Tuesday rundown for August 15

Inflation remains in a stubborn area that is hitting wallets across the country. AMD has NVDA's earnings rapidly approaching and TSLA's price action has been wild. 🥴

Good morning! 🌄 The big news in my inbox is around China's unexpected moves to cut rates to jumpstart the economy:

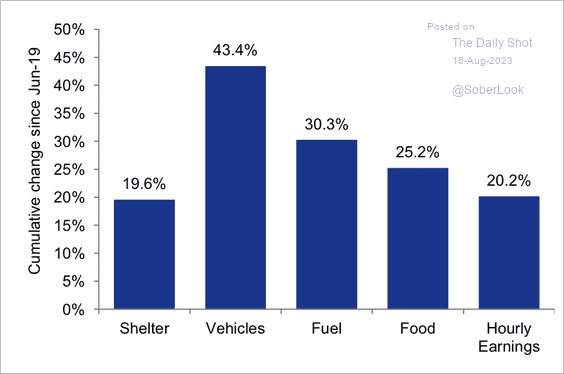

As we look at US inflation data and how it affects real people's budgets, vehicles and fuel for those vehicles are both becoming bigger pressures:

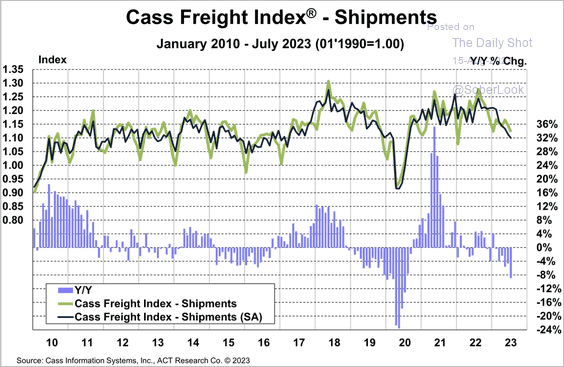

Also, freight shipments are declining. I'm not sure what might be causing this turn, but reduced retail sales and stubborn inflationary pressures on manufacturing could be to blame:

Let's get another look at AMD and TSLA for now. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Time for data!

AMD

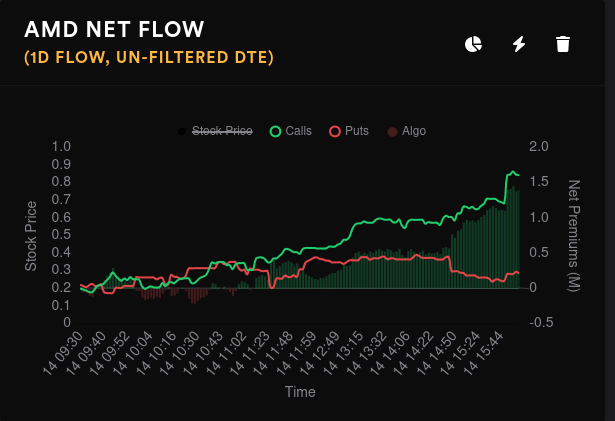

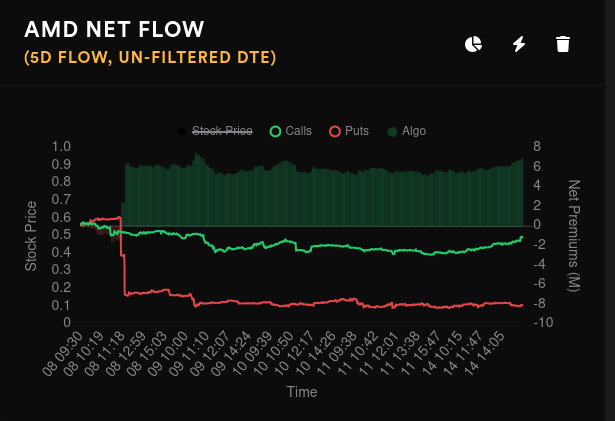

Net options flow looked good yesterday as price wandered up around $111 but those moves looked a bit small on a five day chart:

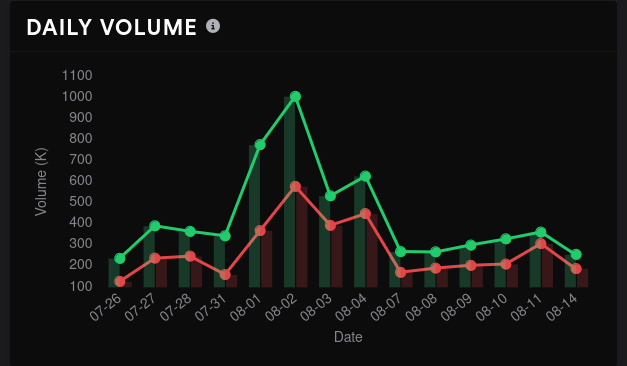

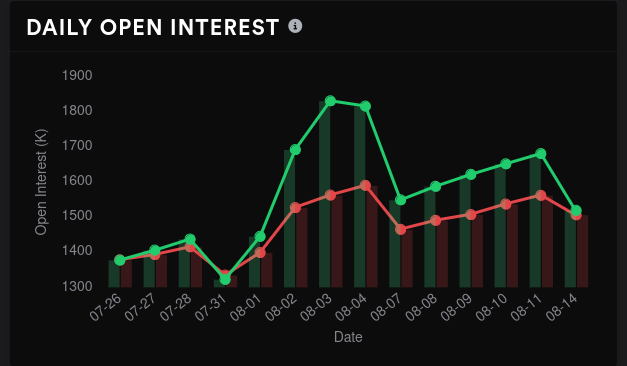

But options volume and open interest sank yesterday. This makes me a bit less likely to believe the the price movement.

Here's a quick roundup of other data from Tradytics:

- Dealers remain short, which implies customers are bullish. AMD typically has bullish price movement in the past with this setup.

- 8/18 is the most bullish expiration by far, but I still worry that it might be masked by the massive drop in puts last week. Options expiration dates after 8/18 look very indecisive.

- Vanna is lightly negative for 8/18 and 9/15 which provides buying pressure if IV is expanding. One might argue that it will expand a bit as we approach NVDA's earnings on August 23.

- Positive vanna returns for AMD on the 10/20 expiration.

- Options traders have repeatedly bought up $120 calls for November 2023 lately.

AMD's aggregate GEX suggests a move to $115 with some freedom to move from about $112 to $117:

Crunching down to solely 8/18, there's still some movement allowed from $112-$114 here and $122 is the largest price magnet. I'm doubtful we will see $122 with the liquidity problems AMD continues to have just past $118.

$115 is clearly the target for 9/15 and this expiration has the most gamma exposure out of any OPEX this year:

On aggregate, big money options traders love that $125 strike and have gone very bullish on it:

But some traders went incredibly bearish on the $90 strike for 9/15 and they keep holding:

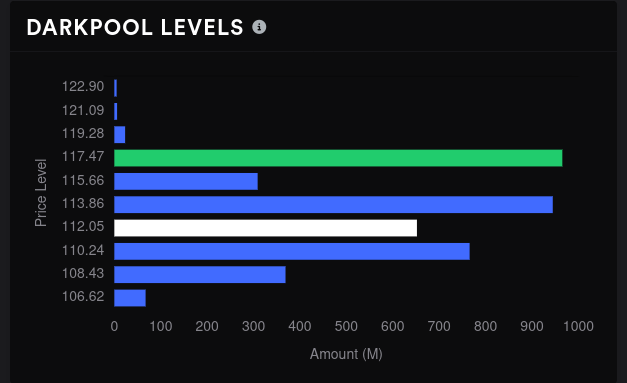

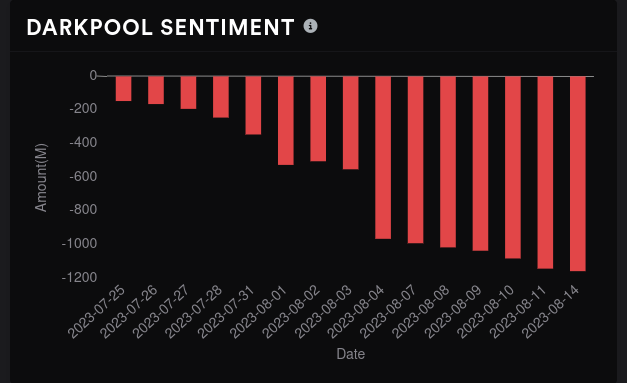

Dark pool trades remain stubbornly negative and they went more bearish again yesterday. Levels around $112 keep shuffling around. $117 is the largest level now but I think it's that way because the lower levels shrank so much.

