Wednesday roundup for 8/2

AMD earnings came and went. Where is AMD going and what are TSLA's most critical levels coming up? 🤔

AMD's earnings report landed last night and although they didn't perform as well as they did the same time last year, the market responded with an after hours rally that topped out around $125 (a critical vanna level) and fell back down below $120 this morning.

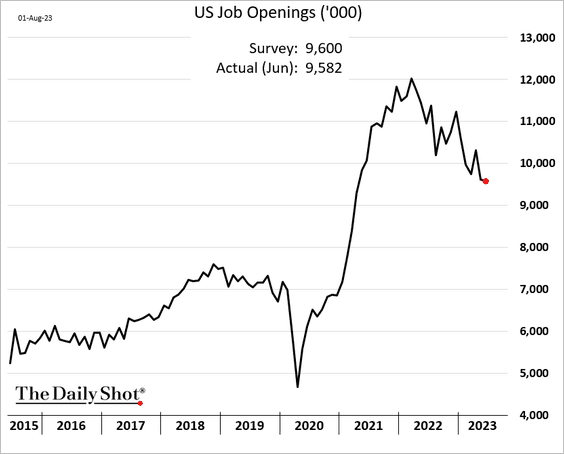

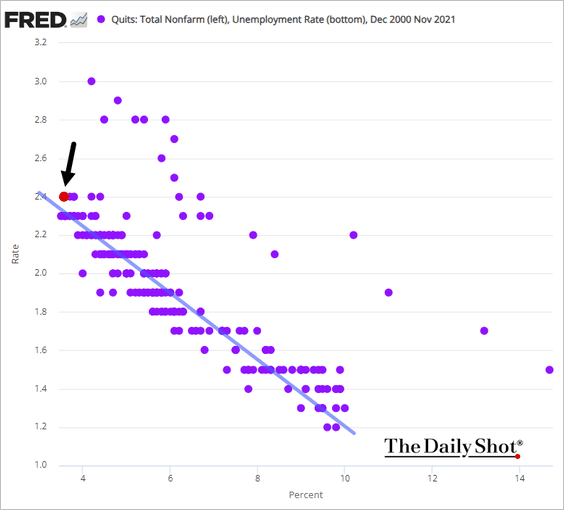

The big economic news overnight was the downgrade of the US credit rating. This caused an initial drop, but these events have had varied effects on the market including no effect at all. Employment data shows that job openings are trending down and quit rates are approaching levels we typically saw before the pandemic:

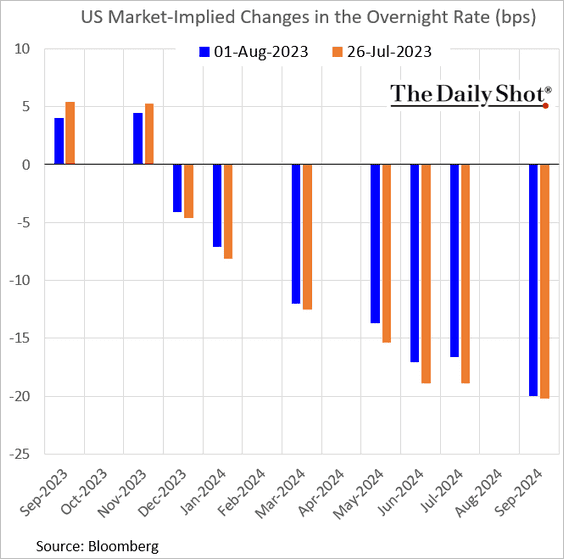

Bets on another rate hike are dwindling:

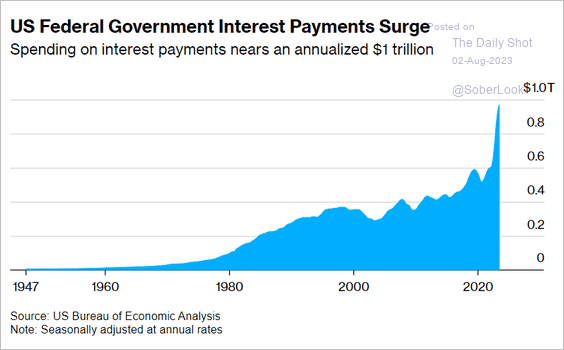

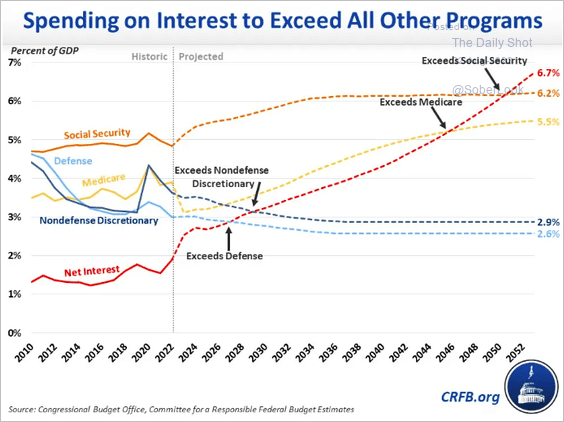

The government is also spending more on interest payments and at this rate, it has a possibility of exceeding some of our other big expenses in the future:

In this post, I'll take a brief look at AMD since we just had earnings and it needs time to settle. I'll also look at where TSLA could be going between now and 9/15. But first:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's go!

AMD

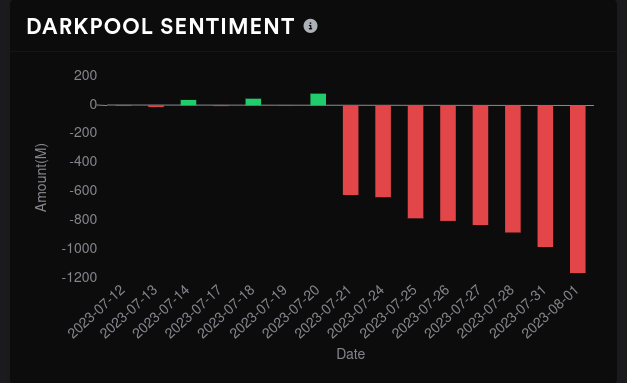

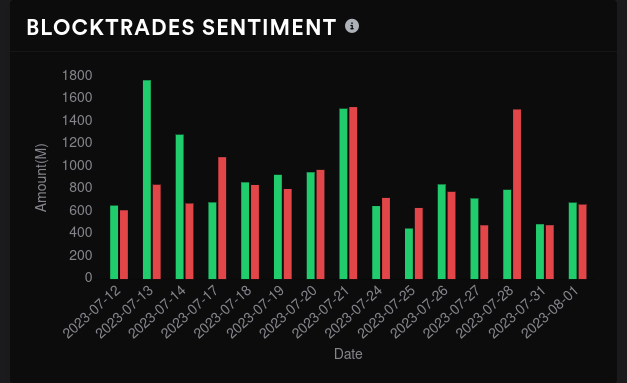

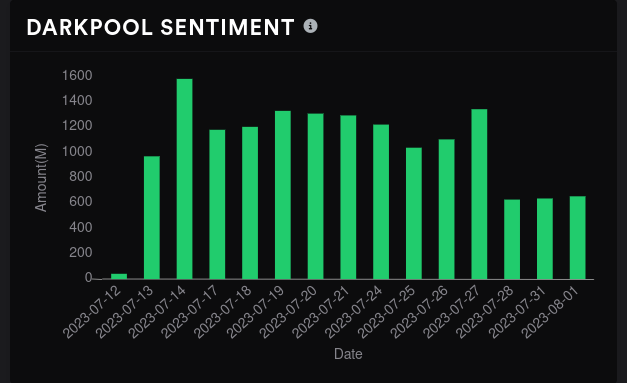

Most of the data I have in front of me this morning comes from pre-earnings options data, so that isn't terribly useful for us this morning. However, some bearish dark pool sales came through on a delay after the market closed yesterday. As a reminder, AMD's dark pool trades were bearish starting abruptly on 7/21 and that bearish pattern intensified going into earnings:

We're sitting in an area right now where we don't have too much volume to support the price. Our biggest level remains at just under $111 but keep an eye on that $117 level. It grew yesterday to become the second largest level and if it builds, this could become our next base of support.

