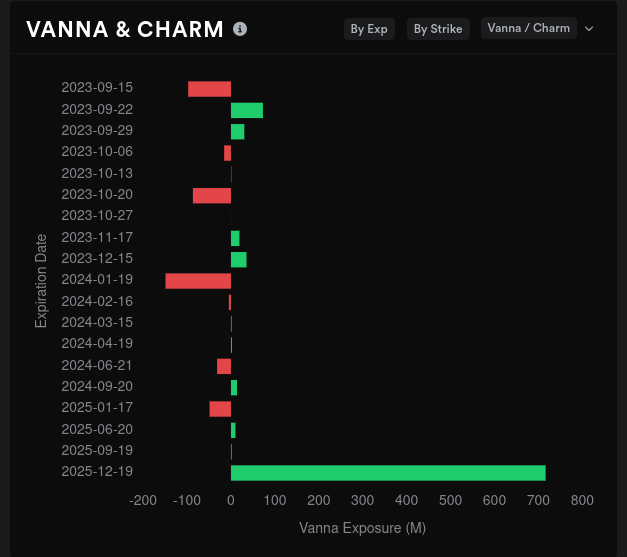

Options vanna

As a reminder, vanna measures how much options deltas move based on a change in implied volatility. Abrupt changes in volatility lead to dealers changing their hedges to remain dynamically hedged. We can look for these levels where dealers are forced to make moves and then guess on where the stock price will change.

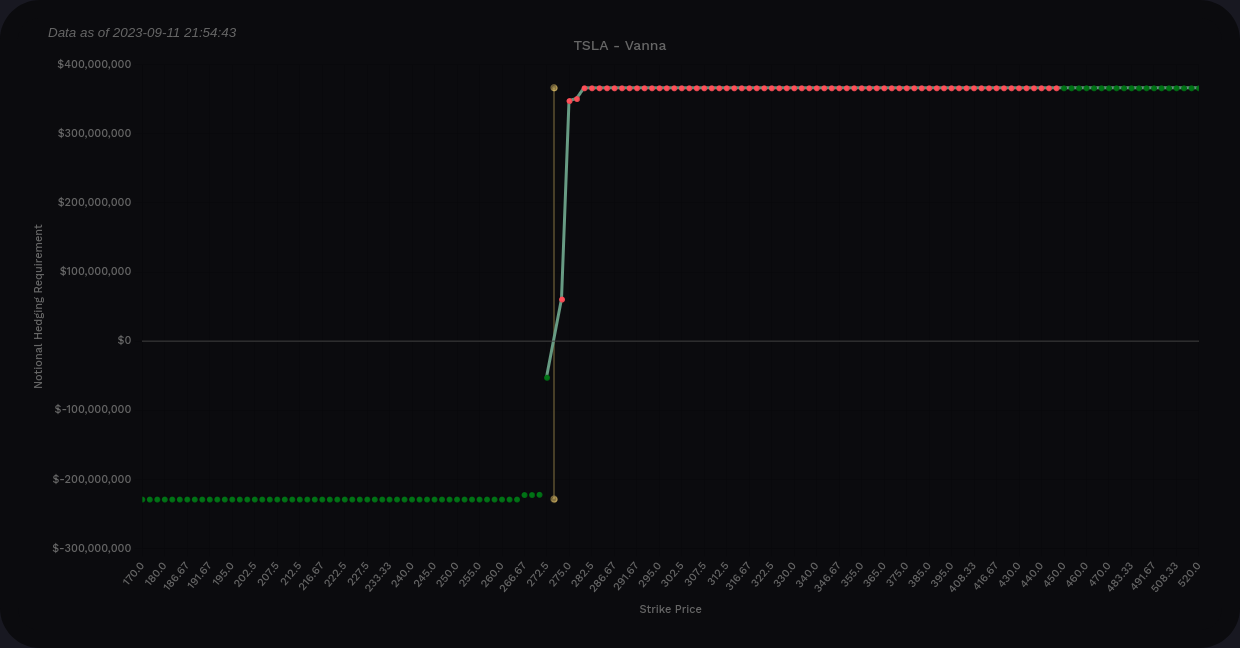

If we look at TSLA's vanna across all available strikes, we can see that positive and negative vanna are in balance. This is neither bullish or bearish. It suggests that TSLA will trade in a range.

$270-$275 is the easiest range to see here, but remember that vanna needs some distance to operate. Its effects are strongest around 0.15-0.35 delta, so these two strikes are quite close to the current price (about $272 right now pre-market). It's unlikely that they have a big effect on price right now.

