Q2 TSLA earnings are coming

TSLA earnings are coming! Are you ready? Let's break down the data and have a look at AMD while we're at it. 💸

TSLA earnings are upon us! They announce earnings data after the market closes today with a call following around 5:30 Eastern. That's exciting, but we have other news, too.

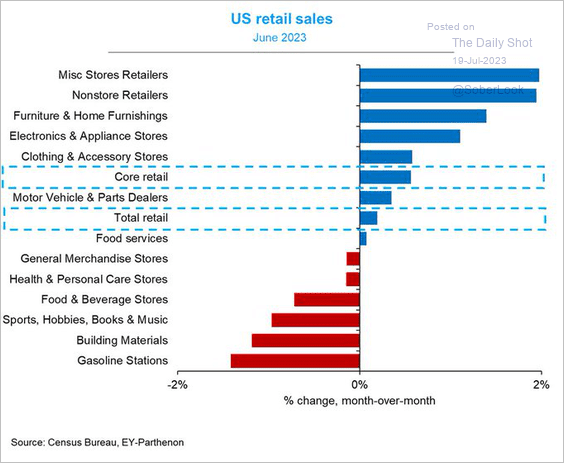

I love getting charts about macroeconomic data from around the world and The Daily Shot has an excellent RSS feed with plenty of charts each day. A couple of them caught my eye, including one showing that retail sales improved less than expected with some mixed results per sector:

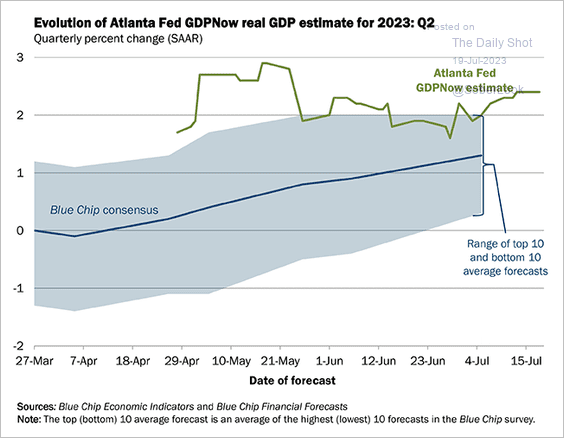

Also, GDP estimates are gradually increasing:

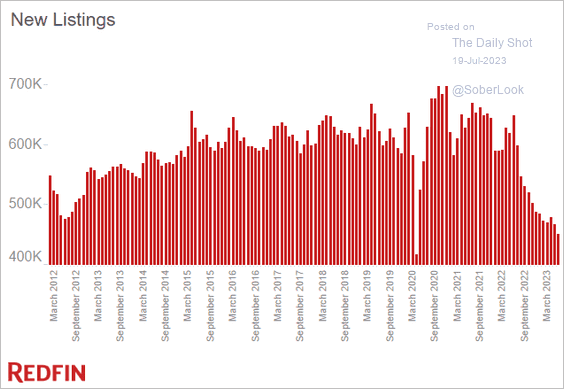

But housing continues to be a problem. Prices remain high, new starts remain low, and the amount of new listings are at their lowest points in a very long time:

Go check out the site for much, much more data. Before we get into it:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's kick this off with a TSLA earnings preview.

TSLA

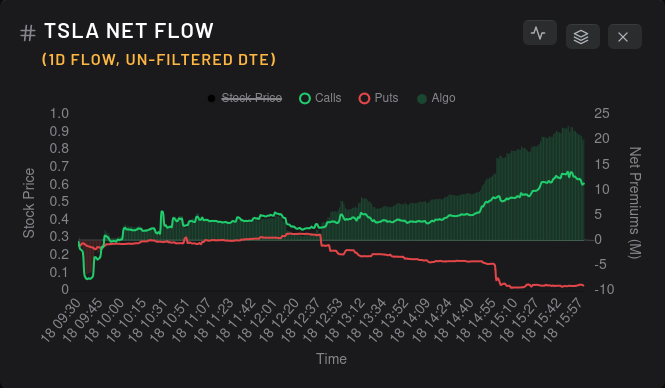

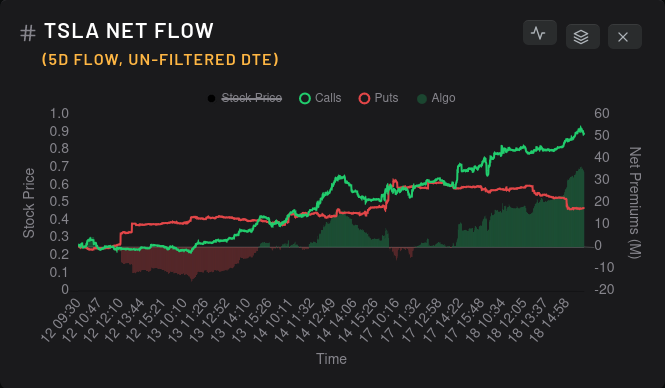

Net options flow for TSLA was a battleground until lunchtime when the divergence began. The five day flow has gone firmly bullish as well with about a 30M premium spread between calls and puts:

