CRWD pre-earnings stock and options analysis

Let's get a fresh look at CRWD as it runs towards earnings and see where it might be going. 🔒

Welcome to Wednesday! I'm shaking things up a bit by looking at a stock I haven't traded in quite a while. One of my good friends in the Theta Gang Discord was trying to decipher the chart and make a prediction, so I figured it was a good time to give it another look as well!

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

CRWD, or CrowdStrike, is a growing player in the field of cybersecurity with a focus on protecting endpoints (laptops, desktops, phones, etc) for security-conscious companies. CRWD has earnings coming up on 11/29 and it had positive results for the last four earnings calls. 📈

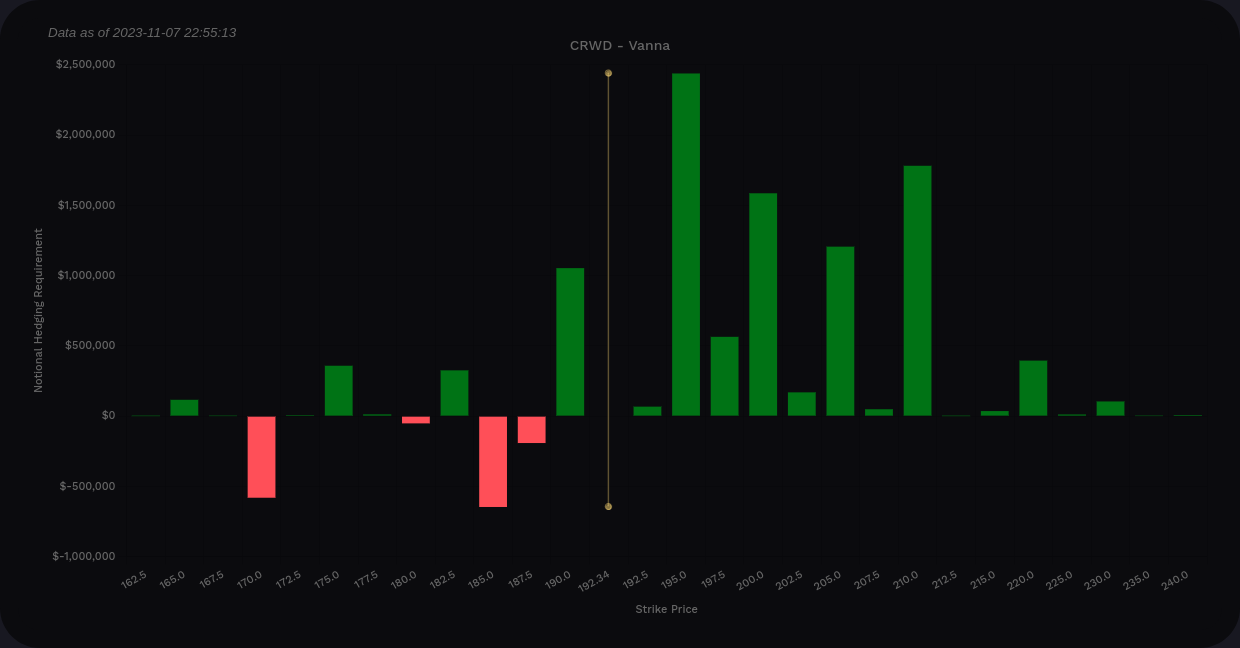

Vanna

My first stop for analysis will be vanna, as usual.

Starting with the curve, CRWD has positive vanna overall and almost all of it is above the current price. The bar chart shows strong vanna levels around $200 and $210. It's trading around $192 this morning.

There's a definite "end of the line" at $230 that will wrestle with any upwards movement past that point. There's also very little positive vanna beyond $230.