$300 is still there on the top side, but I'd like to see more positive vanna above $275 before I start getting giddy about a run to $300.

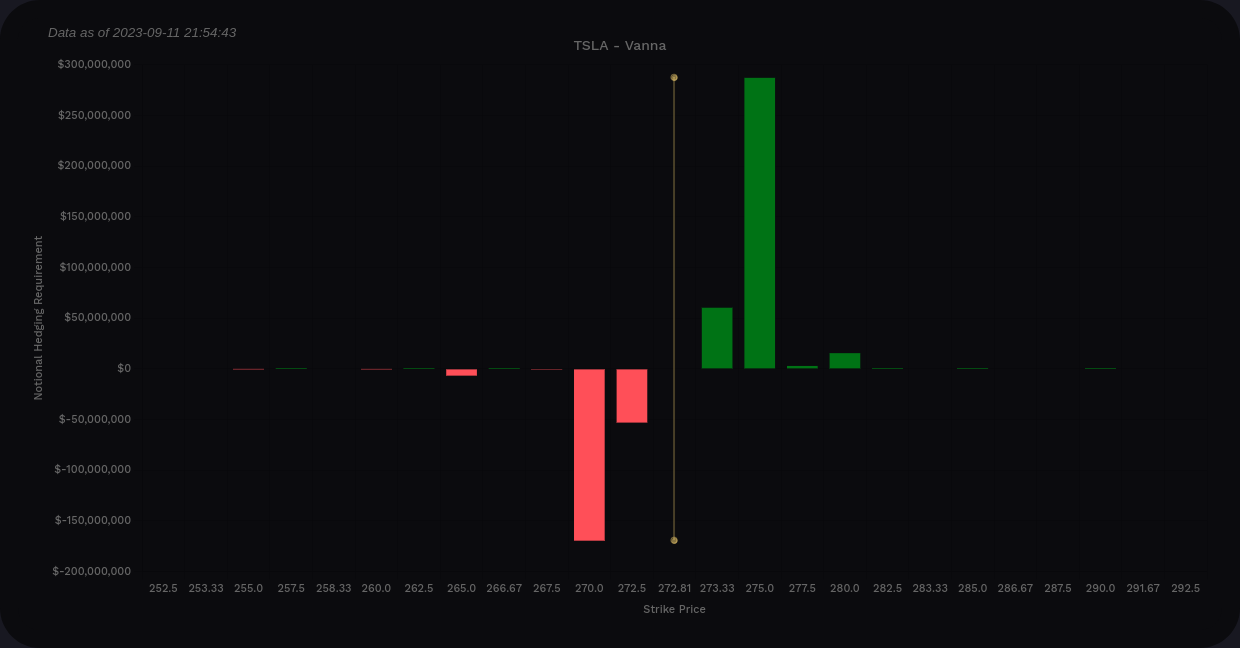

A slightly different picture emerges if we examine all the expiration dates between 9/15 and 10/20. The $270 to $275 range is clear, but vanna above $275 mostly disappears. Vanna tilts more positive here (+366 vs -229), but it's not strong.

I kept adding expirations out through January 2024 and the same range appears over and over. We don't see $300 getting any attention until I go all the way out to 2025.