Market participants seem to be going back and forth as we approach earnings and that's reflected in the contracts dealers are holding onto. At ths moment, bullish traders seem to be winning and this correlates to the net flow charts above:

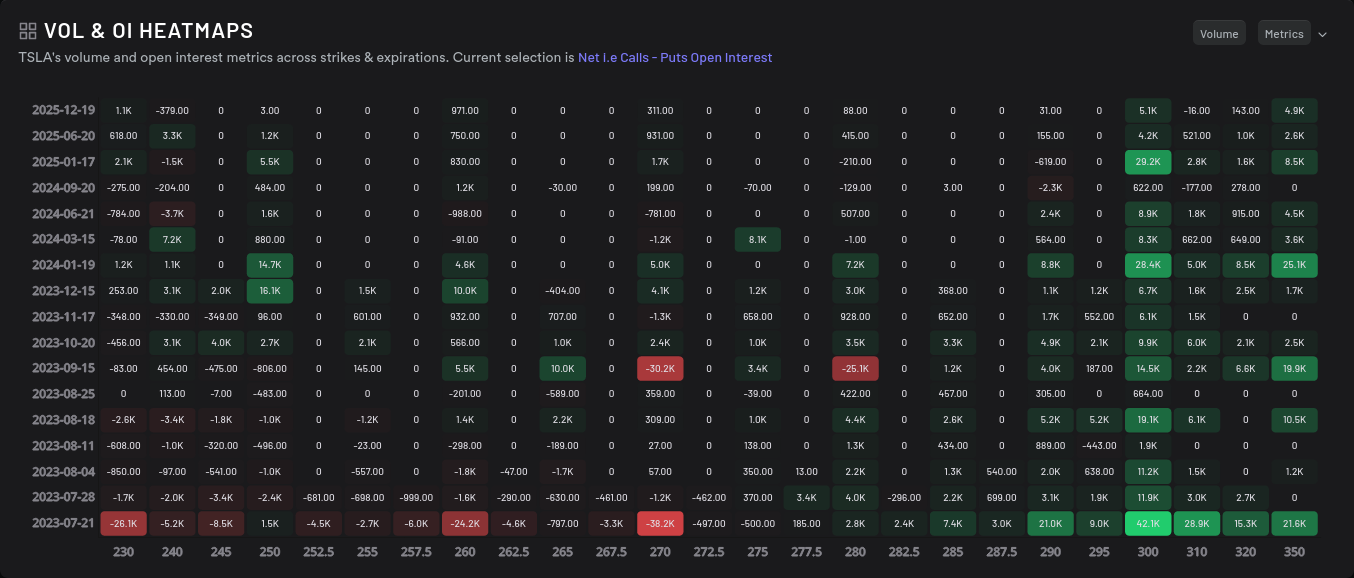

Dealer open interest has gone completely bananas on the bullish side for 7/21: 🍌

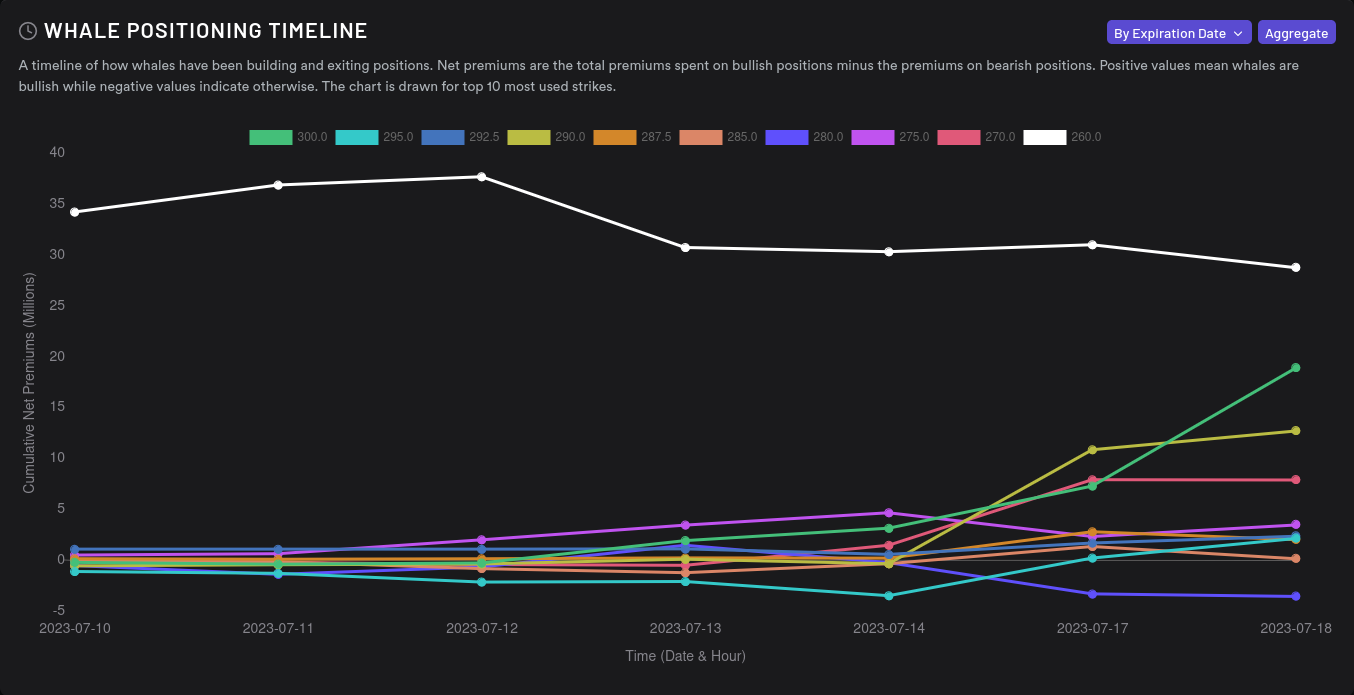

Big money is betting biggest on the $260 strike (white line) but the $300 strike bets are coming up quickly (green line):

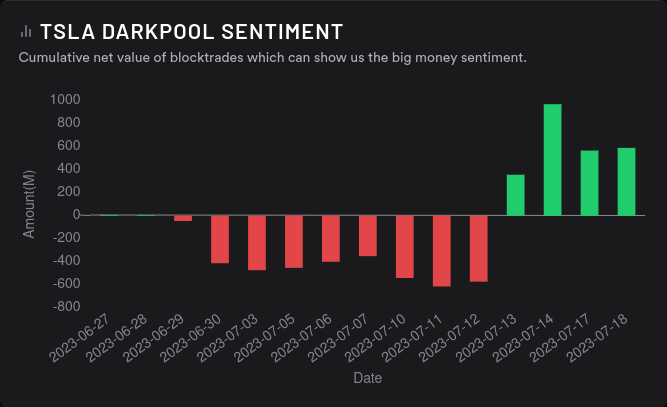

Do the dark pool trades correlate with all of this? They do! Sentiment flipped strongly bullish and there's plenty of volume around the $270-$280 range forming a good base of support:

Volland is having more authentication issues again today, but the only real bar to speak of on the vanna chart is a positive one at $300 with over $1.5B in notional value. There's some negative vanna below price at $290.

On the delta-adjusted gamma chart, there is some resistance at $300 but the effects should be very local and very small. The notional value at $300 is less than $150M.

Bears seem to be lining up bets at $270 and below with bulls, as you might have guessed, making bets at $300 and higher:

AMD

We have earnings coming up for AMD on August 1. I've spent so much time on TSLA that I'll do a lightning round here and line up the things I'm seeing:

- $110-$115 seems like a good level of support in the short term, but each time price crosses that $117 line, the calls seem to fall off.

- Five day net flow is still quite positive but calls fell off abruptly yesterday afternoon.