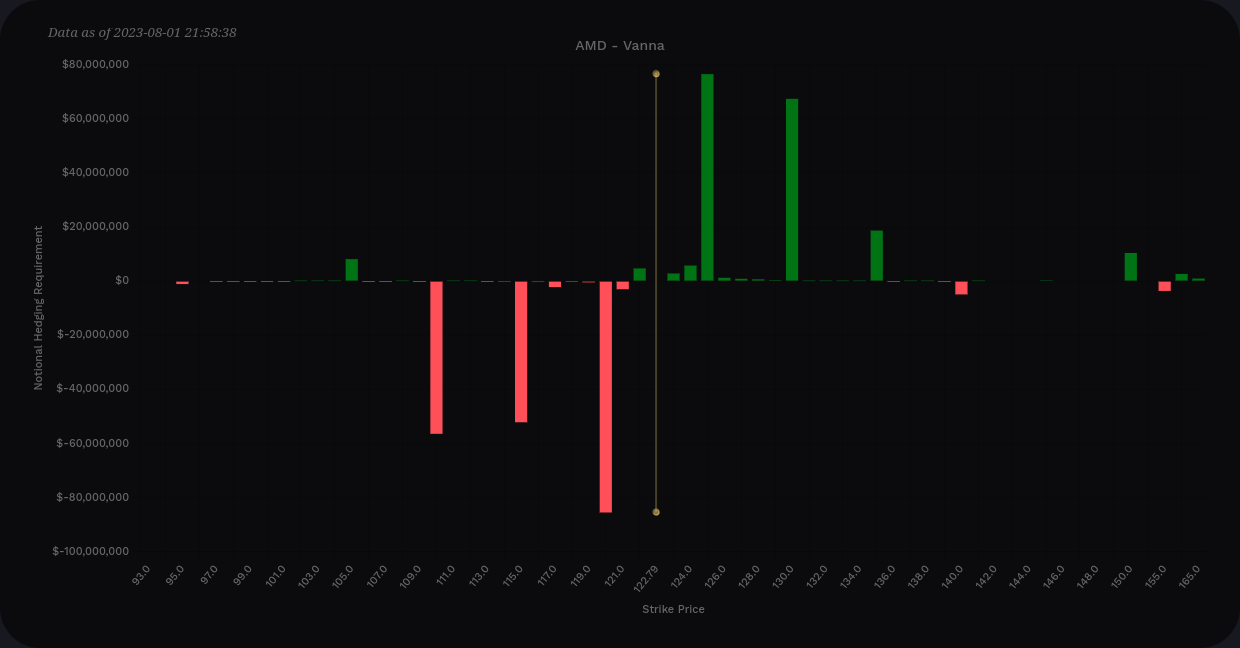

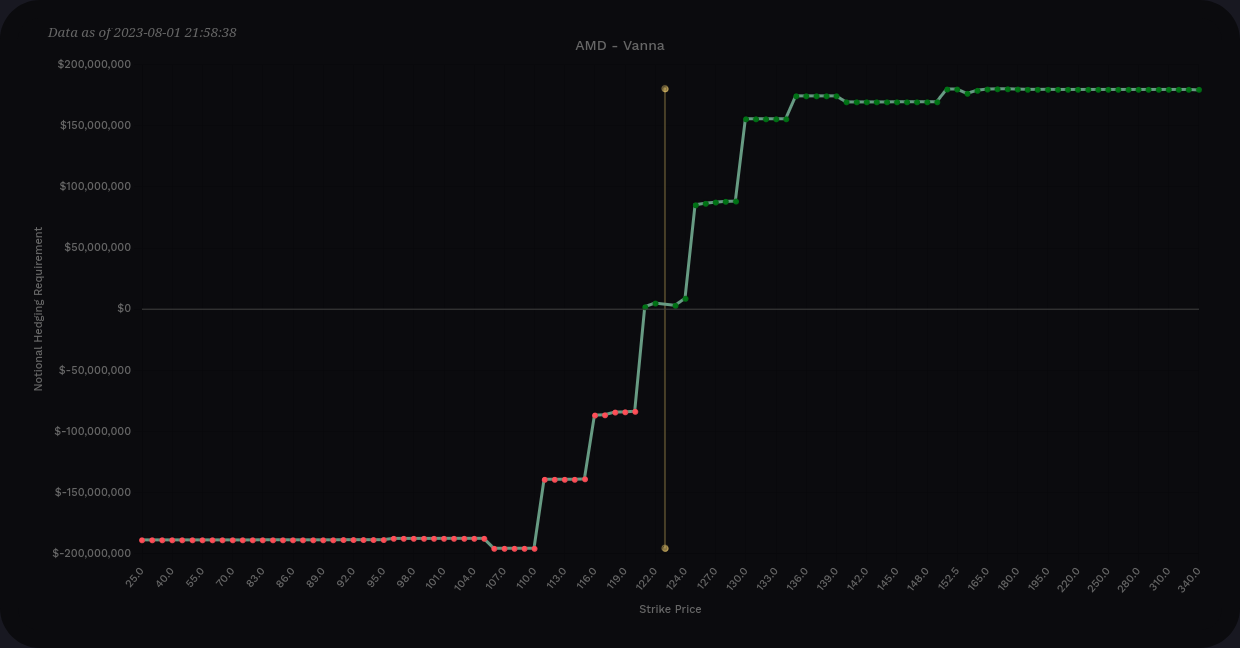

Vanna isn't strong right now, but it will be strengthening soon as we approach the 8/18 OPEX. The curve is pretty balanced right now. If we see a significant reduction in IV (which usually happens after earnings), we could see $120 and possibly $125. However, there aren't any significant levels above $125.

On the downside, an expansion in IV could push us toward $115. What could increase IV in the future? Other earnings, such as NVDA's later this month, could affect AMD's IV.

Before yesterday's close, 8/18 was the most bullish strike based on open interest. (This chart reflects the dealer perspective, so red bars are bullish.)

TSLA

TSLA has wrestled with one of my support lines I drew around $268. It keeps trying to hop over it only to get pushed back down.