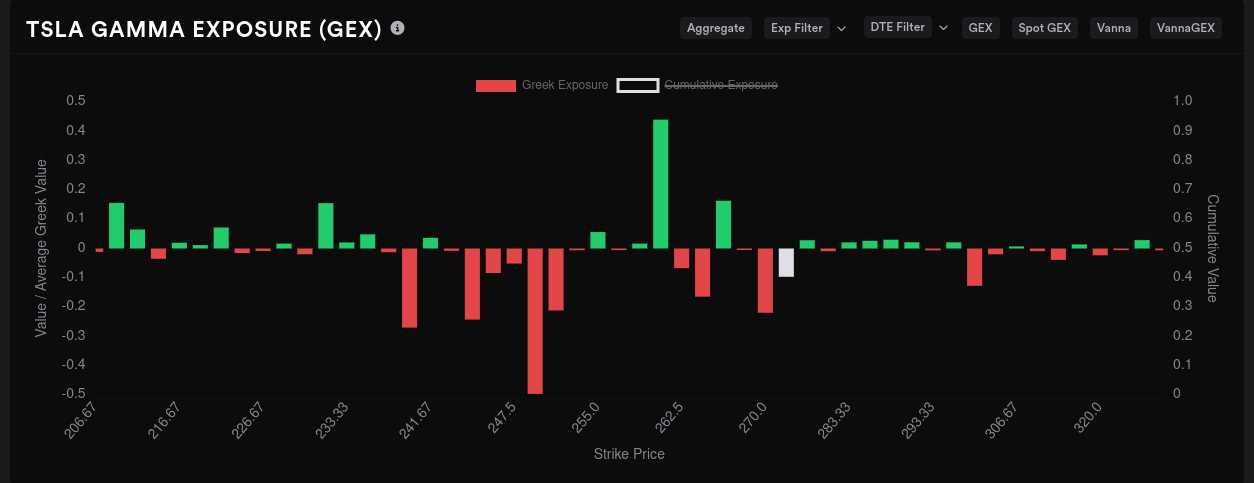

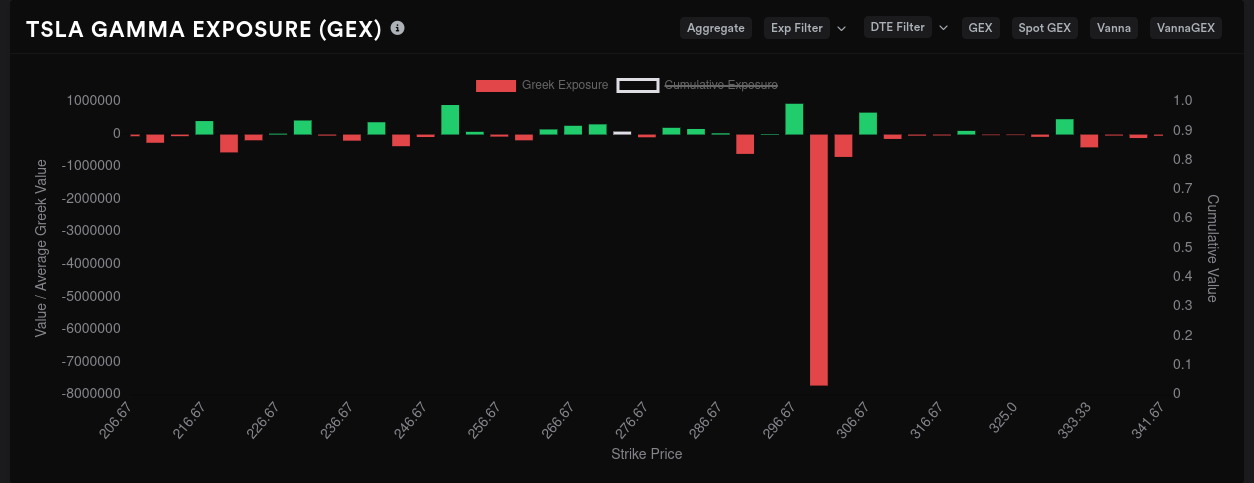

Gamma exposure

The biggest expiration for GEX is 9/15 by a wide margin. Next up is 9/22, 10/20, and January 2024.

Aggregate GEX shows a range of strong price magnets from $245-$252.50. There are some negative GEX levels up around our current price but they aren't strong. $260 might slow a downward move.

Looking at this Friday, 9/15, the clear magnet for price is that $245-$252.50 zone. There's a large negative GEX line at $270 as well, but it doesn't compare to the lower zone. Resistance levels are definitely smaller for this expiration, especially the $260. This might allow for a pullback by the end of the week.

9/22 was another big GEX date, but there's not a lot of negative gamma here to reference. However, there's a STRONG resistance level at $260. If 9/15's GEX forces TSLA back below $260, this line could hold us down for a while. If we don't go back to the $250's, this $260 line could provide support for price going into 10/20.

10/20 is still a ways out, but it's a big expiration date for TSLA. $230 and $250 are the clear magnets here with some secondary levels around $290. $220 shows up as a strong support level.

So what's up with January 2024? This is a long way out, but here's where we're getting this $300 bonanza. I don't see much support for this from vanna, but this is one to watch!

Other options data

Dealer greeks buildup for deltas are looking bullish. Typically, TSLA has some decent bullish moves when dealers have lots of short deltas building up. That suggests customers are in bullish contracts. Other than a brief flip on 9/5, TSLA's dealer greeks momentum has been quite short.

Dealer open interest suggests we have a slightly bearish pattern mainly until we reach 10/20 and January 2024. Be sure to read that x-axis closely. 😉

Vanna isn't having much of an effect lately because so much of it is packed into a 2025 LEAPS expiration. It's difficult to trade TSLA with vanna right now.

How are whales trading TSLA?

- On aggregate, traders with deep pockets went bullish on most strikes on aggregate yesterday (no surprise).

- For 10/20, there's an incredibly bearish sentiment for $225 that began yesterday. We're talking $70M in net premiums on the bearish side. This is definitely a level to watch.

