Quick looks for July 25th

TSLA looks to be making a run and AMD might have some fuel for moves next week. Let's dive into the data. 🤓

The Federal Reserve announces interest rate changes this week, AMD announces earnings next week, and plenty of other companies report earnings this week. There's a lot happening in the market! 🥵

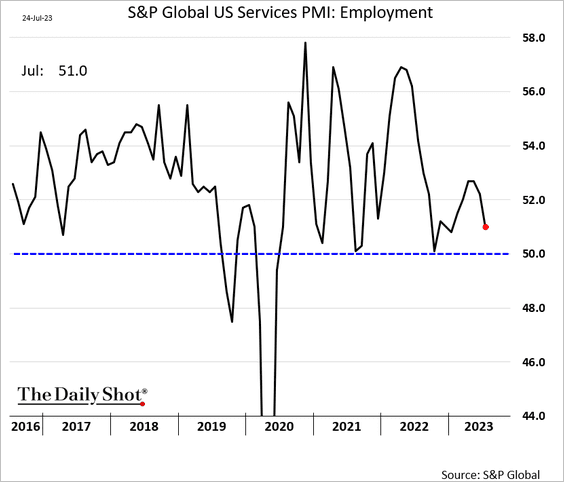

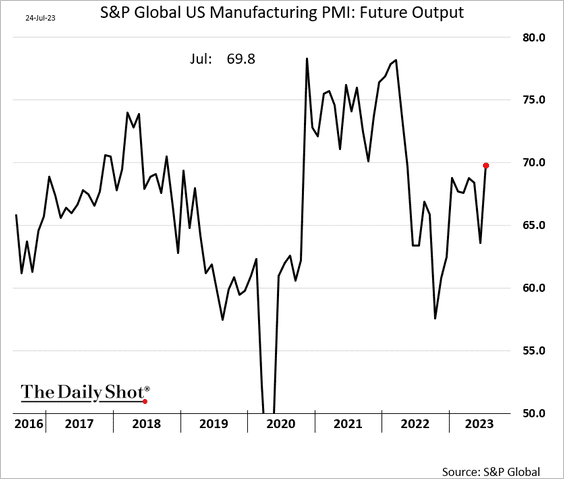

On the economics side, we're seeing services growth shrink and manufacturing of real goods increase. This is expected after the massive growth in services during the pandemic and a return of supply chains to more normal levels:

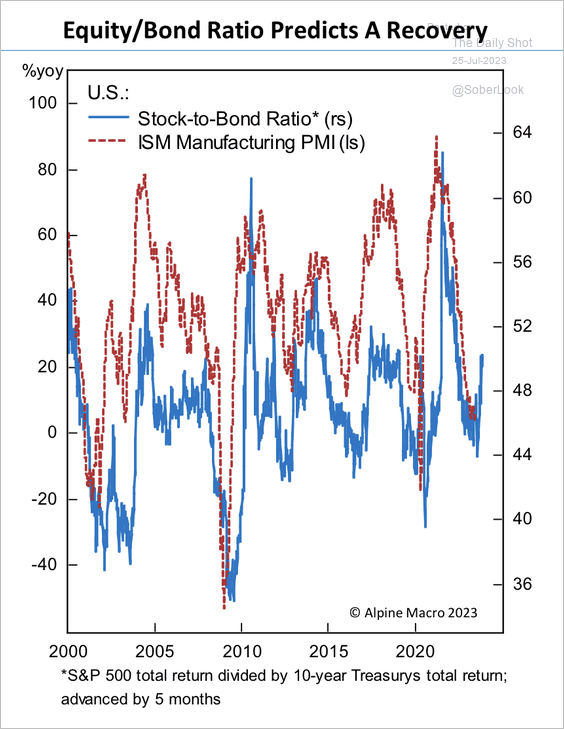

Arguments for and against a potential recession are still in flux, but current equity to bond ratios have a future prediction that looks bright:

