AMD stock and options analysis for September 11th

Let's kick off the week with a detailed look at AMD's stock and options data. 🌇

Good morning. Today is a day of remembrance here in the USA. 🎗️

I'll be taking a look at AMD's stock and options data in today's post. Go check out yesterday's Charts Chat for a deeper look at AMD's chart.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get after it! 🚀

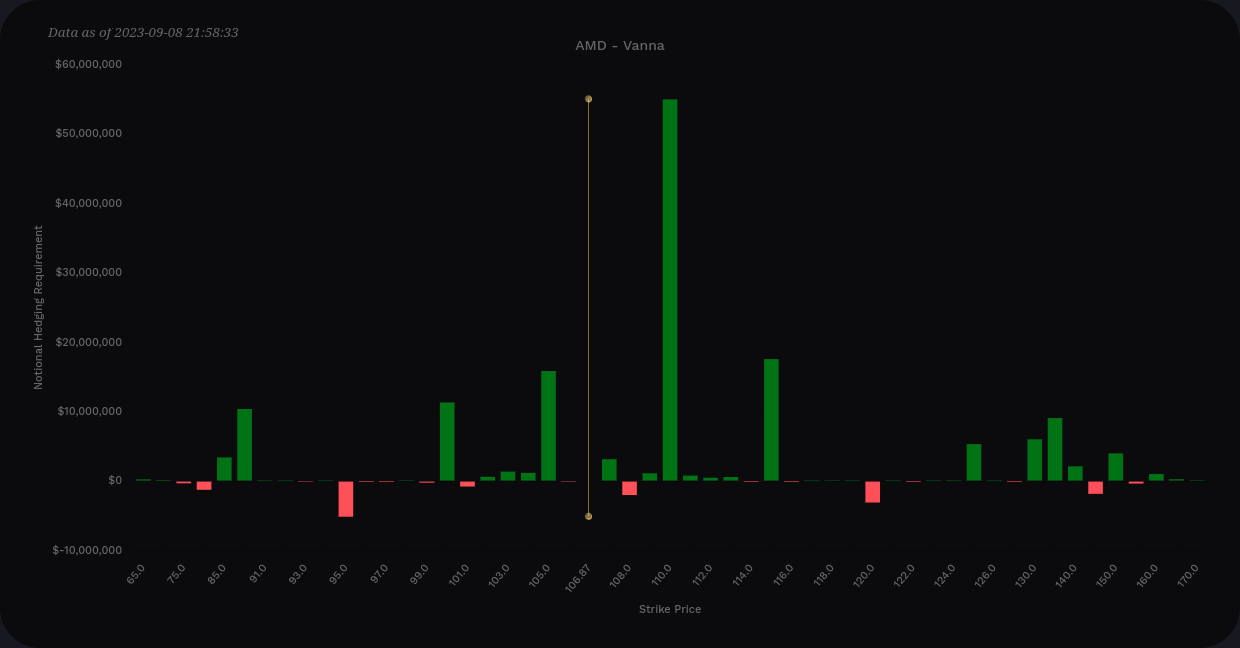

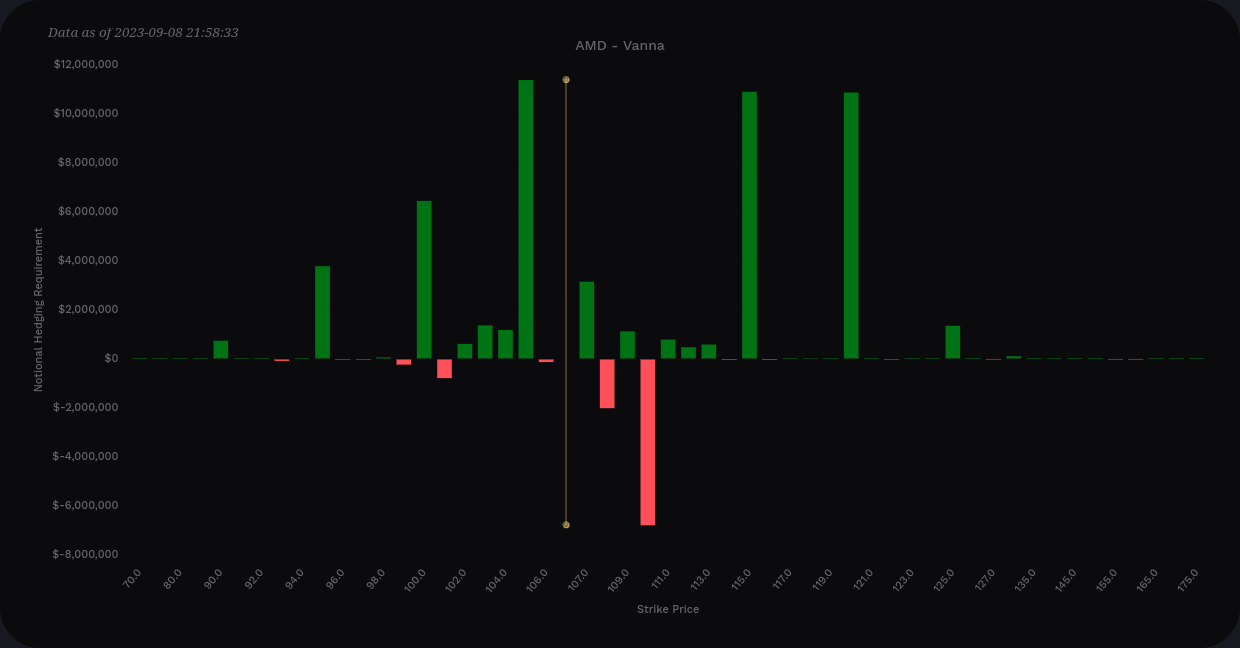

Options vanna

AMD's aggregate vanna remains quite positive with the largest positive bar at $110. There's some decent positive vanna on the $5 increments from $95 to $115, but $120 doesn't look great here.