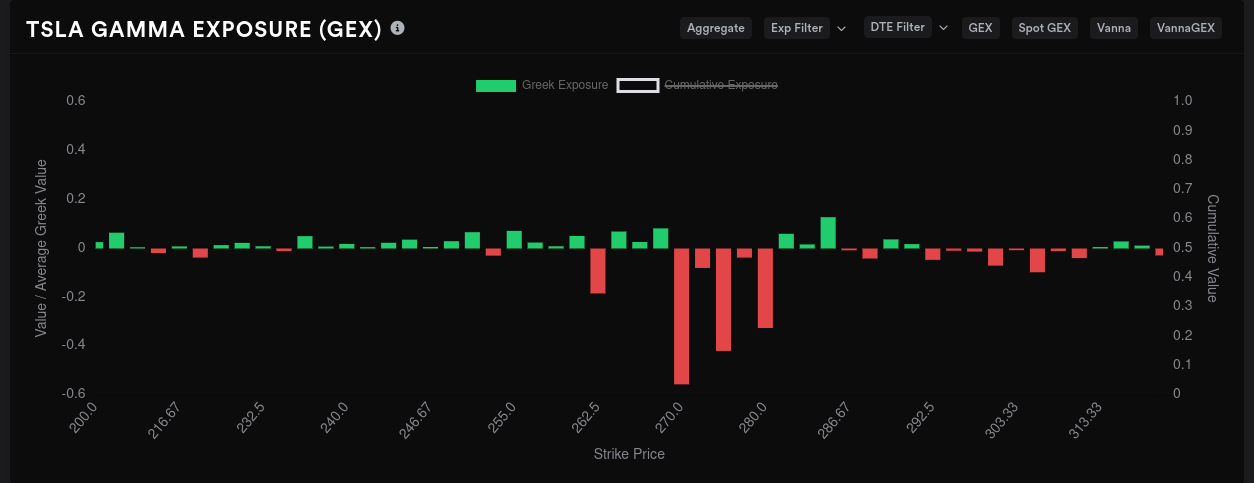

TSLA's aggregate vanna shows a stark negative vanna level at $260 without a lot of positive vanna. Sure, there are some bullish lines just under $270, but you can't deny the bearish effects of that $260 bar:

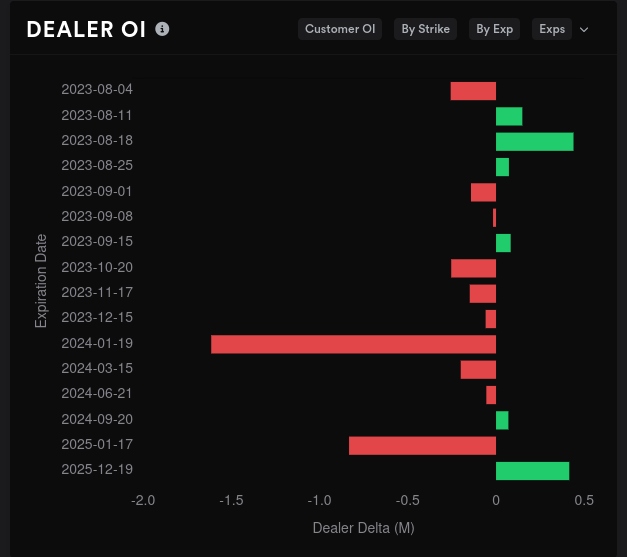

TSLA's open interest shows some bullishness in early 2024 but a whole lot of indecisiveness between now and then:

The aggregate GEX chart shows the biggest price magnet around $270, but there is room to run from $270 to $280 if TSLA can find a way out of the $260 range. We're at $256 this morning and our nearest negative GEX bar sits at $262.50. If we climb there, then that negative vanna at $260 flips positive and could push us into the $270 range.