- On a 15 day momentum, dealers are still short and that suggests that market participants are getting into bullish contracts as a slow, but steady pace.

- Open interest makes 8/18 look incredibly bullish, but 7/21 looks bearish. The expirations between now and 8/18 are very mixed without any big differences.

- Big money options traders are making specific bets for 8/18. $125 and $135 top the list of bullish bets with $120 making a big jump upwards yesterday. These traders are bearish at $140 for 8/18.

- Dark pool sentiment remains firmly bullish as it has since 6/27 and the largest level is around $114. There's a firm base of support from $111-$114 that has been building steadily over the past two weeks.

- AMD's vanna has a very bullish setup with positive vanna spread out between $120-$135. $125 is the largest positive bar, but theres a big negative gamma bar at $110 worth almost $60M.

- Gamma remains weak for AMD but it wants to pin price between $115 and $120 in the short term.

Thesis

TSLA looks looks like a rocket ready to go – somewhere. There are tons of big bets with some decent support underneath it around $280. I'm already long TSLA shares with a covered call at $295 for 7/21 with a $300 breakeven. My cost basis is $259, so getting assigned with a $300 breakeven doesn't sound too bad. 😉

I haven't decided if I want to do an earnings play here yet. 😰

As for AMD, it's still taking the slow and steady wins the race approach and support continues to build around $110-$115. This might change as earnings approach, but for now, it looks pinned into a consolidation pattern. I'm long quite a few shares with a short put at $115 for 8/4 and some covered calls expiring 7/21 at $118 and $119. My cost basis for AMD is around $97.

Good luck to everyone today! 🍀

Discussion