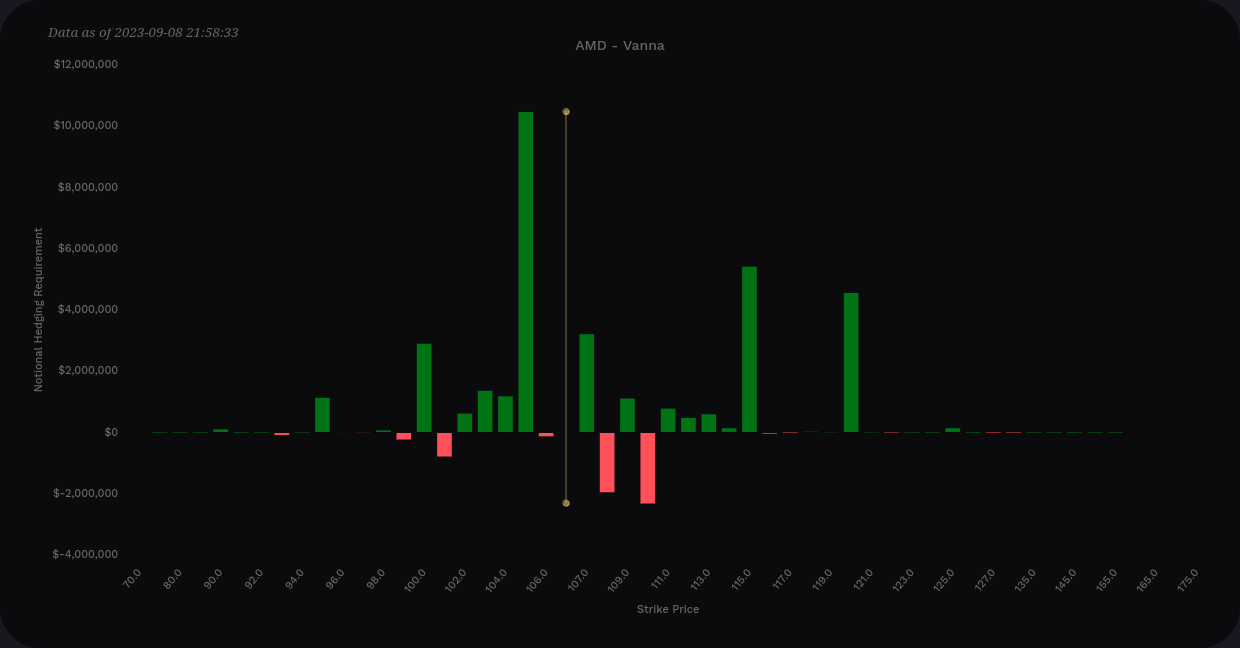

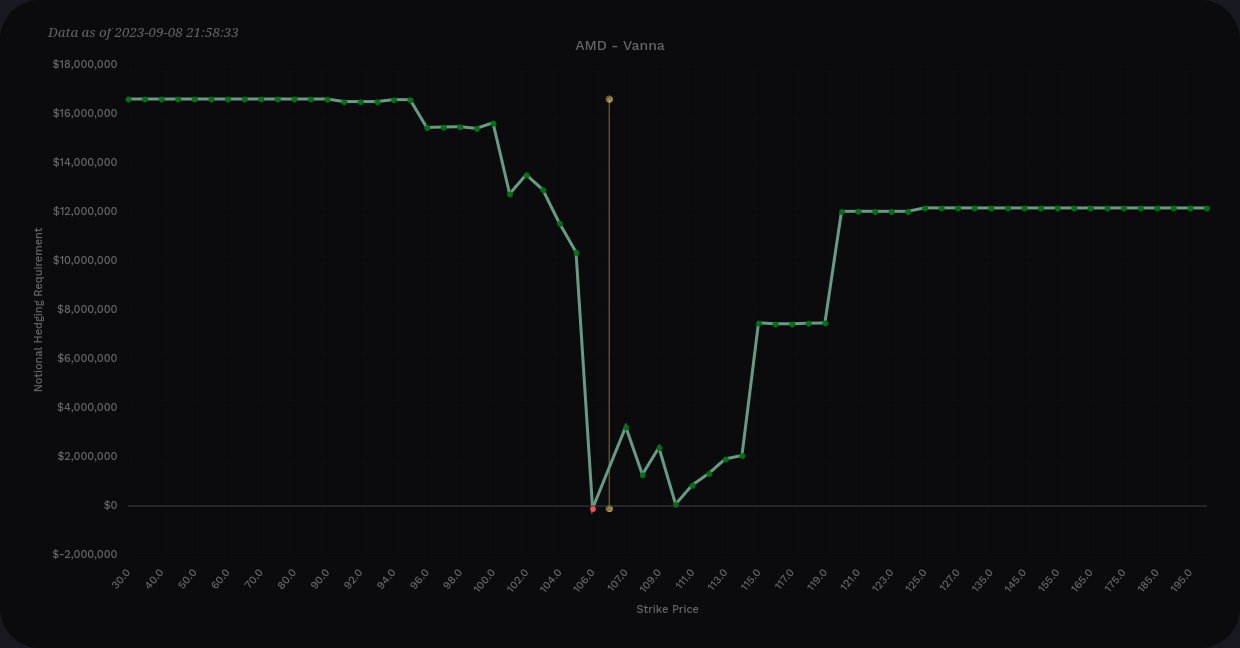

Most of my trades are focused on 10/20 for now and vanna through that expiration looks a bit different. It still overwhelmingly positive, but the recent strength we saw at $120 has come down quite a bit.

Now through 11/17 looks a bit more even with vanna levels at $115/$120. However, we have a negative level at $110 that could get in the way of an upward move.

