AMD 2Q 2023 earnings extravaganza 🎉

AMD reports earnings after the market closes today. Let's take a look at the potential moves and I'll scare you away from betting on earnings. 👻

AMD reports earnings after the market closes today and you can sign up for the earnings call webcast over on their investor relations site. Today's post focuses exclusively on AMD (sorry TSLA trading friends) and we'll try to pick out the most likely price ranges for earnings and the following weeks.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's dig into the data!

Momentum coming into earnings week

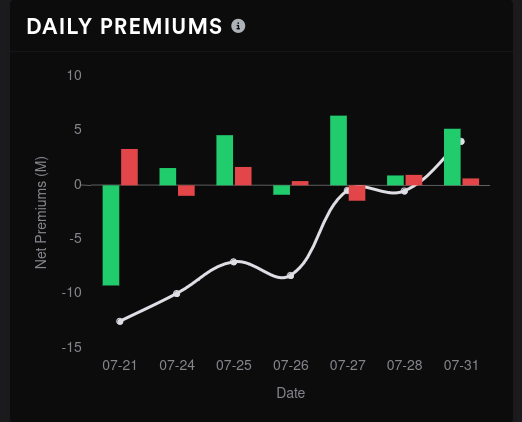

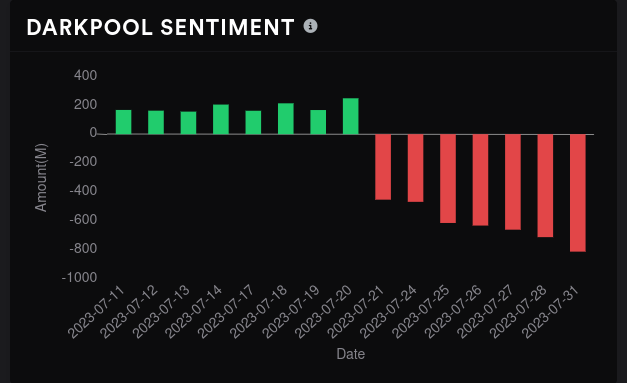

Call premiums fell off on 7/21 but have slowly come back since. The net options flow broke away on the 27th and has been almost entirely bullish since then:

AMD's dealer greeks buildup over 15 days is just the tiniest bit short, which suggests bullish market participants are winning over the bears by a small amount.