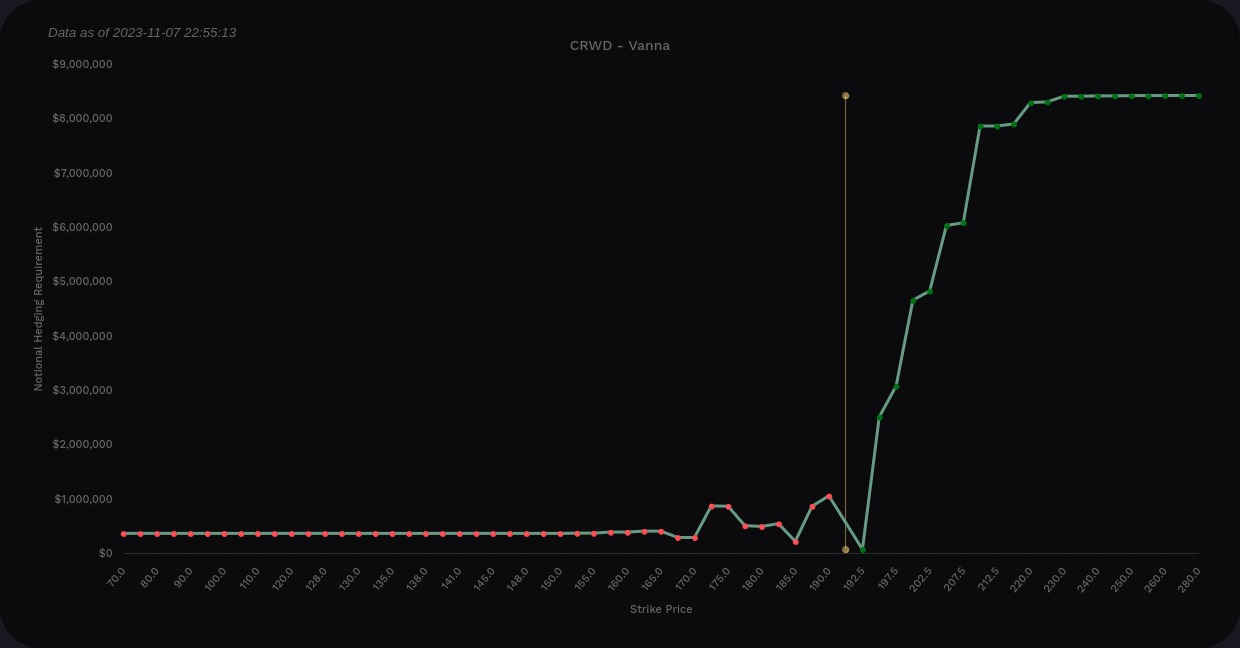

CRWD Vanna from Volland (all expirations)

Most of my trades are focused on 12/15, so let's limit our vanna data to just those expiration dates. Again, the vanna is almost entirely positive and it remains strong up to $210. It's clear that the negative vanna at $230 shows up after 2023. 🤔

CRWD Vanna from Volland (now through 12/22 only)