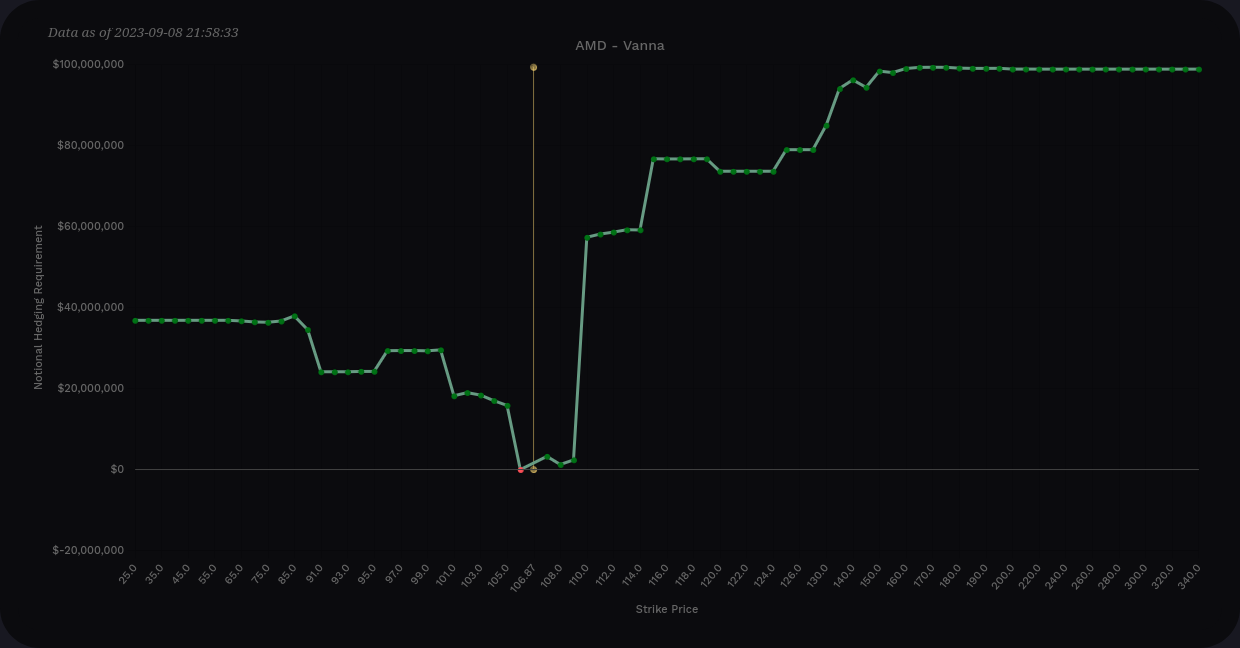

Options vanna suggests we're likely in a $100-$115 range for a while that might expand to $110-$120 by November. Decreasing IV will be a bullish indicator for AMD through 11/17 but we seem to run out of vanna strength at $120.

☝️ Quick reminder: AMD reports earnings on 10/31! 🎃

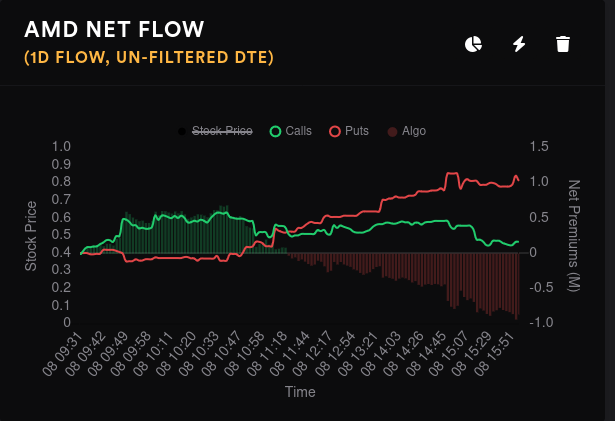

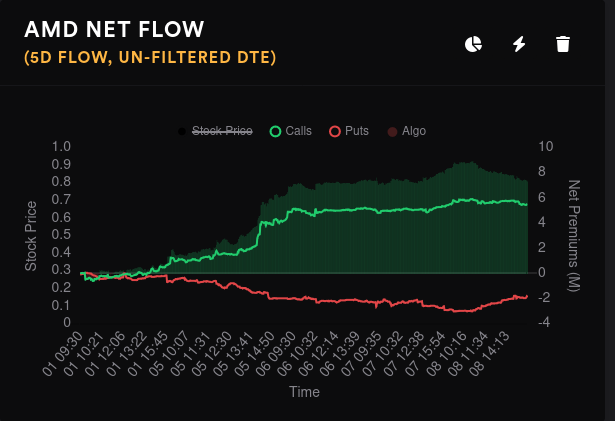

Options flow

Although Friday was bearish towards the close, that movement barely registered on the five day net flow:

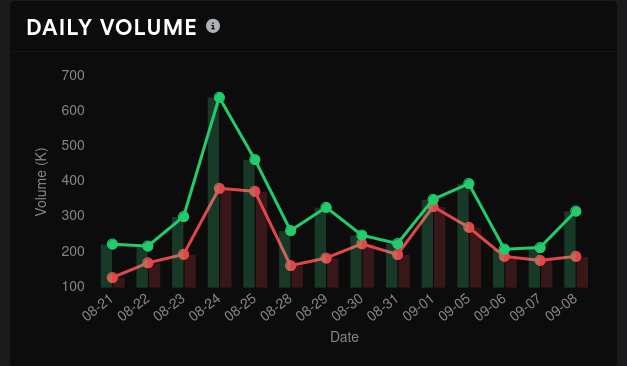

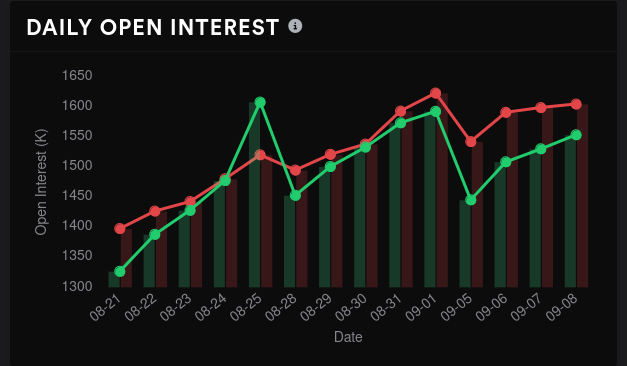

Options volume is up a bit, especially on the call side, and open interest remains at very high levels:

Dealer greeks buildup shows dealer momentum right at the middle line over the past 15 days. This chart was recently green, which meant that dealers were long AMD. This suggests customers were short. A run back to the middle line means that bullish and bearish flow from market participants has nearly evened out. I'll take this as a less bearish sign than a bullish sign.

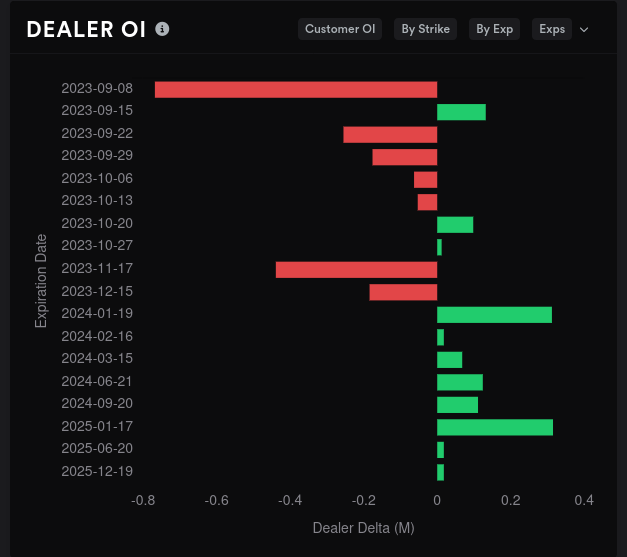

AMD's dealer open interest suggests that we're looking at a lot of indecision for AMD through the end of the year. These bars are flipping back and forth without much strength (check the x-axis). I get excited when I see one of these bars cross the 1M delta mark.

Gamma exposure

Tradytics hasn't pulled last Friday's (9/8) from their data yet, so the aggregate GEX is a bit misleading. Let's check the next three OPEX dates.

9/15 shows a price magnet at $115 with a resistance level at $120. This matches fairly well with the vanna chart.

10/20 is very light on GEX, so these levels don't tell us much. $95 seems like the largest target here, but $115 and $125 are decently sized. I'm not putting much faith in this expiration date until we make it past 9/15.

11/17 is where things begin opening up to the top side. Although I can't find much from vanna to support this, GEX suggests we're headed to $125. 👀 That would force a reckoning with AMD's $117-$120 liquidity zone that has stymied upward moves in the past multiple times.

Conservative traders might want to consider trades in the $95-$115 range at least through 10/20, but 11/17 is on the other side of earnings and is still difficult to read for now.

Whales

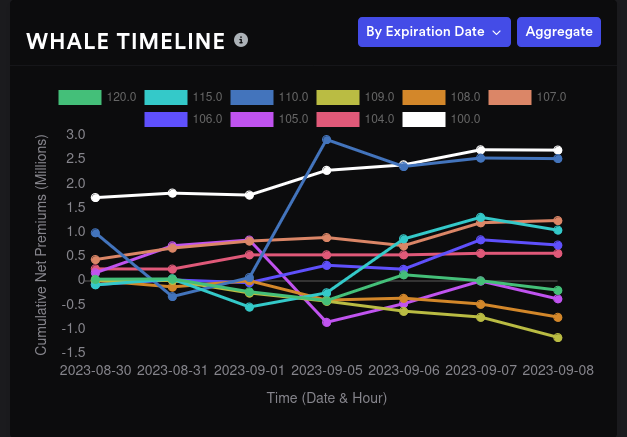

AMD's big money options traders seem to like $100 and $110 on aggregate.