TSLA

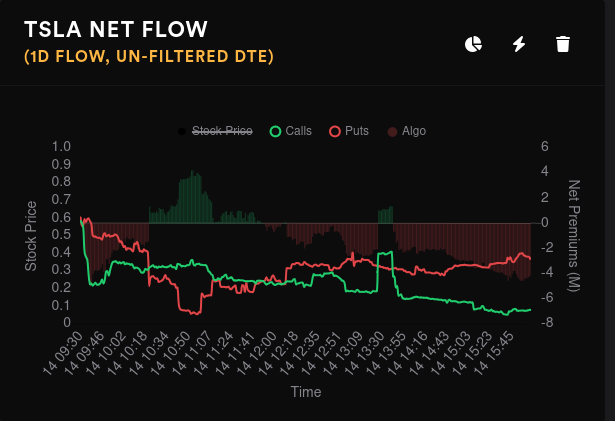

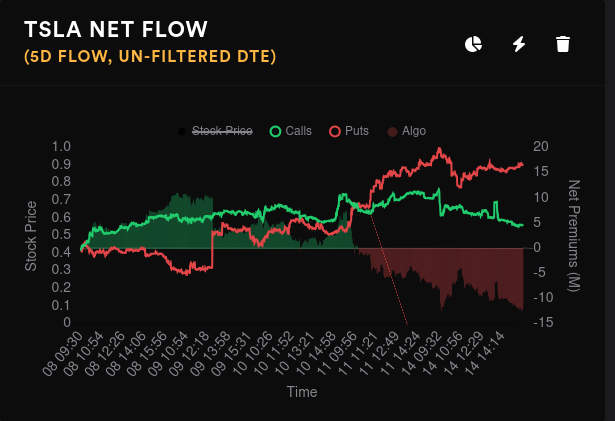

Options flow shows that traders really can't make up their minds with what to do here on TSLA. There are quite a few different pressures coming from different places in the market and that's reflected in the price action. Trading volume is also low.

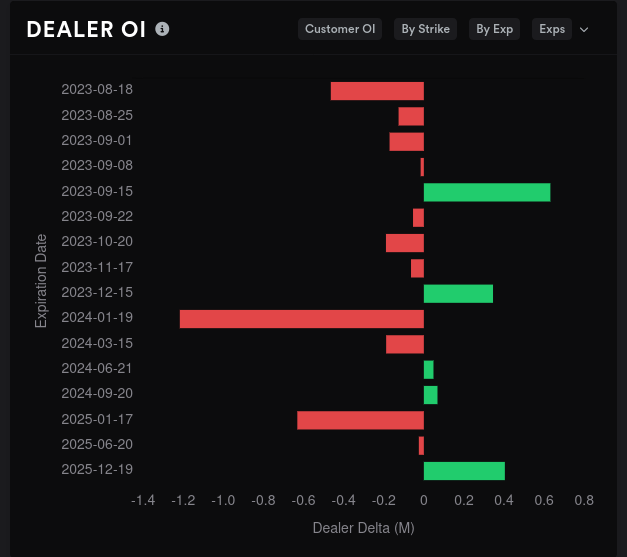

Dealers are still long TSLA and that suggests customers are short. TSLA price is typically not bullish when this chart is green:

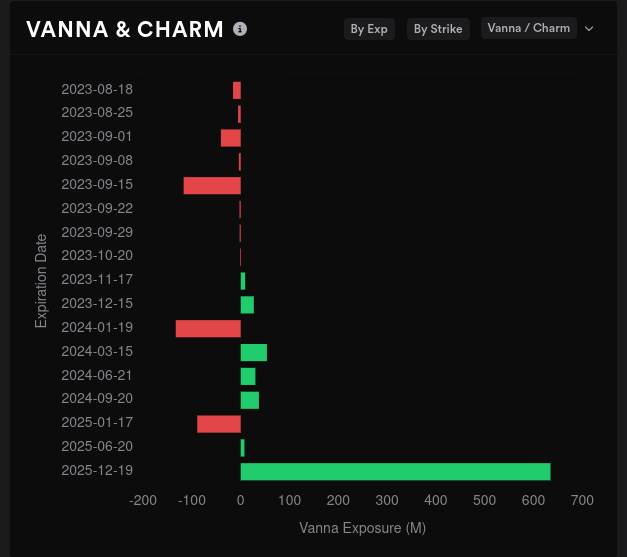

TSLA's most bullish expirations are 8/18 and January 2024. Vanna is quite weak until we get blasted with tons of positive vanna on the 2025 expiration.

