AMD and TSLA analysis for August 8

TSLA continues its downward slide and AMD is running out of time to make its run. I'll take a deeper look at both today. ⏰

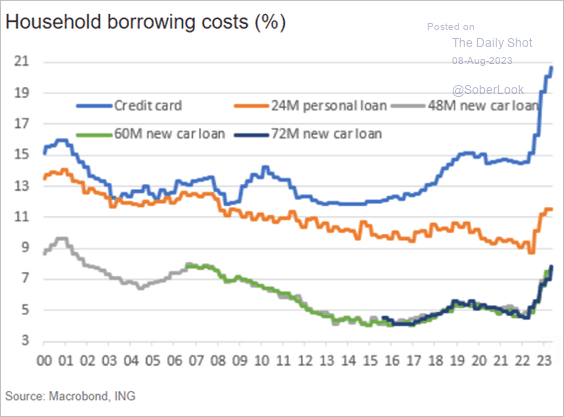

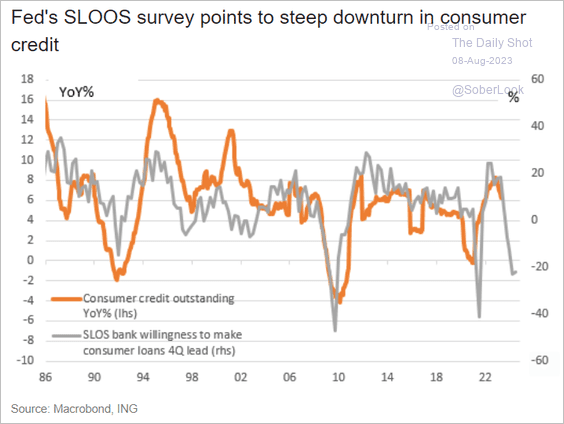

In macroeconomics, the big rumbling seems to be around consumer debt. Interest rates are high and that makes borrowing money for just about anything – especially houses and cars – challenging for consumers.

Debt has been piling up for a while but we recently saw the first tiny drop in that chart since 2021:

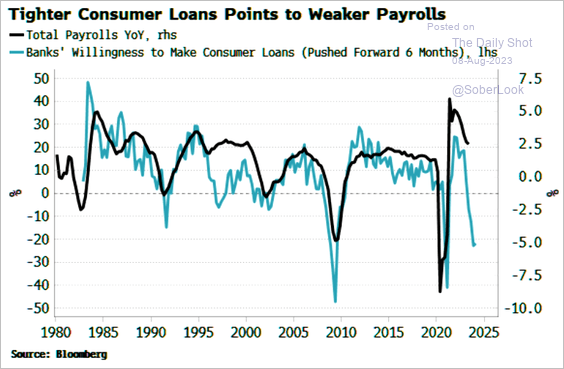

Banks are also less likely to be willing to make a loan to a consumer:

Student loan forbearance is ending soon and this puts more constraints on family finances. This is showing up in consumer spending in a few places already, but watch out for how this could affect overall retail spending into Q4.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get into AMD and TSLA data. 🔎

AMD

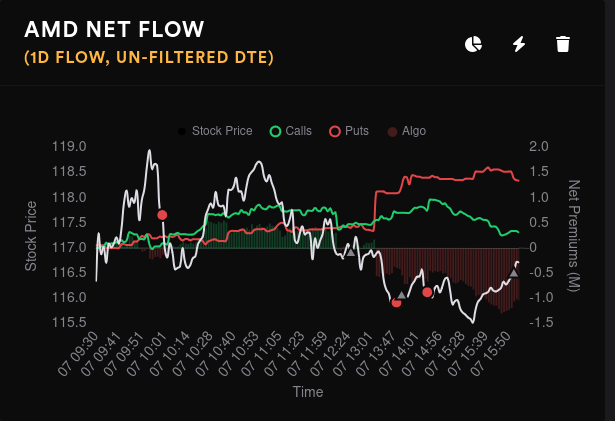

Yesterday was yet another run up to $118 that failed for AMD. As I've talked about for a couple of weeks now, AMD has a real challenge just before $120. There's positive gamma resisting an upward move past that level, dark pool volume isn't moving up fast enough, and our vanna effects fall to zero as soon as we get within 0.15-0.35 delta of $120.