Long story short: if TSLA makes it to $270 and holds, it can run. 🚀

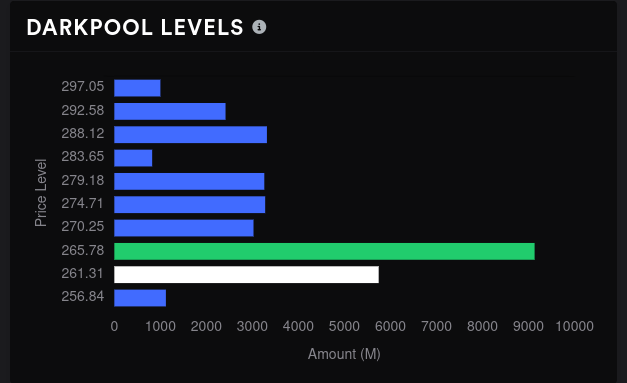

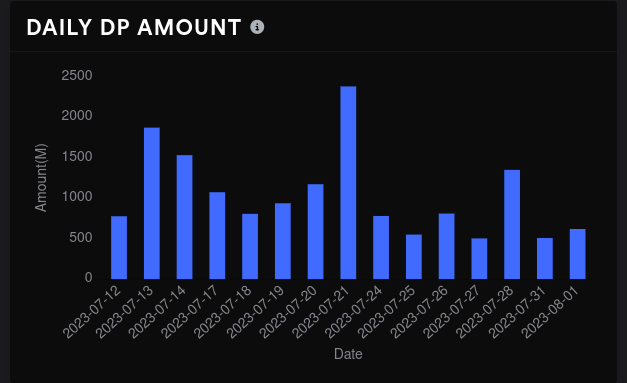

Let's check the dark pools to see if there's any support for this thesis over $270. Sentiment is bullish but that has reduced a bit lately. Our biggest base of support appears at $265 but the range from $260-$265 seems well supported. TSLA's current price of $256 is well below the highest volume levels and sometimes we see a reversion to the mean here that could get us over $260.

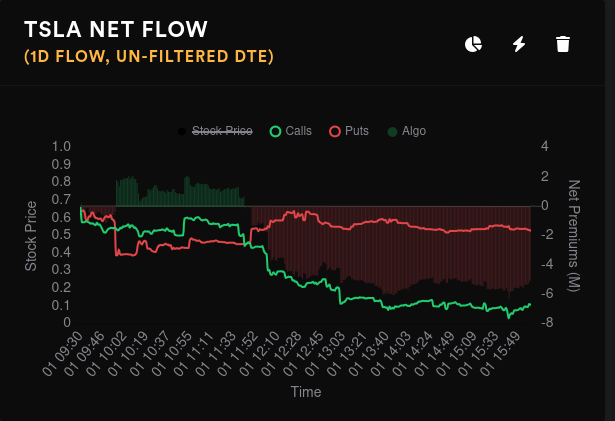

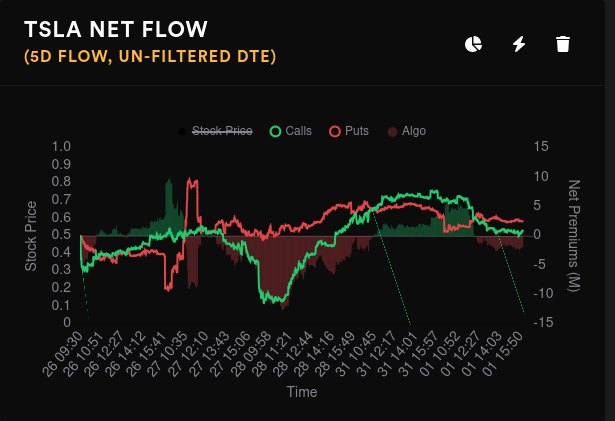

How are options traders making their bets right now? Well, to be frank, TSLA's options flow is totally disgusting. It's difficult to determine where we're headed since there's a battle on right now. Calls sold off yesterday but puts seem to be moving around at a much slower rate:

Big money options traders went bullish on the $280 by a wide margin recently, but the $270 fell off at a rate about half that:

Thesis

AMD has really defied my expectations but I need to see a full trading day or two to see where we're headed. We fell off hard after the last earnings call and then we had that incredible May 5 rally a few days later. That $120 level has been a problem for AMD recently and I'm interested to see if it has enough momentum to hold it.

I covered all of my AMD shares prior to earnings with break even points ranging from $119 to $123, so a hold around $120 would be just fine with me this week. My cost basis is in the $95 range, so if I'm assigned on these calls, I'll have plenty of profits and capital freed for other plays.

In other words: I don't fear the wheel! 😉

For TSLA, I really like this $250-$255 range for a short put, but I'm worried about how the market might digest this credit downgrade news. Potential reductions in interest rates next year would help a company like TSLA to finance debt much more cheaply and that could be beneficial to the stock price.

In the short term, I want to see TSLA climb over $260 and find a way to hold it. If it does and it finds a way to grind past $265, its next roadblock sits at $280. This $265 to $280 range would be a fun one to trade.

Good luck to everyone out there today! 🍀 All of my trades and trade notes are updated daily on my Theta Gang profile.

Discussion