Happy Sunday! I've been intrigued by small caps lately as they seem to be making an interesting overall trend and might be correcting a bit less than the S&P 500 (depending on the lens you use). 😜

I'll dig into IWM (the highest volume small-cap ETF) as well as a few names in the Russell 2000 index.

All investments come with significant risks, including the loss of all capital. Please do your own research before investing, and never risk more than you are willing to lose. I hold no certifications or registrations with any financial entity.

Let's get underway!

My weekend ritual

I always tune in for Chris Ciovacco's update each Friday and this week's video was a good reminder to trade the charts in front of you and avoid making predictions:

Small caps are showing some strength and aren't looking much like they did during the 2022 bear market. However, they aren't gaining enough strength relative to the S&P 500 and NASDAQ yet.

High level overview of small caps

Let's start with a daily chart of IWM since the late 2023 lows:

IWM broke my trend line, but it broke it much less so than SPY and QQQ did this week. Note that we're also in a high volume area from about $195-$206 (see volume by price on the right edge). IWM did slide under the 45 day moving average, but that line is still moving up, as is the 200 day moving average.

I moved back to Heikin Ashi candles to better spot momentum and the past three days are down candles with no top wicks. That's a signal to me that a strong bearish move is underway for that three day period. It could reverse itself Monday morning, but we're currently moving down in a high volume area.

Also notice the on balance volume oscillator at the bottom. Our recent higher high around $111.88 was made on higher volume than the previous, and the recent down days haven't seen a huge surge in bearish volume yet. This suggests to me that buyers have been more active recently than the candlesticks show. There's no guarantee that this will continue, but it's another data point suggesting to me that small caps have a little bit more strength here.

Institutional trading

Institutions have been quite active between $190 and $200:

There's about $9B of volume centered around $190-$200, so that might explain some of the buying pressure we're seeing in the OBV oscillator.

Constituents

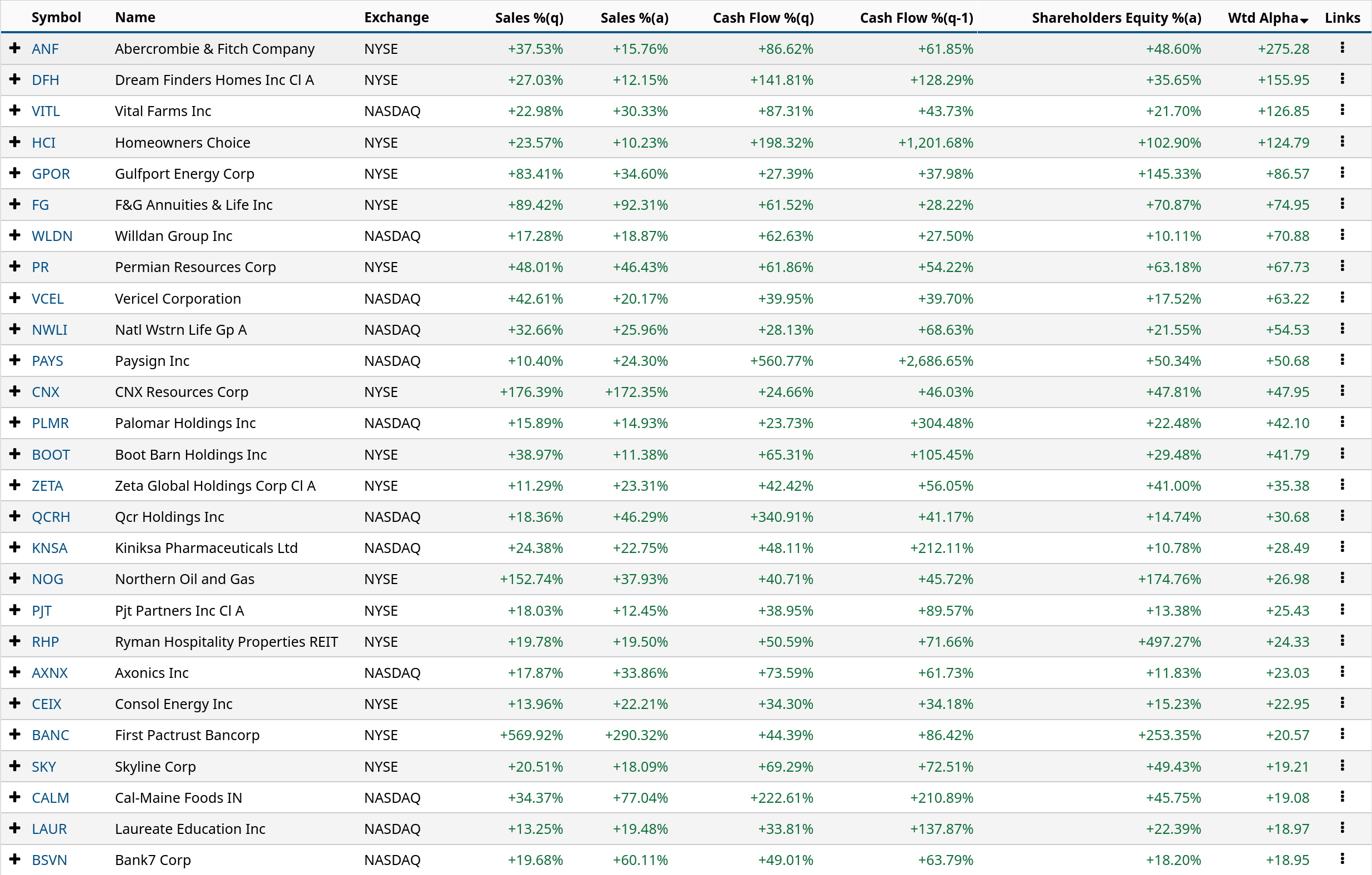

There are plenty of stocks in the Russell 2000, but if I narrow it down using Barchart's "Fundamentally Fine" screener, which looks for growing sales, cash flow, and more, I get a fairly short list:

ANF is absolutely wild. The stock had a wild 7x run from the 2023 lows and it's pulling back a bit now:

It came down through quite a few decent volume levels and is resting just above a volume gap. It's had 6 down candles, each with no wick on the top. It all started with a very small bodied candle in early April. All of those combined suggest we're in a strong down trend.

However, the OBV oscillator at the bottom shows the most recent high failed to break the previous one, but it was made on higher volume. Keep watch for this one to turn, though. We're approaching a low volume area where it bounced Friday and the most recent candles have smaller bodies.

Most of the other stocks on the list are related to clothing, other apparel, and jewelry. This is a good list to watch as CPI numbers creep up but PPI numbers remain quieter.

Thesis

I'm certainly not looking to make a big run into small cap stocks anytime soon, but I have sold some puts on ENPH lately and I'd be eager to sell some more on small cap names with good fundamentals and bullish chart trends.

Good luck to everyone this week! 🍀

Discussion