Weekly prep for April 1

Let's kick off the week with a look at small and mid cap stocks to see how they are performing relative to the broader market. 🐌

No April Fool's jokes here, y'all! I hope you had a great weekend. 🌴

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

I'll run through some of the things I'm looking at this week and plug one of my favorite weekly videos.

Required watching

As usual, I spent part of yesterday reviewing Chris Ciovacco's video on YouTube where he digs into market trends to find the best performing portions of the market. This week's was a good one:

Here are my high-level notes from the video:

- There's not much evidence of anyone running for the exits or picking up assets typically getting traction during fearful times (treasuries, defensives, etc).

- Mid-caps (relative to equal weight S&P 500) just hit a new 52-week high and small-caps look like they're turning a corner on the same relative chart. Mid-caps look good already but small-caps still have a lot of work to do.

- XLE (energy) is certainly gaining strength over XLK (technology), and this initially worried me. Chris sees this as part of a healthy broadening rally where investors are piling money into things that have room to grow – energy included. He doesn't see it as a worrisome sign yet as many of us did in 2022.

- RSP (equal weight S&P 500) has gained some ground on SPY (market weighted S&P 500), but it still has more work to do.

- "Getting cute" and moving your allocations from SPY to IWM might look like a good idea, but it in the longer term, it might perform equally well or better to leave your money in SPY.

Mid-caps?

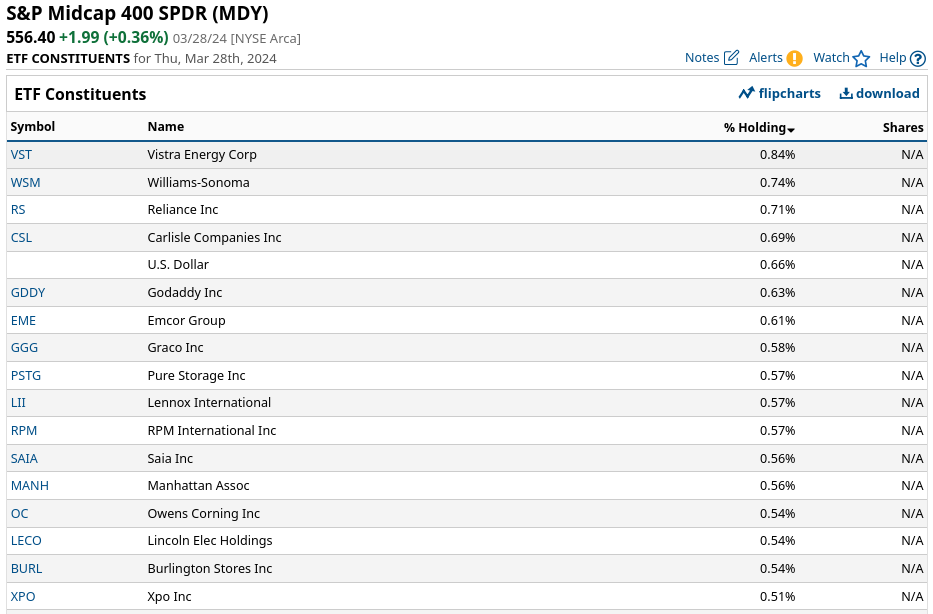

I'll admit that I'm fairly familiar with the large caps and some of the small caps, but I'm doing some serious head scratching to come up with mid-cap names. I ran over to Barchart to look at MDY, the S&P 400 small cap ETF. The largest constituents include:

I plotted a line chart of MDY versus RSP using a really nifty Tron-like moving average ribbon indicator I found on TradingView and the chart looks interesting:

The ratio rallied off a low back in early 2022 and has been grinding higher since then. It just reached a 52-week high last week. It did reach this level back in late 2021 and failed to break out, so that's something to keep in mind.

Small-caps

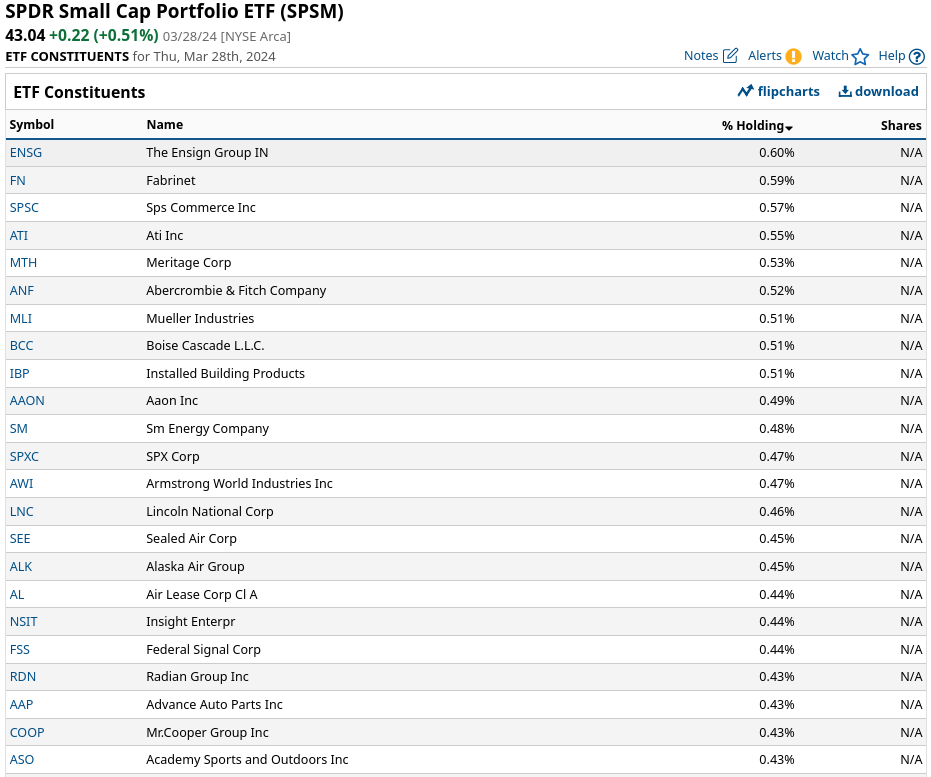

Just to familiarize myself with the small-caps better, I ran back to Barchart and looked at SPSM's constituents. SPSM is a market-weighted ETF for the S&P 600:

Ah, ANF is in here! (That's a fun chart to review.) 😉

The threat of high interest rates crushed this ratio from the highs in early 2021 and it's been on a long, slow downtrend since then. High interest rates cause headaches for small cap stocks because it's much more difficult for them to refinance debt as they grow. Large cap companies usually have an easier time financing debt and it's less impactful to their books.

However, this chart is showing the beginnings of another turn. It could be a brief counter-trend move that eventually falls back down, but it's worth watching. The ratio has tightened significantly and just bounced from a 52-week low.

As Chris notes in the video, the longer an asset runs sideways, the more aggressive the breakout (when it does happen). However, that breakout can go up or down. 😉

Thesis

Volatility on the large and mega cap names has come down a bit lately and I've lightened some of my trades there. Much of my long term holds are still piled into SPY/VOO with a little bit of SGOV and I'm not looking to change that yet.

My strategy lately is to keep working with the Barchart naked puts screener to nail down the puts that match my rules and my trading goals. I'm working hard to make more trades more often with smaller risks on each. My short puts now range across companies from multiple sectors and sizes.

Good luck to all of you this week! 🍀

Discussion