However, most of these bets are for 11/17 and January 2024.

Dark pools

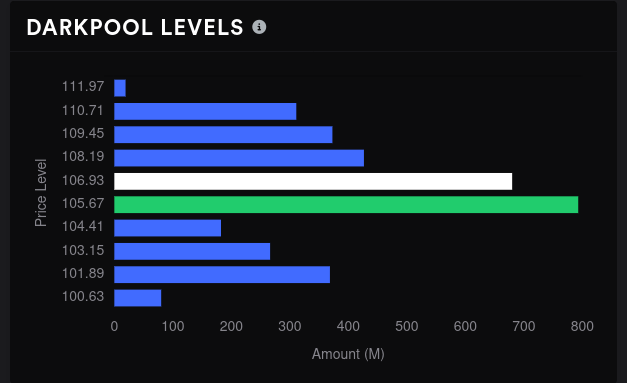

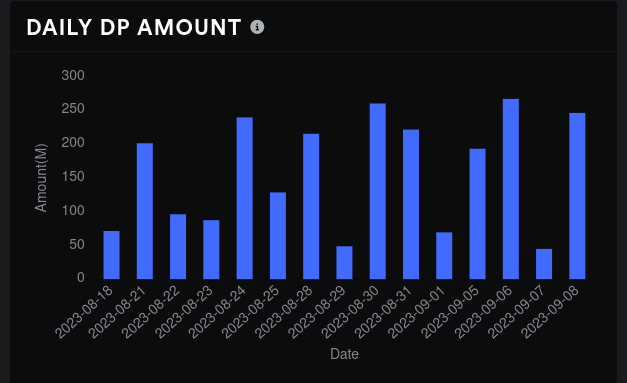

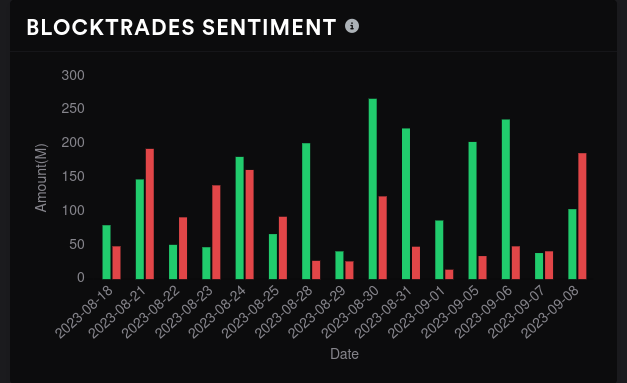

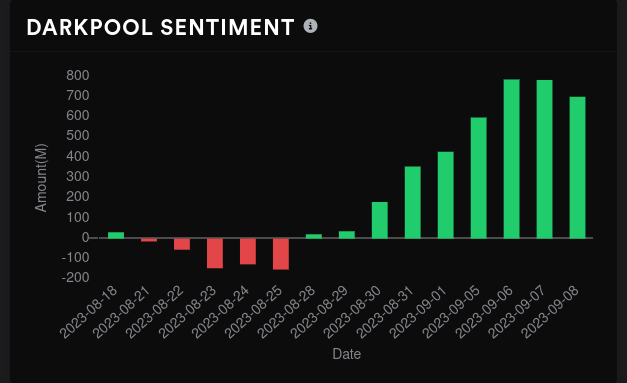

Bullish traders had a seven day win streak, but that ended on Friday with decent volume. The biggest dark pool volume showed up around $105-$107. Overall sentiment seems to be very bullish right now but it's losing momentum.

Thesis

As I talked about yesterday, AMD has a big volume shelf at $110 that could be a resistance zone or a support zone for a new rally. However, I'm very doubtful at AMD getting above $120, at least through earnings. It runs out of vanna at that point, GEX doesn't support the move, and there's a strong resistance zone there on the chart.

On the lower end, $95 remains strong support level from GEX and vanna. $100 is a big psychological level and that's where I'm doing most of my trades now.

I have one short covered strangle for 10/20 with a $100 put and $120 call. I sold five more strangles last week for 10/20 with $95p/$125c to be a bit more conservative. I'll take these down when they show a 50% gain. I'm happy to be assigned on either end of the strangle if it happens. 😉

Good luck to everyone today! 🍀

Discussion