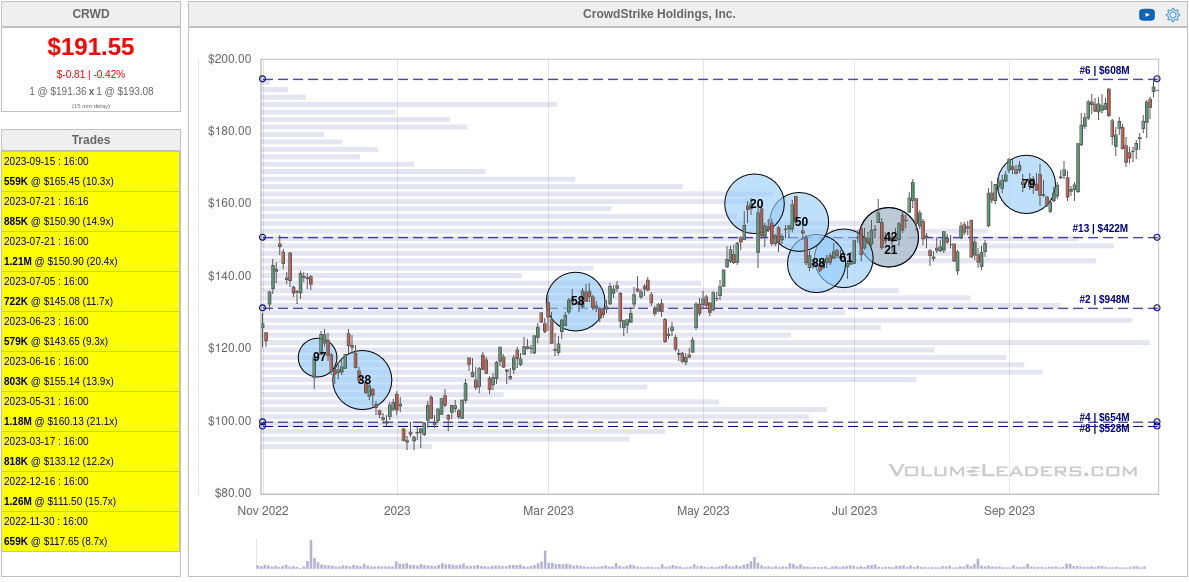

Institutional trading

The chart over at Volume Leaders tells an interesting story as well. There are some large trades in CRWD from institutions popping up at very interesting levels. Keep in mind that these high volume events do not show directionality so it's difficult to tell when institutions might be taking profits or adding to their positions.

The numbers in each circle give you the rank of that trade out of the 100 biggest trades. For example #20 from May 2023 is the 20th biggest trade ever made in CRWD since it began trading.

From the low in 2023, CRWD made it up to it's #2 volume level around $130 and kept climbing. It now sits around its #6 level just below $200. The question to ask here is whether these institutions are adding to their existing positions or taking profits.

To be honest, it could be a little of both, but it's good to see this level of interest here. CRWD is flying a bit high, but I don't see anyone making big trades at the current top (yet).