Aggregate vanna suggests that $270 remains the biggest price magnet, but we have a minefield of resistance in between. $252.50 and $255 will do their best to slow any price movement.

8/18 looks to be boxed in by $235 and $252.50. The biggest magnet for price is at $245.

$270 shows up again as the magnet for 9/15 but my worry here is that our only significant downside resistance drops to $210! Sure, this gives TSLA room to run, but it's room to run in both directions.

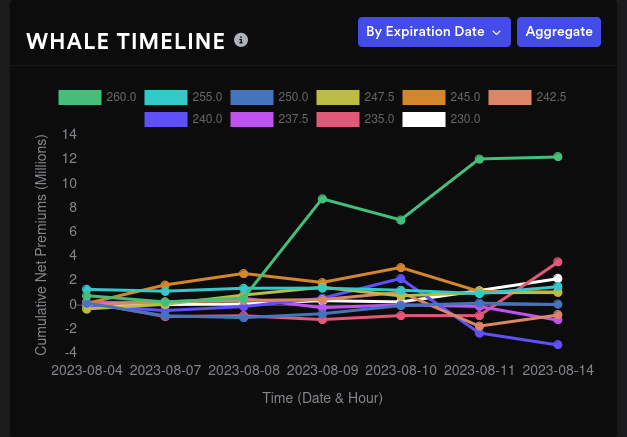

TSLA whales have gone in hard for $250 and held. $245 and $260 are beginning to move up as well. Could this be a sign of an upward move?

The $260 is the most popular for 8/18:

$250 and $240 dominate the 9/15:

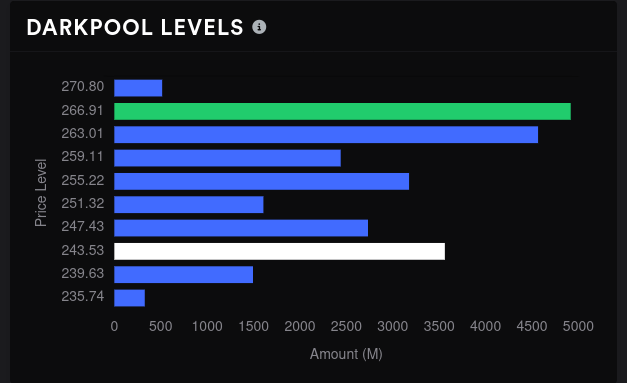

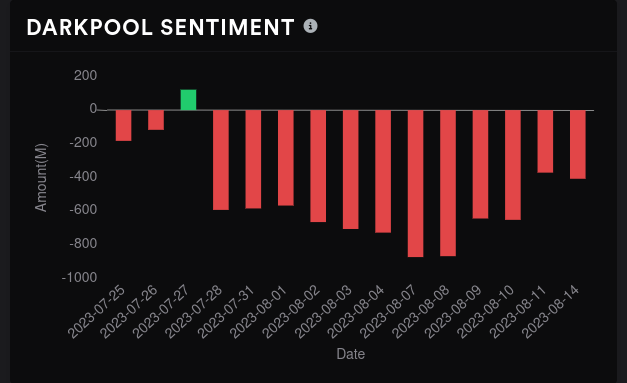

TSLA dark pools had turned bullish yesterday but then drooped a bit yesterday. The biggest level is up at $267 but again, this is likely the biggest level now because the levels below shrank by so much. This could set us up for more resistance in the lower $260's.

Thesis

There's plenty of conflicting data here and much of it seems to come from reduced volume in most equities I examine, especially AMD and TSLA. Treasury yields are fluctuating and the strength of the dollar continues to rise. Commodities markets are also showing big gains in some areas.

All of this threatens liquidity for equities which makes price discovery more challenging. In other words, I'm expecting some wilder price swings as we move into 9/15. You can see this in the GEX charts as resistance levels shrink and move further away, especially to the downside.

AMD looks like it might want to run back up to $117 for 8/18 and then roll back into another range, possibly from $110-$115 or $112-$117, by 9/15. Much of AMD's short-term future depends on NVDA's earnings on August 23rd.

TSLA has taken a wild tumble, but data points to a turnaround. Whales are making bullish bets from $245-$260, dark pools are moving back to the midline, and GEX suggests we might get some price pull to $270. I'm hearing shouts of "TSLA 300!" again, but a run to the $260's sounds much more likely. However, if the bottom falls out on TSLA, $210 could be the next stop.

Good luck out there! 🍀

Discussion