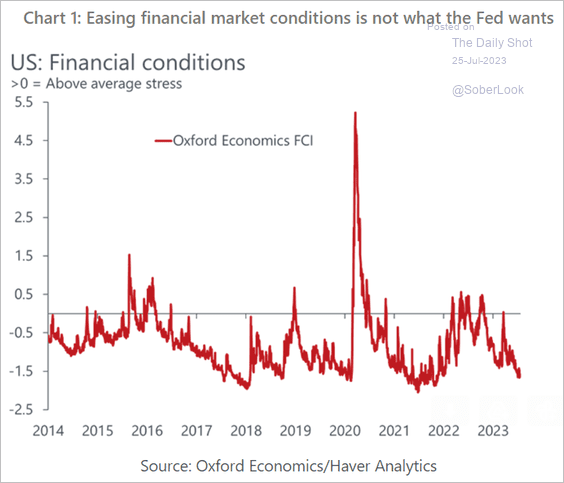

Market conditions are also easing. That's something I love to see, but the Federal Reserve might see this as a reason for additional rate hikes:

But before we continue:

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get to today's quick looks!

AMD

Yesterday's post covered tons of data about AMD, so go read that one for details. What changed for today?

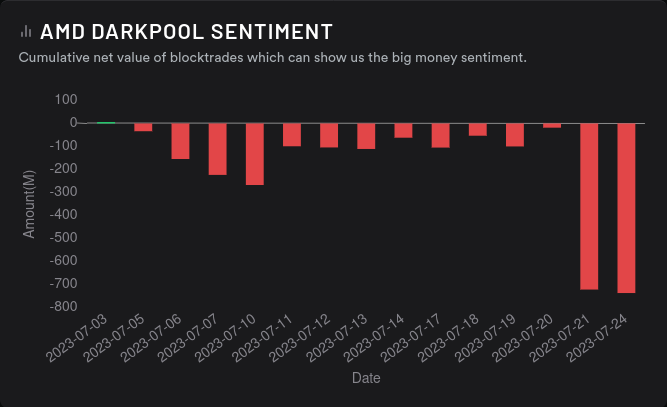

The first thing I noticed was that dark pool volume slid down to $110 after consolidating at $111 yesterday:

In addition, AMD's vanna for 7/28 really changed above the current price. There was positive vanna there yesterday but now the $111/$112 levels essentially cancel each other out:

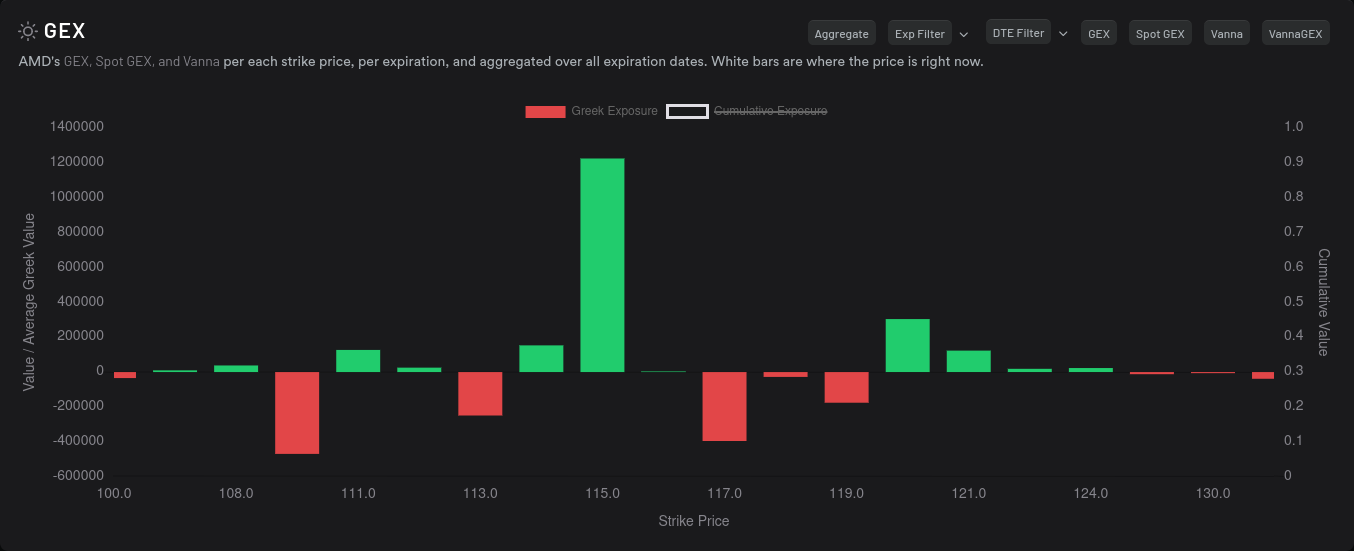

But vanna for 8/4 (earnings week) makes it look like a pull to $115 might be possible:

As for GEX on 7/28, $121 remains the biggest magnet for price, however we have significant positive GEX (usually acts as resistance) at $113 and $119:

8/4 GEX for AMD looks like $109 or $117 could be the biggest price magnets:

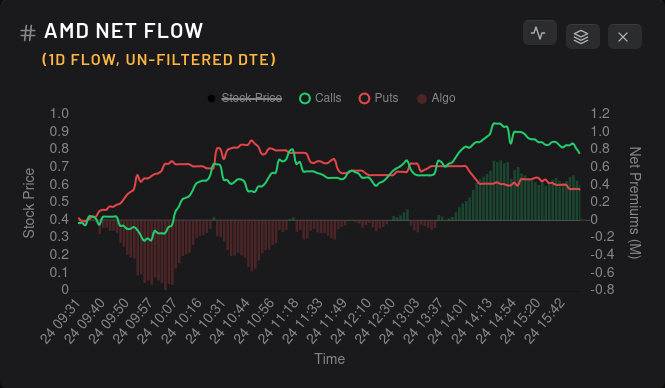

Paired with the vanna chart above, a move to $117 or $119 looks possible next week if we can somehow make it past those walls at $113 and $119. AMD is up over $111 pre-market today. Big money options traders this week have gone bullish on $115 for 7/28 and they aren't moving from those positions.

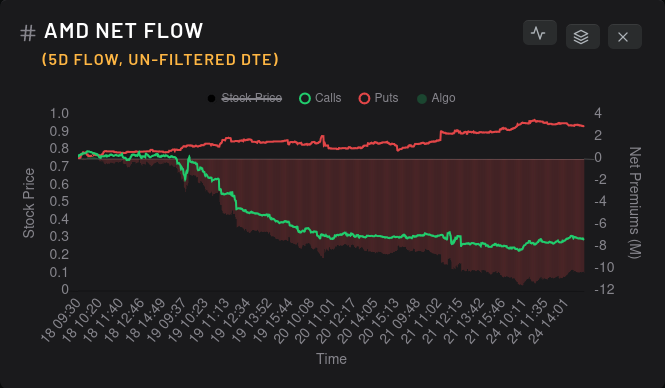

Dealers greeks buildup over a 15 day momentum is looking short which means most market participants are likely getting into bullish contracts lately:

AMD's net flow over five days looks pretty ugly, but there was a battle going yesterday:

TSLA

TSLA has recovered to just over $270 this morning before the market opens and its vanna for 7/28 is highly concentrated:

Looking out to 8/4, this starts looking more bullish:

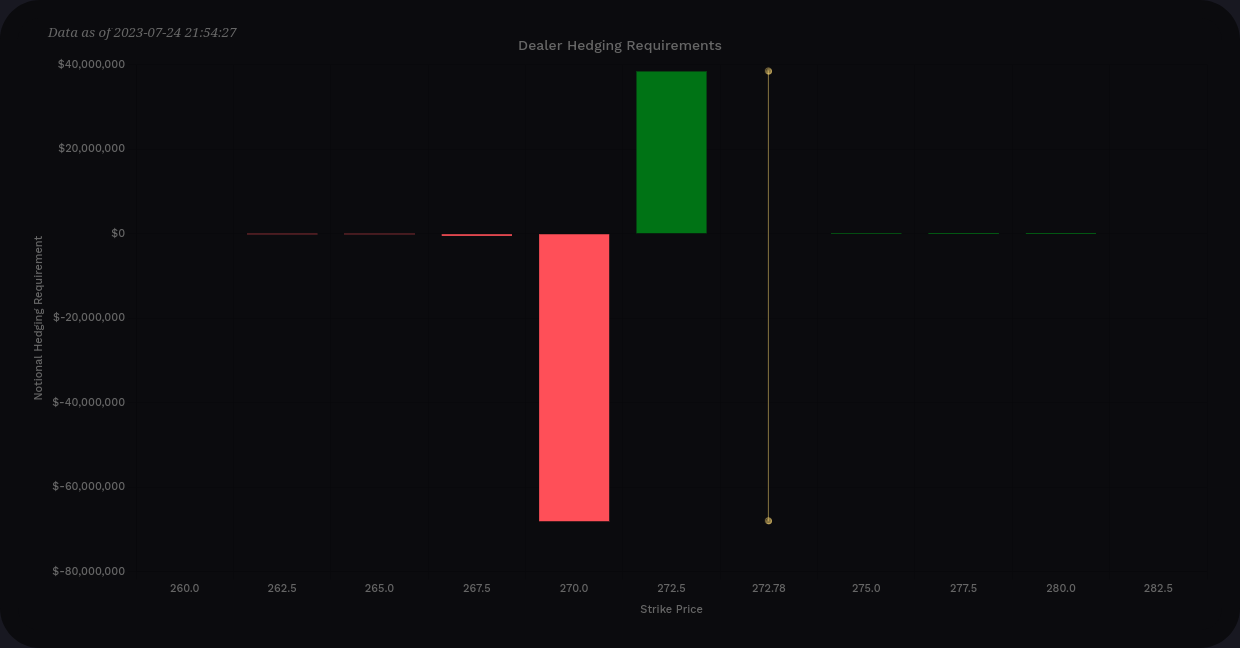

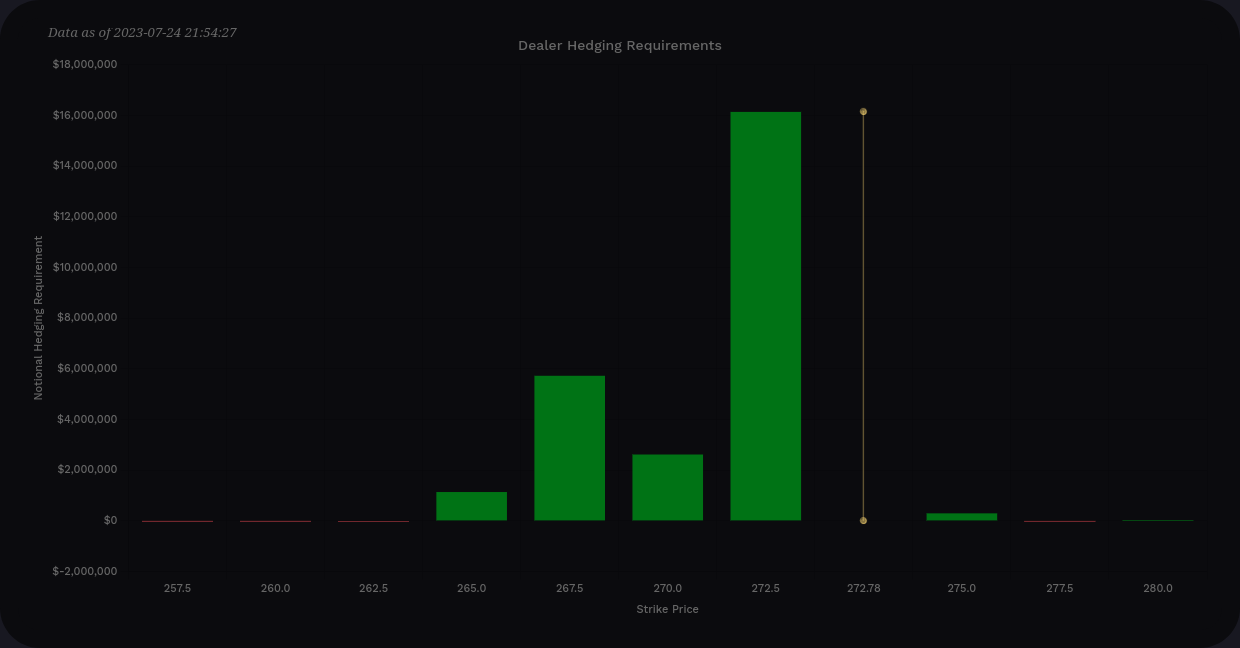

TSLA's GEX for 7/28 has a huge resistance wall at $270 and relatively light resistance up to $295:

Looking out to 8/4, things get a little less clear. The biggest magnets for price show up at $270 and $292.50 but there are quite a few strong resistance points in between:

Dealer momentum flipped long yesterday as TSLA approached $270 at the closing bell. This could be due to the massive resistance in GEX at $270. The $270 negative vanna line would have almost no effect here:

Big money options traders love TSLA $270 for 7/28 and the $300 for 8/18 is beginning to get some bullish action from them, too. Open interest suggests this week will be bullish with some indecision between 8/4 and 9/15:

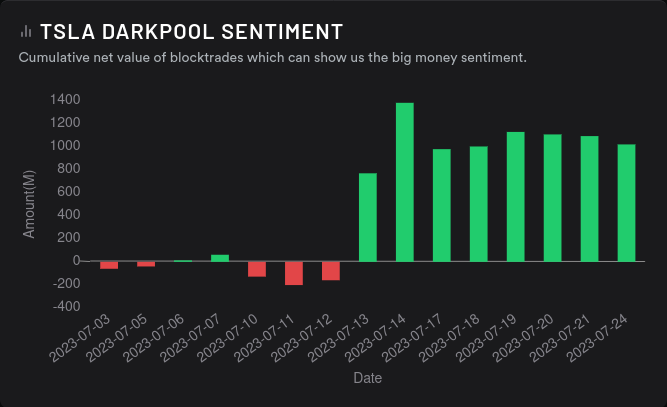

Dark pools suggest that the most volume is centered around $279 and overall sentiment is positive:

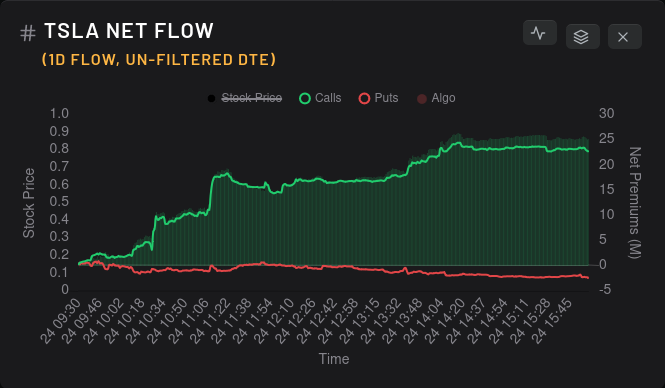

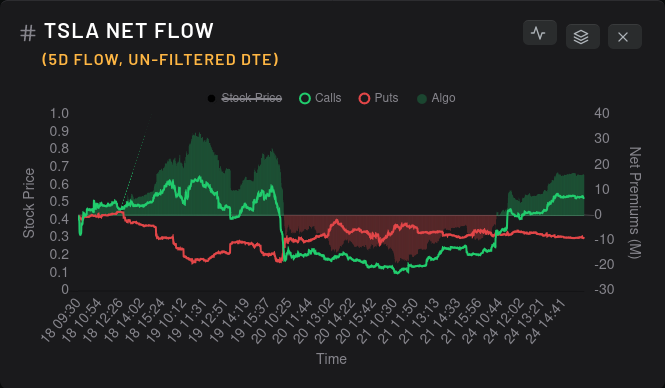

TSLA flow over the last five days looks crazy, but there's no doubt about the bullish feeling yesterday:

Thesis

On TSLA, it looks like there's definitely a bullish surge inbound that could allow it to overtake $270's resistance. On my charts, I'm looking at $280 for the next stop. Dark pool data shows that's a very high volume level as well.

I expected we'd get jammed at $270 based on all the data and I sold some covered calls in that area yesterday. Those aren't looking great today but we have a lot of news remaining for the week.

With the data I'm looking at now, I might go for an aggressive TSLA short put around $270 (on that resistance line) or consider something a bit more conservative around $260/$265 if I see evidence that $270 might not hold.

Once again, AMD seems like it has the $109-$111 zone as a solid area of support that has been tested multiple times. I like having this firm base of support going into earnings. I'm in some short puts and calls right now, so I would get some decent gains if AMD could whipsaw between $111-$117 between now and 8/4.

The $118-$120 liquidity problem zone for AMD still exists. There's decent resistance right around there on my chart and in the GEX data. However, there's plenty of evidence that if AMD does climb over $113, a run to $117 or $118 might be possible before earnings.

Selling puts on AMD around $109-$111 feels like a solid bet. However, I'm a bit worried about selling calls on 8/4 right now since there's a lot of room to run if AMD can get some volume and get over the $118-$120 zone.

You can always follow my trades on Theta Gang or find me on Mastodon. Good luck out there today! 🍀

Discussion