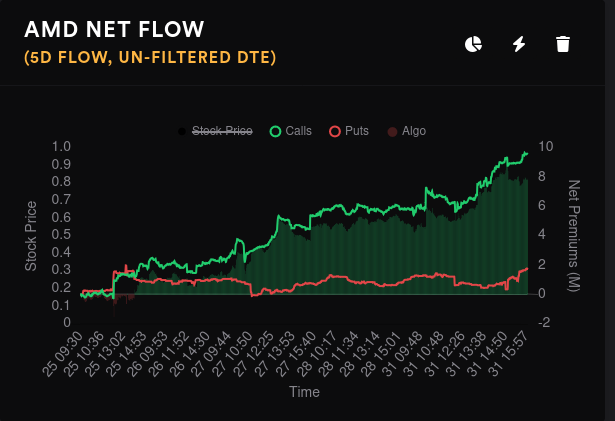

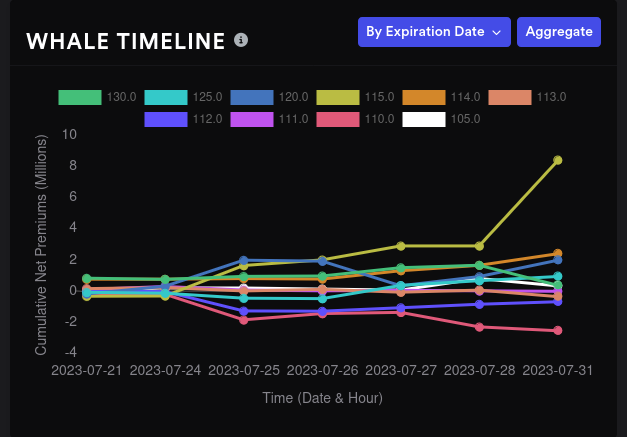

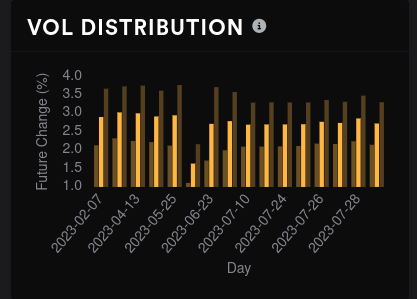

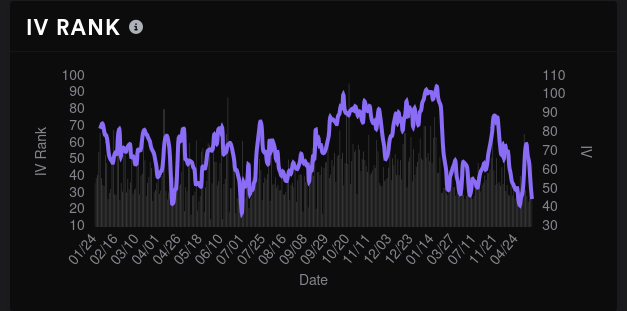

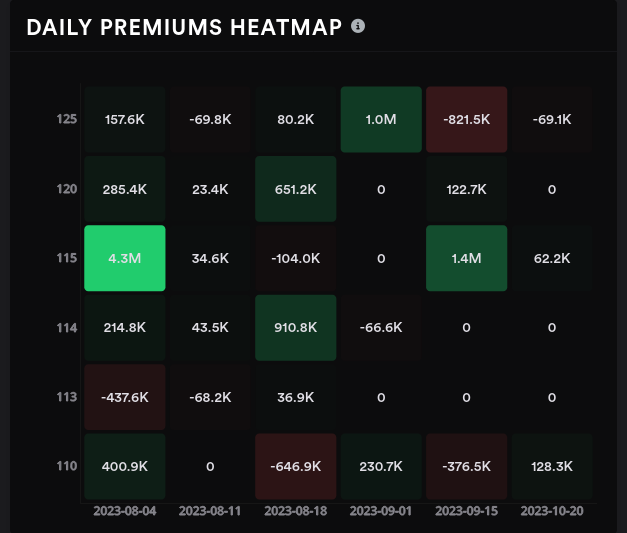

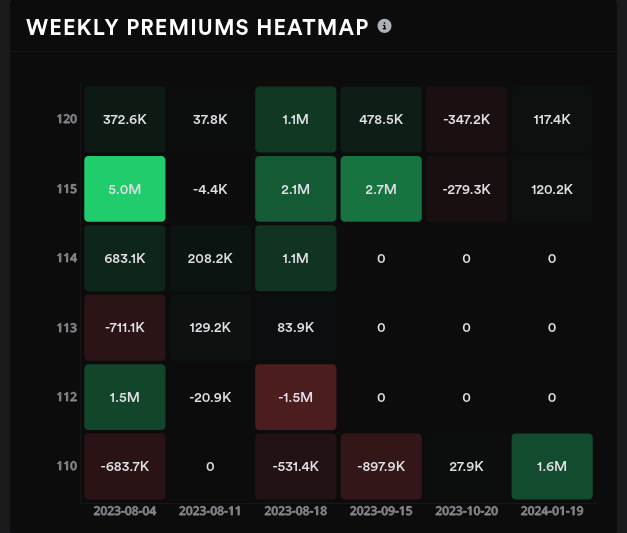

Volatility has remained fairly calm for this earnings cycle and the market's volatility is relatively low as well. Big money options traders seem to be excited about the $115 strike and are going heavily bullish on it. Other strikes look fairly quiet:

Potential range this week

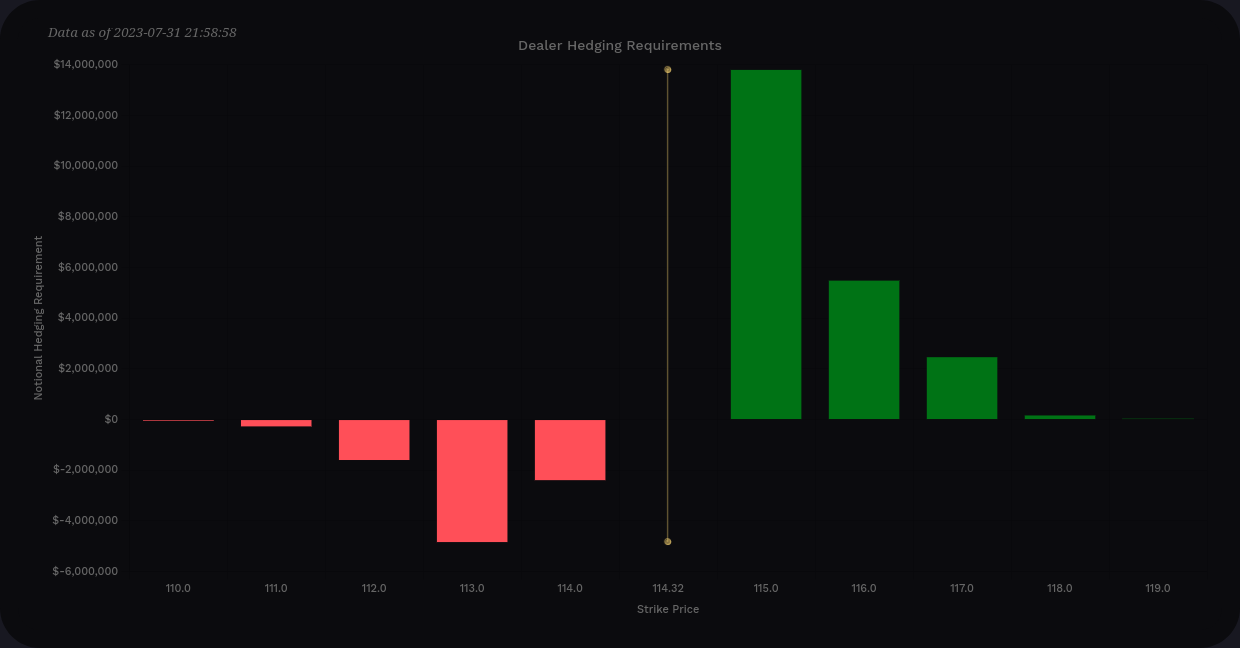

Vanna is at its weakest right now just after OPEX and the vanna data for 8/4 doesn't tell us much we didn't already know. There's more buying pressure above than below, but we're almost sitting on $115 right now. That means the pull from this bar is almost zero. Let's check out the charts from Volland.

Delta-adjusted gamma (DAG) suggests we're boxed in between $115 and the lower $110's:

Combined with the daily and weekly premium hot zones, it looks like $115 is the battle line. This makes me think that we might not see a wide range this week after earnings.

The future 🔮

Okay, so if the thesis is that we're wedged into a range yet again even on earnings week, what's the potential move from now to 9/15? That's the next big options expiration date for the quarter.

At a very high level, dealer open interest suggests that we're looking at bullish moves for 8/18, 8/25, and 9/15. (Remember that dealer OI is backwards from customer OI, so red bars here are bullish.)

AMD vanna from now through 9/15 shows some widening of vanna levels to include a fairly large $120 positive gamma magnet and some initial movement on $125. There's some selling pressure down to $110 and that's our current support level.

How about gamma exposure? One of the best ways to figure out which GEX dates to examine is to review the GEX per expiry. In this case, 8/4 (this week) reigns supreme, followed by 9/15, and then 8/18. Let's get a look at those.

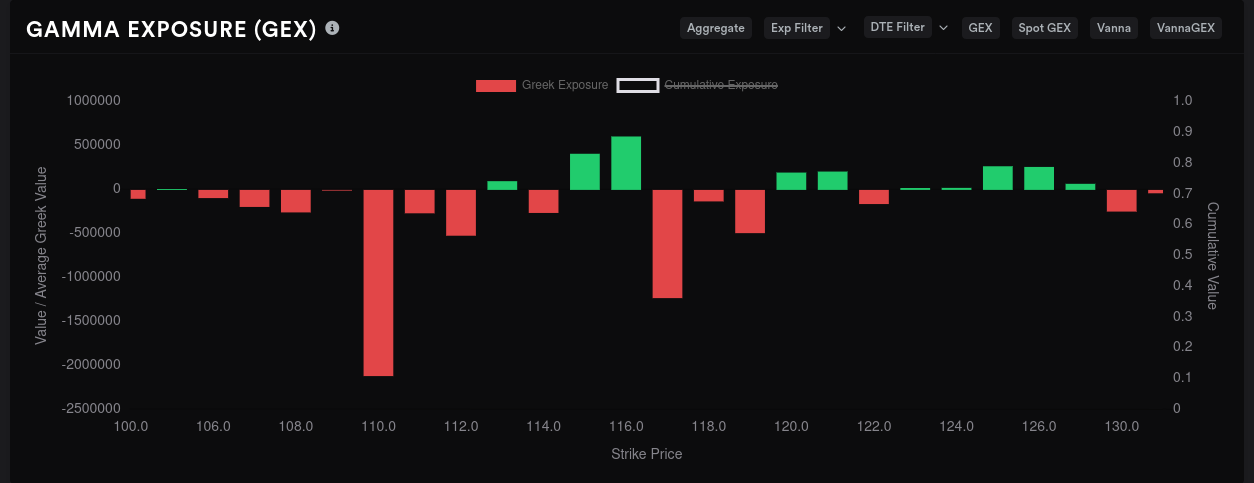

GEX for 8/4 shows that a climb over $115 could have some room to run with the positive GEX lines here being fairly small above that level:

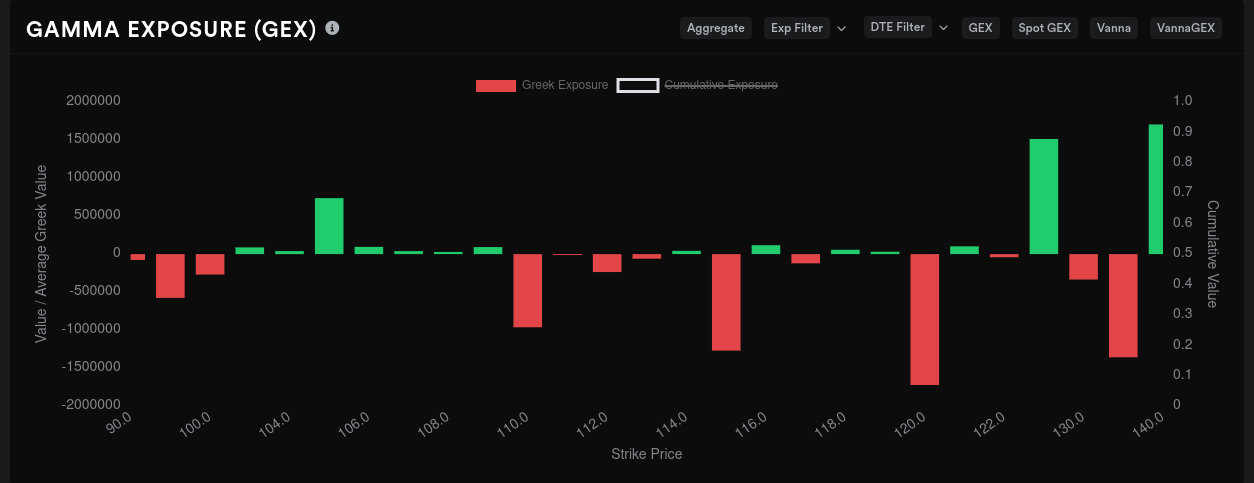

Our next OPEX is 8/18 and boy, doesn't this chart look different? First off, it looks like we're bounded by a much wider range from about $105 to $125. The biggest price magnet sits at $120 with some smaller levels around $115 and $110. My thesis here is that now have room to run, possibly to $125, but our bottom support level sank a bit to $105.

The second highest GEX date was 9/15, the quarterly OPEX. Our biggest price magnet appears to be the $110-$115 area. However, if we can somehow creep over $120 before then and hang out there, a potential run between $125-$135 seems possible.

Why is $110 so special?

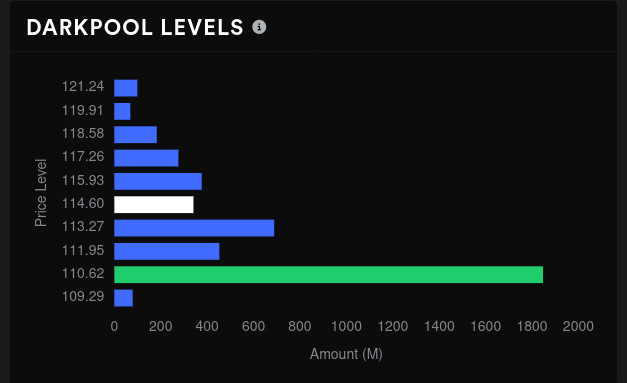

Over and over again, we keep seeing this $110 level showing up as support. It shows up in vanna, DAG, and GEX charts. It's also a support level on my AMD chart (see Sunday's post). It's also been a rock-solid level of support that continues to build more volume in AMD's dark pool data:

It was also a stopping point in the massive 2021 rally where the stock took a breath before rallying to all time highs.

How to play AMD options

First off, please don't.

Okay, let's start with support.

$110 is a solid level where I'd be willing to make bullish bets. It's supported by tons of data. If you want to be a bit more conservative, consider a play down around $105. That level has support through 9/15. Remember that earnings can change the whole paradigm here and a support level can find itself crushed if the company reports something unexpected.

On the top side, this is where things get confusing. $115 is a strong wall that AMD needs to climb over and hold to go higher, possibly to $125 by 8/18 or $140 by 9/15. Aggressive traders might consider betting that AMD will remain under $120-$125 this week. A more conservative bet might be $125-$130 for the top.

As for me, I've sold a couple of covered calls at 0.50 delta (at the money) for $115 expiring Friday. I have a bit too much AMD in my portfolio and I'd love for someone to pay me to sell a little. I'm a bit hesitant to go in on short puts right now because I've been burned recently on betting on support levels through earnings.

As always, my trades and trade notes are in my profile over on Theta Gang. You can always give me a shout on Discord or follow me on Mastodon.

Good luck today! 🍀

Discussion