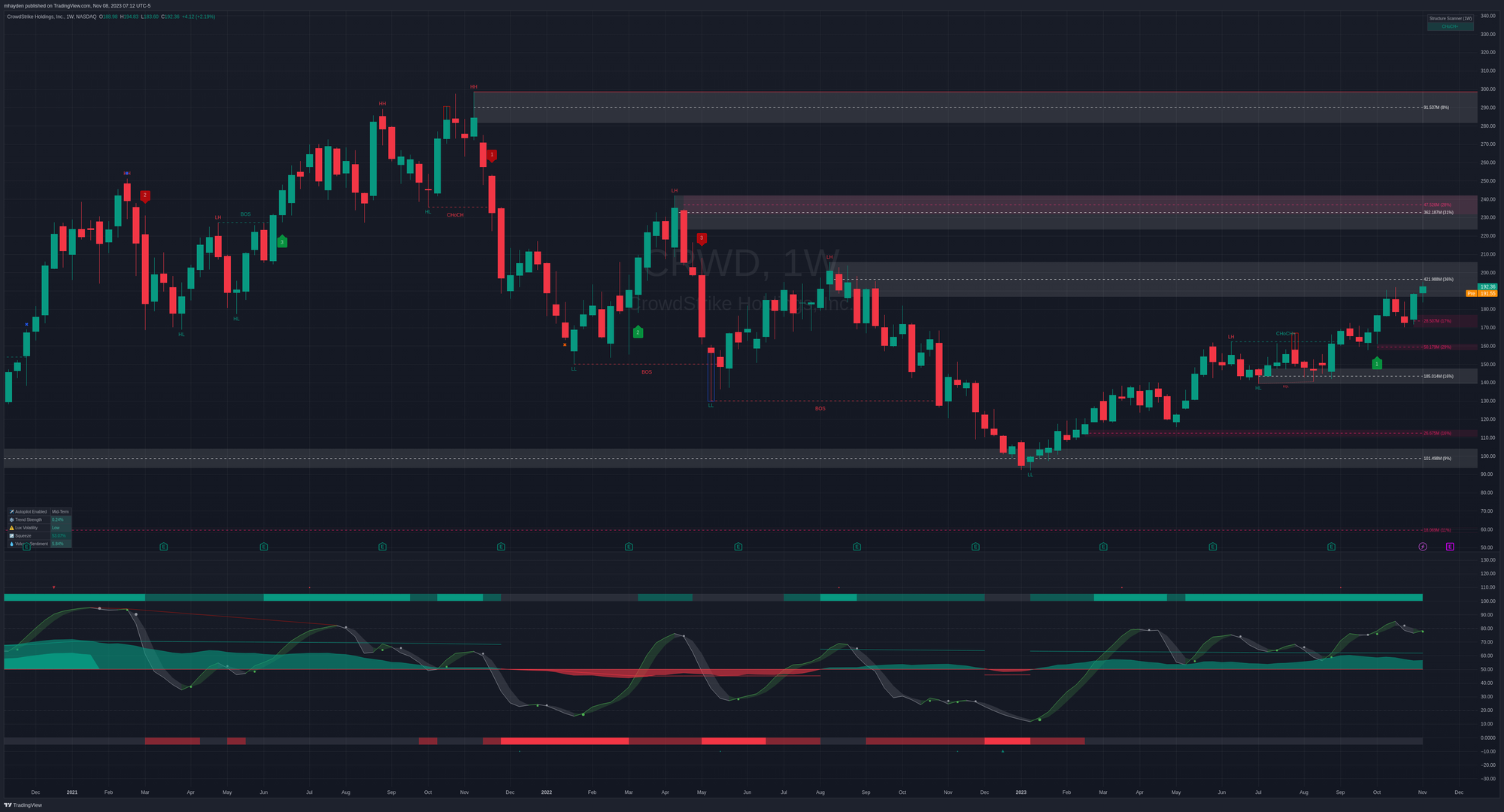

Chart

If we zoom out a bit and look at a weekly chart for CRWD since 2021, it's clear that we began a grind upwards right around January 9th, 2023 and that has continued until today.

The long rectangles on my chart indicate order blocks, an ICT concept. White blocks are weekly order blocks and magenta ones are daily order blocks. These often become important places for price where a breakout can occur or where price can turn around.

CRWD is about a third of the way into a strong weekly order block left over from the August 8th high. Ideally, if we wanted a move higher here, I'd like to see CRWD move through this block, retest it a bit, and keep going, possibly to the next block at $225. If you scan down a bit to July, you'll see that CRWD made a weekly order block, came down to test it, and continued to rally.

The oscillator ticks all of the bullish boxes. There are almost no bearish contrarian signals here, money flow is positive, and the hyperwave hasn't been below the middle line since February 2023. As for market structure, we're in a bullish change of character (CHoCH) since September on the weekly chart.

This chart and all the data I can find looks very bullish. If I was forced to make a bear case, I'd be concerned about this weekly order block from August and whether CRWD can break the high from that month. However, every indicator points to CRWD having enough sustained strength to break through it.

If CRWD does plow through the block, we will get a second bullish CHoCH and that would add even more strength to the chart.

Thesis

I'm really glad someone asked me about CRWD! I don't have any positions on right now for this one but I'm curious about selling some puts, likely around the last daily order blocks at $180 or $170. However, earnings are dangerous, and I'd argue that even if you had the earnings data in your lap right now, it's difficult to plan a successful trade. 🤔

CRWD ticks all of the bullish boxes for me, but it does have some potential speed bumps coming up outside of the earnings call. There are three big levels of weekly order blocks left over from failed highs during the interest rate hikes, but if the worst is behind us as far as hikes go, CRWD stands to benefit from that change.

Good luck to everyone out there today! 🍀

Discussion