- 11/17 shows lingering bearishness for $250 with $255 trending bearish as well.

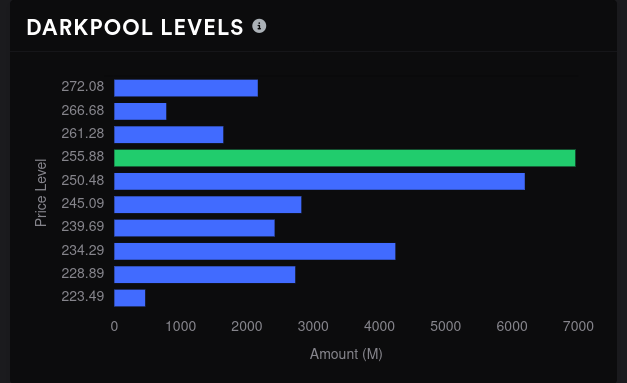

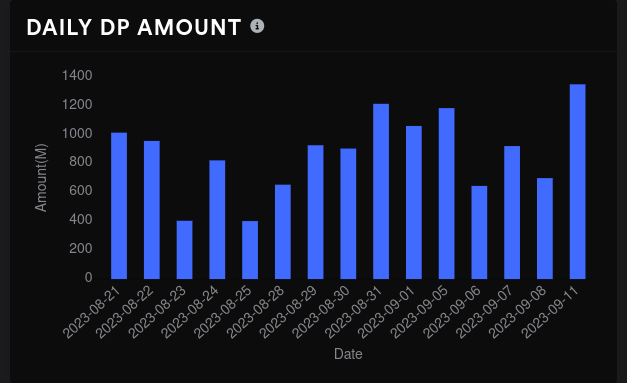

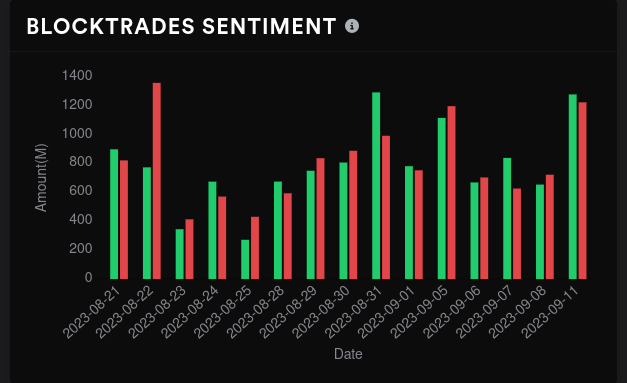

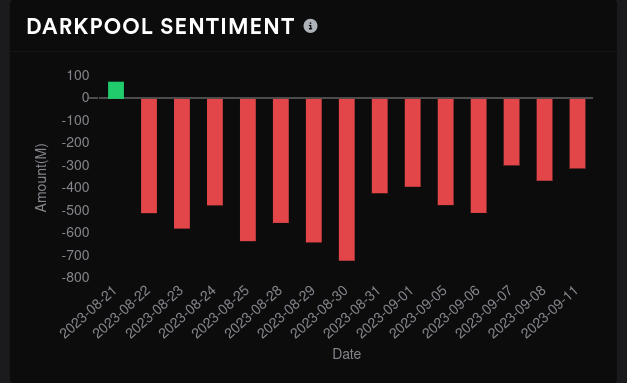

Dark pools

Volume remains heavy in the $250-$255 range with a volume gap around the mid $260's. If we fall through $270, there's not a lot to support it until the $250's. Dark pool volume was extremely heavy yesterday, but bulls and bears were nearly even. Sentiment remains negative.

This leads me to think that this rally likely doesn't have legs.

Thesis

Yesterday's TSLA rally certainly was a surprise, but there was news around a bank raising their price target for TSLA up to $400. Keep in mind that there have been many instances in the past where banks or analyst firms drop these into the market so that someone (usually a bank or a hedge fund) can exit a trade with a profit.

Analyst price targets have no impact on my trading at all. Just go read about what analysts were saying right before Enron imploded. They loved the stock! 🤦♂️

I prefer real data. That's why I started this blog.

All of the information I can dig up shows that TSLA should be in the $250's, and probably closer to the lower end of the $250's. I can't see any options positioning changing after yesterday's move outside of vanna, but TSLA's vanna is so tremendously weak right now that it doesn't really matter.

I still have my $220/$290 short strangle for 10/20 and I'm not making any moves to defend it yet. My $255 covered call for 9/15 is still on the board and I'd be glad to get assigned and take profits there this Friday.

Good luck to everyone today! 🍀

Discussion