As soon as AMD fell below the support line around $117 yesterday, bearish premium spiked abruptly:

8/18 remains the most bullish strike for gamma exposure (GEX) and vanna. Aggregate GEX across all expirations still shows AMD pinned in between $115 and $121:

8/11 GEX doesn't change much from the aggregate:

There is a big change around 8/18. Yes, 8/18 is the most bullish expiry from multiple factors that I see, but what happened to that $114 downside resistance? It shrank and slid down to $105. I love seeing AMD have room to run, but I don't like seeing it have room to run to the downside.

$120 and $122 look like our biggest price magnets for $118. $121 will fight any movement past $120:

Just as before, $115 is our biggest magnet for $115. Combine that with 8/18's loss of downside protection and that makes me think we retract a bit going into September:

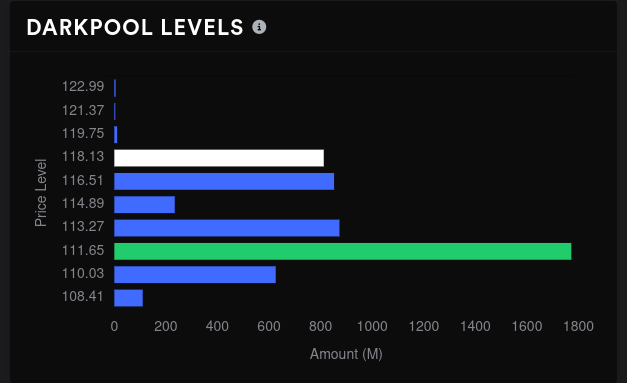

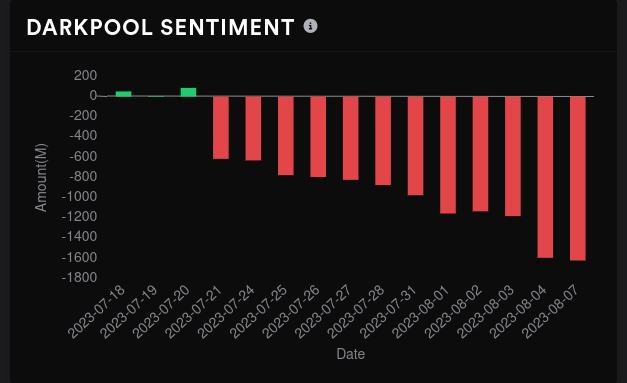

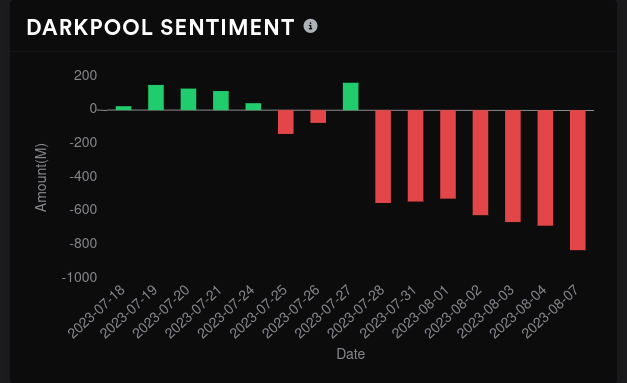

Dark pools are a mixed bag here. On the plus side, the $116 and $118 levels built out past $800 for the first time. That's great! However, sentiment continues tracking lower. My worry here is that the $116-$118 level is not building out as a base like $111, but is building out as a resistance level:

Dealers are still short (customers bullish) and big money options traders are bullish only up through $117 for 8/18. For 9/15, someone with deep pockets is going very bearish on $90:

TSLA

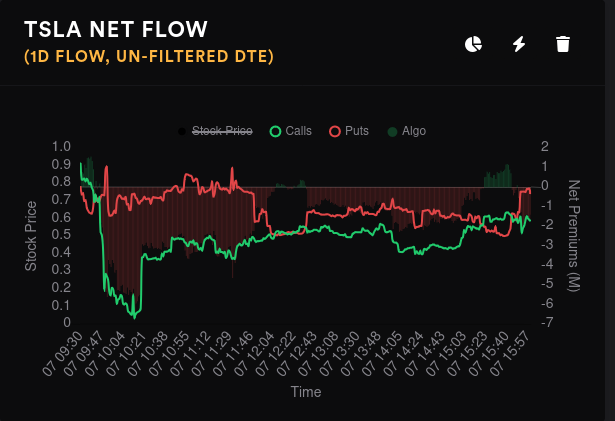

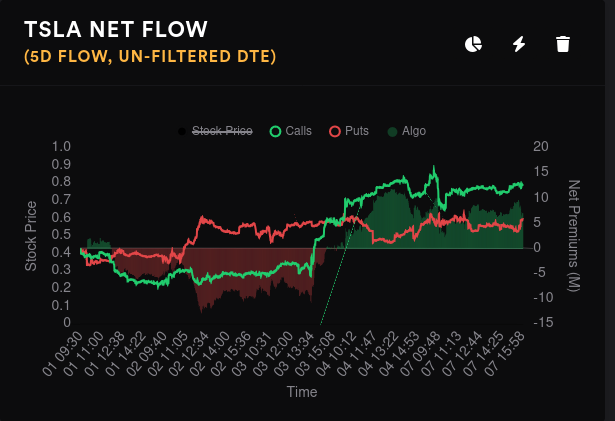

As I mentioned last Sunday, TSLA's chart has several things I don't like. Low volume, price drifting down without much purpose, and we still look overextended. Lower volume leads to plenty of contention between traders that shows up in the options flow:

Dealers are still long TSLA (customers bearish) and no upcoming expiration dates look bullish until January 24. Most are floating around the middle line except for 8/11 and 9/15 which are both bearish. Vanna won't help a move up as it's leaning mostly bearish through 2025. 👀

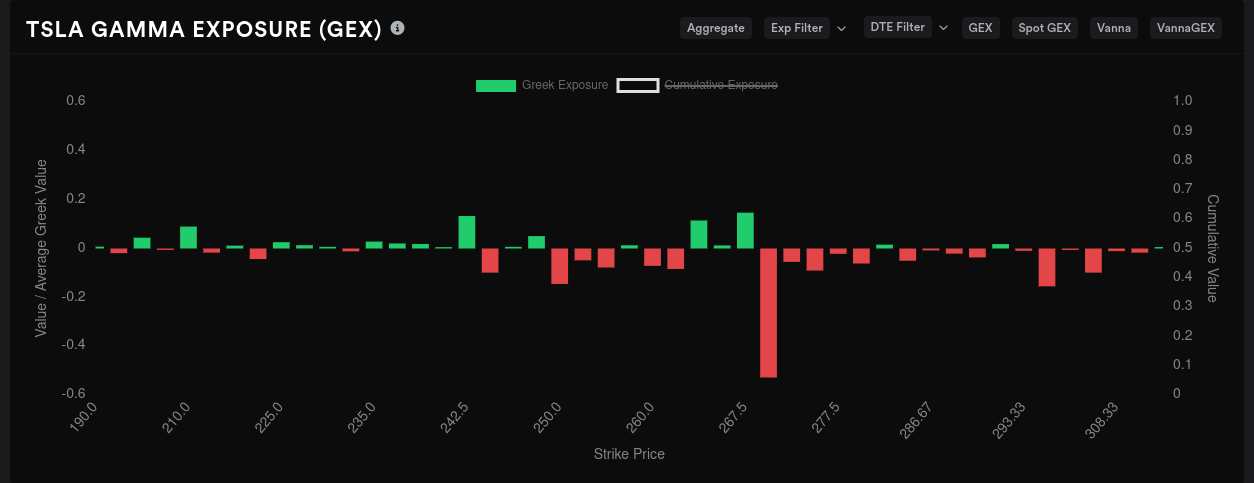

Aggregate GEX suggests $270 as a magnet for price but we're at $246 for now and there's a long way to $270. An optimistic view might be that there's not a lot of resistance for price movement until the middle $260's and that resistance is relatively small:

This week looks like we have a wall of resistance at $265:

The 8/18 OPEX shows the $270 becoming a clear target and the resistance in between eases a bit:

And then 9/15 GEX shows $270 and $280 with the most pull. $260 has some resistance, but it's relatively small when compared to the massive negative GEX lines:

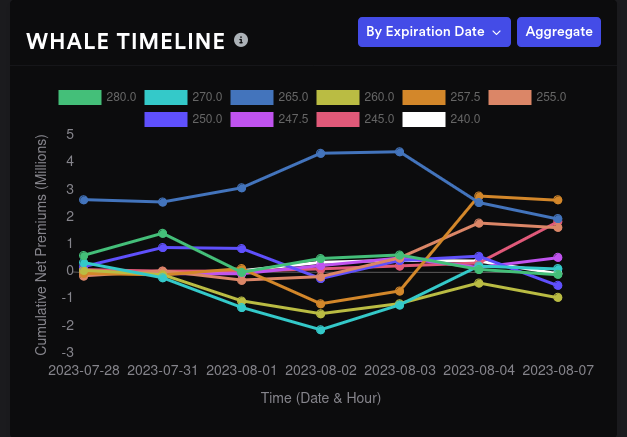

Big money options traders initially got excited about $265 for 8/18 but most lines have run back towards the midline. $257.50 crept up a little for 8/18.

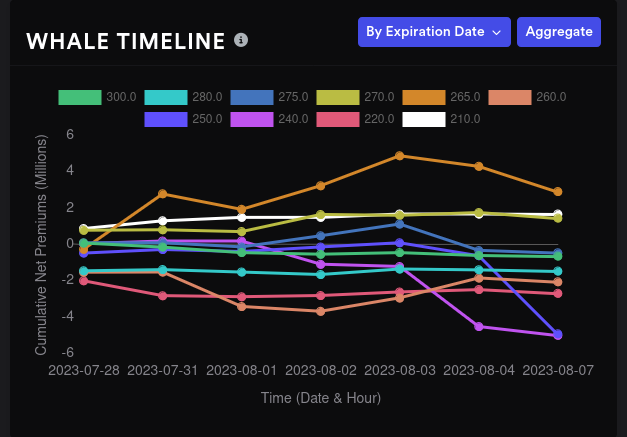

9/15 shows a distinct bearish turn for $240 and $250. Initial bullishness for $265 fell off as well.

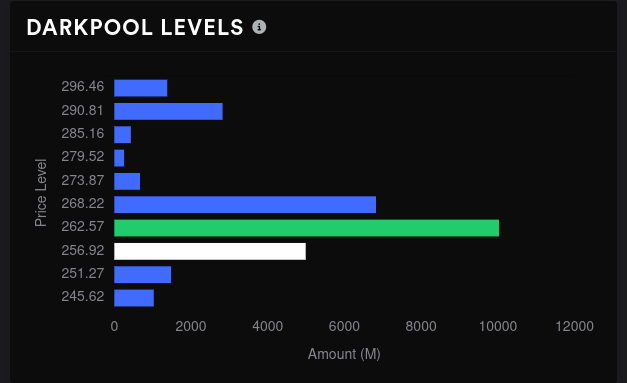

TSLA's dark pool data still shows a decent amount of volume from $257-$268 like we've had for a while, but these levels are consolidating into a larger bar around $262.50. This is worrisome since it's so far above the current price. TSLA does like to revert to high volume dark pool levels from time to time, but we have plenty of resistance from GEX around $260-$265 already.

Thesis

AMD has a fairly brief window to make a run to the $120 zone and stick, but we may lose that hold as we go into September. It looks like we're building out a stronger resistance level from $118-$120 and our downside resistance around $109-$110 might be weakening after 8/18.

As for me, I'm aggressively selling AMD covered calls through 8/18 and I'm okay with assignment there. I'd like to trim my holdings of AMD after 8/18 and look for a new entry if we drop a bit more.

TSLA as in a situation where it had room to run but not enough fuel in the tank to do it. Now I'm seeing a situation where the room to run is slowly closing in on the current price and it might not matter whether there's enough fuel for a rally. $270 was our resistance point a couple of weeks ago, but now it has made its way down a bit, possibly to $260-$265.

TSLA likely has some support in the $240's from some support/resistance lines I drew as well as positive GEX. I'm not counting on it, though.

Good luck to everyone out there! 🍀

Discussion